Market sentiment can affect short-term price movements. That's why Admiral Markets provides sentiment tools to help you read the market and generate higher profits.

When trading, there are many important factors that can be used to analyze the markets. One of the most popular among traders is market sentiment, which basically refers to the general outlook or attitude of investors toward a certain trading instrument or the overall financial market. It shows the general optimism or pessimism of market participants that drives demand and supply, hence affecting the price movements.

Many traders often combine market sentiment indicators with other forms of analysis to identify reliable entry and exit signals. Alternatively, traders can also use Admiral Markets' sentiment tool to check which assets are dominated by bullish/bearish sentiment to confirm their trading positions. But before we get into that, let's learn a little bit more about market sentiment in forex trading.

Why Is Market Sentiment So Important?

Market sentiment is a crucial indicator in the trading world. It is a term used to describe the psychological attitude of market participants toward a particular asset or security. The market's demand and supply are often driven by market sentiment, and it's not always rational. This is typically seen as a result of "animal spirits" behavior, which is a type of crowd psychology where people suddenly have the urge to either buy or sell assets, resulting in high market volatility.

Understanding market sentiment is not exactly easy because there are many factors involved. The most important one is market psychology. Emotions like fear and greed can easily affect market movements, especially following the release of important news headlines or geopolitical events. When the market is dominated by fear, it can result in massive selloffs and quick price declines in instruments like forex, stocks, and indices. Meanwhile, when greed has taken over, we will see the market rallying upwards.

Now in order to understand why market participants behave a certain way, we should be able to observe and analyze market sentiment indicators, such as:

- Volatility Index (VIX): an indicator of a need for insurance in the market. When the volatility is high, the VIX rises up, indicating the increased risk.

- High-Low Index: a comparison of the number of stocks that make up 52-week highs as well as the number of stocks that makes up 52-week lows. When the index is high, it is considered to be a bullish market sentiment and vice versa.

- Bullish Percentage Index (BPI): this indicator measures the total number of stocks in a given index that shows bullish patterns over a certain period of time based on point and figure charts. If the BPI score is high (around 80% or above), it shows that market sentiment is optimistic and vice versa.

- Moving Averages in Technical Analysis: Simple Moving Averages can give the overall price movement of a given asset over a certain period. 50-day or 200-day moving averages, for instance, are pretty common indicators of market sentiment. When the 50-day SMA crosses above the 200-day SMA (often known as the golden cross), it indicates a bullish sentiment. When the 50-day SMA crosses below the 200-day SMA (also known as the death cross), it suggests a bearish market sentiment.

Trading with Admiral Market's Sentiment Tool

Aside from the abovementioned tools, Admiral Markets offers a sentiment widget to help clients see the correlation between long and short positions held by other traders in the market. The tool basically shows the "bull and bear" signals that can be used to identify the overall market mood.

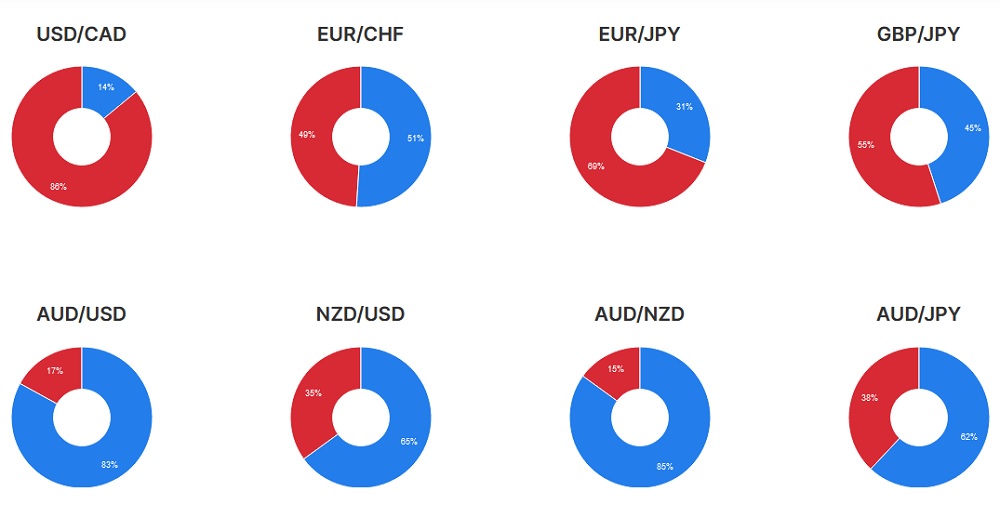

The market sentiment tool follows gold, major forex pairs, and other additional pairs in real time by displaying other traders' long and short positions in the market. Here's an example of what it looks like on Admiral Markets' website:

The sentiment is based on real-time data gathered from several trading service providers. The data above shows market sentiment data on each currency pair, in which the blue part represents the bullish side while the red area is for the bearish side. So, if EUR/CHF's sentiments are 49% in red and 51% in blue, it means that the market tends to be bullish on that pair. The small difference in percentage indicates that the bulls' and bears' strengths are almost equal. Bigger difference in percentages usually means stronger signals and higher chances to profit from the sentiment.

This widget is updated in real-time, which makes it easier for traders to get accurate analyses. However, please note that volume data in Admiral Markets' sentiment tool can change significantly during market moves or when traders open/close positions in huge volumes.

In a Nutshell

Market sentiment is one of the important indicators to trade profitably in financial markets. It is used to spot trading opportunities from short-term price movements as a result of investor attitudes toward a certain asset. Market sentiment is usually described as either bullish or bearish. When it's bullish, asset prices are usually going up, and vice versa.

Emotion often drives the price movement, so market sentiment can be irrational at times. In this case, you can use sentiment tools like the one offered by Admiral Markets to see the overall market sentiment in real-time without much of a hassle. As you can see from the example above, the data is very easy to read, even for beginners. Overall, it is a highly useful tool to help you see bullish/bearish signals to execute your trade at the right time and generate profit.

Admiral Markets is a forex and CFD brokerage that has been operating since 2001 to provide smart financial answers for traders around the globe. Their main services revolve around 3 key activities: Learning, Trade, and investing. In doing so, they have many registered subsidiaries, including Admiral Markets UK Ltd, Admiral Markets Pty Ltd (Australia), Admiral Markets AS Jordan Ltd, Admiral Markets Cyprus Ltd, Admirals SA (Pty) Ltd (South Africa), and Aglobe Investments Ltd (Seychelles) for the worldwide market.

Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

32 Comments

Viola

Apr 27 2023

I've been trading for a few months now and I find market sentiment really interesting. I used to get a lot of loss streaks in my early days and I had no idea what I did wrong. Apparently, I forgot to put market sentiments into consideration. Didn't know what it was, didn't really care about what other traders think about the markets. Now I'm constantly learning about it, especially the way it affects the market as a whole. What I want to know is how to measure the total market sentiment of a certain financial market. Also, has anyone know anything about daily sentiment index and kind enough to explain?

Ravi

Apr 28 2023

One simple way to measure the total market sentiment in stock market is to analyze the charts of bellwether stock indexes such as S&P 500 or the Wilshire 5000. These indexes are often seen as the benchmark of American stock market in general. It's actually really easy. If the index has been going slow and in a steady decline for several months, you can conclude that the market sentiment is generally pessimistic/bearish. The same concept applies to the opposite direction.

As for the daily sentiment index, it's a popular indicator of short-term market sentiments. The value is calculated based on data about futures, forex, and treasury securities. If the score's above 50, then the market sentiment is considered bullish. If it's under 50, then it's bearish. Hope this helps :)

Nissa

Apr 27 2023

Hi there.

I was wondering if you could help me figure out how to trade with market sentiments effectively. Some people say that it's better to follow market sentiments, while others say you should go against the sentiments. I'm not sure how these strategies work though. What are the pros and cons of using each option and who is it most suitable for?

Thank you so much for the response.

Imania

Apr 28 2023

The most common use of market sentiments is trading in the same direction as market sentiments. So, when market sentiment is bullish, we can expect the prices of securities to rise in the near future. This is often known as the "herd behavior" and often results in the creation of bubbles because of the free-rider effect.

However, I must say that following the herd doesn't always make a good investment strategy. I know some investors that prefer to trade against current market sentiments. In the midst of market pessimism, they would look for falling stocks with strong fundamentals and promising growth potential in the future. In other words, they're taking advantage of the low prices while keeping in mind the intrinsic value of the company.

At the end of the day, the choice is all yours. Market sentiment is a great way to "read" the market and predict future price movements, but you must proceed with caution. Sometimes market sentiments are unpredictable and completely out of track. As the author mentioned in the article, it can be irrational at times even.

Marianne

Apr 29 2023

I totally agree. There is no ultimate strategy to use when it comes to trading with market sentiments. You can either trade with the trend and join the herd or go against it and succeed later. However, I must warn you that the latter is more suitable for experienced traders with a good fundamental understanding. Short-term price movements are usually not a good description of the fundamental performance of a company because market participants often overreact over certain news. Thus, it's better to look for long-term prospects of the company instead.

Gerard

Apr 27 2023

Hey dude, talking about the sentiment analysis itself. If most of the currency pairs at the blue one, it can bullish and if on the red one it will be bearish. Okay, I understand the basic of the seintiment analysis and it is really look like sginal where the market will go. Either it is bullish one or it will be bearsih. But What I want to ask now is about how the sentiment of bullish and bearish equal? Just like the artile said, 49% red and 51% blue. what steps that I need to take in order to get the strong signal of the market?

And what good percentage that needed to take the choice of the sentiment analysis? Thank you!

Rudy

Apr 28 2023

Hey there! When it comes to sentiment analysis, the basic idea is that a predominance of blue can indicate a bullish market sentiment, while a predominance of red can indicate a bearish sentiment.

However, if the sentiment is more evenly split, like in the example you gave of 49% red and 51% blue, it can be more challenging to determine the market's direction. In this case, it's important to look for additional indicators or analysis to confirm the sentiment before making a trade.

As for what percentage is best for a strong sentiment signal, there isn't a one-size-fits-all answer. The ideal percentage depends on the market conditions and the asset being traded. Generally, a higher percentage of either bullish or bearish sentiment is more favorable for a strong signal. But it's important to always consider other factors and perform a thorough analysis before basing a trade solely on sentiment analysis.

Margelius

Apr 29 2023

If you want to make better trading decisions, you can pair sentiment analysis with other types of analysis to get a clearer picture of where the market might be going. For example, technical analysis involves looking at charts and indicators to spot trends and patterns. Fundamental analysis, on the other hand, takes into account news and economic events that could impact the market.

Market structure analysis is another type of analysis that looks at the order book and liquidity of the market to understand sentiment. Lastly, price action analysis observes how prices move and can help identify trading opportunities.

By combining sentiment analysis with any of these other types of analysis, you can make smarter decisions about when to buy or sell, and not rely too heavily on just one type of analysis.

Andreas

Apr 27 2023

According to the article, Simple Moving Averages can provide an idea of the price movement of an asset over a specific period. Commonly used moving averages are the 50-day and 200-day indicators, which can reflect the market sentiment. If the 50-day SMA crosses above the 200-day SMA (golden cross), it indicates a bullish sentiment, while if the 50-day SMA crosses below the 200-day SMA (death cross), it indicates a bearish sentiment.

HOw about if I change the sum of the day. I mean 200 days into another number or 50 day into another number? And why the default moving average always 50 and 200 days?

Seth

Apr 29 2023

Yes, you can change the number of days for the moving averages to suit your trading strategy and timeframe. The 50-day and 200-day moving averages are commonly used because they cover a significant period of time, allowing traders to see the long-term trend of an asset. However, traders may also use other periods for their moving averages, such as 10-day or 100-day moving averages, depending on their trading style and preferences.

The choice of the default moving averages (50-day and 200-day) is based on historical analysis and the preferences of traders who have found them to be effective in identifying market sentiment.

Wahyu

May 6 2023

Thank you for the great article! I gained some perspective on another trading strategy that involves using sentiment analysis. I was especially surprised by the Admiral Markets' feature called Admiral Market Sentiment Tools, which allows us to see the positions of other traders in the market, including the percentage of traders holding buy and sell positions.

I'm very interested in using sentiment analysis for trading, and I have a question about how to make a trade based on this analysis. For example, if the sentiment for EUR/USD is showing 80% buy positions and the rest sell positions, which position should I take - should I buy or sell? Should I follow the trend in the market?

Thank you!

Jorge

May 7 2023

Here's the deal: sentiment analysis is just one tool in your trading toolbox. It's important to use other indicators and analysis to get a well-rounded view of the market. So, while a bullish sentiment might make you want to buy, it's not a guarantee that the market will continue in that direction. You need to consider other factors like technical analysis and market news before making a move.

If you're into trend-following, you might consider a long (buy) position when the market sentiment is bullish and a short (sell) position when it's bearish. But, it's always wise to look for confirmation of the sentiment signal from other sources before jumping into a trade.

So, sentiment analysis can be a useful tool, but don't rely on it alone to make your trading decisions!

Licha

May 8 2023

It is not only using one analysis to getting know about the market movement. I mean, to make sure the market go, it is better use some analysis too. There are a bunch of indicators you can use to help you make better trading decisions when you're using sentiment analysis. Here are some examples:

Technical analysis: This is where you look at past market data to see if there are any patterns or trends that can help you predict future price movements. You can use stuff like moving averages, Bollinger Bands, MACD, RSI, and Fibonacci retracements to analyze price movements and figure out when to buy or sell.

Fundamental analysis: This is when you look at economic and financial data to see what's driving market movements. You can use things like interest rates, GDP growth, inflation, and corporate earnings to get a sense of what's going on in the economy and make informed trading decisions.

Market news: Keeping up with the latest news and events is key for making good trading decisions. You can use sources like financial websites, news outlets, and social media to stay up to date on what's happening in the markets.

Volatility indicators: Volatility measures how much prices are changing in a market. You can use stuff like the VIX (Volatility Index), ATR (Average True Range), and Bollinger Bands to figure out how much risk you're comfortable taking on.

It is yes we need to follow the trend but we can prepare ourself if the market suddenly change its course. With some analysis that you can combine with, you can avoid risk of losing money.

Angel

May 7 2023

Hey there, I'm pretty new around here and just stumbled upon some articles that were recommended by a friend. I saw one that talked about market sentiment and how it's usually described as either bullish or bearish. I'm still trying to wrap my head around it though, because I thought that if market sentiment is bullish, then asset prices should be going up. But, apparently that's not always the case? Sometimes prices can go down even when the sentiment is bullish, and it's got me all confused. Like, what's going on? How can I accurately read market sentiment if it doesn't always align with asset prices? Are there other factors that I should be considering? I want to make sure that I'm not making any rookie mistakes, so any help in understanding this would be greatly appreciated.

Reza

May 8 2023

o, I hear ya. Market sentiment can be a tricky thing to wrap your head around, especially when it doesn't always match up with prices. But here's the deal: market sentiment basically refers to how investors as a whole feel about a certain asset or market. When it's bullish, people are feeling positive and optimistic about the asset, which can lead to higher demand and prices going up. But, there are other factors at play too. Like, if there's suddenly a ton of supply or bad news comes out about the asset, that can offset the bullish sentiment and bring prices down. So it's not always a straight shot up. To read market sentiment, you can look at things like news articles, social media trends, and investor surveys to get a feel for how people are feeling about the asset. It takes some practice to get the hang of it, but it's definitely worth it for spotting trading opportunities. Hope that helps

Jorge Jared

Jun 1 2023

Is market sentiment really a reliable indicator for making trading decisions, or can it be a bit dodgy at times? The article talks about how market sentiment is all about capturing the vibe and attitude of investors towards different assets. It's like a mood ring for the financial markets, where bullish sentiment means prices are on the rise, and bearish sentiment means they're headed south. But let's be real here, mate. Sometimes market sentiment can be as fickle as the weather Down Under.

So, my question is, should traders put all their eggs in the market sentiment basket, or is there a need to be a bit more cautious? How can traders navigate the potential pitfalls of relying solely on market sentiment? Are there any savvy strategies or additional factors they should consider to avoid getting caught up in the hype or making dodgy decisions? Give us the inside scoop, mate!

Tony

Jun 16 2023

@Jorge Jared: Hey mate, I hear ya! Market sentiment can be a tricky beast to tame when it comes to making trading decisions. It's like trying to predict the weather in the Outback – you never know when it's gonna change on ya!

(read : What is Market Sentiment in Forex and How to Measure It?)

So, here's the deal. While market sentiment can give ya some insights into the general mood of investors, it's not always a foolproof indicator. Sometimes it can be a bit dodgy, ya know? It's like relying on a mood ring to make all your life decisions – sure, it's cool, but you gotta take it with a grain of salt.

To avoid putting all your eggs in the market sentiment basket, traders need to be smart and cautious. They can't just blindly follow the herd. It's important to consider other factors like fundamental analysis, technical indicators, and economic news. These can provide a more well-rounded perspective and help ya make more informed decisions. Good luck out there, and may the market gods be ever in your favor!

Thiery

Jun 18 2023

Hey there! Could you provide insights into the origin of the information displayed in the sentiment widget? Is it based on Admiral Markets' clients' trading positions exclusively, or does it incorporate data from a broader range of market participants? Understanding the source of the sentiment data used in the tool can give traders a better understanding of the reliability and representativeness of the sentiment signals provided. Additionally, does Admiral Markets provide any additional information or context regarding how the sentiment tool calculates and interprets the market mood based on the long and short positions of other traders?

Bruno

Jun 19 2023

@Thiery: Hey, dude! Great questions you've got there! So, when it comes to the sentiment widget provided by Admiral Markets, it's important to know where the information comes from and how it's calculated.

The sentiment data displayed in the widget is not exclusively based on Admiral Markets' clients' trading positions. It actually incorporates data from a broader range of market participants. This means it takes into account the positions of traders from various sources, providing a more comprehensive view of market sentiment.

As for the calculation and interpretation of the market mood, Admiral Markets may provide additional information or context to help traders understand how the sentiment tool works. They might offer insights into the methodology used to calculate sentiment, such as the ratio of long to short positions or any specific algorithms applied.

Thiery

Jun 18 2023

Hey there! Could you provide insights into the origin of the information displayed in the sentiment widget? Is it based on Admiral Markets' clients' trading positions exclusively, or does it incorporate data from a broader range of market participants? Understanding the source of the sentiment data used in the tool can give traders a better understanding of the reliability and representativeness of the sentiment signals provided. Additionally, does Admiral Markets provide any additional information or context regarding how the sentiment tool calculates and interprets the market mood based on the long and short positions of other traders?

Hector

Jul 12 2023

@Thiery: The sentiment widget provided by Admiral Markets is pretty cool, but let's dig into where the information comes from and how it's calculated. So, the widget doesn't just rely on data from Admiral Markets' clients. It actually takes into account a wider range of market participants, including retail and institutional traders. They gather information from different sources to give you a more complete picture of market sentiment.

Now, when it comes to additional info or context, Admiral Markets may have some documentation or explanations about how they calculate and interpret the market mood based on traders' long and short positions. It could cover things like how they weigh different participants, the time frames they analyze, and any specific criteria or algorithms they use. Having access to that kind of info can give you a better understanding of how reliable and useful the sentiment signals from the widget are.

To get all the juicy details about Admiral Markets' sentiment tool, I suggest checking out their official documentation or reaching out to their customer support. They'll be able to give you specific insights and clear up any questions you have about how the widget works and how to interpret those sentiment signals. Happy trading!

Ghuk Tae

Sep 1 2023

Hello, good morning senior traders, although I am still limited to reading articles about the world of trading, I am very excited when I hear and read things related to trading information and other instructions that have made me a successful trader. I am interested in the article submitted by this author, it is very useful, and straightforward and the choice of words is easy for trader readers to understand even though those who read are beginners like me.

So after reading this article, I decided to give their demo account a try. I trained with him for several months and finally felt ready to open a live account. But I'm not sure this broker is available for US traders. Actually, of the many trading brokers that I know, it is very rare for brokers to get licenses from US regulators. Can I, as a US broker, entrust my funds and trade in US territory?

According to the articles I read, it is known that getting a US license is very difficult because the requirements are quite strict, is that true or not? However, I don't understand why it happened. Why is it so difficult for brokers to enter the United States market? Are the regulations in the United States really that strict? This is really difficult for American citizens who want to trade with a safe and trusted broker.

Capoor

Sep 2 2023

Hey bros! It's lucky you have experience with Admirals. So here is the deal with a broker that accepts US traders. Admirals is a global brokerage firm, which has many branches around the world including the US region which is known for its complex regulations and strict policies. Banay brokers are said to be good brokers, but they can't enter the US market, but Admkrals is indeed on a different level as a global broker.

If you are already familiar with MetaTrader 4 and 5, then this is the right choice for you to use as a trading platform at Admirals. It is user-friendly and has a simple interface which is perfect for beginners. Regarding the regulatory aspects, it is definitely safe to trade with them as they are regulated by some of the most reputable authorities in the industry, such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities, Investments Commission (ASIC) in Australia, CySEC (Cyprus), JSC (Jordan) and FSCA (South Africa). Apart from that, US Admirals have also obtained a valid license from the European Food Safety Authority (EFSA). This has proven that this broker is also SAFE and GOOD for US traders.

Leopard

Sep 3 2023

That's right, not many brokers accept US traders. According to the articles I read, it is known that getting a US license is very difficult because the requirements are quite strict. One of the main reasons why forex brokers do not accept US clients is because of the strict regulations imposed by the US government. The US government has implemented a number of regulations regarding forex brokers, including the Dodd-Frank Act which was introduced in 2010. This law requires forex brokers to register with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) which can be a lengthy and expensive process.

In addition, forex brokers are also required to meet a number of other requirements, including maintaining minimum capital requirements and submitting periodic financial reports to the authorities. These regulations can be difficult for forex brokers to comply with, which is why many prefer not to accept US clients.

Well despite the many rules in the US, it is important to remember that these regulations are designed to protect traders and ensure that the forex market operates fairly and transparently. As a result, it is important to choose a regulated and trustworthy forex broker, even if they do not accept US clients. Yeah, therefore, in my view, Admirals is a good broker because it can enter the US market, although not all instruments can be traded by US traders. this Broker has one of the best and most good study and research materials for trading EAs.

Moreover, recently, I have good news that Admiral is expanding its foot in the US with plans to restructure its group by merging parent entities Admiral Markets US and Admirals Group US. The merger is expected to be completed in the first half of 2024. As part of the plan, Admiral Markets will also revoke the operating license of its Estonian subsidiary, which is expected to take place in the second half of this year, possibly in August 2023. Read here (Admirals Restructuring Plan and Revocation of Estonian License)

However, if you need another broker for comparison, you have to read this (Forex Brokers Offering Us Clients)

Rudeous

Sep 10 2023

Although a little off topic, I have a few questions regarding the Admiral Mobiles App. The articles I read indicated that this app is a great tool for mobile trading, with lots of features and a clean, efficient interface. However, as a trader, I am most interested in whether the application includes indicator tools for chart analysis. I think this feature is very important for my trading needs, and I would like to confirm whether this feature is available on the Admiral Mobiles App. If so, I'd love to explore this feature and see how it can help me improve my trading strategy on the go. Can you give me more information about this? I ask this because the article is not very clear about the trading tools they provide

Bosse Einar

Sep 11 2023

As the user of Admiral app, I can say this app is perfect for the trader that want to use mobile app feature. Some of the Admiral Mobile App are :

Technical Indicators: The app may provide a wide range of technical indicators that traders can use to analyze market trends and identify potential trading opportunities. These indicators may include moving averages, oscillators, momentum indicators, and more. Traders can customize the settings of each indicator and apply them to their charts.

Drawing Tools: The app may offer various drawing tools that traders can use to mark up their charts with trend lines, support and resistance levels, and other visual cues. These tools may include horizontal lines, vertical lines, trend channels, Fibonacci retracements, and more. Traders can also annotate their charts with text labels and shapes.

Customizable Charts: The app may allow traders to customize their charts to suit their preferences. Traders can choose from a variety of chart types, including line charts, bar charts, and candlestick charts. They can also adjust the timeframes of their charts to view historical price data over different periods.

Advanced Charting: The app may provide advanced charting features that allow traders to perform in-depth analysis of market trends. These features may include the ability to overlay multiple indicators on the same chart, compare different markets on the same chart, and view custom indicators created by other traders.

Chart Saving and Sharing: The app may allow traders to save their customized charts and share them with other traders. This can be useful for collaborating with colleagues or sharing trading ideas with the community.

Setha

Oct 20 2023

I'm looking to grasp a better understanding of the dynamics in trading, particularly regarding the concepts of volatility and liquidity. I noticed in the article that the Volatility Index (VIX) is described as an indicator that rises when volatility is high, pointing to increased risk. Now, I'm curious about how this relates to the concept of liquidity in the market. Could you elaborate on the differences between volatility and liquidity, and how they influence trading decisions? It seems that while VIX gauges market uncertainty, liquidity addresses the ease of buying or selling assets, but I'd like to comprehend the nuances of these factors and how traders can effectively navigate both in their strategies.

Thank you! Hope there is clear answer about the volatility and liquidity that happen in the trading

Gerald

Oct 26 2023

@Setha: Forex can be a bit of a maze, but let's break it down. First, we've got Volatility - that's all about how much prices bounce around in the market. When there's high volatility, it means prices are doing big jumps in a short time. This can be risky, but it also offers a shot at big profits. On the flip side, Liquidity is like how smoothly traffic moves on the road. It's about how easy it is to buy or sell things in the market without causing a mess with prices. Traders love markets with high liquidity because it makes trading a breeze. When there's low liquidity, things can slow down, and you might run into issues with orders and prices not playing nice. So, to sum it up, traders often chase high volatility for the thrill, but it can be a rollercoaster. Low volatility gives you a smoother ride, even though it might take a bit longer to get where you want to go.

Mendy

Mar 22 2024

So, I was reading this article, and it made a big deal about how market sentiment is super important for making profitable trades in financial markets. It's basically all about figuring out what investors are feeling about certain assets and using that to spot trading opportunities. Admiral Markets offers this service, which is pretty cool.

But here's the thing that got me thinking: the article mostly talks about short-term price movements. I'm wondering if market sentiment can also be useful for long-term trading. You know, like when beginners prefer to play it safe with longer-term trades instead of going for riskier short-term stuff like scalping. It'd be great to know if market sentiment matters for the long haul too.

Jurgen

Mar 26 2024

Hey There! Market sentiment isn't solely confined to short-term trading; it can definitely influence long-term investment strategies as well. While the article mainly discusses short-term price fluctuations, grasping how investors perceive certain assets can be advantageous for longer-term approaches. This is especially relevant for novice traders who prefer safer, longer-term investments. Being aware of the overall sentiment surrounding an asset can guide decision-making and risk management effectively. In essence, market sentiment isn't limited to rapid trades; it's a valuable tool for strategic long-term investment too.

For instance, picture yourself as a beginner investor eyeing a specific stock for a long-term investment. Before finalizing your decision, it's wise to assess the market sentiment surrounding that stock. If you observe predominantly positive sentiment among investors, signaling confidence in the company's future prospects, it could bolster your conviction in investing. Conversely, if you detect negative sentiment, possibly due to concerns about the company's performance or external industry factors, you might opt for a more cautious approach or explore alternative investment opportunities. Thus, even in long-term investment scenarios, understanding market sentiment can empower you to make well-informed decisions and potentially mitigate associated risks.

Alexia

Mar 28 2024

Hey! So, in the article, they talked about how important market sentiment is in trading. Basically, it's all about the vibe or attitude that traders have toward a specific asset or security. Now, you might wonder, why does the psychological stuff matter in trading? Can our own feelings as traders actually affect the market? And what about those big-shot traders – do their emotions play a role too?

Gary

Mar 31 2024

The answer bout your question, absolutely yes!!

As traders, our psychological state can influence our decisions and actions, which in turn can affect market dynamics. For instance, if a large number of traders are feeling optimistic about a certain stock, they might be more inclined to buy it, driving up its price. Conversely, if sentiment turns negative due to, say, bad news or economic uncertainty, traders might sell off their positions, causing the price to drop.

Now, when it comes to big traders or institutional investors, their actions can have an even more pronounced effect on market sentiment. These players often have significant resources and can execute large trades that move markets. Additionally, their reputation and track record can influence how other traders perceive market conditions and make decisions accordingly.

So, in a nutshell, yes, both individual traders' psychology and the actions of larger market participants can play a significant role in shaping market sentiment and ultimately impacting market movements.