While trading, it's common to find false breakouts in any time frame. But did you know that you can actually take advantage of these so-called failed breakouts?

The forex market is known for its dynamic nature, and false breakouts are a common occurrence that can deceive traders and lead to potential losses. False breakouts happen when the price appears to break through a significant support or resistance level, only to swiftly reverse and move back within the previous trading range.

To effectively trade false breakouts in forex, traders need a well-defined approach and a set of strategies to navigate these challenging market conditions. In this article, we will explore key techniques and tactics that can help traders identify and capitalize on false breakouts, turning them into profitable opportunities.

Understanding False Breakout

The term "breakout" basically refers to any price movement that breaks through any defined key levels, whether they are high and low levels, support and resistance, supply and demand, or even psychological levels. The breakout can occur either horizontally or diagonally, depending on the price action pattern.

We have mentioned that confirming the breakout is highly important in this strategy. Sometimes, the price will break the barrier for a little while only to come back in the opposite direction. This is called a false breakout.

There are several reasons why the market failed to break out. Commonly, it is caused by the tough battle between the big players such as the central banks, financial institutions, and hedge fund managers.

If one of them does not wish the price to pass a certain level, it will immediately double its lot size and increase its position. In times like this, the other players can also go with the flow and follow the path by making orders in the opposite direction. As a result, the price will slide quickly and sharply turn in the opposite direction from the breakout.

In short, a false breakout is a technical analysis that occurs when the price of a security or market breaks through a significant support or resistance level but then quickly reverses back to the previous trend. Forex traders often use support and resistance levels to identify potential breakout opportunities, where the price is expected to move in a sustained manner in the direction of the breakout.

However, false breakouts can frustrate traders who enter positions based on these breakouts, only to see the price reverse and move against their expectations.

This can happen for a variety of reasons, such as:

- Stop hunting: Institutional traders or market participants with significant resources may intentionally trigger stop orders placed above or below key levels, causing a temporary surge in price before reversing it. This practice aims to generate liquidity or force other traders out of their positions.

- Lack of momentum: Sometimes, a lack of sufficient buying or selling pressure after a breakout can result in a false breakout. If the market lacks the necessary momentum to sustain the price beyond the breakout point, it may quickly reverse.

- News or economic data: Unexpected news releases or economic data can lead to false breakouts. Traders may initially interpret the news as significant and push the price beyond a key level, but as more participants analyze the information and reassess their positions, the price can reverse.

How to Avoid False Breakouts

Apart from confirming the breakout before entering the trade, there are several other ways to avoid false breakouts:

- Look at a higher time frame. This way, it's easier to confirm the validity of the breakout because there's more information available on the chart.

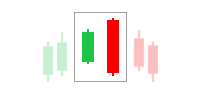

- Confirm with price action. You can use your technical analysis skill on this one because it's important to pay attention to what candlestick patterns are formed at the key levels that the price is trying to break. If the candlestick forms a reversal pattern such as Pin Bar, Doji, Engulfing, or Three Inside, then you should be prepared for a reversing movement.

- Use additional indicators. You can anticipate a false breakout by using indicators like Oscillators (RSI, Stochastic, CCI, MACD, etc.) and ADX. The key is simple: if the trend's momentum is increasing, then there's a big chance of a breakout. But if the momentum is weakening, then the breakout may be false.

Using False Breakouts to Your Advantage

What's interesting about false breakouts is that apart from the fact that they can ruin your breakout strategy, you can actually use them to your advantage instead. This is often called the way of contrarian trading.

Like breakouts, false breakouts can happen in any time frame and market condition. Here's an example of false breakouts on a sideway or ranging market.

From the chart, we can see that there are 4 false breakouts; 3 occur at the resistance level while the other 1 occurs at the support level. Traders who are familiar with price action analysis are surely able to identify the false breakout by looking at the candlestick patterns.

The first circle identifies a strong bullish candle followed by a similarly strong bearish candle, indicating a strong market consolidation. We can go long only when the highest level of the bullish candle has been broken.

But alas, the price never rises past the bullish candle's high and goes back down as shown in the chart above. Typically, contrarian traders will use limit orders in areas close to resistance or support levels (in this case, sell limits in 1, 3, 4 and a buy limit in 2).

To know for sure which strategy works best, we should understand the overall price movement by referring to a higher time frame so we can see the dominant trend at that time. If the uptrend is dominant, the sideway chart will tend to break the resistance. But if the downtrend is the predominant one, the chart will tend to break the support level.

Conclusion

The forex market is a really volatile place. One of the worst things that can happen to a forex trader is getting caught in the middle of the wave, where the market moves back and forth in an unpredictable, extreme manner. Breakout strategy can be really profitable for any trader, but there are times when your prediction may not work out and you could end up losing a lot of money.

That is why false breakout is a great backup strategy that can offer a way to make back the money that you may have lost on the traditional breakout trade. However, trading with a false breakout strategy is not exactly easy for beginners, so it would be a big help to learn certain things like technical analysis and price action before you use it.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance