OCO order is one great tool to improve trading performance on crypto exchanges like Binance. Find out what it is and how to use it to make profits.

Many traders are attracted to crypto trading because of the high flexibility and high potential returns. In order to invest in the crypto market, it's important to have enough knowledge and a good trading strategy. This is why crypto exchanges like Binance are offering a lot of interesting features to help traders generate profit in the long term. One of them is OCO (One Cancels the other).

It basically refers to a feature that allows you to place two orders at the same time and cancel one order automatically when the other order is executed. This can be an effective tool to secure profits on the market. Here's the complete explanation to get you started.

Contents

How OCO Order Works

OCO (One Cancels the Other) order is a type of conditional order that combines a limit order and a stop limit order with the same order quantity, but only one of them can be executed. So, if one of these orders is partially or fully filled, the other remaining one will be canceled automatically. Note that if you manually cancel one of the orders, you will also cancel the other one automatically.

Most of the time, OCO order is used by expert crypto traders to manage trading risks. It is a risk management tool that's often overlooked by traders in the crypto market despite its ability in locking profits as well as protecting trading positions against market volatility at the same time.

Before we go further and explore the possibilities created by an OCO order, it's important to understand the difference between limit and stop limit orders in crypto trading.

Limit and Stop Limit Orders

A limit order refers to the type of order to buy or sell an asset at a favorable price. Before making a purchase, traders need to determine the maximum acceptable purchase limit price. It gives the trader an advantage to make an entry or exit at a point that's at least as good as the specified price. A buy limit order is intended to be executed when the price hits the limit or goes lower. Meanwhile, a sell limit order is intended to be executed when the price hits the limit or goes above it.

Limit orders are useful for trading assets that are either thinly traded, highly volatile, or have wide spreads. It can give traders more control over the buying and selling prices of their trades, and help them put a limit to the amount that they're willing to pay for the trade.

On the other hand, a stop limit order basically combines the concept of stop and limit order. When placing a stop limit order, traders can determine the minimum profit that they're willing to walk away with as well as the maximum loss that they're willing to lose.

The downside is that the trade may not be executed if the asset does not reach the stop price during the specified time. However, once the price reaches the stop price, the stop limit order becomes a limit order to buy or sell the asset at a specified price. This means that if the price hits the stop price, the stop limit order will be executed at a specified price or even better.

A Practical Way to Use OCO Orders

OCO orders can be a powerful tool to use in crypto trading. It works best in choppy markets where the price can move quickly in the opposite direction, and that is why OCO order suits the volatile crypto market. In addition, it can save traders from terrible losses without having to glue them on their seats the whole day.

When you open a long position on a crypto asset, you can use OCO order to mitigate the risk and lock in profits. Once you open a buy order, simply place two sell orders by using the OCO model above and below the initial entry price. Keep in mind that the sell orders are not market orders just yet. Regardless of the price movement, only one of them will be executed. And when that happens, the other one will be canceled.

Let's say you just bought 5 BNB at the price of 0.0026385 BTC because you believe that the price is closer to the major support zone and will move up according to your prediction. In this case, you place a take profit order (limit order) at 0.0030 BTC and a stop loss order (stop-limit order) at 0.0024900 BTC that is triggered at 0.0024950 BTC.

If your prediction is correct and the price of BTC really rises to or above 0.0030 BTC, then your limit order will be triggered. You can lock in the profits from the price movement. At the same time, your stop limit order will be canceled.

However, if your prediction is wrong and the price falls to or under 0.0024950 BTC instead, your stop limit order will be triggered and the remaining limit order will be canceled. This can help you minimize your losses in case the price goes down even further.

Understanding OCO Orders on Binance

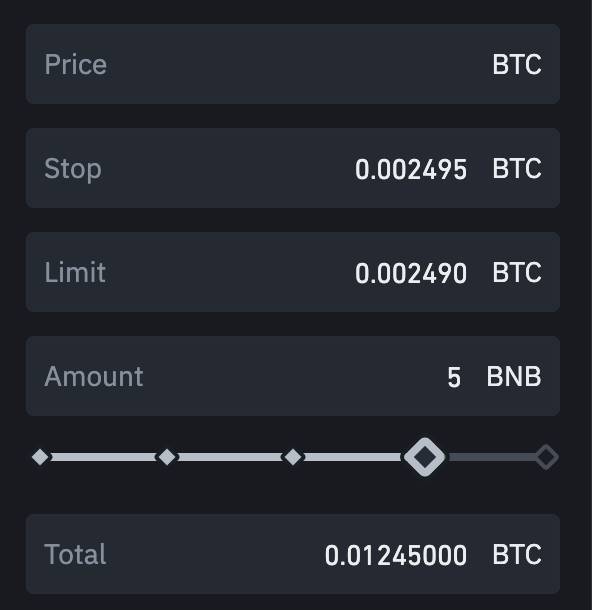

When placing an OCO order on Binance, it basically works as a form of trade automation. OCO orders can be placed as either a pair of buying or selling orders. Once you choose the desired OCO option, you'll need to insert the details of your order. Look at the image below.

Limit Order

Price: Decide the price of your limit order. Basically, it is the take profit price or the price you'd be comfortable to exit your position if the trade goes in your way. You'll be able to see this order on the order book.

Stop Limit Order

- Stop: This represents the price at which your stop limit order will be triggered. So, when the asset reaches this trigger, the system will replace the regular limit order with a stop limit order. Many traders prefer to set a stop trigger a little higher or lower than the actual stop limit price to give the order time to be executed at the right price.

- Limit: This represents the actual price of your limit order once the stop is triggered. It is the stop loss price or the price you'd be comfortable to exit your position if the trade does not go in your way.

- Amount: This is the exact price of your order.

- Total: This represents the total value of your stop limit order.

How to Place an OCO Order on Binance

In order to place an OCO order on Binance, you can simply follow the guideline below:

- Log in to your Binance account and go to "Trade", then click "Spot". Decide whether you want to buy or sell, then click "OCO".

- Enter the order details.

- Click "Buy BNB" to place an OCO order.

- To check your OCO orders, you can simply scroll down to the "Open Orders" section. Alternatively, you can also see the history of your executed orders in the "Order History".

The Benefits of OCO Order

- Protects Gains

To begin with, OCO order allows you to protect your profit. With this type of order, you can maximize your profit and set a minimum take profit price in case of a trend reversal. Simply set a limit order as your profit target and set a stop limit order to protect your gains. This is particularly helpful in the crypto market where prices often move in a different direction very quickly. The process is also relatively easy to follow as long as you make a good analysis and have a good understanding of limit order and stop limit order. - Risk to Reward Customization

Another benefit is that you can customize your risk-to-reward ratio and decide how you will manage your trade. By opening two orders at the same time, you can not only maximize your profit but also minimize your loss with the pre-determined stop trigger price. - Less Monitoring

OCO order gives you the opportunity to semi-automate your trading. This is not to say that you're handing over your trades to a robot and such but it is simply a way to make you relax a little bit and give you some free time as the system doesn't require much monitoring. The orders will be triggered automatically, saving you from emotional trading and impulsive decision-making.

All in all, OCO orders are the unique type of orders that can reduce trading risks while at the same time protecting your gains when trading. It's a great choice for crypto traders, particularly experts with a solid trading strategy and those who don't have much time to watch the charts all the time. Still, it's important to note that in order to make profits with this order type, you need to have a good understanding of limit and stop limit orders. Currently, OCO order is available in advanced platforms and crypto exchanges like Binance.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano