Martingale strategy was derived from gambling practices where a gambler doubles his bet every time he loses. Similar method can also be used in forex trading.

No matter if you are an experienced trader or a novice one, you might have heard about Martingale somewhere. Although it is a controversial strategy, many traders and automated trading uses Martingale strategy -sometimes wrongly thinks that it improves their winning probability or profitability. Before you believe the claims made by them, let's take a closer look to this particularly risky strategy.

Martingale strategy was derived from gambling practices where a gambler doubles his bet every time he loses. Similar method can also be used in forex trading by doubling lot size in the second trade while letting the previous losing trade floats.

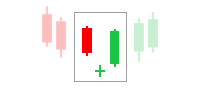

This is how people usually do it:

Someone who uses martingale opens new position every time his initial position suffers loss (he does not do that if the initial trade is a winning one); the second position is twice bigger in value than the first. If the second position still doesn't bring fruit, he opens new position in double the second position. That way, the price does not have to turn back all the way for the trades to profit or recover lost grounds.

Sounds great, isn't it!? However, such strategy can bankrupts you if price does not revert back. Say, you buy the EUR/USD during downtrend because there are buy signals on the indicators you used, but price fails to go up. Then instead of closing the trade, you are stubbornly holding onto that trade while opening the second position and doubles the lot size. It will certainly be great if afterward prices turn back; but it will end in disaster if it is not. Thus, it's important not to get a fix on a certain strategy. Be flexible, and remember that Martingale needs extra careful handling.

Oftentimes, Martingale user limits his losses to several trades only, or up to a certain percentage of his available margin. For example, he will stop opening new trades after the third trade although it may still be in a loss. That way, he will not suffer too much if the market is trending. It is also possible for trader to only halt the strategy after a certain percentage of his balance is used up. These strategies can prevent total loss, but they do not necessarily helpful in improving the probability of success.

Still, there are quite many successes in trading with martingale strategy, hence its infamous popularity. If you take a look at forums or such, you will find that there are ways to moderate martingale's high risk content. In this sense, there are some important things to note if you are going to make use of martingale strategy:

- Keep lot sizes small

- Don't use high leverage (keep in mind that higher leverage disguises higher risk)

- Limit your drawdown

Beside of that, it is also better to not use Martingale when the market is trending. It may very well be the end of your account if you dare to do so. Similarly, if you want to make use of robot or expert advisor (EA) that utilized Martingale, take care in setting up your account's money management. Apply the same rules: keep lot sizes small, don't use high leverage, and limit your drawdown.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance