Binance offers a wide range of payment methods, including credit cards. Let's find out how to use them to buy cryptocurrency on the exchange.

Today, buying crypto is pretty easy and there are many different options to do it. As a leading exchange, Binance allows users to buy crypto with a debit card, VISA, or Mastercard credit card among other methods like fiat deposit, bank transfer, and e-wallet. How to do it?

Steps on Buying Crypto with Debit/Credit Cards

But before we go further, it's important to make sure that your credit card provider allows cardholders to purchase any type of cryptocurrency.

Other than that, check the credit card types supported by the exchange. Some exchanges like Binance only accept Visa or Mastercard payments.

Here is the step-by-step guide that you could follow:

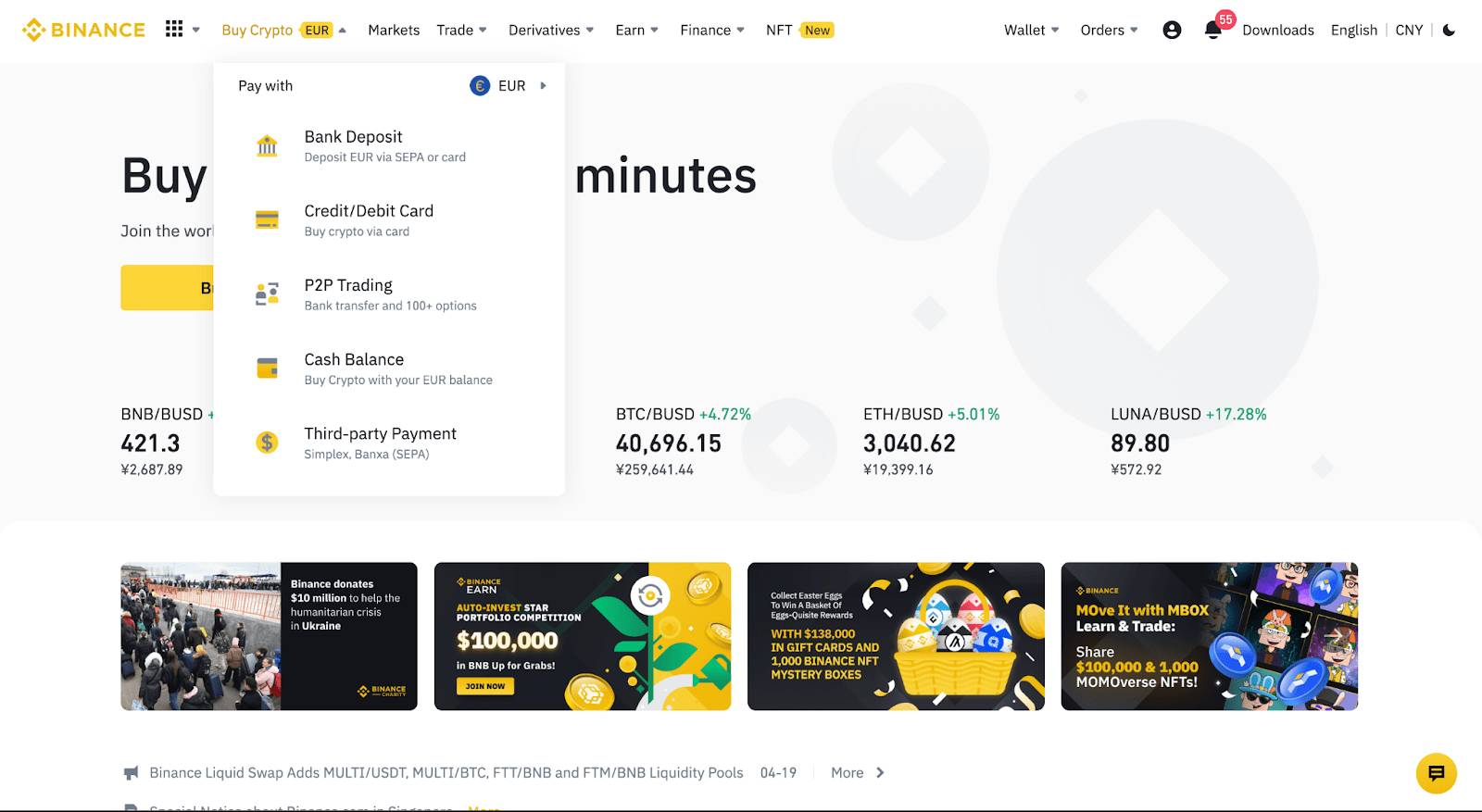

- Head over to Binance's official website and log in to your account. Click "Buy Crypto" and choose "Credit/Debit Card".

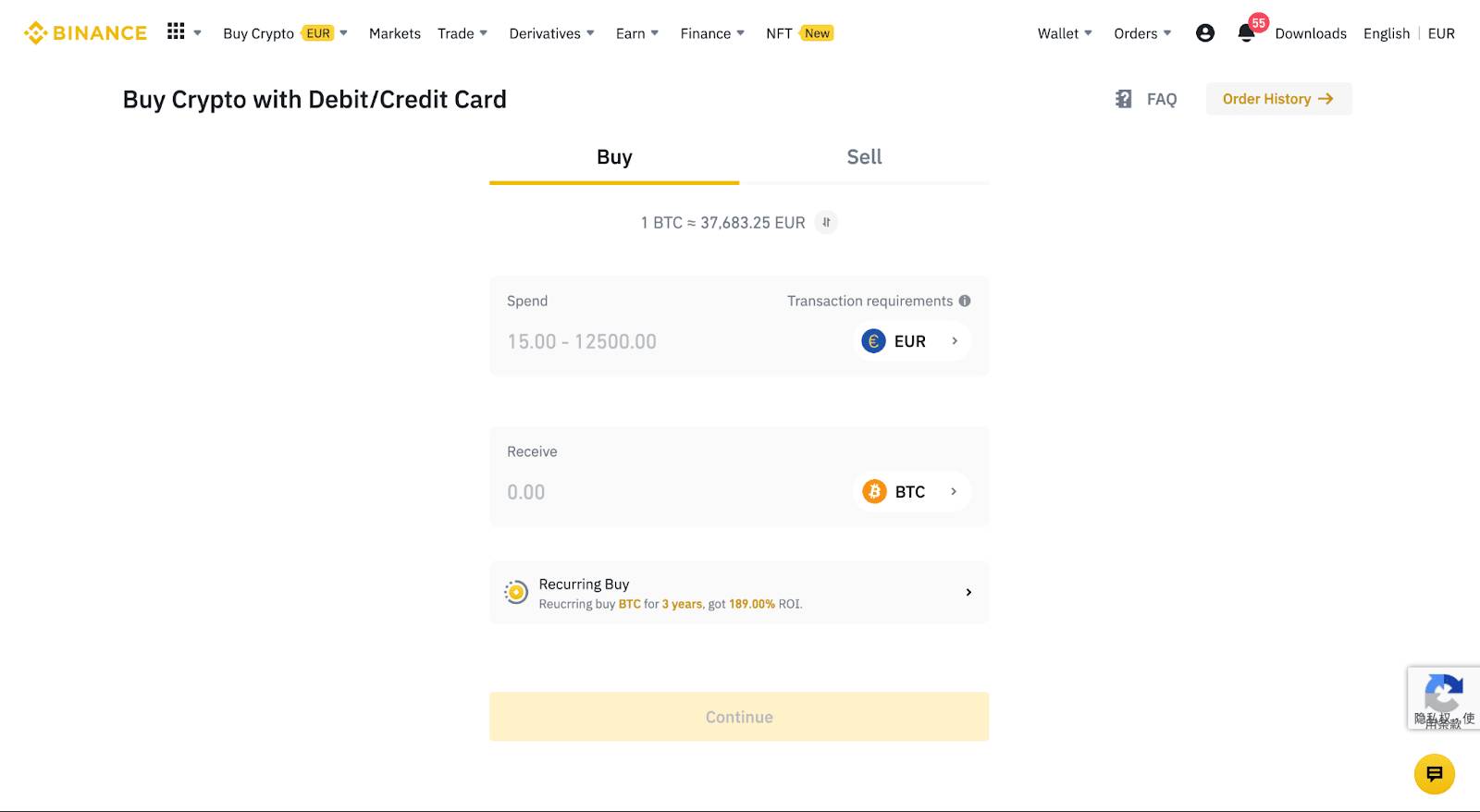

- On this page, you can buy with different fiat currencies. Just insert the fiat amount that you want to spend and you'll see the amount of crypto you can get.

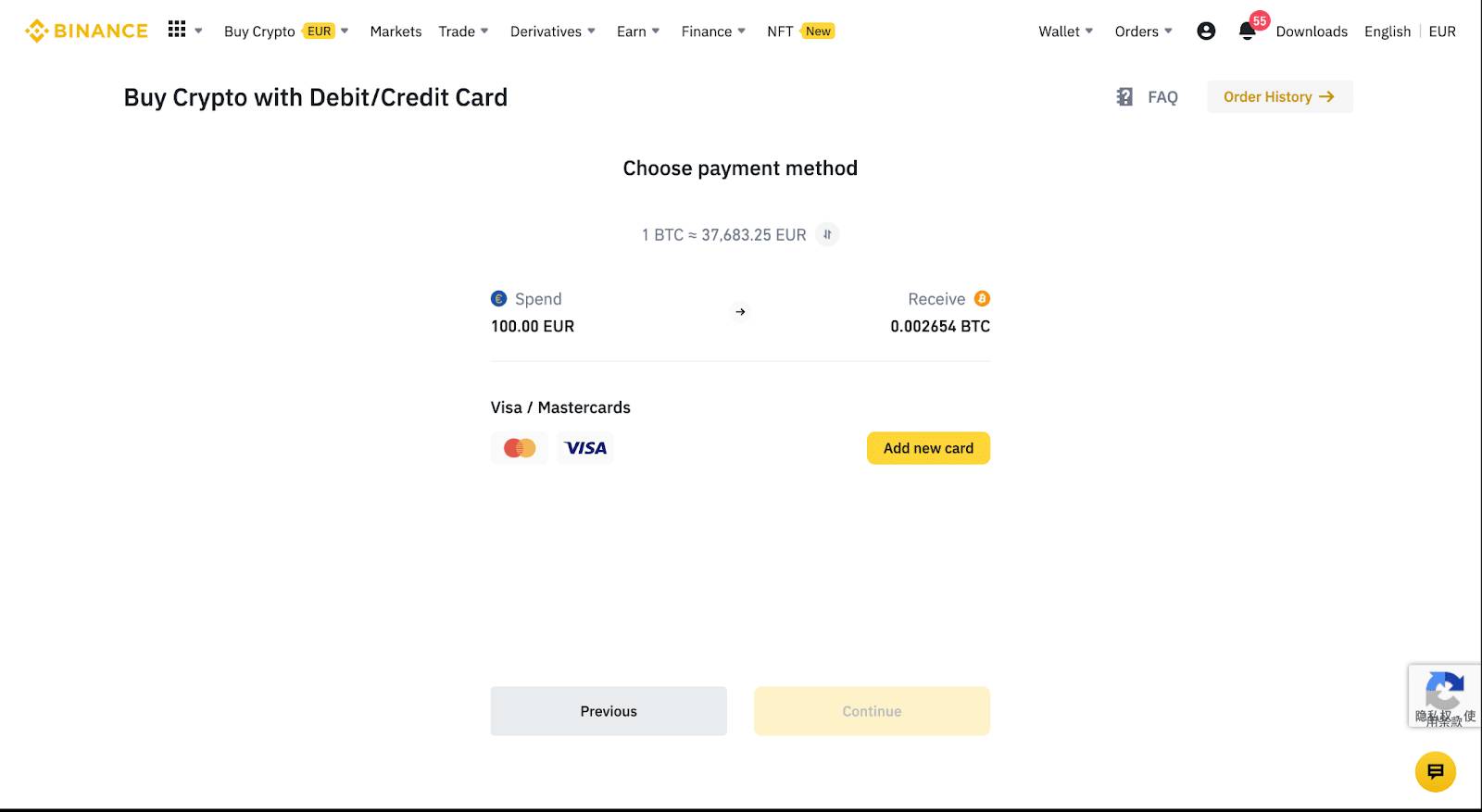

- Click "Add new card".

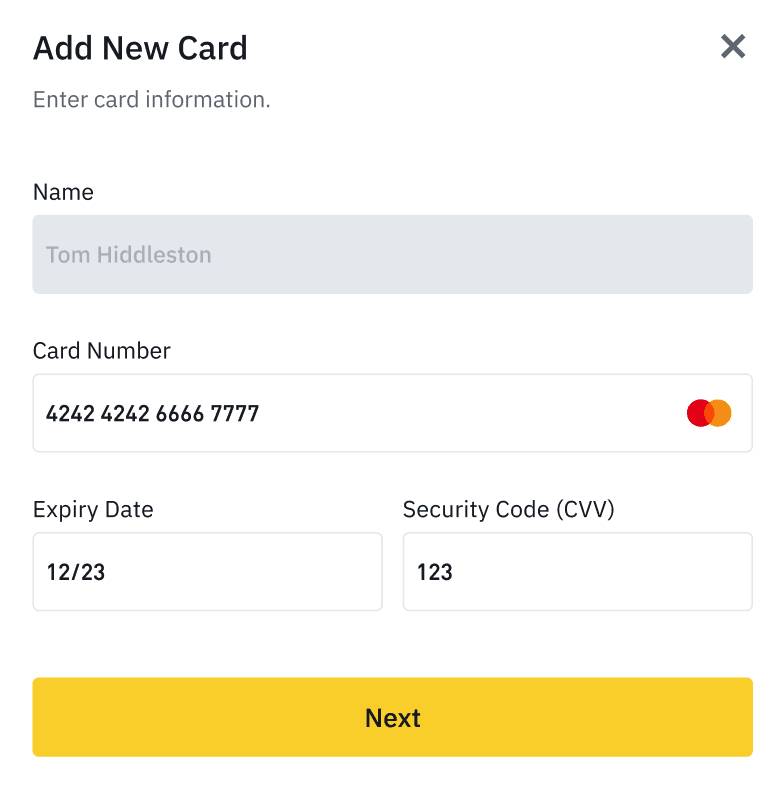

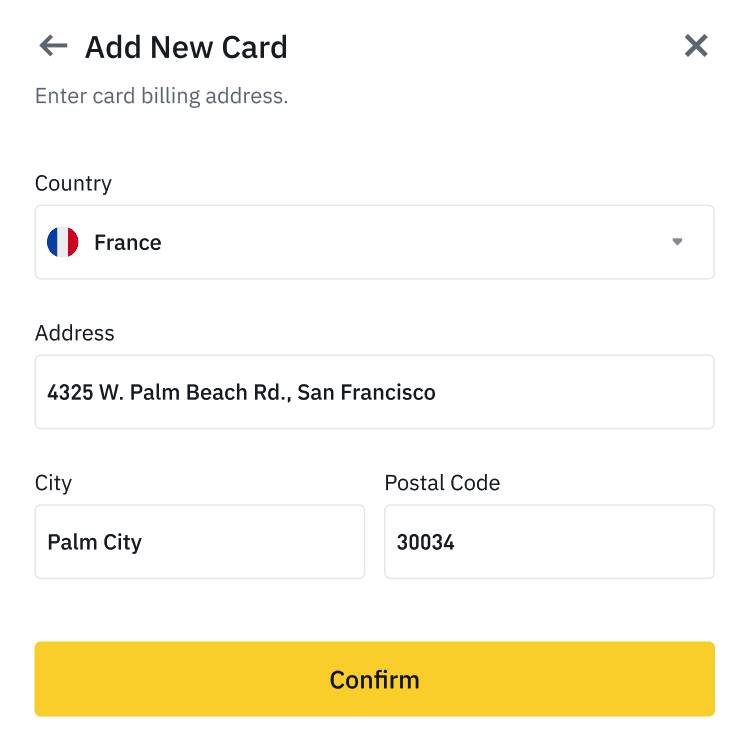

- Enter your credit card information. Remember that you can only use a credit card in your name.

- Input your billing address and click "Add Card".

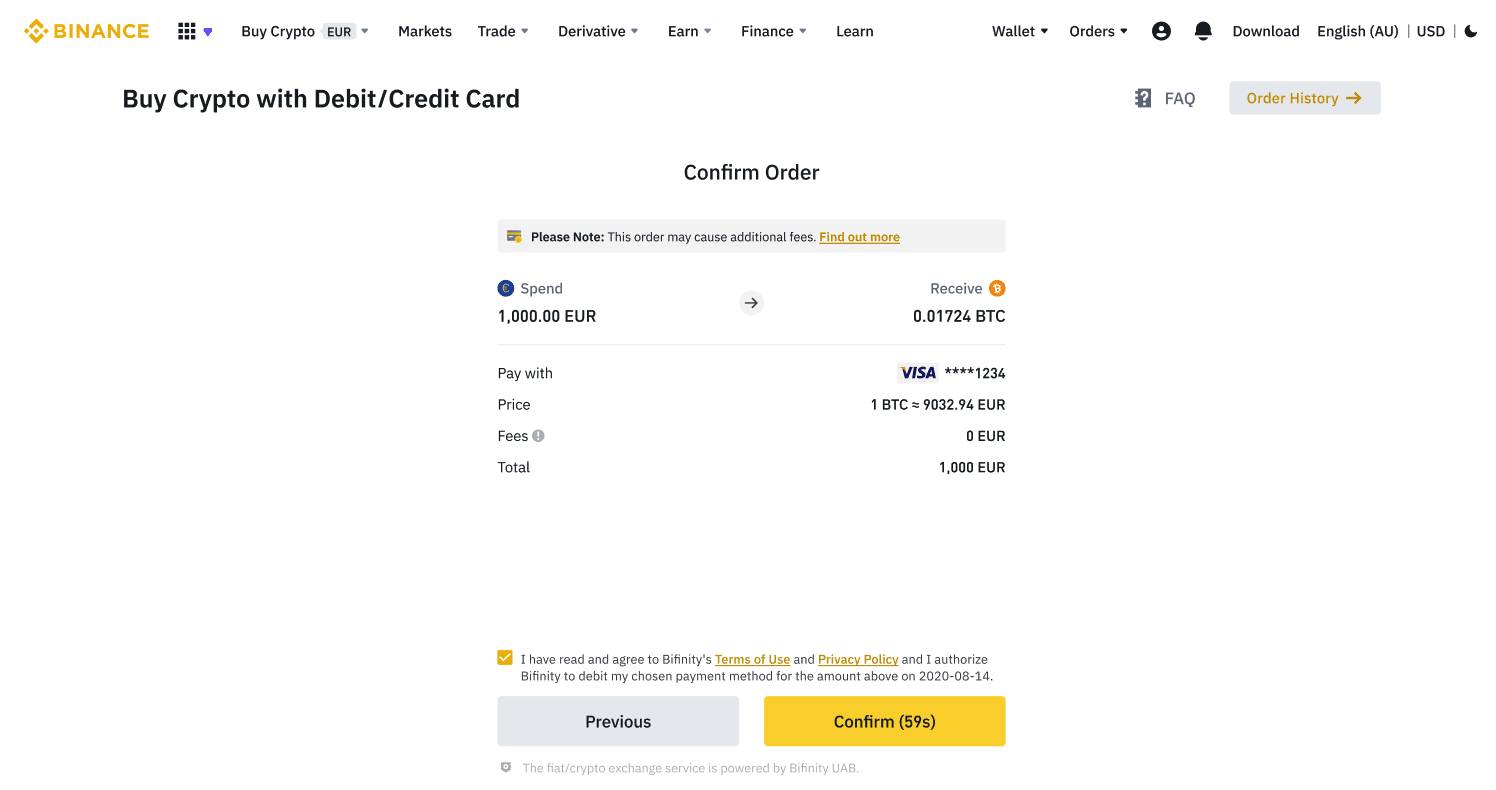

- Read the payment details and check the fees as well. Confirm your order within 1 minute. Otherwise, the price and the amount of crypto you'll get will be recalculated.

- Click "Refresh" to see the latest market update.

- Once it's confirmed, you will be redirected to your bank's OTP transaction page. Just follow the instructions to verify the payment.

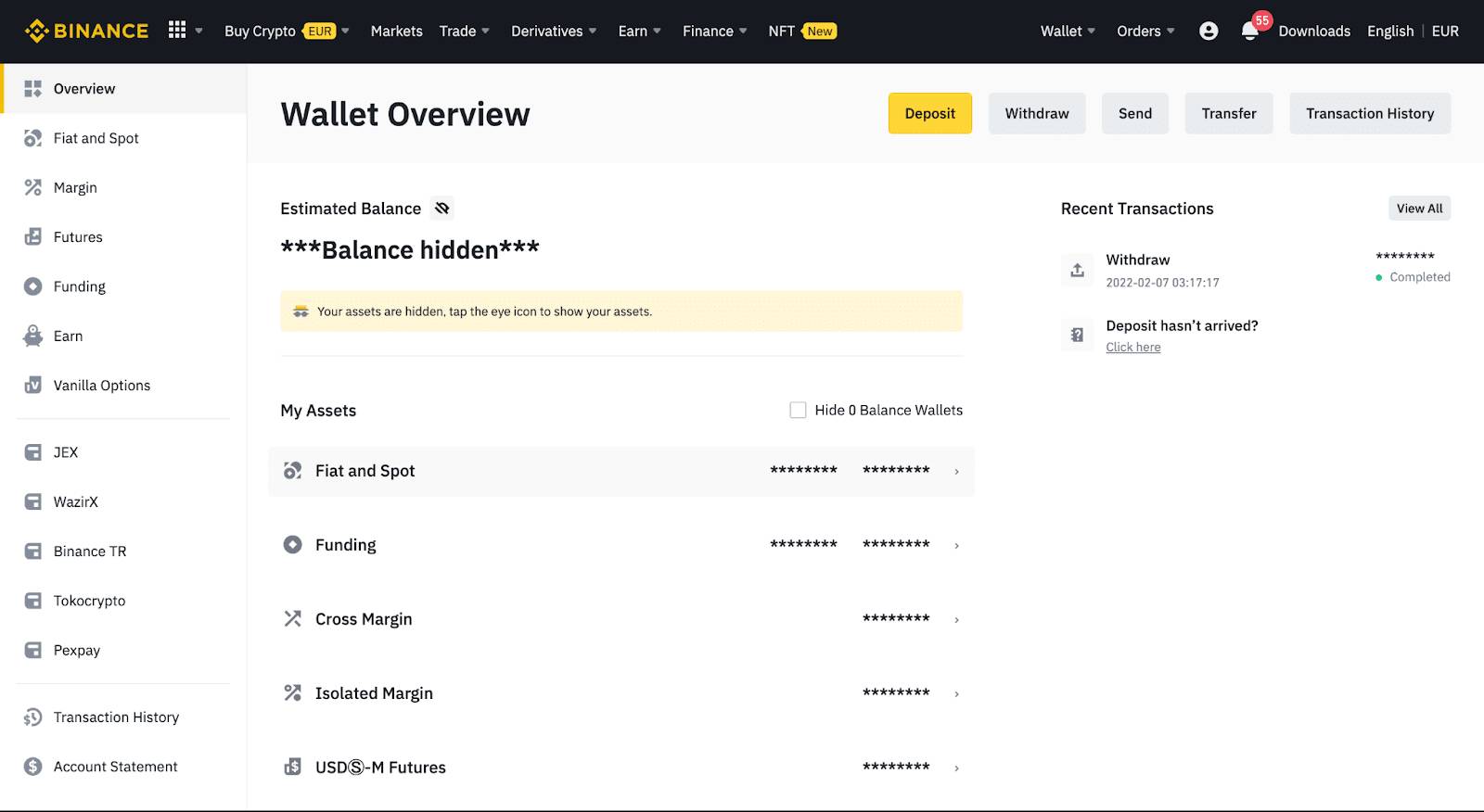

- You can see the crypto you purchased by clicking "Wallet", then choose "Overview".

Is It Safe to Buy Crypto with Cards?

Most of the time, the answer is yes. Crypto payment with cards basically means you connect your debit/credit cards to your online trading account so you can make transactions easily.

But before you can use them, you'll need to verify the cards and identity. This step is highly necessary to make sure that the card is yours and protect you from frauds.

However, it's extremely important to remember that signing up on a fraudulent "exchange" or website can lead to your data being stolen along with your card information.

Thus, you must ensure that the platform you're using to buy the crypto is safe and not prone to hacking. In this case, Binance is a fully regulated crypto exchange that has been around since 2017 and has served over 28.5 million worldwide users as of October 2021, so you don't need to worry about security issues.

Benefits of Buying Crypto with a Credit Card

The use of credit cards in the crypto industry is getting more popular day by day. There are a few advantages that come with credit cards. Let's take a closer look at each one.

- High Convenience

Credit cards allow you to buy crypto and make investments without having to have the exact amount of cash on your hands. This means, you can take advantage of the available opportunities as soon as you see one on the market. No need to wait for your monthly salary to arrive and miss the chance of making a profit as a few days period can be a huge difference in the crypto market. Just remember to pay your credit card bills at the end of the month to avoid getting charged by your card issuer. - Speedy Processing

Compared to other payment methods, credit cards are extremely fast. Bank and wire transfers could take several days to process, while credit cards typically need only a few seconds. Therefore, you can easily snatch the market opportunity and make transactions easily. - Beginner-friendly

Binance offers a simple user interface to make it easier for any user to navigate. It is a highly ideal option for beginners in particular as there's no need to go through complicated processes. At Binance, you simply need to enter your card number, expiry date, and CVV to immediately start making money. - Chance to Earn Rewards from Staking

Staking is another interesting feature offered by Binance and it can certainly offer you handsome returns. In fact, it can be a powerful source of passive income. Just buy some crypto with your credit card and stake it on Binance Farm to earn up to 20% APY.

Some Notable Risks

Like any other payment method, credit cards also come with several downsides. Here are some notable risks that you should consider.

Scams and Fraudulent Activities

We have mentioned that not all crypto exchanges are safe for credit card transactions. Some may look to exploit their users and run away with their money. Not to mention that your credit card information is also at risk.

While credit cards typically have strong fraud protection compared to other card types, every cardholder must still be aware and able to spot scams. Even at a trusted exchange like Binance, users must complete their due diligence before making any transactions with credit cards.

A Risk to Your Credit Card Score

As a credit card holder, it's crucial to know how credit cards work. The credit score basically reflects the amount of credit used, so the more credit you use, the higher your credit score will be. If you use too much credit, you could ruin your credit score and the number could continue to pile up if you fall behind on your monthly credit card bills.

For that reason, you should only use the credits as much as you can afford. Just because you can make transactions without having to pay right away, doesn't mean you can spend as much as you like because, at the end of the month, you still need to pay eventually.

For beginners, it's recommended to start small and perhaps consider using a dollar-cost averaging strategy.

It is also worth noting that banks and credit card providers usually have a maximum limit of cryptocurrency that you can buy each day. Thus, you need to check your purchases and make sure that the amount doesn't pass your daily limit.

Different Types of Fees to Expect

There are several types of fees that cardholders can expect when buying crypto assets with a credit card. So, before making any purchases, research the necessary cost and consider the amount depending on your financial situation.

Transaction Fees

First, cardholders must pay a commission fee to the crypto exchange. The amount varies depending on the exchange, and it is usually higher than other payment methods like bank transfers.

Binance offers a transaction fee of up to 2% per transaction, which is one of the lowest in the industry. However, there may be some additional transaction fees from the credit provider.

Cash Advance Fees

Cash advance refers to the amount of cash you borrow directly from your credit card provider. This usually involves withdrawing cash from the ATM.

The amount fee for a cash advance is usually 3-5% of the total amount. For example, if you borrow a $100 cash advance, you may need to pay $3-5 in fees.

Some crypto-credit transactions are also considered cash advances. The amount of fee can either be $5 or 10% of the transaction amount - whichever is higher.

So if you buy $1,000 worth of cryptocurrency, you may need to pay a $100 fee to your credit card provider.

Foreign Transaction Fees

A foreign transaction fee may be applied to users who purchase crypto with USD via a credit card on a platform that operates outside of the US.

This can also happen to those whose credit cards are issued domestically but are buying crypto with other fiat currencies. The fee is usually about 3% of the total transaction amount.

So if you buy $500, you may need to pay a $15 fee.

The Bottom Line

Using credit cards is a way of buying cryptocurrency that's worth considering. Although the transaction fees are relatively higher than other methods, it offers a number of benefits that are hard to miss.

By using credit cards, you can buy cryptocurrency quickly and easily. It is also considered safe as most credit cards have excellent fraud protection and their issuers are legitimate companies.

At the end of the day, the choice is all yours. Make sure that the payment method you choose benefits you and fits your current condition.

Did you know that Binance issues their own debit card? How does it work and is there any benefit? Learn further in "Binance Visa Card and How to Get It".

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano