Do you know that Binance also offers a saving option where traders can simply hold their assets and earn interest from them?

If you look at your financial condition right now, do you feel confident that you'll be able to handle some financial downturns in the future?

Or do you feel like you're still living from one paycheck to another and wouldn't be able to survive in the long term without it?

These are some reasons you should consider getting passive income and adding it to your overall investment portfolio.

Binance is one of the most globally known online trading platforms and exchanges that has been around since 2017. Apart from allowing traders to buy and sell various crypto assets on the market, the company also offers a saving feature, where traders can earn interest simply by holding on to their owned assets.

Let's look deeper into this feature and see why you should participate.

What is the Saving Feature of Binance?

Many traders from all around the world have managed to make a fortune from crypto trading. It is often said to be a great investment since it offers a chance to get huge returns and easy access.

However, it would be best to remember that trading requires time, effort, and money. Now if you're not interested in trading but still wish to increase your crypto holdings, you should consider using the "Saving" feature in Binance with the following steps:

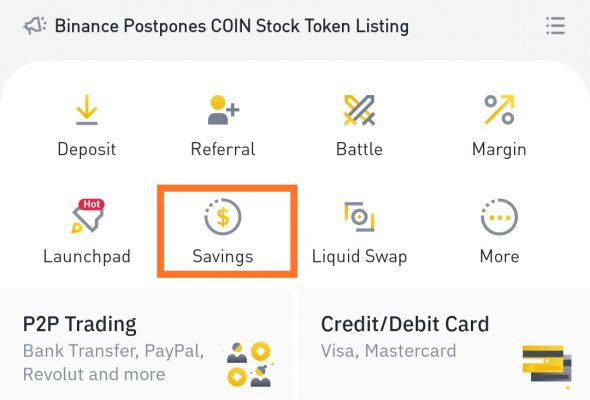

1. To access the Saving feature, you need to open your trading app and click "Saving" as illustrated down below.

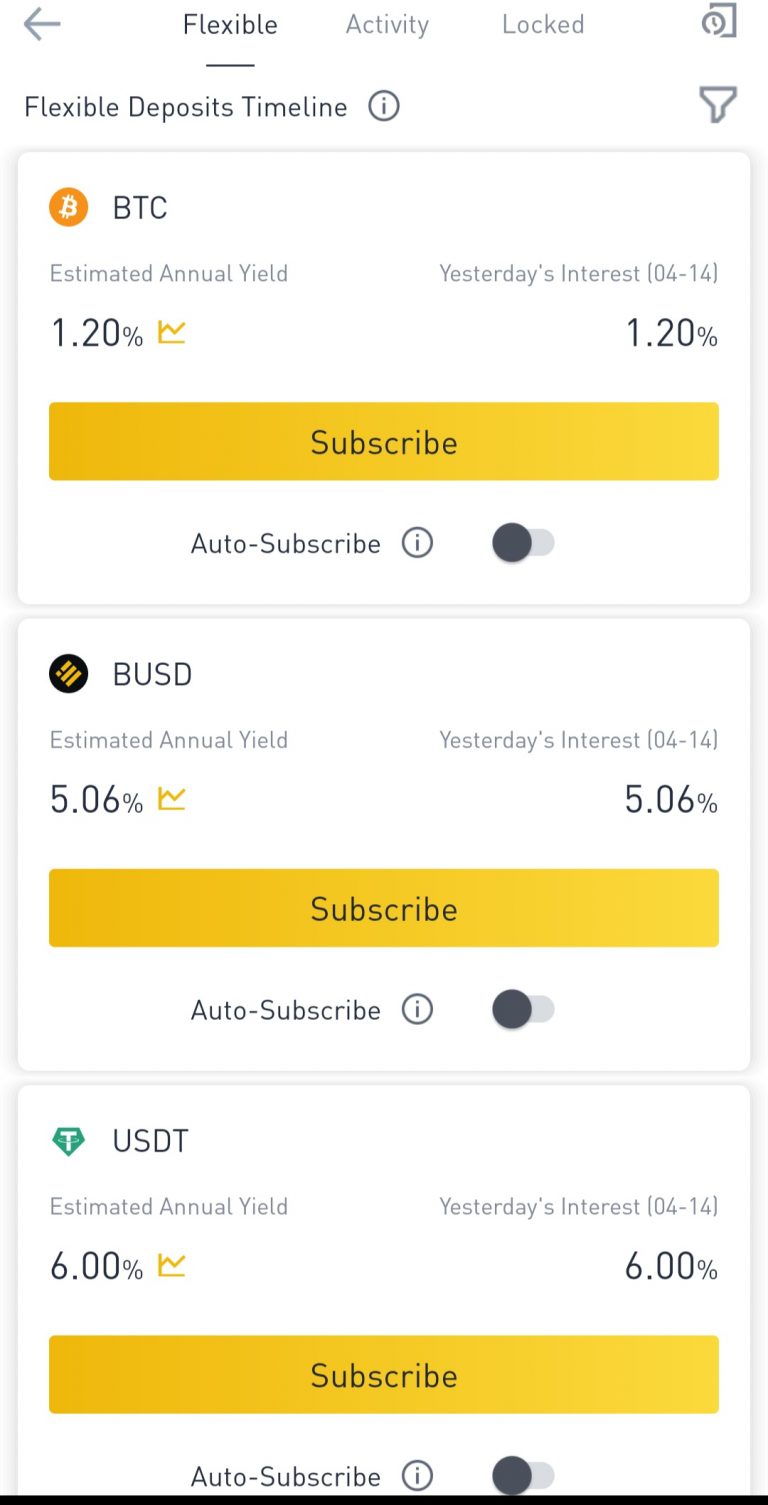

2. Once you enter, you will see that various crypto asset choices are available along with various interest rates as seen in the image below.

You can think of the concept as a regular bank saving account, so you will earn interest from the crypto assets you own in your account's balance. It offers more options based on risk tolerance, desired returns, and time horizon.

Generally, you deposit some funds, subscribe to one of these options, and earn interest from it. You can keep track of all of your crypto assets currently earning interest under the "Earn Wallet" on your Binance dashboard.

Alternatively, you can use the Auto-Subscribe feature, which automatically moves your funds from your wallet to a saving account at a pre-specified time. Remember that Flexible and Locked accounts have a specific minimum amount, depending on the type of coin used. So ensure your wallet has sufficient balance to start saving with Binance.

Type of Accounts in Binance Saving

In the Binance Saving feature, there are several types that you can choose, such as:

1. Flexible Saving Feature

Flexible Saving is one of the most popular ways to earn passive income from crypto assets in Binance. As the name suggests, flexibility is probably the biggest advantage that you can get from this feature. By only subscribing to the program, you can earn daily interest and withdraw your funds anytime you want without any withdrawal fee.

The withdrawal process is also very simple and doesn't take long. You can withdraw your assets at any hour of the day except for 07:50-08:10 HKT. Head to the wallet dropdown and "Savings Asset". Then click "Flexible Saving" and choose "Redeem" under Operations on the product.

There are two redemption systems available for Flexible Saving, namely:

- Fast redemption – The redemption will be processed instantly, and the interest earned that day will be forfeited.

- Standard redemption – The redemption process will be processed the following day so that you won't lose any interest earned that day.

Furthermore, choose and subscribe to your crypto assets on the platform to enjoy the feature. If you open the Binance platform, you will see a bunch of interesting crypto assets to choose from, along with the interest rates offered. Binance offers 141 cryptocurrencies for Flexible Saving, including some famous ones like BTC, USDT, LUNA, AVAX, etc.

Moreover, the interest rate in Flexible Saving ranges from around 0.5-4% per year. Based on the available flexible saving assets, it will be calculated and distributed to account holders daily. The amount is rounded down to 8 decimal places. Keep in mind that the calculation starts on the second day after subscribing.

Another thing worth mentioning is the tier system for certain types of crypto. This is important to consider which crypto to choose and calculate the interest you will get. Different levels of APY (Annual Percentage Yield) are based on the amount being deposited to the Flexible Saving feature.

For instance, if you plan to deposit some USDT, then for the first 75,000 USDT, you will accumulate 5% APY, earning 0.50% for the remaining amount. Each crypto has a tier system, so head to Binance's official website to see the full list.

See Also:

2. Locked Saving Feature

Locked Saving only provides minimal flexibility when accessing your funds, but you will get a higher chance to earn better returns. In contrast to Flexible Saving, the Locked Saving feature is where you will get interested only after the "lock-up" period ends.

Therefore, you won't be free to withdraw any time you want. Nine crypto assets are available for Locked Saving: AXS, CAKE, EGLD, DOCK, FUN, MDX, USDT, BTC, and LINK.

Once you subscribe to the Locked Saving feature, Binance will deduct the funds from your exchange wallet and "lock" it for a certain period, ranging from seven to ninety days.

Once the lock-up period ends, the funds and the interest you earn will be returned to your wallet. If you decide to withdraw, the platform will automatically display both the initial tokens committed to the program and the interest. You can view this information on your Binance account's "Balances".

There is an option to move the coins to your Flexible Saving account before the locked duration is completed. But by doing so, you will lose any interest that you've earned along the way. This is why before you subscribe and place your funds into the account, ensure you won't need to use the coins before the duration is up to earn the rewards.

The EndNote

Earning passive income is a way to generate money without working actively. It can provide stability, security, and freedom in your financial life. Binance offers two ways to earn passive income with cryptocurrency: Flexible and Locked Savings.

Flexible Saving allows you to earn interest on your cryptocurrency holdings daily. You can withdraw your funds anytime, but you will earn a lower interest rate than if you locked your funds for longer.

Locked Savings offers a higher interest rate, but you must lock your funds for a set period. You cannot withdraw your funds early without penalty.

The best option for you depends on your needs and risk tolerance. If you need access to your funds at any time, Flexible Saving is a good option. If you are willing to lock your funds for a longer period, Locked Savings may offer a higher return.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano