Numerous payment options are available for FP Markets deposit and withdrawal, including credit/debit cards, bank wires/transfers, and electronic wallets.

FP Markets, a trusted forex and CFD broker, offers access to over 10,000 assets through advanced trading platforms. They also provide quick and easy procedures for deposit and withdrawal. There are only three (3) steps you need to take in order to top up your FP Markets account or cash in your profits.

How Do I Deposit Money at FP Markets?

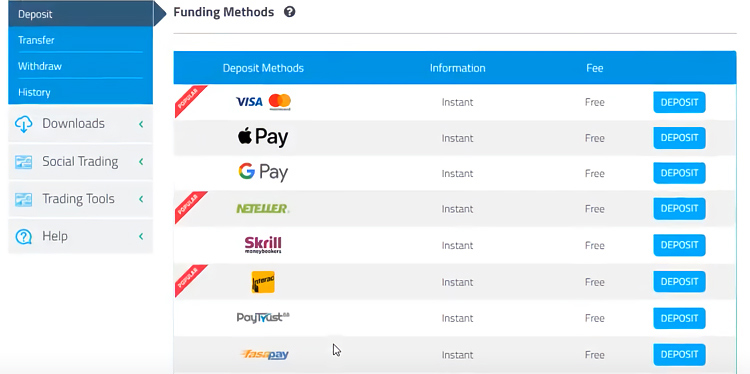

After registering an account on FP Markets, you may found numerous payment options are available for FP Markets deposits, including credit/debit cards, bank wires/transfers, electronic wallets (PayPal, Neteller, Skrill, Poli Pay, and BPay), and broker-to-broker. Choose the most suitable payment option for you, then follow these 3 easy steps:

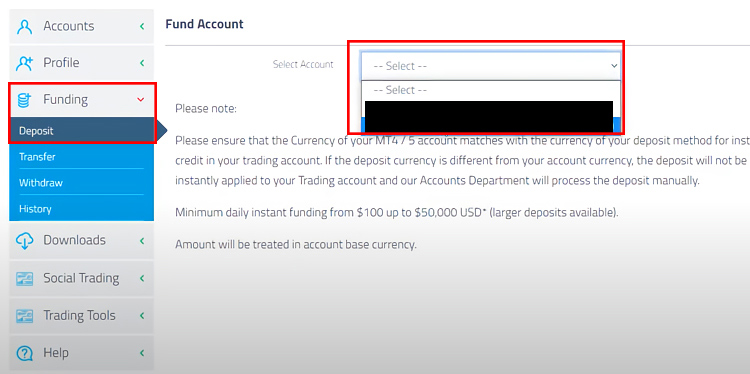

- Log in to your Client Area. Look at the left side of the screen, choose "Funding", then click "Deposit". At the "Fund Account" window, determine which trading account you want to fund.

- The window will then display all the available payment methods in FP Markets. Choose yours.

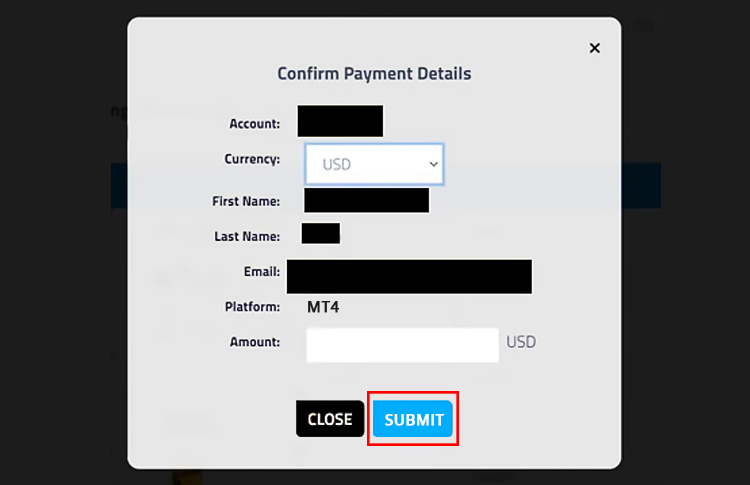

- A pop-up form related to your chosen method will appear. Complete all the blank fields in the pop-up form, then click "Submit".

You will then be redirected to your preferred payment gateway. Follow the appropriate procedures. Once everything is done, a "Transaction Approved" window will appear. Click "Done", and go back to the Client Area to check your account balance.

Deposits through cards and e-wallets will arrive instantly, but bank wires may take up to five business days. Contact FP Markets via Live Chat or Email if you experience any difficulties.

How to Withdraw Funds at FP Markets?

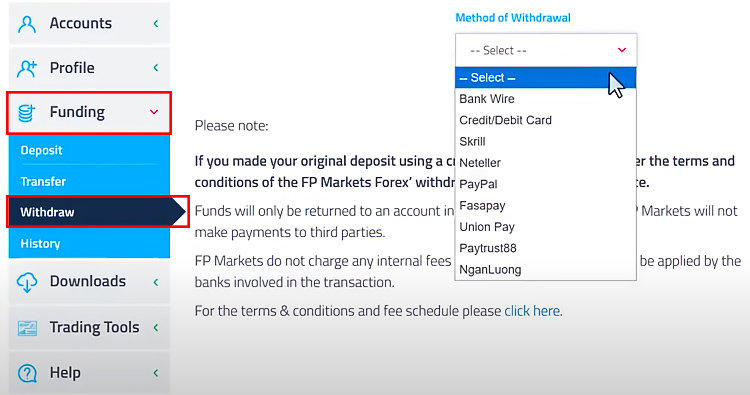

FP Markets provide fewer options for withdrawals, including credit and debit cards, domestic bank transfers, international bank wires, and electronic wallets (PayPal, Neteller, Skrill, PayTrust88).

Note that the first withdrawal amount must match your deposit amount, and it must be made using the same payment method. Profits can be withdrawn using a different method once deposits have been removed. If your deposit method is not available for withdrawal as well, you will have to withdraw your funds through bank wire.

Additionally, make sure that you have verified your account to minimize the risk of withdrawal failures.

Determine the amount of funds you want to withdraw, then follow these 3 steps:

- Log in to your Client Area. Look at the left side of the screen, "Funding", then click "Withdraw". At the following window, determine which withdrawal method you want to use.

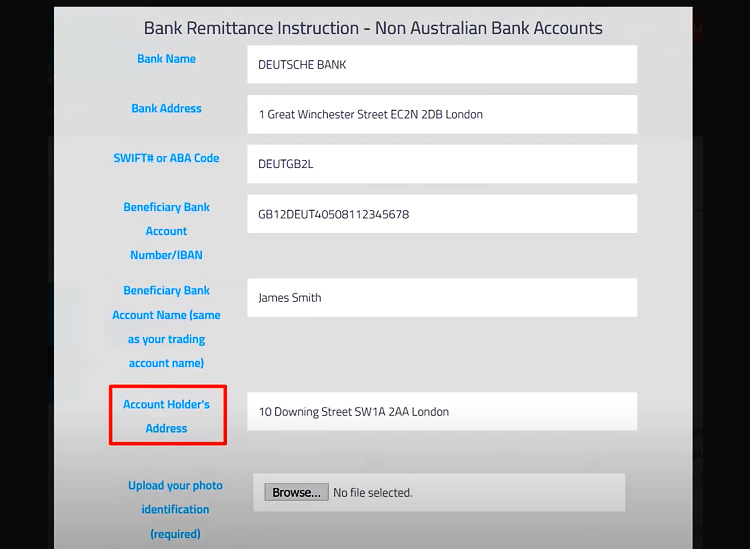

- For the first withdrawal in FP Markets, you will be asked whether you have set up your payment details. In case you haven't done it already, you will have to first complete the pop-up form. For example, here are the details you need to provide for withdrawals to a non-Australian bank account.

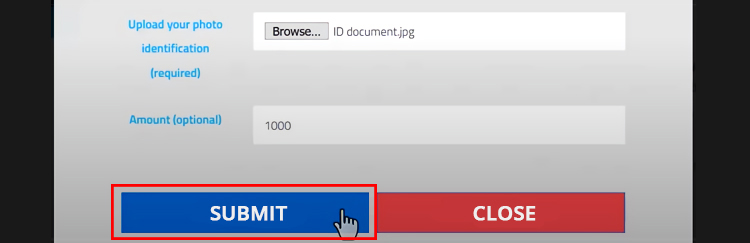

- Specify your trading account, upload a copy of your official ID document, and fill in the amount of funds you want to withdraw in the same form. Then, click "Submit".

Your funds will arrive in your e-wallet/bank account within one business day if FP Markets have received all the necessary documents. Contact FP Markets Live Chat or Email if you experience any difficulties.

FAQ About FP Markets Deposit and Withdrawal

-

How much is the minimum deposit at FP Markets?

MT4/MT5 accounts require an AUD100 minimum deposit, while the minimum deposit for Iress accounts is AUD1000 (or currency equivalent). -

What base currencies are available at FP Markets?

FP Markets offers at least 10 base currencies: EUR, GBP, USD, AUD, CAD, SGD, HKD, JPY, NZD, and CHF. -

Is there any deposit and/or withdrawal fee at FP Markets?

FP Markets does not impose any additional costs for both deposits and withdrawals. However, be aware that payments to and from foreign banking institutions may be subject to intermediary transfer fees, which are not covered by FP Markets. -

Is there any minimum withdrawal requirement at FP Markets?

FP Markets does not require that you accumulate a certain amount of funds before withdrawal. Theoretically, you can even withdraw AUD1. However, as your payment gateway may impose intermediary transfer fees, your withdrawal amounts have to be higher than those costs.

FP Markets is a trusted global broker offering more than 10,000 CFD products across forex, shares, indices, commodities, and cryptocurrencies. This broker supports low commissions and tight raw spreads from 0.0 pips that are made possible by their partnership with leading banking and non-banking financial institutions.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

12 Comments

Cleo

Dec 29 2022

Stevanie

Dec 29 2022

Harrison

Dec 29 2022

Ryan

Dec 29 2022

Harrison: In my experience, I have been in the world of trading for 5 years by making lots of deposits at several brokers, one of which is FP Markets. The average processing time for depositing funds is around 1 working day. If it takes more than 1 working day, there is a possibility that there will be certain errors. For the length of time the process of funds entering the account is within 1 working day, that is normal for the broker. Deposit fees from FP Markets charge between 1.8% and 3.18% for credit card deposits.

Imel

Dec 29 2022

In my experience in trying to trade in several different brokers. Withdrawals using the international bank transfer method are subject to certain fees. At this FP Markets broker, are there any fees if you want to withdraw funds using the international bank transfer method?

Hugo Samidd

Jan 17 2023

Imel:

Actually, FP Markets does not charge fees for both deposits and withdrawals. But the charge comes from additional fees such as:

It applies anywhere and can't be helped because it's already out of the broker's control. The only thing that we can do is look for the lowest additional fees possible. For references, you can also read this:

Jeremy

Feb 15 2023

Dude, I have to appreciate the withdrawal process which only takes 1 day. With other brokers, the withdrawal process took 3-4 days. So don't expect your money to arrive immediately. However, if FP Markets really claims to offer the fastest withdrawals, then I think it is worth using FP Markets and automatically trust this broker.

Anyway, based on the article, FP Markets seems to offer many options for deposit and withdrawal methods. That means bank transfers, credit/debit cards, Skrill, Neteller, PayPal, Fasapay, Union Pay, and even some local banks. What is the fastest and cheapest of all these options?

Ryu Okada

Feb 15 2023

Jeremy: The best payment option to keep in mind is electronic payment.

Skrill, Neteller, PayPal. Why did we say that electronic payments are the cheapest and fastest payment method? Because electronic payment options guarantee the fastest processing with instant processing. Also, compared to bank transfers, brokers do not charge fees when depositing via e-payments, so fees for e-payment options are low, and withdrawal fees are relatively low compared to bank transfers.

And the last function is safer to use. If you find that the broker is trying to defraud you, the e-wallet company can step in as a third party in the dispute at no additional cost.

There are five e-payment option that most used in Forex Broker. You can read at here :

Sammy

Feb 15 2023

1AUD seems like very little money so I agree that withdrawal funds have to be high, not because you can't withdraw 1AUD, but similar to what the minimum transaction for payment gates is like In some cases, a higher balance may be required to complete the transfer with the payment gate option.

On the other hand, the costs that can be incurred are still very high. In my opinion, it seems very difficult to withdraw with a small amount of money. Therefore, if you want to stop trading, I think you have to do so when you have $10 of equity left. It's hard, but don't go as low as $1 as withdrawals are expensive. But what if you trade and lose and want to stop Forex with $1 left? What should I do to save the $1?

Lionel

Feb 15 2023

Sammy: Dude, don't be offended. I think it's a silly question. If they were going to quit forex, most traders quit forex too late and have already lost money. Traders who want to quit, on the other hand, think for a while before making a decision. Therefore, a planned withdrawal from forex trading can save you money before you lose it all. On the other hand, if you're trying to save AU$1, you'd be better off hitting an inactivity fee as it's impossible to save just AU$1 with FX. After getting inactivity fees, the next month, iif your deposit 0 AUD, it mean the broker will d all your account that inactivity for years

Tetty

Feb 15 2023

dude this is stupid question. But what about if my withdrawl getting rejected because of the bank. I mean, I have cases like this. So, the broker ask for the bank detail. It is really like the picture and the step also similar to the article. Need to fill the Bank Name, Bank Address, Swift Code, Account number and so on.

And I checked for twice and I think there is no problem in that. SO, I began to withdraw my funds and getting rejected. The reason is because I fill the registration with wrong data. What should I do then?

Boehly

Feb 15 2023

Tetty: In my experience, you should check the deposit option you are using. To receive payments, you must use the same payment option. If you think you are using the same payment option, you should check your SWIFT code.

Here's the problem. Swift code is the most important code when making international money transfers. So if the swift code is wrong, the withdrawal will fail. Also, some banks' Swift codes are the same from one state to another. However, some banks may apply a switf code based on your state of residence. For example, if you lived in California, the Swift code for Chicago would be different, even for the same bank.

If you feel that all of these conditions apply, but still failed to verify your bank account, try to update your passbook. sometimes You may need to update your passbook. If you are still not able to withdraw your funds, please contact customer service.