Familiarize yourself with forex trading in the UK, including basic terminologies, guides to enter the market, and the ideal strategies.

Forex is by far the largest financial market in the world with a daily global turnover of $6 trillion. According to the Bank of International Settlements (BIS), the UK accounts for 43% of the turnover with more than $2 trillion of trading volumes each day. Without further ado, let's dive into the world of forex trading in the UK.

Is forex trading legal in the UK? Yes, forex trading in the UK is legal. It is regulated by the Financial Conduct Authority (FCA) who issues licenses for forex brokers to operate their business in the country. The FCA is one of the most reputable forex regulatory bodies across the world as its rules and laws are very strict. It is no brainer that the FCA license is the first thing you should look up when choosing a broker; this license leaves very little room for scammers as well as protects your funds if your broker goes bust.

Forex trading in the UK can be tax-free, but it depends on what type of trader you are. The HMRC, the tax department of the UK, classifies forex traders into two: Speculators and investors. Speculators are traders whose main source of income comes from non-Forex activities; thus, this type of trader is not liable to pay tax under the UK tax law unless forex profits hit the tax allowance of £12,500 for the 2020-2021 periods. Investors are traders who treat forex trading as a business from which the main source of income derives. Therefore, any forex profit has to be taxed on a capital gains basis.

If you have a hard time figuring out whether your forex income is subject to tax, don't hesitate to contact your tax advisor. A professional will help you set this matter straight. Of course, you can also help yourself by keeping a record of your trading activities in case your forex income is or becomes taxable.

Contents

Forex Trading in the UK: The Basics

- Trading Hours

The forex market is decentralized unlike most other financial markets; therefore, forex trading is active 24 hours a day, 5 days a week (Monday to Friday). Opening and closing hours vary across the world due to the use of local time zones. For forex traders in the UK, the market opens at 08:00 AM and closes at 04:00 PM GMT. - The Brokers

Forex brokers are parties; companies, institutions, agents, or individuals that act as intermediaries between traders and the interbank system for buying and selling foreign currencies. As an individual trader, you will most likely not be able to directly make transactions with the interbank system. You'll need a middleman (a forex broker) to forward your transaction to bigger brokers or banks. As mentioned earlier, the most reliable forex brokers in the UK are those who obtained licenses from the FCA. - Trading Platform

A trading platform is a software where you conduct your trading activities. There are various useful indicators, tools, market analysis, and educational content available on a platform, which is free to use when you register an account. For forex brokers in the UK, it is a standard practice to create their own proprietary platforms to appeal to potential clients, but if you are new to the game, you might want to start with MetaTrader 4 (MT4) platform. The MT4 is a robust platform known for its simplicity as well as an abundance of indicators and features, making it very popular among beginners and seasoned traders alike. Besides the MT4, other platforms widely regarded as the best are MetaTrader 5 (MT5), Trading Station, xStation, and cTrader. - Mobile Apps

With mobile apps, you can easily execute trades anywhere you go. More and more traders these days choose mobile apps thanks to the rapid development of mobile devices technology. The top forex brokers in the UK provide mobile apps that can compete with desktop versions in terms of functionality, such as market analysis, technical indicators, trading community, educational content, and many more. - Spread

Forex brokers receive their income through spread which is the difference between the buy price (ask) and the selling price (bid). This is how traders pay their broker in forex trading. For instance, if the GBP/USD pair has an ask price of 1.0902 and a bid price of 1.09000, the spread is 0.0002 (1.0902 - 1.0900). - Leverage

Leverage is the ratio of capital borrowed from a broker to the traders' deposit (also called the margin). Most forex brokers in the UK offer leverage to traders as a means to trade with the bigger sizes. You can utilize leverage to magnify profits, but at the same time, it also amplifies potential losses. - Pip

Pip, an abbreviation of "percentage in point" or "price interest point", is a standard unit of measurement in forex trading, which pertains to the smallest change in the value of a currency pair. Most currency pairs are quoted to 4 decimal places, meaning a price movement of 0.0001 represents 1 pip. - Lot

Lot, also a standard unit of measurement, pertains to the size of currency units required to open a trade. The standard lot size is 100,000, representing 100,000 base currency units ($100,000 if you trade on USD). There are also mini lot (10,000), micro-lot (1,000), and nano lot (100). - Order

An order, in its simplest definition, is an instruction sent out to the broker to enter or exit a trade. Nowadays, automated and algorithmic trading systems are increasingly utilized by traders to execute orders, though you can still do it manually through the trading platform.

Start Forex Trading in the UK

If you are new to forex trading, these simple steps will help you to enter the market.

1. Choose a Forex Broker

Multiple forex brokers in the UK are available for your choosing, but first, make sure that the brokers are licensed by the FCA. You can shortlist the brokers based on your needs and experts' reviews, but your choice should be made only after you test all the shortlisted brokers by opening demo accounts.

See Also:

2. Open an Account

Follow the instruction of your forex broker to set up your account. In this step, your broker will verify your identity and give you options for money transfer. Although minimum deposits differ between forex brokers in the UK, the majority offer a minimum deposit as low as £100. Again, it is highly recommended that you open a forex demo account before investing your hard-earned money.

3. Fund the Account

If you have prepared yourself for the risk, it's time to deposit real money into your account. Funding an account is made easier these days with various methods provided by most brokers, either from credit cards, debit cards, or bank accounts. Brokers have different offers (such as leverage or margin)for different types of accounts, depending on the amount of your deposit.

4. Download a Platform

Your broker offers either their own proprietary platform or a third-party platform such as MetaTrader. Sometimes, your option also depends on the type of your account. Your platform should be able to run smoothly, so you can minimize technical errors.

5. Choose a Currency Pair

The number of currency pairs to trade varies among brokers. However, most brokers offer major currency pairs (pairs that include USD such as EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD) as these pairs are the most popular among traders; thus, this guarantees enough liquidity for trading almost all the time. Major currency pairs are offered by most brokers at the lowest spreads.

Minor currency pairs, on the other hand, do not include USD. Pairs that include GBP, EUR, and JPY are among the most-traded. The last are exotic currency pairs which include a major currency and a currency from a developing country, such as USD/BRL (Brazilian Real) or USD/THY (Turkish Lira). These pairs are traded at low volumes, resulting in higher spreads than those of the aforementioned two.

6. Buy or Sell

This step is the very essence of Forex trading. You buy a currency when you are confident that the price will rise, and on the opposite, you sell if you think the price will drop. Use technical indicators on your platform and pay attention to market analysis before you make your choice. You can also focus on economic events that usually triggers price movements in the market.

7. Set Stop Loss and Take Profit

Stop and Limit Orders are tools offered by your broker to help minimize trading risks. To limit your losses, a stop-loss order is designed to automatically exit a trade when losses reach a price that you've set beforehand. Likewise, a take profit order exits a trade when your profits reach a predetermined price.

8. Monitor and Exit Trades

Monitor your opened position on the platform or get notifications when your trade hits a certain target. Exit the trade by simply "close" and the platform will show you profits or losses generated from the trade.

Forex Trading Example in the UK

Suppose you are trading EUR/GBP and you want to buy €10,000 with a current price of 0.89030. The broker offers a leverage of 1:50, or in other words the margin percentage is 2%. Your margin requirement will be £178.06 (10,000 x 0.89030 x 2%).

After a while, the price moves up to 0.89350 or a change of 32 pips. Your profit then will be £32, calculated by subtracting the buying price from the selling price and multiplying the difference by the lot size ((0.89350 - 0.89020) x €10,000).

Trading Strategies for Forex Traders in the UK

The forex trading volumes in the UK might be gigantic, but that doesn't guarantee instant success for any newcomers who want to try their luck. The following strategies can help you approach forex trading the right way.

Trading with Momentum

A momentum indicator shows the strength of price movement in a particular direction. It is a type of lagging indicator which signals a market trend when it is already in progress. Traders usually pair momentum indicator (blue line on the chart below) with moving average indicator (cyan line) to smooth out the chart. When the blue line crosses the cyan line from below, it is a signal to buy. When the crossing happens from above, it is a signal to sell.

Breakout Trading

A breakout takes place when the price moves far and beyond previous price ranges (support or resistance level). The idea of a breakout strategy is to enter the market shortly after the price makes a breakout in the hope that the movement gains traction.

Mean Reversion

Mean reversion is the theory that the price of a currency pair will eventually return to its average levels despite the price fluctuation. The average price is calculated by using either the simple moving average (SMA) or the exponential moving average (EMA), preferably the EMA which puts more weight on the latest closing price. You can implement this strategy if you observe the price moves in a certain range. Enter a trade when the price is moving away from the mean.

Retracement and Reversal

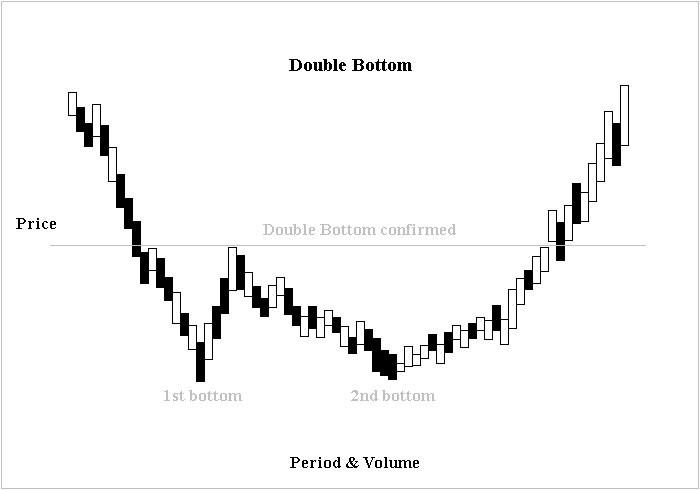

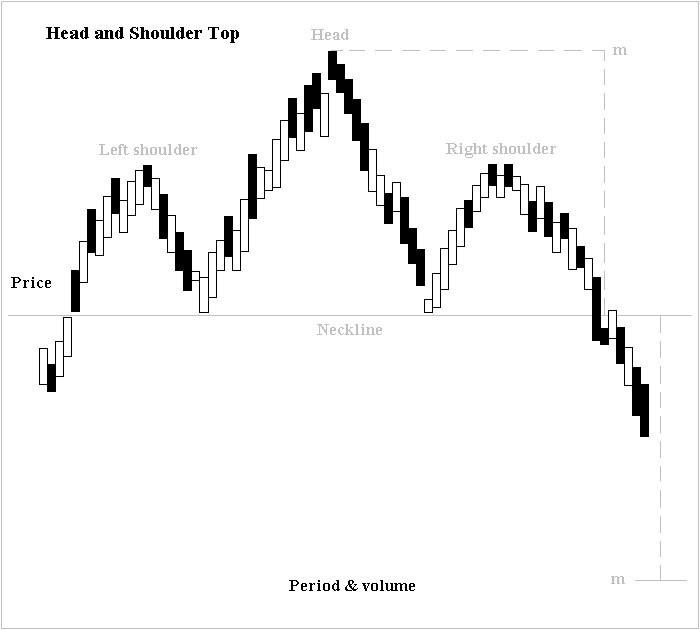

Oftentimes, the price moves against the trend (pullback). If the movement is temporary, it is called a retracement. For example, a temporary drop can be followed by uptrend continuation where the price rides on the overall uptrend. Take advantage of this situation by opening a trade when the price action is falling. You should, however, be careful because if the pullback continues, then it is a signal of reversal where there is a change of direction in the market trend. Confirm reversal with momentum indicators and charting patterns such as double bottom or head and shoulders pattern as exemplified below.

Carry Trade

This is an alternative strategy that you might want to try. A carry trade involves buying a low-interest-rate currency and converting it to a high-interest rate one. The profit is generated from the difference in the interest rates between the currency pair. The Japanese Yen is the most popular currency in carry trades due to its low-interest rate.

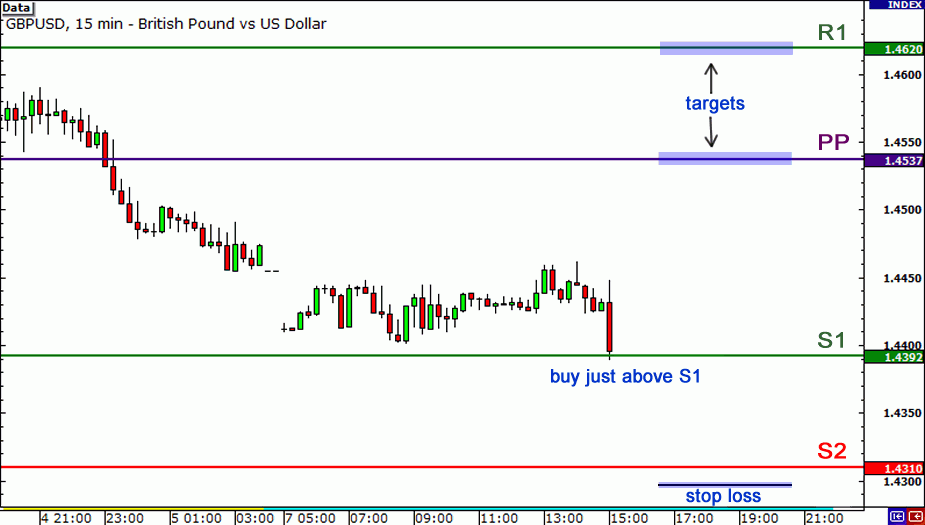

Pivot Point

The pivot point is the average of the high, low, and closing prices from the previous day. This strategy is utilized alongside support and resistance levels which are calculated by using the pivot point itself. Since many traders use pivot points to determine the area where prices are expected to change direction, they often become self-fulfilling. Typically, the technical indicators will include two support and two resistance levels. Buy a currency pair if the price is nearing the support level and sell if it is nearing the resistance level.

Ways to Trade Forex in the UK

The forex market in the UK is extremely attractive and filled with a lot of opportunities. Various kinds of profiting from the UK's forex market are as follows:

- Short Selling Currency: You sell a currency pair at a low price and buy it back at a higher price, as opposed to the popular method of buying a current at a low price.

- Contract for Differences: With CFDs, you don't actually own currencies. The advantage of CFD is the availability of various tradable instruments, not just forex. You trade with leverage and gain profit from the difference between the entry and exit price.

- Currency Option: The basis of this method is to speculate on the price movement. It is a contract that gives the buyer the right (but not the obligation) to buy (call option) or sell (put option) a currency pair at a pre-agreed price on or before the expiration date.

- Binary Option: Brokers allow you to buy a contract at a fixed price within a defined period of time for a fixed return; thus it is called a fixed-return option. Keep in mind that if the speculated price is not reached, you will lose 100% of your investment. On a positive note, however, your loss is limited.

Implementing techniques aside, every now and then you need to expand your trading knowledge through education. A vast ion of resources is within your reach, such as YouTube videos, books, webinars, online forums, articles, and even experts' social media accounts. For more advanced learning experiences, you can learn from the Trading Basics section where you can equip yourself with some knowledge about building a career as a trader.

Forex Brokers for UK Traders

The forex market is getting increasingly competitive among brokers. To help you pick your choice, here is a ion of forex brokers for UK traders. Click on the available buttons for in-depth reviews and when you want to start trading.

Conclusion

With a large market and reputable regulation, forex trading in the UK is an attractive place for traders to invest their money in. What's more, it is easily accessible as registering for an account can be done with a few simple steps. After you started, it is important to keep learning and honing your trading skills. The very last thing you want is to lose money in the world's largest market.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance