The early hours of the London session provide a great opportunity to make money due to high liquidity and volatility, hence it's probably good to learn The London breakout strategy.

There are loads of forex trading strategies that can be used to tackle the forex market, but not all of them are as reliable and effective as a breakout strategy. A "breakout" refers to a condition where the price moves beyond a certain range, hence breaking it. This is important because it gives us a sign that the price is currently transitioning from a range to a trend and provide a good opportunity to ride it.

Today, we're going to focus specifically on the London breakout strategy. This strategy has been used by both institutional and retail traders for a long time, so it has proven to have good profitability and is easy enough to follow.

Contents

What is the London Breakout Strategy?

In the simplest term, the London breakout strategy is a day trading strategy that seeks to take advantage of the ranging market price prior to the opening of the London session. In forex trading, the market is categorized into three time zones, namely the Tokyo session, the New York session, and the London session. The London session, in particular, provides a number of great trading opportunities because it overlaps with late trading in Asia in the morning and with the New York session in the afternoon.

The basic idea of the London breakout strategy is to find a ranging market before the London session starts, then open a long position if the price breaks above the resistance line of the range or open a short position if the price breaks below the support. While this seems simple, you still need to be wary of fake breakouts that might occur when smart money is in play. However, this can actually be a strategy on its own if you know how to read the signs and enter the market at the right time.

Why Trade with London Breakout Strategy

London is known to be the center of forex trading, mainly because of its strategic location. To put into perspective, about 43% of the total forex transactions happen in London. We've also mentioned that the London session overlaps with two different time zones every day. Together, their orders lead to high liquidity and greater profitability. It can also lead to lower transaction costs because you don't need to keep your positions open overnight.

The first 1-3 hours is pretty crucial for the GBP/USD because it might determine its overall trend direction for the rest of the day. As a side note, most trends in forex trading occur during the London session and typically end at the beginning of the New York session. It's also worth noting that the volatility might die down for a while in the middle as traders often go off to eat lunch and wait for the New York session to begin.

This strategy is particularly suitable for intraday traders because it focuses on the short-term aspects of the price movement.

How to Trade the London Breakout Strategy

The London breakout strategy is actually very simple. Note that we will be using a 1-hour time frame and GBP/USD as the currency pair. As for the risk, you can set it anywhere from 1% to 2% of your trading account.

Now, the early step of the strategy is to determine your entry point. In doing so, you need to pay attention to the following things:

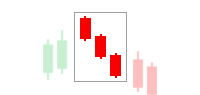

- Look at the 3 previous candlesticks in the Asian trading session and plot the high and low points of those candles.

- Draw a horizontal line starting from the highest point of the three candlesticks. If the price breaks above this line, then it's a buy signal.

- Draw another horizontal line on the lowest point of the three candlesticks. If the price breaks below the line, then it's a sell signal.

Here's what it looks like on the chart.

Notice that prior to the opening of the London session, the price was in a range bound because there was not much movement going on. After a little while, the price broke the resistance line and started to make big movements to the upside. This is the kind of the opportunity that you want to look for in the London breakout strategy.

Where to Place Your Orders

In the London breakout strategy, you'll need to open two opposite pending orders at the same time. Once the price breaks the line and activates one of the orders, you can cancel the other pending order.

- For the buy order, place a buy stop order from 1-2 pips above the top horizontal line of the range. Then place a stop loss at least 5 pips below the lower horizontal line.

- For the sell order, place a sell stop order 1-2 pips below the lower horizontal line of the range. Then place a stop loss at least 5 pips above the top horizontal line.

One of the methods that you can apply to manage your trade is using trailing stops. Remember that the point of this strategy is to ride the trend and make a profit from the huge price movement. Therefore, you need to be able to lock your profits as long as the trend keeps moving in your favor. In order to do this, you could trail your stops at 30 pips so that every time the price moves by 30 pips, your stop loss will follow.

The Best Time to Close the Order

This is not mandatory in any way, but it's highly recommended to close your trade at the end of the London session, regardless of the amount of profit or loss you make. It's not a great idea to hold on to your position overnight and hope for the price to continue the trend until the US trading session because it's too risky. Remember that the best trading opportunities occur at the beginning of the London session and usually slows down near the end. The trend can sometimes even reverse at the end of the London session because the European traders are locking in their profits.

The Upsides and Downsides

It is quite clear that the main benefit of the London breakout strategy is simplicity. Any trader can take advantage of the volatility and make money if they do it correctly. Also, there's no need to use complicated trading indicators as the strategy only relies on simple price action. The key is to enter the market at the right time when the trend is about to start and the liquidity is high. If you miss the chance, you might as well wait for the next day to open the position.

However, just like any other strategy, the London breakout is not immune to losses. Some days might be slower and less crowded, which means there might be fewer trading opportunities as well. Typically, Mondays and Fridays are not particularly great for trading because they are close to the weekend, so you might want to avoid trading on those days.

Another downside is that many economic news and data are typically released during the early hours of the market opening, which can drive the volatility extremely high. As a result, the market can make a lot of unpredictable movements in a short period of time. Not only that, but this can also cost you more money if your broker uses variable spreads. Some brokers with fixed spreads can even widen the number during such volatile periods. So, if there's too many news being released during the London opening, it's not recommended to open a position and risk your money.

Lastly, you should also be aware of the possibility of false breakouts. The London session is exactly the time when all kinds of traders gather and invest their money. This means the market is not only filled with individual traders but also banks and other institutional entities. This increases the chance of losing if the price breaks the line only to move right in the opposite direction a while later. If your stop loss is too tight, you might get kicked out of your trade before even tasting the profit.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

1 Comment

Geoffrey Kiarie

May 30 2023

It's a well researched article. Keep it up.