Pepperstone is one of the leading trading brokers in the world, giving traders who apply access to trade across all markets via user-friendly platforms.

Pepperstone is one of the leading trading brokers in the world. They give traders access to trade across all markets via sophisticated but user-friendly platforms with cutting-edge technology, low prices, low latency, high-speed execution, and award-winning customer service.

The Pepperstone Professional Account is designed to offer exclusive features and benefits that are not available to regular users of the platform. To qualify as a Professional Client with Pepperstone, you need to meet specific eligibility criteria, which may include a significant trading history, a certain level of trading activity, and a substantial portfolio of financial instruments.

I opened an account in Pepperstone many years ago, and throughout that time, I've been quite pleased with the trading conditions and service they've offered me.

Understanding Pepperstone Professional Account

The Pepperstone Professional Account provides exclusive features that aren't available to regular users of the platform. You will be eligible for their renowned Active Traders program if you are a professional customer. More importantly, you can also access the increased leverage and other special account features.

In exchange, you won't be eligible for the protections afforded to retail customers, such as safeguards against negative balances and prohibitions on using leverage.

Pepperstone Professional Client Benefits

The users of Pepperstone Professional Account have access to greater leverage than regular users. They can use leverage up to 1:500 for most forex instruments on the system.

Other than that, they can earn up to $1000 per referral if they refer a friend to the platform. A professional client in Pepperstone can also be eligible for discounted commissions and daily refunds if they're qualified for the Active Traders program.

As a professional client, you will be assigned a relationship manager who will look after all your trading needs and any queries you may have regarding your account or the platform.

Once in a while, you can even receive exclusive invitations to VIP events, seminars, workshops, fine dining, sporting shows, and countless other experiences.

Access to a VPS solution is also available which will be immensely beneficial if you have an unstable internet connection. This is especially needed if you trade with Expert Advisors.

How to Apply as a Professional Client

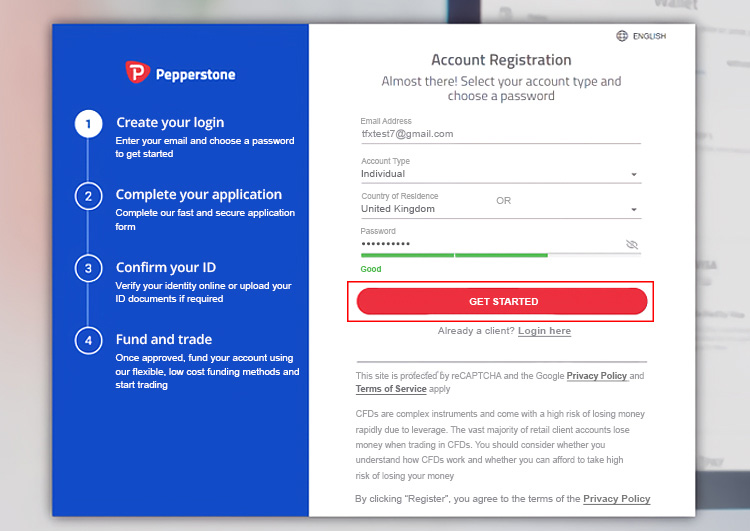

1. You must complete the online application form to open an account in Pepperstone. Usually, it will take you around three minutes to do if you want to establish an individual customer account with Pepperstone.

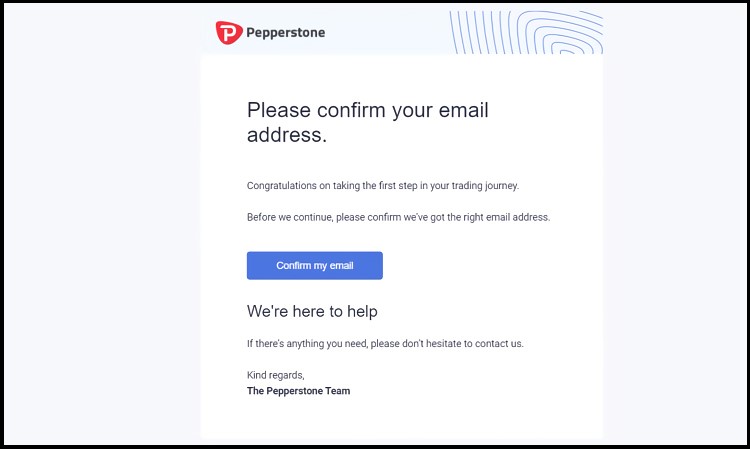

2. For the purposes of KYC (Know Your Customer), once your information has been submitted, you will be required to validate your email address and send in your Proof of Address (POA) and Proof of Identity (POI) papers.

3. When the accounts team has finished verifying your papers, you will be able to fund your account and begin trading when they have done so.

In order to create a corporate account, you will be required to present supplementary paperwork, such as a certificate of incorporation and articles of association. During the process of creating an account, support agents are available to help you in case you have any questions or concerns.

If you meet all the requirements, becoming a professional client on Pepperstone takes only a few steps. This quick and easy self-certification procedure can be found in the Secure Client Area.

It just takes a few minutes to complete. To establish that you fulfill the requirements for eligibility, you will be asked to take a quick test. You will be required to make a self-certification stating that you fulfill two of the following three requirements:

- You need to have experience trading with leverage on derivative products

- Your Pepperstone trading portfolio needs to exceed a cash value of $500K

- You need to have significant professional experience working in finance

See Also:

Funding Your Professional Account

The process of making a deposit in a Pepperstone professional account is the same as depositing into other Pepperstone accounts.

Pepperstone provides its customers with a variety of deposit and withdrawal methods that are both easy to use and convenient. This includes payments made by wire transfer, credit/debit cards, and electronic wallets.

It's important to note that you can be subject to additional costs when utilizing certain ways of payment, while clearance of wire transfers often takes a couple of working days.

Because I utilize a variety of digital wallets, I find that this choice offers greater convenience. Especially when significant market news has just been released, I urgently need to replenish my trading account.

I don't want to have to sit around for many days while a bank transfer is processed since there's a chance I could lose out on an opportunity to try to capitalize on the news.

Does Pepperstone Professional Account Suit You?

As mentioned before, clients who qualify as professionals may apply to trade with greater leverage of up to 1:500. Hence, you are able to trade higher position sizes with higher leverage than you would be able to without it. However, you must keep in mind that raising your position size also increases the risk you take.

As such, you would suit Pepperstone Professional Account only after you establish a good trading discipline. This is important to make sure you don't abuse the high leverage and be responsible in using it. In addition, you also need to be prepared of handling a higher chance of losing in order to not be triggered into revenge trading.

Where to Find the Information on the Official Broker Site?

- This information is reported per Apr 23 2024.

- We can not ensure if this offering is still available or remain the same in future.

- The broker announcement page may or may not exist anymore, You may explore Pepperstone homepage and try to find "Promotion" section on the menu, footer, etc, to ensure the availability and validity of this promotion.

Pepperstone is an award-winning broker offering various trading instruments including forex, CFD, and crypto. This Australian broker is regulated by the Australian Securities and Investments Commission (ASIC).

$5K Refer a Friend Bonus

$5K Refer a Friend Bonus Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest

22 Comments

Saiko

Apr 4 2023

Hey there! I came across an article about Pepperstone, and I was thrilled to learn about their professional account and the exciting features it offers. It's my aspiration to have a pro account with them in the future. As I delved into the article further, I noticed that Pepperstone emphasizes the use of cutting-edge technology in their trading platform. I'm genuinely intrigued by this aspect. Could you provide me with a detailed understanding of how Pepperstone harnesses cutting-edge technology to deliver exceptional trading experiences? Specifically, I'm interested in how their trading platform leverages advanced technology to ensure low-latency, high-speed execution, award-winning customer service, and a user-friendly interface. Moreover, I'm keen to know how these technological advancements align with the offerings and benefits provided within their professional account. I believe understanding these aspects will help me grasp the value and potential advantages that Pepperstone's cutting-edge technology can bring to traders like myself. Thank you!

Pedro

Apr 5 2023

@Saiko: Pepperstone leverages cutting-edge technology to deliver exceptional trading experiences. Their platform prioritizes speed and efficiency, utilizing advanced infrastructure and servers for quick trade execution. With a user-friendly interface and customizable features, it's easy to navigate and personalize according to your preferences. Their customer service team, available through live chat, email, or phone, offers prompt assistance whenever needed. Professional account holders enjoy additional benefits and exclusive resources tailored to experienced traders. Pepperstone's commitment to technological advancements ensures seamless trading and empowers traders to focus on their strategies. With their top-notch technology, you can trade with confidence and stay ahead in the markets.

Sagor Hamari

Apr 15 2023

What are the potential benefits and drawbacks of applying for professional client status on Pepperstone? While I understand that professional clients are afforded certain regulatory exemptions and are subject to different margin requirements, I'm curious about whether there are any other advantages or disadvantages to consider. Additionally, I'm interested in understanding how the application process works and what sort of documentation is required to support an application.

Mainul Hasan

Apr 15 2023

@Sagor Hamari:Pepperstone offers professional client status to certain traders who meet specific criteria. While there are some benefits to applying for professional client status, there are also some drawbacks to consider.

Benefits of professional client status on Pepperstone include:

Regulatory exemptions: Professional clients are exempt from certain regulations that are designed to protect retail clients. For example, they may not be subject to the same level of leverage restrictions as retail clients.

Lower margin requirements: Professional clients are often required to meet lower margin requirements than retail clients, which can give them greater trading flexibility.

Access to more products: Professional clients may have access to a wider range of financial products, such as derivatives and complex financial instruments, that may not be available to retail clients.

Dedicated support: Professional clients often receive dedicated support from their broker, which can include access to a personal account manager and other resources.

Drawbacks of professional client status on Pepperstone include:

Higher risk: Trading with higher leverage and more complex financial instruments can be riskier, which means that professional clients may be more susceptible to losses.

Limited protection: Professional clients are not afforded the same level of protection as retail clients, and may not be eligible for compensation in the event of financial misconduct.

Fewer regulatory safeguards: Professional clients are not subject to the same level of regulatory protections as retail clients, which means they may be more vulnerable to unethical or fraudulent practices.

Limited access to dispute resolution: If a professional client has a dispute with their broker, they may have limited options for dispute resolution.

The application process for professional client status on Pepperstone generally involves completing an application form and providing supporting documentation. This documentation may include proof of trading experience, financial statements, and other evidence of your ability to meet the requirements of professional client status.

It's important to carefully consider the benefits and drawbacks of professional client status before making a decision. If you're unsure about whether professional client status is right for you, it may be helpful to speak with a financial advisor or other trusted professional.

Karlin Paldo

Apr 15 2023

Can you provide a more detailed explanation of the criteria that Pepperstone uses to determine whether a trader is eligible to apply as a professional client? While I understand that there are certain requirements that need to be met, such as having a certain amount of trading experience or meeting a minimum net worth threshold, I'm interested in understanding how Pepperstone evaluates these factors and whether there are any additional considerations that are taken into account when assessing an application.

Sonia Raitam

Apr 15 2023

@Karlin Paldo:Pepperstone has specific criteria that they use to evaluate whether a trader is eligible to apply for professional client status. These criteria include the following:

Trading experience: Pepperstone requires that professional clients have at least one year of experience trading in the financial markets. They may also consider the types of financial instruments that the trader has experience with, as well as the volume and frequency of their trades.

Financial knowledge and qualifications: Pepperstone may also consider a trader's level of financial knowledge and any relevant qualifications they may have. This could include certifications or degrees in finance, accounting, or economics.

Net worth: To be eligible for professional client status, a trader must meet certain net worth requirements. The specific net worth threshold may vary depending on the jurisdiction in which the trader is located.

Trading activity: Pepperstone may also consider a trader's trading activity, including their trading volume and the size of their trades.

Professional status: In some cases, Pepperstone may require that a trader provide evidence of their professional status, such as proof that they are a registered investment advisor or that they work in the financial industry.

In addition to these criteria, Pepperstone may also consider other factors when evaluating a trader's application for professional client status. These could include the trader's overall financial situation, their investment objectives and risk tolerance, and any other relevant factors that may impact their ability to trade in the financial markets.

It's important to note that meeting the criteria for professional client status does not guarantee that an application will be approved. Pepperstone may conduct a thorough evaluation of each application to determine whether the trader is eligible for professional client status. If you are interested in applying for professional client status, it's important to carefully review the eligibility criteria and provide any required documentation to support your application.

Yosen

Apr 21 2023

The professional account offered by Pepperstone has a lower minimum deposit requirement compared to other brokers, who typically require much higher deposits for a professional account. This makes it a good choice to try trading with a professional account at Pepperstone, as it feels more like a standard account than a professional one. Furthermore, according to the author, it's possible to negotiate commission prices with the broker, which is a new and valuable insight. I'm curious to learn more about it. Additionally, could you provide more information on ASIC, the regulatory authority that oversees Pepperstone?

Yerren Green

May 19 2023

@Yosen: Let me answer! ASIC, which stands for the Australian Securities and Investments Commission, is the regulatory authority overseeing Pepperstone. Think of ASIC as the big watchdog in the Australian financial world. They're responsible for making sure that brokers and other financial institutions play by the rules and operate in a fair and transparent manner.

ASIC has some serious powers when it comes to regulation. They set and enforce strict standards to protect traders and investors, maintain the integrity of the financial markets, and promote confidence in the financial system. They keep a close eye on things like market manipulation, fraud, and misconduct, taking swift action when necessary.

One of ASIC's main goals is to ensure that traders like you are treated fairly. They have rules in place to make sure brokers comply with their obligations, such as safeguarding client funds, providing accurate and timely information, and maintaining robust internal controls.

By regulating Pepperstone, ASIC provides a layer of oversight and accountability. This means that Pepperstone must adhere to ASIC's regulations and meet their high standards. It's a way to ensure that you, as a trader, can have confidence in the integrity and reliability of the broker you're dealing with. You can learn more about ASIC in here : ASIC Regulation Details

Simeone

May 26 2023

Hey there! I've been looking into Pepperstone's pro account, and I noticed that they offer a leverage of up to 1:500 for most forex instruments. That sounds pretty impressive to me, but I'm wondering if a leverage ratio of 1:500 is considered high for professional traders in the forex market. I understand that higher leverage can amplify both profits and losses, so I'm curious about the level of risk associated with such high leverage. Are professional traders generally comfortable using this level of leverage, or do they tend to opt for lower ratios? I'd love to hear your insights on whether a leverage of 1:500 is commonly used by experienced traders or if there are alternative leverage options that are more commonly preferred.

George

May 28 2023

@Simeone: Hey! It's great to see your interest in Pepperstone's pro account and leverage options. A leverage ratio of 1:500 is indeed considered high in the forex market (read more about high leverage : Pros And Cons Of High Leverage In Forex Trading ).

While it can potentially amplify profits, it's important to note that it also increases the risk of losses. Professional traders have varying preferences when it comes to leverage, and it often depends on their trading strategies and risk tolerance.

Some experienced traders may be comfortable using higher leverage, while others may opt for lower ratios to manage risk more conservatively. It's always crucial for traders to assess their own risk appetite and develop a sound risk management plan when utilizing high leverage.

Jane

Jun 9 2023

Hey, I came across this interesting information about Pepperstone, and it got me scratching my head. So, apparently, they have a minimum deposit requirement of $200, which seems to be the norm among top brokers these days. But here's the thing that's boggling my mind—how the hell can you actually start trading with just $200? Is it really enough to get into the trading game?

I mean, $200 doesn't sound like a whole lot, especially when you're dealing with the financial markets. So, I'm curious to know if that amount is sufficient to make trades and actually see some results. Can you really make substantial profits with such a small deposit? Or is it more of a beginner-friendly option to dip your toes in the water?

Alejandro

Jul 14 2023

@Jane: I totally get your confusion about starting trading with just $200 at Pepperstone. It does seem like a small amount to dive into the trading world, right? But here's the thing: while $200 may not be a fortune, it's still enough to get started. Think of it as a way to dip your toes in the water and learn the ropes of trading without risking a huge chunk of money.

Now, let's be real here. With a $200 deposit, you're not going to become an overnight millionaire. The profits might not be mind-blowing, but hey, you can still make some gains. It's all about managing risks, having a solid trading strategy, and building up your skills over time.

Starting with $200 is actually a beginner-friendly option. It lets you get a feel for the markets, test out different strategies, and gain valuable experience without breaking the bank. It's like a stepping stone towards potentially growing your trading capital and earning bigger profits down the line.

So, don't stress too much about the initial deposit size. Focus on learning, improving your trading skills, and gradually increasing your capital as you become more comfortable. It's a journey, and with the right mindset and dedication, you can make progress regardless of the starting amount.

Leandro

Jul 15 2023

Is a leverage of 1:500 considered high in the context of trading? I came across this article mentioning that Pepperstone Professional Clients have access to leverage up to 1:500 for most forex instruments. While it sounds enticing, I'm curious about the implications and risks associated with such high leverage.

Additionally, the article mentioned that professional clients can earn up to $1000 per referral if they meet certain terms and conditions. Could you provide more details on these conditions and how the referral program works?

Furthermore, it seems that professional clients who qualify for Pepperstone's Active Trader Program can enjoy discounted commissions and daily refunds. I'm intrigued by the mention of a VPS solution, specifically designed to assist traders with slow or unstable internet connections, particularly in third-world countries. How does this VPS solution work, and what are the benefits it offers to traders in those regions?

Sally

Oct 25 2023

@Leandro: I can break down your questions here:

Hope these can help you to answer your questions!

Gerald

Oct 28 2023

I've just gone through the article, and it seems there's a drawback to becoming a professional client with Pepperstone. The article highlights that professional clients won't enjoy the protective measures typically available to retail customers, including safeguards against negative balances and restrictions on leveraging. So, I'd like to inquire about how the absence of these "protections" in the context of the Pepperstone Professional Account affects the trading experience for professional clients and what particular safeguards or advantages are reserved for retail customers that professional clients may not have access to. Furthermore, I'm curious about how the benefits associated with the Active Traders program, increased leverage, and special account features for professional clients compensate for the lack of these protective features usually provided to retail clients.

Fakir

Oct 31 2023

@Gerald: The absence of protective measures, such as safeguards against negative balances and restrictions on leveraging, in the context of the Pepperstone Professional Account can significantly impact the trading experience for professional clients. Professional clients, unlike their retail counterparts, are exposed to higher risks due to the absence of these safeguards.

Firstly, the lack of protection against negative balances means that professional clients are potentially more vulnerable to significant losses that could exceed their initial investment. This absence of a safety net can lead to a more volatile trading experience, as traders need to manage their risk more diligently.

Secondly, the removal of restrictions on leveraging for professional clients can be a double-edged sword. While it offers the potential for higher profits through increased leverage, it also increases the potential for larger losses. Without these restrictions, professional clients must exercise even greater caution to avoid over-leveraging and incurring substantial losses.

Lidya Chandrawati

Nov 16 2023

Drawing from the author's experience with the professional account offered by Pepperstone, it's highlighted that the Pepperstone Professional Account comes packed with exclusive features and perks that regular platform users don't get. To qualify as a Professional Client with Pepperstone, you've got to meet specific eligibility criteria, which could include having a substantial trading history, a certain level of trading activity, and a hefty portfolio of financial instruments.

Now, getting this professional account seems to require a chunkier amount of funds, and let's face it, not everyone's swimming in cash like that. So, here's the million-dollar question: Does the Professional Account really have more advantages in the trading game compared to a regular account?

Phillips

Nov 20 2023

Typically, professional accounts offer perks like increased leverage and additional tools, which can be advantageous for seasoned and high-volume traders. However, it's crucial to weigh the potential risks associated with higher leverage. The overall advantage depends on factors such as an individual trader's experience, preferences, and risk tolerance. While professional accounts may provide more tools and flexibility, they also come with their own set of considerations.

Now, sharing my perspective, I'd say yes. The higher leverage in professional accounts stems from the larger funds involved. To illustrate, if you have $100 with a 1:500 leverage, you get a trading power of $50,000. On the other hand, a professional account with, say, $100,000 would have a trading power of $50,000,000 at the same 1:500 leverage. This translates to a significant advantage in both trading and risk management. Having higher funds makes it easier to handle risks and manage money effectively. Hope it can clear your question!

Sharlotte

Nov 29 2023

I'm a bit confused here. If I have a professional status, it's logical that my deposit would be higher compared to a regular account. However, the article mentions that, as previously stated, professional clients can request higher leverage of up to 1:500.

I'm trying to understand why some brokers, which allow lower initial deposits, offer higher leverage, while brokers that require significantly higher deposits provide lower leverage. I acknowledge that Pepperstone still offers a relatively high leverage of 1:500 compared to other brokers. However, I'm looking for an explanation for the reasoning behind these terms.

Kerry

Dec 5 2023

The variation in leverage offered by brokers, depending on deposit amounts and professional status, is often influenced by regulatory considerations and risk management practices. Brokers may provide higher leverage to accounts with lower initial deposits to attract a broader range of clients, including those with limited capital. This can be advantageous for traders looking to amplify their positions with a smaller investment.

On the other hand, brokers may offer lower leverage to accounts with higher deposits as a risk management measure. Higher leverage magnifies both potential profits and losses, and limiting leverage for larger accounts helps mitigate the risk of substantial losses.

The provision of higher leverage to professional clients is often based on the assumption that these individuals or entities have a deeper understanding of the markets and can manage the increased risk associated with higher leverage. (read :Why Do Brokers Give Leverage?)

Pepperstone's decision to offer a leverage of 1:500 may reflect their assessment of the balance between providing flexibility for traders and ensuring responsible risk management.

Gilang

Dec 18 2023

Hey, I find this statement intriguing: To set up a corporate account, you need to submit additional documents like a certificate of incorporation and articles of association. I'm curious, do corporations actually engage in forex trading? If so, what types of companies are involved in forex trading through brokers? And could you explain the distinctions between trading forex as a company compared to trading as an individual?

Heru

Dec 23 2023

Your interest in creating a corporate account for forex trading is valid. Corporations, like other entities, can engage in forex trading through a broker. Typically, companies involved in international trade, import/export, or those seeking to manage currency risk may participate in forex trading. When creating a corporate account, additional paperwork such as a certificate of incorporation and articles of association is usually required to verify the legitimacy of the business.

The key difference between trading forex as an individual and as a company lies in the legal and tax implications. When an individual trades forex, the profits and losses are typically treated as personal income or capital gains. In contrast, trading as a company involves different tax considerations and may have implications for corporate structures and reporting requirements.