Apart from trading, crypto investors can generate profit from crypto staking. Here's everything you need to know about staking coins on Huobi Global.

Staking is basically the act of committing your crypto coins to support a blockchain and confirm transactions on the network. It is the heart of the Proof of Stake model, which is known as an alternative to the energy-consuming Proof of Work model. Staking can be a smart way to make use of your cryptocurrency to generate passive income, but there are some things that you should know beforehand. Today, we're going to unveil how staking works and how to start staking on one of the leading crypto exchanges in the world, Huobi Global.

Contents

How Staking Crypto Works

Staking is the process of locking crypto coins to verify transactions on a blockchain network and it only works with cryptocurrencies that use the Proof of Stake model. Basically, it starts with the blockchain users pledging their coins to the crypto protocol. Then, the protocol chooses multiple validators to confirm blocks of transactions and add them to the network. The more coins you commit, the higher the chance to be chosen as a validator.

Every time a block is added to the blockchain network, new crypto coins are minted and distributed to the block's validator as staking rewards. Most of the time, the rewards are the same type of crypto that the validators are staking, although some blockchains may use a different type of crypto as well.

You can combine resources with other investors in a token pool and receive rewards in proportion to your contribution to the pool. This is quite a useful strategy, especially on networks with higher barriers to entry. This can also save you from all the complicated processes, as you simply need to hold your tokens and let the pool provider takes care of the technical requirements. Huobi Global even offers staking pools without any fees incurred, so it is quite beneficial for investors.

That being said, if you want to stake your coins, you must first own a crypto coin that uses the Proof of Stake model like Ethereum, Solana, Terra, and Cardano. Then you simply need to decide the amount of crypto that you want to stake. You can do this through various popular crypto exchanges like Huobi Global.

However, please keep in mind that your staked coins are basically locked, so you won't be able to use it until the staking period ends. In some cases, you can unstake them at any time you want, but you won't get any rewards. Therefore, make sure to read the full terms and policies before pledging your coins.

Benefits of Staking on Huobi Global

Although it is possible to stake your coins without the help of a third party, there are some unique advantages that you can only get by staking through crypto exchanges like Huobi Global, such as:

- Very easy. This is undoubtedly a great advantage to all kinds of users, especially beginners. There's no need to manage private keys, locate nodes, sign off on transactions, or perform other complex tasks to participate in crypto staking. With Huobi Global, you can start staking your holdings with just a few simple clicks.

- No need to worry about losing your assets. Huobi Global prioritizes the safety of users' funds, so they only support trusted projects for staking and monitor the system in real-time to ensure that everything runs smoothly.

- Get high passive income without additional fees. Huobi Global shares the revenue from the validator rewards, so you don't need to worry about paying extra fees to the exchange. However, please note that the APY may vary according to the actual income.

How to Stake on Huobi Global

Staking coins on Huobi Global can be done in three easy steps:

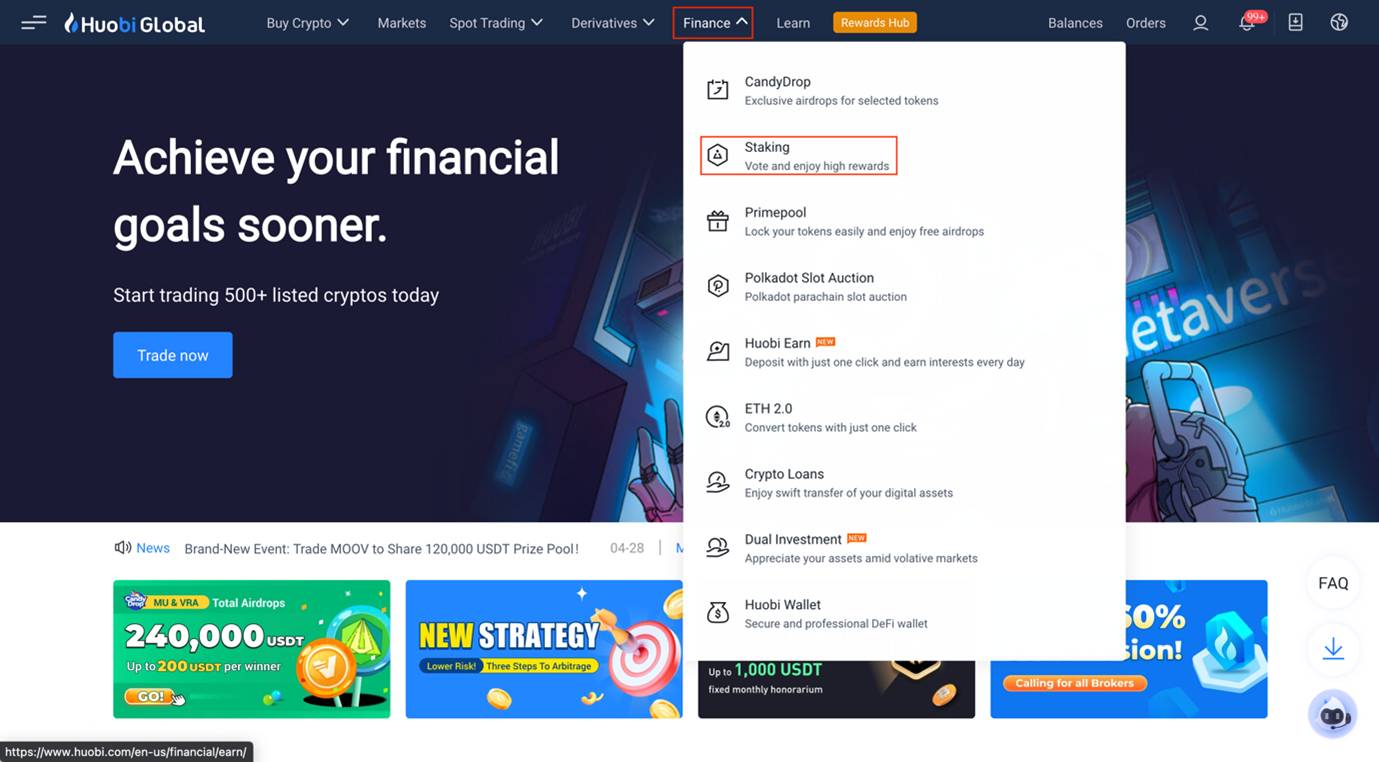

1. Head over to Huobi Global's official website and log in to your account. Then, hover your cursor to the Finance drop-down menu at the top of the screen and choose "Staking".

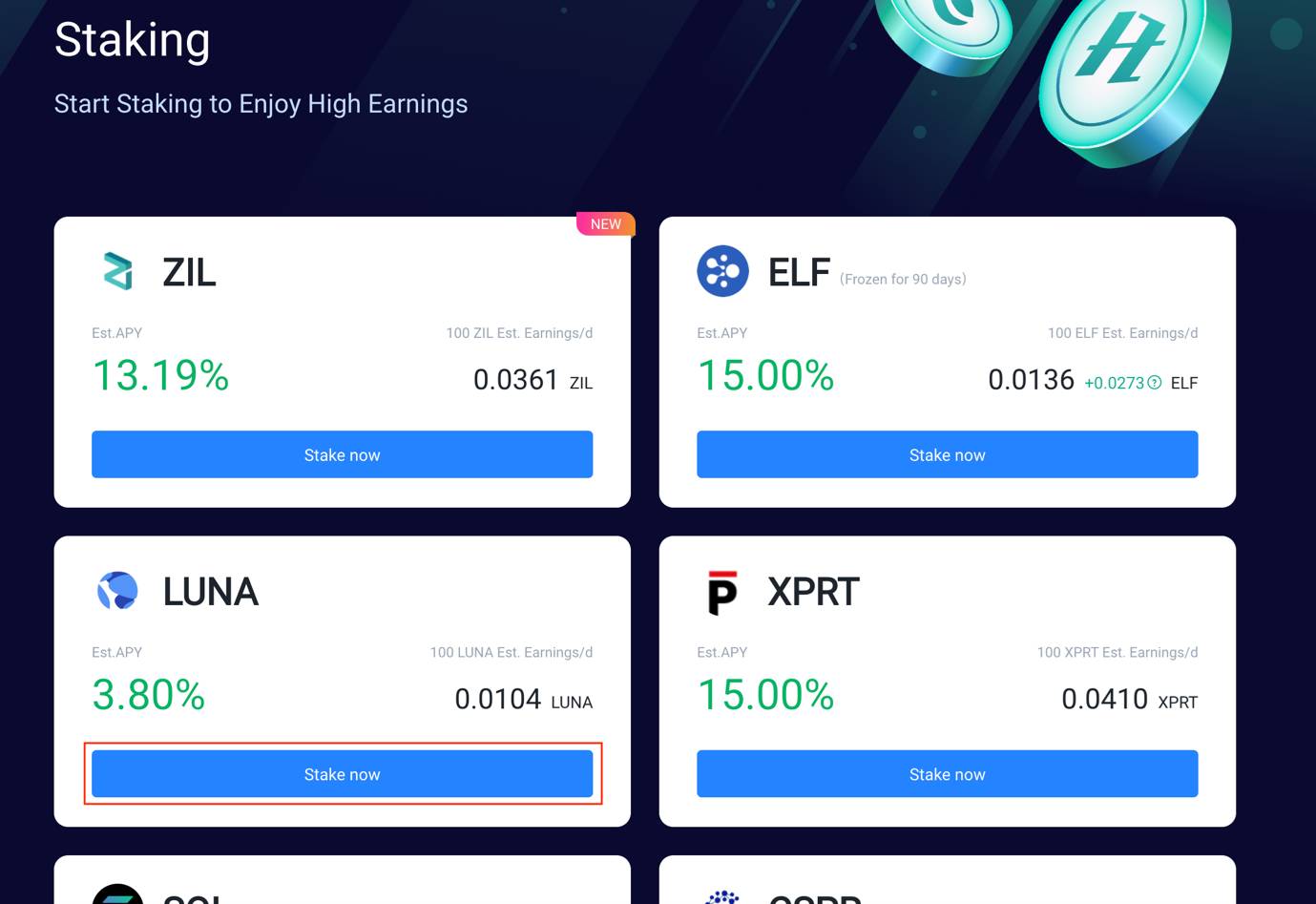

2. You'll see a list of different tokens available for staking along with the estimated APY and other details. Choose the token that you want to stake and click "Stake Now".

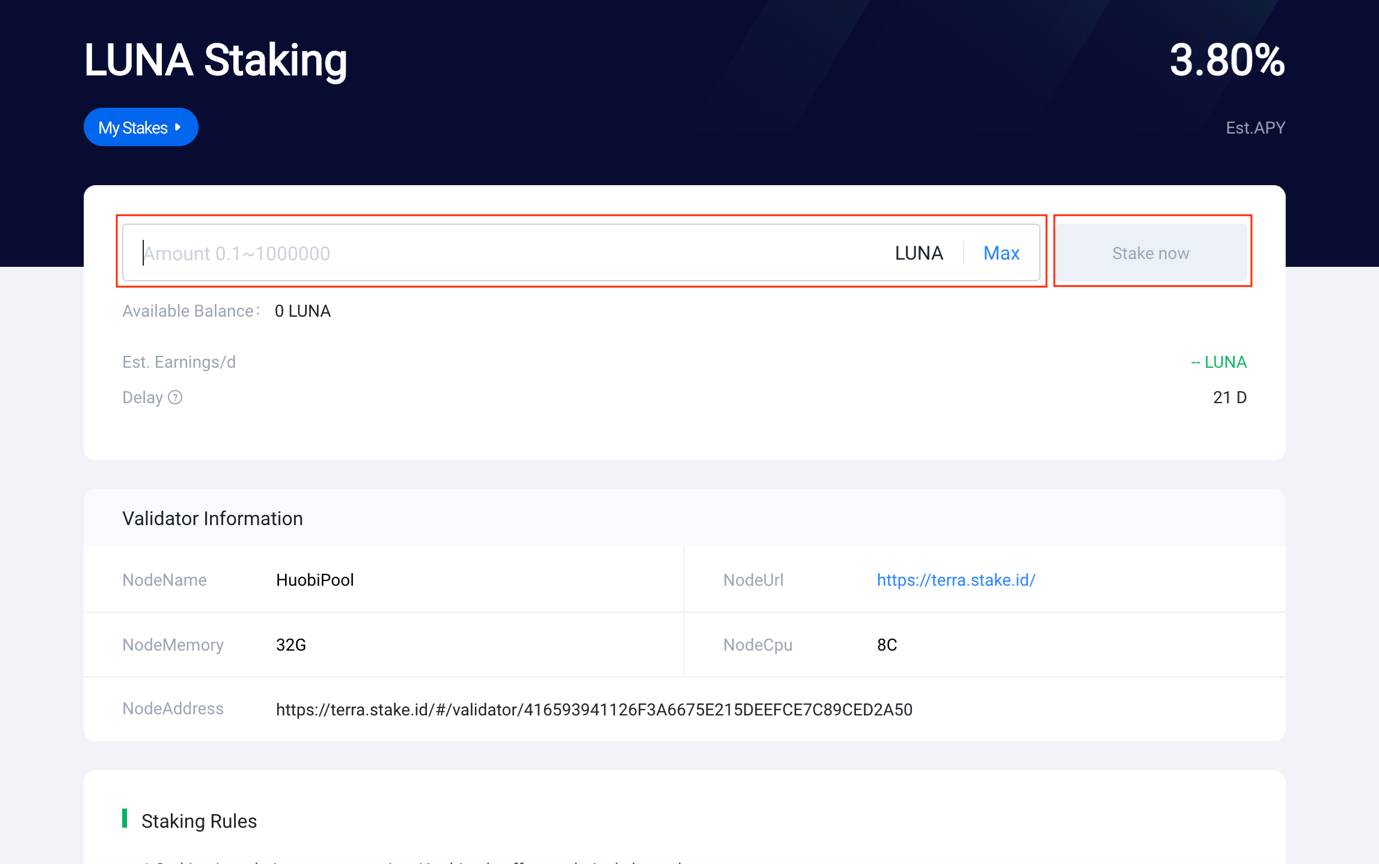

3. Enter the amount that you want to stake and click the "Stake Now" button on the right side. Before submitting, make sure to read all the details and information on the page, including the "Delay" (unlocking time) and the "Staking Rules".

ETH 2.0 Staking on Huobi Global

Ethereum 2.0 or Serenity is a planned upgrade of the original Ethereum network, which involves the switching from Proof of Work to Proof of Stake. The upgrade aims to enhance the network's speed, scalability, and efficiency. In the past few years, Ethereum has been facing a number of issues regarding its Proof of Work system. Thus, the big upgrade is considered necessary to bring improvements to the network and make it better in many aspects.

On the road to the launch of Ethereum 2.0, the network has introduced the Beacon Chain, which is a staking validation platform that works as the central coordination mechanism for validation on the upcoming Ethereum 2.0 network. This allows ETH holders today to stake their tokens to earn staking rewards.

In that case, Huobi Global provides a ETH 2.0 staking service for users to pledge their ETH tokens and earn rewards in the form of HPT and BETH. BETH is now available to trade on Huobi Global with BETH/USD and BETH/ETH.

In order to start staking ETH 2.0 on Huobi Global, you can do the following steps:

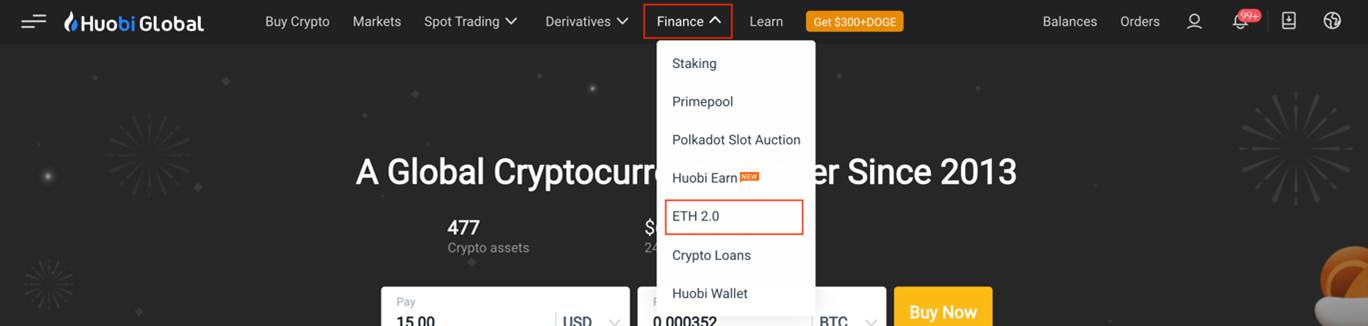

1. Log in to your account, then click "Finance" and choose "ETH 2.0" on the main page.

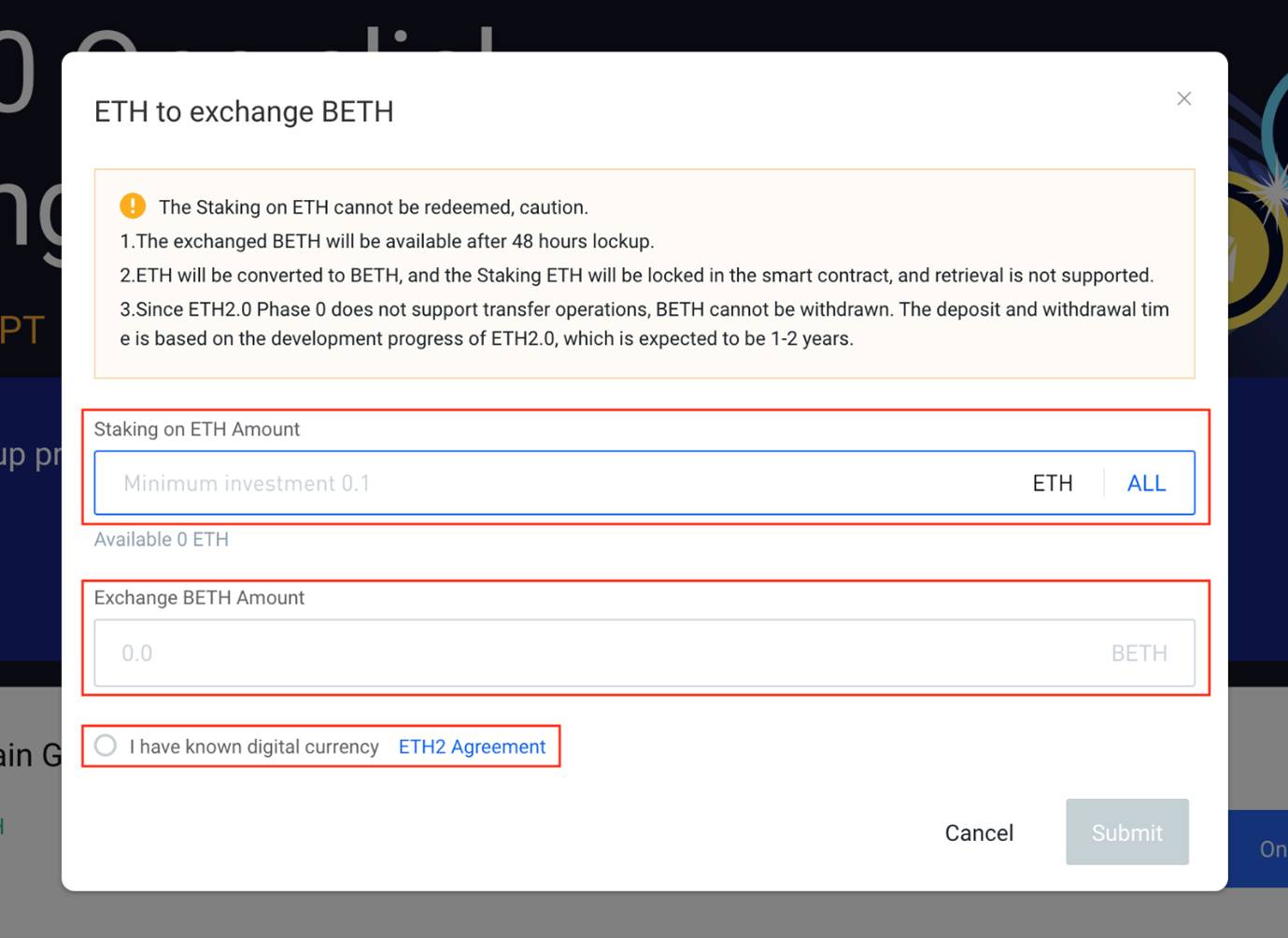

2. Click on "One-click Exchange".

3. Enter the amount of coins that you wish to stake. You will also see the corresponding BETH amount in the box below it. Make sure to read all agreements and warning before proceeding further, then click "Submit" to start staking.

Are There Any Risks?

Compared to active crypto trading, staking is considered less risky because there's a small chance of losing your assets to staking. However, this does not mean that staking is free of all risks. First of all, there's the market risk or the potential adverse price movements of the asset that you are staking. For instance, if you get 15% APY from staking an asset but the price drops 50% in value throughout the year, then you would have made a loss, even though the amount of crypto you have doesn't change. This is why it's important to choose the asset carefully before staking.

Secondly, you should be aware that staking often comes with locked periods, which can last for weeks or months depending on the program you choose. During this time, you won't be able to access or use your staked tokens for anything at all. If the price suddenly crashes, you wouldn't be able to sell them and if you unstake it, you won't get any rewards. Also, remember that even though you will get annual returns, you could still get losses should the price of the staked token fall.

Another thing to consider is the rewards duration. Since you need to stake the coins for a specific amount of time, you won't immediately get the rewards. In other words, you'll need to wait to receive passive income. To mitigate the negative effects and maximize the profit, you can choose to stake assets that pay daily rewards, but keep in mind that this option is not available for all assets.

Lastly, there's always a chance of theft and scam. You could lose your wallet's private keys or find that your holdings have been stolen. This is why it's important to back up your wallet and store your private keys safely. Furthermore, it's recommended to stake using apps that allow you to control your private keys as opposed to using custodial third-party staking platforms.

Bottom Line

If you own some crypto that you can stake and you're not planning to trade them in the next future, staking is certainly a great idea. You won't have to do anything super complicated, yet you'll be earning additional income from your idle assets. It's recommended to stake your coins in trusted crypto exchanges like Huobi Global, but make sure that you choose the program wisely. Consider the potential returns that you'll get as well as the crypto's market price in the long-term.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Toncoin

Toncoin Dogecoin

Dogecoin Cardano

Cardano