Trade safely and get full access to IC Markets services by getting your account verified. Here's what you need to do.

IC Markets is one of the most popular brokers that has been around since 2007. The Australian-based company is known for supporting a bunch of tradable assets like forex, precious metals, and CFDs, making it suitable for traders with various different strategies such as scalping, day trading, and more. IC Markets also offers low commissions and spreads in comparison to other brokers in the market. Aside from operating in Australia, the business is also quite popular in Asia, Europe, and North America.

In terms of security, IC Markets is considered safe as it operates under the regulation of several financial authorities, including CySEC and ASIC. Being a regulated broker means that IC Markets needs to comply with a long list of policies. This includes implementing client identity verification to prevent fraud and scams.

See Also:

Client Verification on IC Markets

As a financial service provider, IC Markets aims to create a safe trading space for all of its customers. In order to do that, the broker needs to know who they are dealing with first. This is why client identity verification is needed.

Basically, after you created an account, the broker would ask for certain information regarding your identity. You'll need to upload certain documents to prove that you're a legit person and not a scam. The broker will then assess those documents in order to verify your account. Once the process is complete, you can start trading on your account and enjoy the broker's full service.

IC Markets is an online forex broker operating under the company of International Capital Markets Pty Ltd. Traders under the Australian jurisdiction are provided with the trading service of IC Markets AU that is headquartered in Australia and licensed by the Australian Securities and Investments Commission (ASIC).

On the other hand, non-Australian traders who open an account in this broker are registered under IC Markets SEY that is based in Seychelles, and regulated under the Seychelles Financial Services Authority (SFSA). The dual operation is a result of the relatively new rules from ASIC that prohibit their regulated broker to offer trading services outside Australia.

Classified as an ECN broker, IC Markets provide clients with MetaTrader 4, MetaTrader 5, cTrader as platform trading options. This broker also follows market trends to include Cryptocurrencies as one of its products, enriching its already wide selection of trading assets that include Currencies, Indices, Metals, Energies, Softs, Stocks, as well as Bonds.

The minimum deposit in IC Markets is in the middle range compared to other ASIC-regulated brokers, as it reaches $200 for every client. Market analysis materials are also prepared regularly for trading insights on IC Markets's official website, proving their competence to serve their traders with important contents created by market experts that work specifically for them.

For payment methods, IC Markets allows funding and withdrawal via wire transfer, credit card, PayPal, Skrill, Neteller, FasaPay, UnionPay, as well as Bitcoin via BitPay. The more interesting aspect from this broker is its multi-base currencies that include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

As the trading technology in IC Markets is highly equipped with co-located servers and extremely low latency (especially on cTrader), the broker is widely known for its capability in hosting traders with the special needs for high-frequency trading as well as scalping.

To sum up, IC Markets is a fitting destination for active traders looking for a well-regulated broker. IC Markets is also flexible in terms of base currency and payment methods, signaling their commitment to welcome traders beyond their home country. As of late 2019, IC Markets provided their website in 18 international languages including English, Korean, Indonesian, French, Spanish, Italian, Malay, German, and Chinese.

How to Verify Your Account

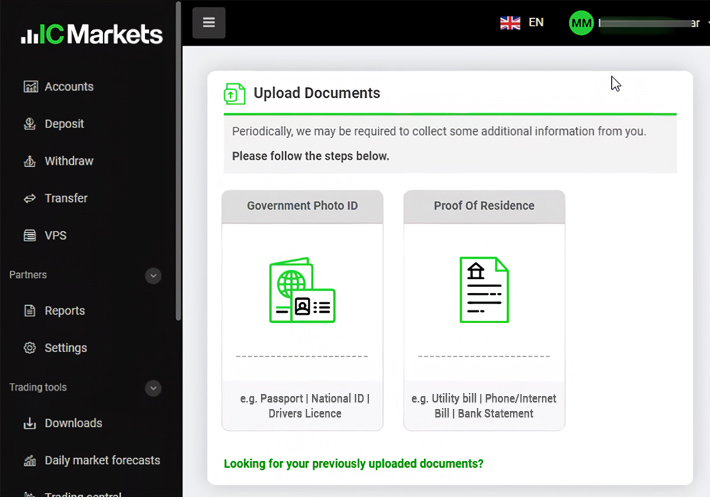

Client identity verification process may vary in different brokers. Some might take several days to complete and involve multiple approval steps. Thankfully, identity verification on IC Markets is very easy to do. You'll only need to upload two types of documents, namely the government photo ID (national ID, international passport, or driving license) and proof of residence (utility bill or bank statement). Then, the broker will process them and notify you in 24 hours.

Here are the steps that you should follow to get started:

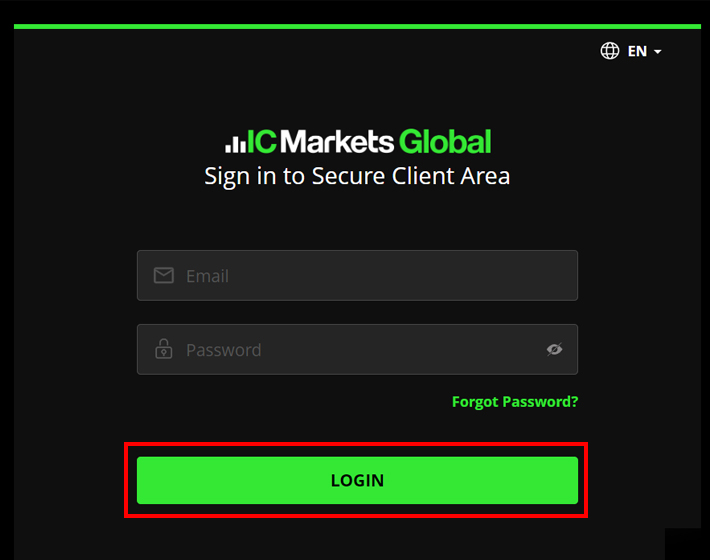

1. Head over to IC Markets' website and log in to your trading account. Simply enter your username and password, then click "Login".

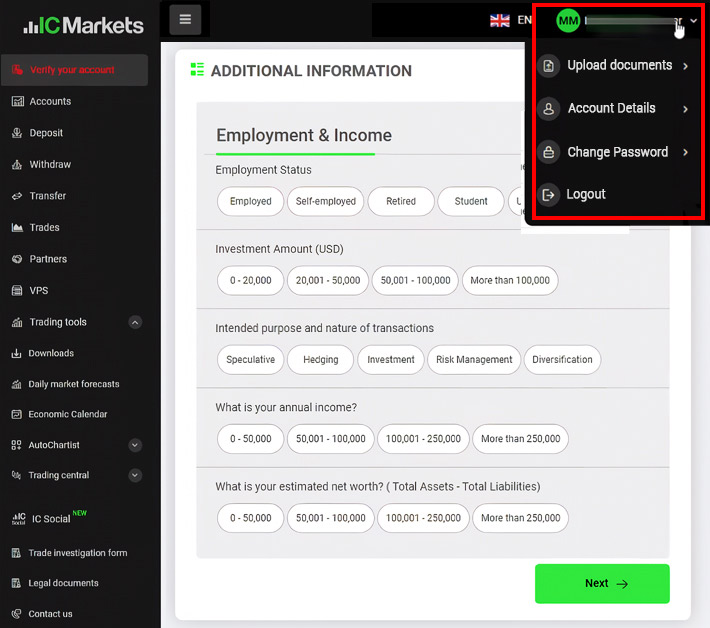

2. Click your profile on the top right of the screen and click "Upload Documents" in the drop-down menu. You'll then be taken to the upload page.

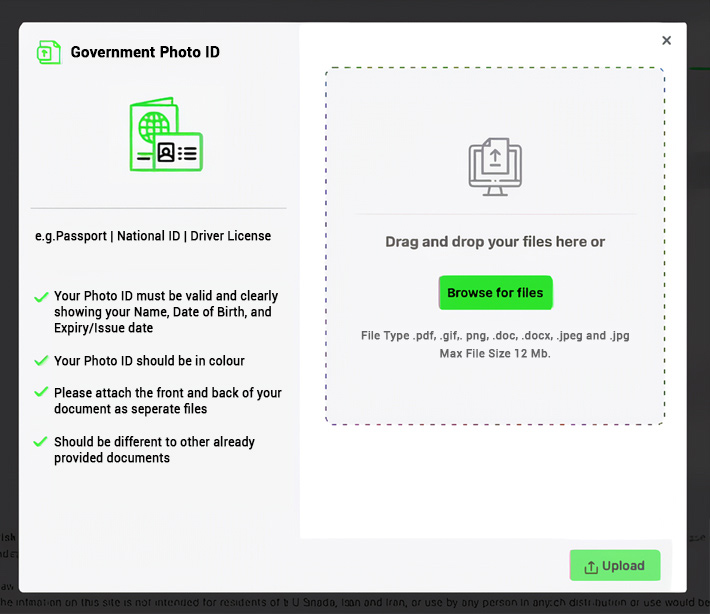

3. Click on the "Government Photo ID" to upload your photo identity documents, which can either be your national ID card, international passport photo, or your driving license.

4. Click "Browse File" to find a copy of the document on your device, then click "Upload". Make sure to read the requirements first on the left side of the screen.

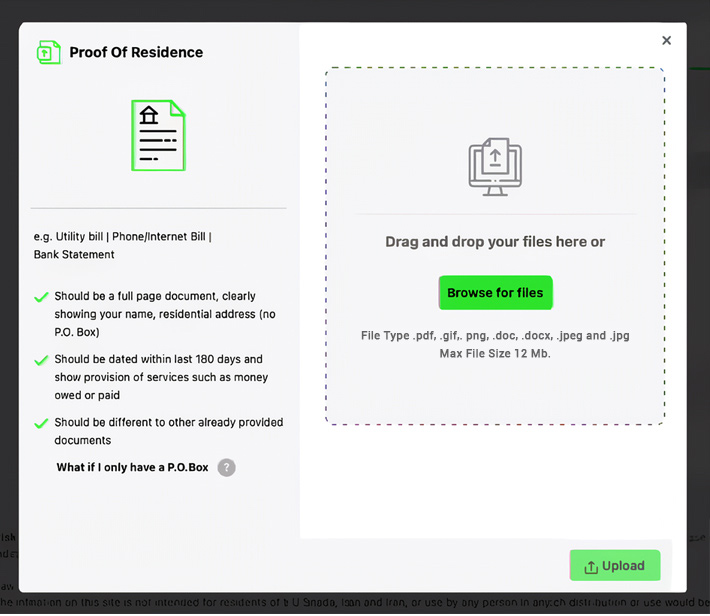

5. Then you'll need to upload your proof of residence. You can use your utility bill or a bank statement to complete the procedure. Make sure that it has your full name and address and is dated within the last 3 months.

Just like the previous step, click "Browse File" to find a copy of the document on your device, then click "Upload".

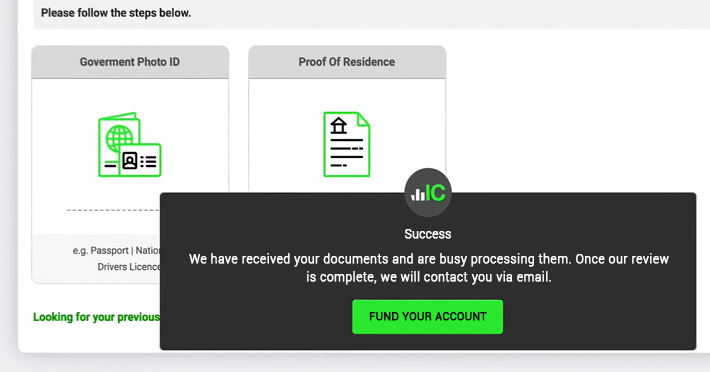

6. Once completed, you'll see a message on the screen confirming that your documents are successfully submitted and will be processed immediately.

The identity verification process on IC Markets typically takes about 1 business day. You will be notified through your email once your account is ready to use.

The Bottom Line

Identity verification is crucial to ensure the safety of the broker and its clients. Due to the heightened risk of scams and money laundering cases, brokers need to implement such procedures in order to know who they are dealing with and ensure that the other clients are completely protected. However, the process is not always simple. It can even take up to several days in certain online brokers due to low efficiency. Not only does this create unnecessities, but it also delivers a relatively poor experience for new clients.

If you are searching for a reliable broker with speedy verification process, try IC Markets. Just simply submit your documents and wait for 24 hours to start trading with your account.

Free FOREX Virtual Private Server

Free FOREX Virtual Private Server Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

38 Comments

Brian

Oct 7 2022

Does IC Markets also implement the KYC procedures?

Ketlyn

Feb 22 2023

Brian: As far as I know this broker has obtained a license from the FSA, one of the leading regulators in the world, which does not allow any form of money laundering.

In accordance with the FSA's Anti-Money Laundering and Counter-Terrorism Financial Act, IC Markets Global has policies and procedures in place to ensure compliance with the law. These policies and procedures are designed to prevent money laundering activities from occurring. IC Markets' Global Anti-Money Laundering Policy outlines the documents you must provide us before opening an account.

In making this Anti Money Laundering or AML program a success, IC Markets applies KYC steps to each of its members in order to reduce any risks that could endanger the security of your trading processes such as hacking or other forms of fraud. Apart from being a fast and easy process, KYC is not only beneficial for brokers, but KYC is also very beneficial for clients at this broker, because it can protect us all from an incident or things that might harm us one day.

After completing the three KYC stages, what you need to do next is fulfill the blessing requirements that need to be uploaded for the verification stage. Furthermore, you only need to wait a maximum of once 24 hours for the verification process to be carried out by the broker. If successful, you will get an email! And don't forget to also activate the push notification feature on your cellphone so you can be informed about the results of your KYC process!

Global traders are protected by the FSA regulator, so you don't have to worry about money laundering. I believe your funds are guaranteed in this broker. Raw Trading Ltd, IC Markets Global, is authorized by the Seychelles Financial Services Authority as a Security Dealer for the provision of financial services under License NO SD018.

Francesca

Oct 11 2022

Can I trade if my account is still unverified?

Louise

Feb 22 2023

Francesca: IC Markets is one of the leading Forex brokers that offer a user-friendly trading platform and lots of features to help traders achieve their goals. This broker has an excellent reputation among traders and offers very competitive spreads, as well as a fast and stable trading platform. If you intend to start trading Forex, I think the IC market can be a broker worth considering for trading.

This broker doesn't actually require account verification, but you can't trade in real. Maybe if you trade with a demo account you still can. because at this broker, before making a deposit or withdrawal, make sure your account is verified first. You cannot make deposits and withdrawals if your account has not been verified.

In addition, if your account is not verified, you will definitely have limited use of the features provided by this broker, such as bonus offers and others.

In my opinion, verification is very, very important to do to secure your account. Because it is related to money and not a few numbers are generated, there is no misuse of the account by other parties. And when there is misuse by other parties, all you have to do is submit proof of your personal data as you uploaded it before.

Karoline

Oct 18 2022

What happens if I upload the wrong document?

Urashini

Feb 23 2023

Karoline: Security is a top priority at IC Markets. Customer balances are managed separately from company funds at the Australian National Bank (NAB). In addition, the broker has the largest liquidity providers involved, which indicates a high level of seriousness. Therefore, there is fast order execution and no requotes. High liquidity for traders is provided by IC Markets.

To trade on IC Markets, traders must first open an account and it is also recommended to verify the account afterward. if you haven't verified or your verification hasn't been approved, you can't make deposits or withdrawals at this broker. So basically you can't trade, because trading requires a deposit.

Account verification usually takes a few minutes to a few hours in some cases. If you have not heard back from our account verification team about the current status of your account application via email, we advise you to visit the live chat support provided by the IC market broker.

If the documents you listed uploaded on the IC Markets platform are not as requested, usually this broker will reject your documents so you cannot receive email notifications from this broker. So be careful when uploading documents.

After all, account verification is also important for the security of your funds and account to avoid all forms of crime in trading.

Belinda

Oct 28 2022

Is IC Markets a good choice for beginner traders?

Sweety

Feb 23 2023

Belinda: IC Markets is one of only a few pure ECN brokers that novice traders can reach. While many other ECN brokers fail in providing education and analysis and often force traders to self-educate through third-party materials, IC Markets provides a full arsenal of study materials, independent market analysis, and Webinars to provide its users with a comprehensive education on Forex trading. IC Markets also supports the three best software options and 24/5 customer service.

For traders using algorithms or scalping strategies, IC Markets is a good choice as it has low trading costs, high leverage, fast connectivity, and huge liquidity.

Apart from that, from my opening point of view, this broker is also good for all traders. not only for beginners, but experienced traders are also definitely more comfortable with brokers who provide an easy, fast, and fully digitized account opening process. But unfortunately, the initial deposit is quite high, so if you are a novice trader who has limited funds, you will definitely think that the amount is too high.

Enzo

Oct 28 2022

Is anyone having a problem with me? I am interested in becoming a client of IC Market. For several months, I have been trading in a demo account to prepare for real trading. Now, I feel ready to open a real account and sign up with them. However, during the KYC process, I was not verified because I am from the US. The broker rejected me as their client. I would like to know if anyone has experienced the same problem and how to avoid it, so I can become verified and start real trading at IC Market. I hope someone can provide an answer. Thank you very much!

Jorge

May 16 2023

In simple terms, brokers like IC Market have to follow rules and regulations set by different countries to ensure fair and safe trading. In the United States, there are organizations like the SEC and CFTC that make sure brokers play by the rules and protect investors.

Now, when it comes to international brokers like IC Market, it can get tricky for them to meet all the requirements set by US authorities. They would need to register with the SEC, become part of organizations like FINRA, and meet specific financial obligations. This can be a lot of work and may not fit with how international brokers typically operate.

Because of these complications, some brokers decide it's better to not accept clients from the US. It helps them avoid legal and regulatory problems and focus on serving clients from other countries where the rules are more in line with their way of doing things.

Kenny

May 18 2023

I think it is because of US regulations. I mean its are designed to protect investors and ensure fair and transparent financial markets. If a broker fails to comply with these regulations, it can lead to serious consequences, including:

Given these potential risks and liabilities, brokers like IC Market may choose to be cautious and prioritize compliance with regulations to avoid these adverse consequences.

Kazimiera

Oct 31 2022

Does IC Markets support crypto trading?

Bennica

Feb 23 2023

Kazimiera: IC Markets offers to trade in forex (currencies), CFDs (bonds, indices, commodities, cryptocurrencies), and futures. There are more than 2,000 different assets available. The condition is very good. In comparison, you can rarely find a cheaper and safer broker.

Cryptocurrencies are hyped now and you can trade them on IC Markets via CFDs 24 hours per week. You will pay no commissions and low spreads. The funny thing here is that it is cheaper to trade CFDs on IC Markets than it is to buy real currency on the exchange.

Several types of cryptocurrencies that are traded include Dash, Litecoin, Bitcoin, Ethereum, Bitcoin Cash, Ripple, and many others.

keep in mind that Crypto has high volatility and it is difficult to predict market movements, so you have to be careful when trading. My advice, if you want to open a position in crypto, for example, bitcoin, you can open a low position first to analyze the market.

For global traders who want to join the IC market, there is no need to worry because this broker has been regulated by the FSA (Financial Services Authority), so there is no need to worry because it is safe from all forms of money laundering.

Hansen

Dec 22 2022

Hey there! I hope you're doing well. I've been considering opening a live account with IC Market, and I didnt heard that they require proof of ID taxes, like a taxes ID. Because if I open an account with my local brokers , I need to prepare that ID. So, Before I proceed with the account opening process, I wanted to clarify something. Do they usually conduct a questioning process to verify the ID taxes or not? I want to be well-prepared and know if I might need to answer some questions or provide additional information about my tax documentation during the verification process. It would be great to have a clear understanding of what to expect. Thank you so much for your help!

Chelsea

May 19 2023

In my experience, during the verification process, you may be required to submit various identification documents, such as a government-issued ID, proof of address, and potentially proof of tax identification, depending on the broker's requirements. They may also ask you to answer certain questions related to your tax documentation to ensure its authenticity. But, if they don't ask about your tax's thing, you don't have to prepare that.

But, to get accurate and up-to-date information about IC Market's specific procedures and requirements for verifying proof of ID taxes, I recommend reaching out to their customer support directly. They will be able to provide you with the most accurate information and guide you through the process.

Sania

Jan 30 2023

I am not 17 years old yet, but I am interested in trading in the forex market because I see that my father and brother are getting a quite reliable income there. Can I get verification? If not, is there any solution that can be provided? Thank you.

Larry

Feb 6 2023

Sania: I recommend that you ask your father or brother to open an account for you. As you know, some brokers allow you to open multiple accounts with one ID, but only once. For example, IC Market accounts have only two options for him: RAW and Standard accounts.

For example, if your father opened a standard account, you could ask him to open a raw account. However, to remember this, you must first ask for permission as both accounts have different trading terms. Another solution is to wait until you're 17. This is because to open a real account, you need to present your ID. However, you do not need to verify your age if you are trading on a demo account (the demo account is for training purposes and all money in it is virtual).

Sabitzer

Feb 6 2023

In fact, the verification steps of IC Market are very simple. I mean other brokers sometimes want global traders to upload additional documents like notarized documents, lease agreements, mortgage statements, and even notarized driver's licenses just to prove that your identity and address are real.

c'mon, we just want to trade Forex, not open a bank account. And fortunately, the IC market is not such a broker. All you have to do is upload your ID card and proof of address. The simple thing is that you don't need to notarize every document, protecting you from additional fees. As you know, to notarize a document, there must be a cost!

Robert

Feb 22 2023

Sabitzer: I also completely agree with your opinion, opening an account with IC Markets is very easy and the process of opening an account is hassle-free, hassle-free, and completely digital when compared to other brokers.

Luckily, you only need to upload two types of documents, namely photo identification (KTP, international passport, or driver's license) and proof of residency (utility bill or bank statement). Processing is also quite fast, ie 24 hours.

while some brokers provide complicated conditions, as far as I know, IC Markets is a broker that is quite responsive for account opening and verification. as a trader, I don't like trading platforms that provide complicated verification requirements with lots of data that I have to prepare. I am thinking to join this broker and open a demo account here. I haven't dared to try trading because I haven't had enough experience.

Ostland

Feb 22 2023

Sabitzer: Indeed, I admit that opening an account and the verification process at the IC market is quite easy, short, and does not require a lot of data like other brokers. The requirements for account verification are also very easy and don't require a lot of data, just an ID card and proof of domicile.

IC Markets offers two types of live accounts and one demo account, however, Each type of live account requires a minimum deposit of 200 USD. for novice traders, the amount of the deposit is too high. This is according to my perspective as a novice trader.

Even though for deposits, this broker does not charge fees, but yeah for traders with limited funds the deposit amount at this broker is quite high. even though there are several brokers who do not apply a low enough minimum deposit amount to open an account, such as AvaTrade, XM, and other funds.

Thomas

Feb 23 2023

I like all the registration procedures provided by the IC Markets broker, in my opinion, this is quite easy and not complicated. Even though I don't have much trading experience yet, I have tried several demo accounts at several brokers, such as Blubery Market.

In my opinion, out of all the brokers I tried, the registration process was more comfortable at IC Market. If there are too many files or documents that have to be uploaded to the platform from the broker, I find it too complicated, and yeah the vibe is like wanting to register for a population census if there are too many documents.

At first, I asked, do all brokers offer a process that is this complicated and long? But now I have found the answer, which is not all. it turns out that there is an IC Market that provides an easy registration and verification process and only requires a few documents.

However, I have a few questions for this broker, does this broker provide cryptocurrency trading for its traders? I'm really curious. As a beginner, can I try it?

Tabitha

Feb 23 2023

Thomas: Wow, you don't know about trading at IC Market, do you? IC Markets offers quite a large ion of cryptocurrencies. Usually, brokers only offer a general ion of crypto pairs and limit crypto trading to less attractive account types, but that is not the case with IC Markets.

IC Markets offers Bitcoin, Bitcoin Cash, Ethereum, Dash Coin, Ripple, and Litecoin pairs. These pairs are available for all account types, and trading conditions allow for short trades in crypto.

Leverage is capped at 1:5 for crypto, which is pretty standard for this product, due to the sometimes extreme volatility. The spreads charged on these cryptocurrencies are varied and much higher than fiat currencies, but still not much different from those applied by other brokers.

Skye

Feb 23 2023

Tabitha: even though I like highly leveraged trading, I also wouldn't choose highly leveraged trading when it comes to crypto. The risk is too high, the market is also difficult to predict. There are some brokers that provide crypto trading with very high leverage, however, it is too risky.

Maybe beginners who don't understand crypto volatility think that the amount of 1:5 leverage is too low for trading, but actually it's already high in crypto trading. especially for those of you who are novice traders and want to trade crypto, you can consider IC Markets as a trading provider broker.

Cryptocurrencies are volatile, unregulated, decentralized, and almost completely controlled by retail speculators. Trade the newest and most exciting asset class in the form of CFDs with an FSA-regulated Forex CFD provider.

The price movements of cryptocurrencies such as Bitcoin or Ethereum are mainly influenced by news and sentiment, namely the fear and greed of retail speculators. These sometimes dramatic moves can lead to large daily price swings, making cryptocurrency CFDs an attractive product for the aggressive and experienced day trader.

IC Markets Cryptocurrency CFDs allow traders to hold buy or sell positions without owning any cryptocurrency. This means that traders can be exposed to cryptocurrency price movements without having to worry about the security risks of holding cryptocurrency and the counterparty risk of cryptocurrency exchanges. It's similar to trading energy futures like oil, in that you don't need to own physical crude oil to speculate on its price.

Yolanda

Feb 23 2023

I have been interested in this broker for a long time. I like the offers provided by this broker. And also to open an account at this broker is not too difficult, very easy.

I was surprised after reading comments from friends in this article that this broker also provides crypto currency instruments, and wow, I feel even more impressed with this broker, because rarely do brokers provide complete crypto trading.

Even though it has high volatility, crypto trading also offers big profits, so there's nothing wrong if you want to try trading at this broker.

However, there are a few things I want to ask. I am actually also interested in Copy trading. By using the social trading platform, investors and financial market beginners can imitate traders from successful traders from around the world. The trader makes all trading decisions, while the investor, after subscribing, receives trading signals from them, which are copied to the trading account automatically or manually.

What I want to ask is, does this broker also provide a Copy Trading platform for its customers? if anyone knows how to help answer yes guys...

Karenna

Feb 23 2023

Yolanda: In addition, they offer 2 copy trading services for social traders, education for IC Markets is known for offering excellent services for active traders, providing them with some of the lowest commissions on the market and excellent quality of order execution. The broker also features great opportunities for passive income.

copy trading is a service that can automatically copy trading positions that have been made by expert traders. The way it works is by linking the account that is owned with the account of the expert trader in question.

IC Markets is a broker in their category that does not have a proprietary copy trading platform, which is why the broker has partnered with top social trading platform providers ZuluTrade and MyFxBook Autotrade. With partnerships with ZuluTrade and MyFxBook Autotrade, IC Markets can offer to show how to find signal providers, copy trades and also discuss key trading conditions.

It's quite easy to start copying trades from ZuluTrade and MyFxBook Autotrade to your IC Markets account. After you have decided on a signal provider, you must subscribe by pressing Follow in the profile. Once you have subscribed, Trader's trades will be copied to your IC Markets account for a predetermined amount.

However, the conditions for trading with ZuluTrade are not that good. In particular, only standard account types with an average spread of 1 point are available for copy trading. And the difference is the increase, which is 1.5 points. Therefore, the average exchange rate for EURUSD is 2.5 points, and it can be even higher for other trading pairs.

Reynarl

Feb 23 2023

Wow, I didn't expect this broker to be good. After I read this article, I was really amazed by the account verification requirements at this broker, it's very easy, anti-complicated, and doesn't require a lot of documents.

After I researched more about this broker, I found out that IC Markets offers unlimited demo and free accounts for traders. In the personal area, you can open different demo accounts for your purposes. A demo account is an account with virtual money. I

It simulates trading with real money 1:1 and I recommend trading beginners to use it before we start with real money. Apart from that, a demo account is a great way to practice new strategies and markets.

Good trading service, the account opening is also fast, and the instruments are also quite complete. All the features and services are good and compete with other brokers that are on par. However, is this broker also safe for trading and security of funds? In my opinion, what is the most important thing in trading? It's useless if all the features and services are good but security is not guaranteed.

Friends, if anyone understands about safety, and regulators at IC Markets, please help explain...

Grace

Feb 23 2023

Reynarl: Regulation by official authorities is very important for online trading. The license gives the broker a trustworthy relationship with the customer. In order to obtain such a license, IC Markets must comply with certain rules and conditions. Violation of these terms will result in the immediate loss of the license. Therefore fraud on the customer can be excluded here.

IC Markets is regulated by ASIC (Australia), FSA (Seychelles), and CySEC (Cyprus). It is an independent agency of state government agencies. Customer money transactions are carried out by National Australia Bank (NAB) and Westpac Banking Corporation (Westpac). Both are top international banks with high liquidity. In addition, IC Markets uses external and independent auditors who control the broker.

The broker makes a very serious impression and I trust the safety of this broker. Trade with peace of mind knowing that IC Markets is overseen by some of the most stringent regulatory bodies in the world. When funding your trading account, your funds are held in a segregated client account with a top-tier banking institution. IC Markets Global complies with the Securities Act and Securities (Business Conduct) Regulations and maintains strict policies and procedures regarding the maintenance and operation of these accounts.

Mahamub Alam

Mar 25 2023

I'm having trouble getting my account verified on IC Markets. Can you provide a step-by-step guide on the verification process? What documents do I need to provide for verification, and what are the requirements for each document? How long does it typically take for my account to be verified, and what happens if my documents are rejected? Additionally, I'm concerned about the security of my personal and financial information during the verification process. What measures does IC Markets have in place to protect my data, and how can I ensure that my information is safe and secure? Overall, what advice do you have for someone who is having difficulty getting their account verified on IC Markets?

Ankosh Sanny

Mar 25 2023

I've successfully verified my account on IC Markets, but I'm interested in learning more about the benefits of having a verified account. How does having a verified account impact my trading experience, and what additional features or privileges do I have access to? Are there any trading restrictions or limitations that I should be aware of as a verified account holder? Additionally, what are some tips or strategies you would recommend to verified account holders to help them maximize their profits and minimize their risks? Finally, I'm curious about the verification process for corporate accounts. What documents and information are required, and what are the benefits and limitations of having a verified corporate account? Overall, what advice do you have for someone who is new to trading with a verified account on IC Markets?

Dedi

Jun 19 2023

@Ankosh Sanny: Having your account verified on IC Markets comes with some sweet perks that can level up your trading game. First off, it adds an extra layer of security and trust, so you can trade with peace of mind knowing your identity is confirmed. Plus, it helps IC Markets meet those pesky regulatory requirements.

With a verified account, you might unlock cool features and services that non-verified traders miss out on. Think higher deposit and withdrawal limits, speedier transactions, and primo customer support. Oh, and keep an eye out for exclusive promotions and bonuses just for verified account holders. Talk about trading with an edge!

Now, let's talk restrictions. Usually, verified accounts don't come with specific trading limitations. But, remember, trading itself has risks. So, as a verified trader, it's smart to manage those risks like a pro. Set realistic profit targets, use stop-loss orders to protect your positions, and stay in the know about market news and analysis.

If you're new to trading with a verified account on IC Markets, you can start read this article to gain more knowledge about the trading world! (read : Currency Trading Guide for Complete Beginners )

Jesse

Jun 20 2023

Greetings! I wanted to reach out and express my deep interest in the realm of finance. It has come to my attention that a significant number of brokers have a policy in place that restricts individuals below the age of 18 from engaging in trading activities. Despite this barrier, I have been actively honing my trading skills on a demo account for quite some time now, and I am confident in my abilities.

However, the challenge I currently face lies in the fact that only a limited number of brokers are open to accepting traders who fall below the age of 18. In light of this, I am particularly intrigued to know the specific minimum age requirement stipulated by IC Markets for individuals who wish to open an account and participate in trading activities on their esteemed platform.

Thank you!

Karreen

Sep 12 2023

First I had to get my impression of the IC market. I was surprised that IC Market can do both ECN and STP execution. I mean, not many brokers can do that so the spread is also guaranteed to be low. Meanwhile the commission is $6 per lot for trader c and $7 per lot per round, very competitive but not too low compared to other brokers. Overall, in my opinion, IC Market does offer good low fees.

Second, let's discuss the technical tools available for day trading or day trading support at IC Market. The article clearly discusses the account verification process at this broker. I still need a lot of information regarding trading at IC Markets, especially the trading tools. The question is what trading tools does IC Market offer? and of the many different trading tools, which are the best or most commonly used by day traders?

Vermillion

Sep 13 2023

Dude, you need to know the IC Market has many trading platform that you can use and one of them is Metatrader which is provided all the trading tools that you need. SO, in other word, if you trade with IC Market using Metatrader, you can get all the trading tools from basic into pro tools.

But if you trade with Mobile app, You need to determined some tools that used in day trader. After that, you can just do the match with the IC Market's trading tools.You can read the source of trading tools that needed in day trader with this article :

Based on the article that I shared, MA, RSI, EMA, MACD or other technical trading tools are available at the app. The IC Market APp it self offer more than 65 indicators and it is very completed tools. You can read the review at here : ic market mobile app review

So, the conclusion is both IC Market Trading Platform and Metatrader are offering many indicators that important to day traders.

JK Damian

Sep 21 2023

William

Sep 23 2023

If what you mean about the chart or the market movement is the same as another trading platform, I can say yes, the trading platform from IC Market and the other has displayed the same thing as the market like the movement of the chart. Also, the other function of a broker's own trading platform is that we know some traders in some countries may not enjoy Metatrader or cTrader because some are blocked. However, with this IC Market trading platform, traders can easily trade without downloading other trading platforms, and I think the IC Market mobile app has great features too. Bollinger, EMA, MACD, etc. I don't need many indicators and tools because most of you use the tools and indicators that I mentioned before However, if you don't want to use the platform, use other IC Markets support such as Metatrader or cTrader.

Larrson

Sep 23 2023

There is another reason brokers still have their own trading platforms. I mean yes, they offer the option to access their servers through a neutral trading platform like Metatrader and cTrader. But why do brokers like IC Market also try to create their own trading platforms?

All because they want to prove that they are also advanced brokers. If I remember correctly, the mobile trading application was first used from the personal area and monotonous trading system and is now evolving into a trading platform that also provides technical tools. And in my opinion, today's traders will choose brokers with advanced trading platforms even if they don't use it because they will feel that these brokers have advanced technology and can be trusted. It's like when you go to a coffee shop, which one would you choose: Do you use the coffee machine to make coffee or just make it with hot water?

Andrian

Feb 23 2024

The article mentioned that once you've set up an account, the broker will request specific details about your identity. You'll be required to submit certain documents to authenticate yourself as a genuine individual and not involved in any fraudulent activity.

I'm curious about the rationale behind this requirement. As users or traders, we entrust our funds to the broker. So, why is it necessary for the broker to verify the authenticity of individuals and ensure they're not involved in scams? Thank you.

Sherel

Feb 26 2024

So, why does the broker hassle us with all this identity verification stuff? Well, it's not just to make our lives difficult – there's actually a pretty good reason behind it. You see, the financial world is a bit of a wild west, with all sorts of shady characters trying to pull a fast one. To keep things on the up and up, regulators have slapped brokers with rules that they have to follow. One of these rules is making sure they know who they're dealing with.

By verifying your identity, the broker can make sure you're not some scammer trying to launder money or pull off some other dodgy scheme. It's like their way of putting a big padlock on the door to keep the bad guys out. Plus, it's not just for their own sake – it helps protect your money too. By making sure only legit folks can access your account, they're reducing the risk of someone swiping your hard-earned cash. (read : Is KYC Important in Forex Trading?)

So yeah, while it might seem like a pain, think of it as the broker's way of saying, "We've got your back, mate."