Higher interest rates from The Fed are coming to combat the ongoing inflation. What impact could this have on the crypto market?

It's not surprising to find the crypto market going slow in one minute, then turning completely wild in the next. The volatility can indeed be extremely high at times, especially after the release of important news or big events. There are many reasons why the market can be as volatile as it is, but it's mainly because cryptocurrency is still a young, emerging market that's trying to create space for itself in the world.

Back then, people were so skeptical about cryptocurrency, but now, digital assets have proven their worth and become a global sensation. Authorities are starting to take this matter seriously and companies are incorporating blockchain technology into their business.

Apart from that, cryptocurrency is a speculative asset. It is very sensitive to news and events. When the news is good, the price will go up, and when the news is bad, the price will fall. Government regulation, geopolitical news, and illicit activities are some of the matters that might cause the price to shift.

Another important event that could heavily affect the global economy is the interest rate decisions, monetary policy statements, and press conferences held by the Federal Open Market Committee (FOMC). These events typically have a high impact on various assets, like the USD currency pairs, gold, and oil. Apparently, it also has a trickling effect on other markets, including cryptocurrency. Let's see the full recap of how Fed meetings affected the crypto market and Bitcoin.

Contents

Understanding Fed and FOMC Meetings

Fed stands for Federal Reserve System. It is the central bank of the United States created by the Congress back in 1913 to promote monetary policy that could maintain the country's healthy economy. The main goal is to maintain a safe, stable, and flexible financial system. Furthermore, the Fed is responsible for several financial matters, including regulating banks, conducting monetary policy, maintaining financial stability, and providing bank services to the government, bank holding companies, as well as international organizations.

At least eight times a year, the Fed holds the Fed Meeting, which is also called the Federal Open Market Committee (FOMC). The meeting is held to review economic and financial conditions of the country as well as to assess price stability and the country's employment rate. Every three weeks before a meeting starts, the agenda of the meeting should be announced.

How Does the Fed Meeting Affect the Economy?

The Fed is able to affect financial markets by setting and adjusting the federal funds rate, which refers to the overnight rate that banks use to lend to each other for a short amount of time. The rate is mainly used to reach the Fed's goal of 2% positive inflation per year and maximum employment. Changes in monetary policy could influence the economy through the monetary transmission mechanism.

When interest rates are reduced, the cost of borrowing money also lowers. With cheaper loans and credit cards, consumers would spend more and causing the demand to rise. Increasing demand will then cause business owners to recruit more employees to increase production capacity, resulting in the decrease of the unemployment rate. In contrast, increased interest rates will result in less spending and lower demand for goods. As a result, the economy will grow slower and even stagnant.

That being said, the Fed would increase interest rates to prevent the economy from growing too fast or to cure hyperinflation. Conversely, the Fed would lower interest rates when inflation is falling in order to encourage economic growth.

How Does the Fed Meeting Affect the Crypto Market?

Apparently, Fed meetings are also very important for crypto investors because the federal funds rate does not only affect interest rates but also exchange rates and prices of goods and services in general. When the interest is low, consumers are more likely to spend their money on alternative investments like stocks and cryptocurrency. However, a rise in interest rates could mean a lower appetite for high-risk, high-return investments like cryptocurrency. Instead, investors would prefer to invest their money on interest-related products.

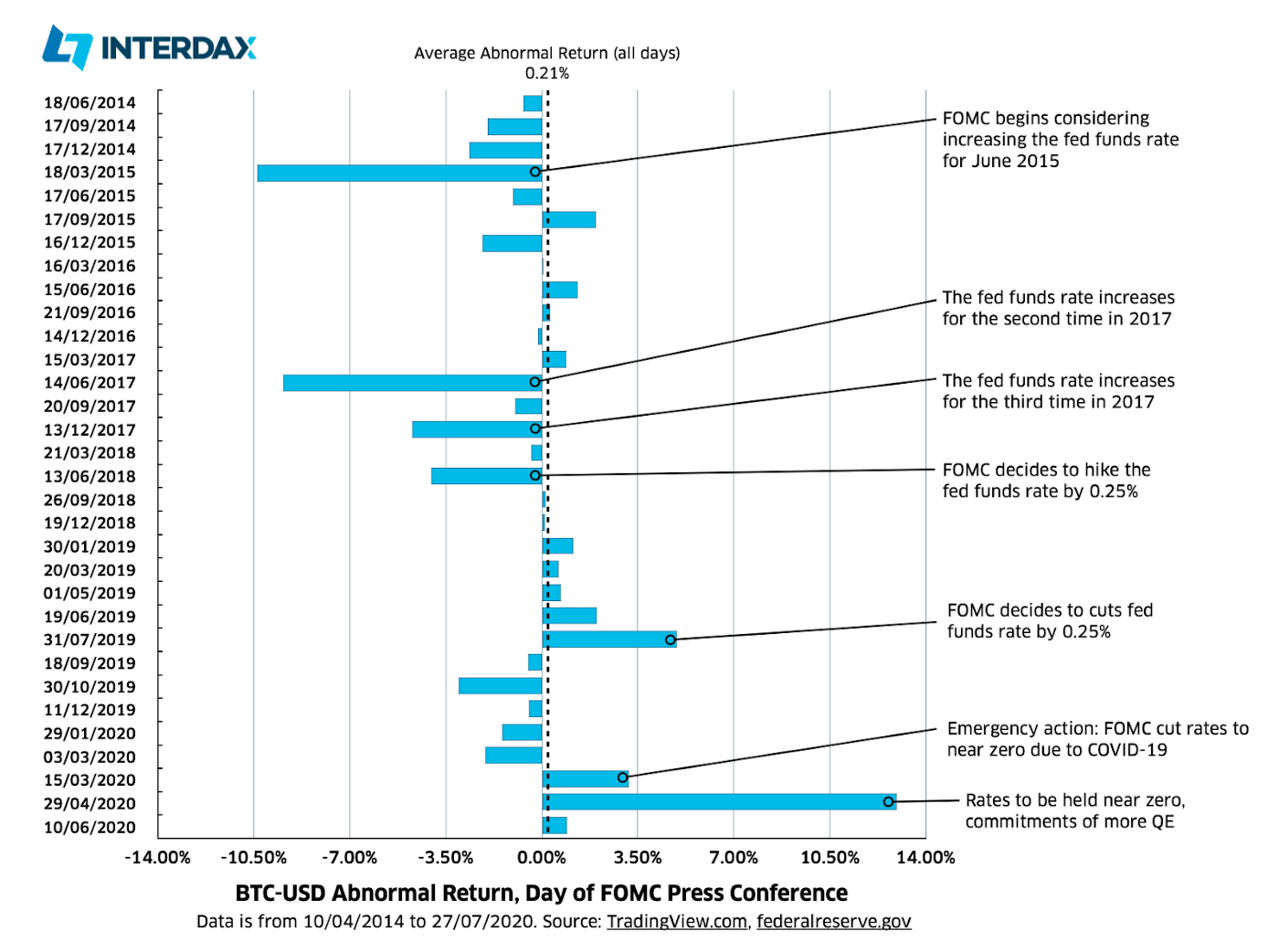

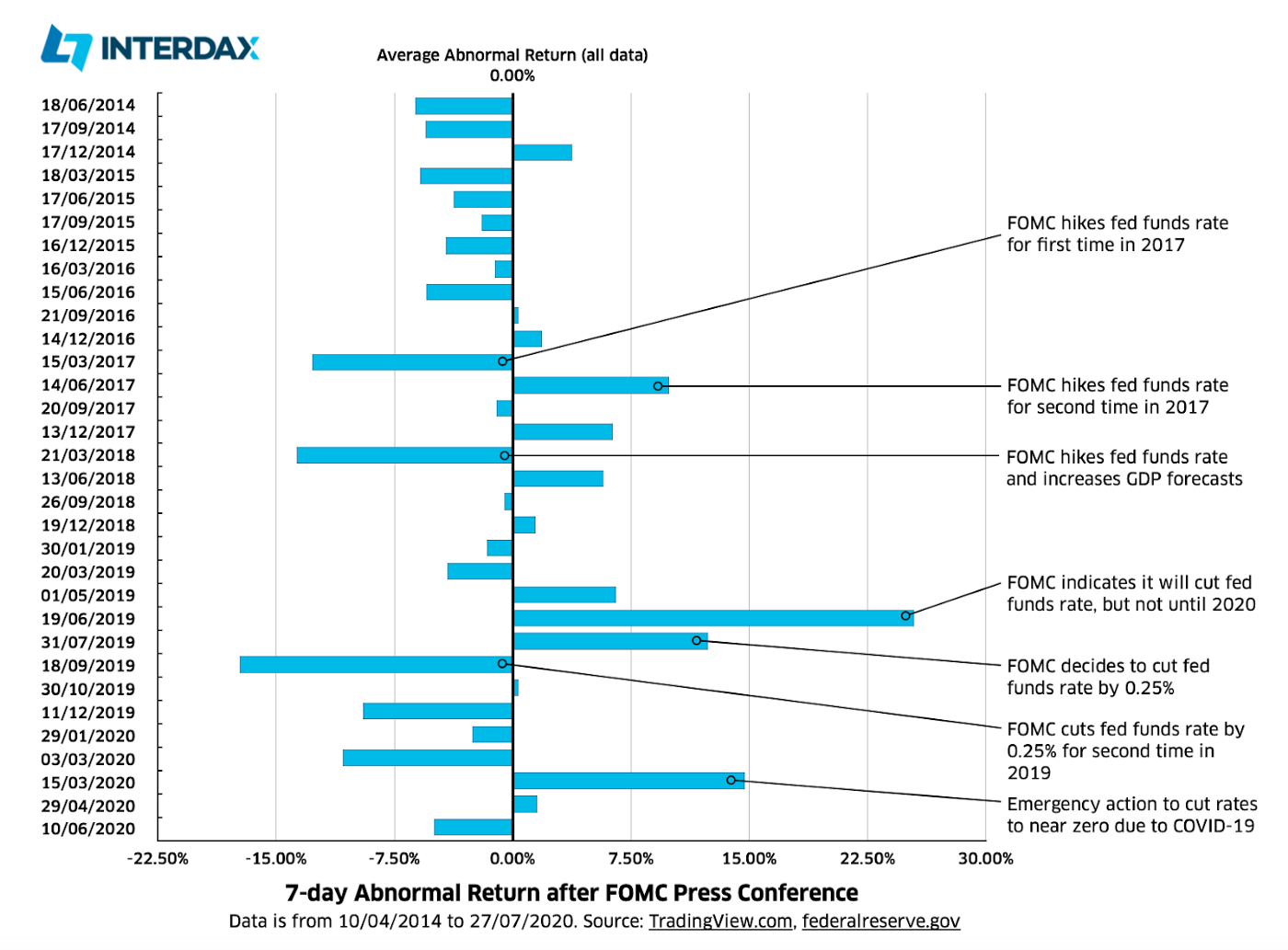

If we take a look at the price history of Bitcoin in the past few years, we can see that the prices have often shown reactions to Fed statements and press conferences, especially regarding major changes in interest rates and monetary policy.

As shown above, when the Fed cuts the interest rates, the daily abnormal return of BTC is mainly positive. On the contrary, the daily abnormal return is usually negative when the Fed increases the interest rates. Although not all cuts or hikes directly cause an immediate effect on BTC's daily return, this indicates that there is a correlation between the two variables. There is some evidence for longer-term effects as well, as shown in the weekly chart, but the result is not always favorable for investors.

See also: Bitcoin Price Today

The Prospects of Cryptocurrency and Its Relations to Fed Rates

In December 2021, Federal Reserve Chairman Jerome Powell has confirmed that the Central Bank would increase interest rates in March 2022 in order to combat high inflation in the United States, which happened mainly because of the COVID-19 pandemic. Basically, businesses couldn't meet consumers' orders due to slow recovery and low supplies. With such high demands and low supplies, prices simply went up. Plus, businesses could continue putting such high prices because consumers have enough savings in their accounts during the pandemic. As a result, inflation is inevitable.

According to the United States Department of Labor, the annual inflation rate in the US has accelerated to 8.6% in May of 2022 – the fastest pace since 1982. Thus, it is unsurprising that the Fed has decided to raise interest rates in March and May, and these hikes won't likely be the last increase this year either. The odds are high that the Fed will raise rates several more times in the following months to bring inflation back to their 2% target.

Consequently, higher interest rates have impacted the crypto market quite significantly. For instance, in January, the price of BTC fell from $38,000 to $35,600 less than 24 hours after a Federal Reserve meeting was held. Even before that, BTC already sank from $46,500 to $43,200 following the FOMC publication that indicated rate increases in 2022. Since then, BTC and crypto have been in a longer-term bear market.

What It Means for Your Trading Strategy

High interest rates, rising inflation, and international conflicts can certainly stir up the market and create volatility for crypto investors. The increasing interest rates in particular have a high chance of dragging the price of Bitcoin and crypto in general even further down, somewhat ensuring another crypto bear market for the rest of the year. How far the price will go down is anyone's guess, but considering the previous crypto crash that exceeded 89% in 2017 and 2018, the worst scenario could be very bad.

See Also:

However, it is worth noting that volatility is nothing new in the world of crypto and the market today is different than it was in 2018. Some analysts even argued that macroeconomic issues caused by the pandemic might stabilize in the next few months, followed by slower inflation. When that happens, the Fed might also ease the rate hikes and stop the crypto market from going into a downward spiral.

Besides, interest rates are not the only factor that could influence crypto prices. There are other things to be considered and many ways to generate profit from cryptocurrency. For instance, many crypto experts are re-evaluating the industry as several major companies like Nike are beginning to monetize their products in the digital metaverse. This could attract new investors to participate and thus, increase the popularity of cryptocurrency.

With that being said, it's best for crypto investors to be cautious when investing in cryptocurrency and not let emotions control their decisions. Try to build a well-diversified portfolio and don't invest more than 5% of your total balance in cryptocurrency. For the record, most successful traders have diversified investments with crypto making up a small part. Last but not least, you could also try passive income options like crypto saving, staking, or even lending.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano

16 Comments

Amelia Heart

Jul 14 2022

Can BTC price go up this year?

Divany

Jul 22 2022

Amelia Heart: There is a possibility that BTC will rise again in 2022, but the pace is still debatable. Some experts even argue that BTC will pass $100,000 this year, though the opinions vary on what exactly will happen then. After all, volatility is nothing new in the crypto world, so we should always be ready for the ups and downs.

Miranda Wallace

Jul 15 2022

How long will the inflation continue?

Divany

Jul 22 2022

Miranda Wallace: Inflation will likely to continue as long as businesses still struggle to keep up with consumers' demand of goods and services. Many economists believe that the inflation will stay above the Fed's 2% mark this year, but there's a chance that prices could drop all of a sudden. According to the latest Morningstar research, we can expect to see high inflation in 2022 and an extreme drop in between 2023 and 2025.

Shannon

Aug 3 2022

Should I invest in cryptocurrency this year?

Divany

Aug 25 2022

Shannon : We must admit that the first half of 2022 has been pretty rough for crypto holders. Although the prices have been showing some small surges in the past few weeks, the crypto market is still largely unstable.

It's hard to predict where things are going in the remaining months, so no one really knows for sure. This is why it's recommended to only trade with the money you're prepared to lose and diversify your portfolio for long-term sustainability.

Robert Jill

Aug 15 2022

Can you earn interest on crypto?

Divany

Aug 25 2022

Robert Jill: Yes, there are several ways that you can choose to earn interest on cryptocurrencies. Some of them are crypto staking and crypto lending. Not all exchanges offer such services though, so it's important to check before registering.

Zaccharias Yemar

Aug 22 2022

When is the next Fed meeting?

Divany

Aug 25 2022

Zaccharias Yemar: According to Forbes, the next Fed meeting in 2022 will take place on September 20-21. Then, the Fed is scheduled to meet again in early November and mid-December.

Kain

Jan 5 2023

Phil

Jan 5 2023

Kain: What is the future of cryptocurrencies? It will rise again, believe me. Why is the value of cryptocurrencies so low right now? Because of the global economy, inflation, economic crisis, war and etc. Since the value of cryptocurrencies is determined by supply and demand, many investors are not investing in cryptocurrencies, which caused the price to drop. Instead of crypto, they invest their assets in safe havens like US dollars and gold. Not only those dropping cryptocurrencies, but I believe they are also affected by the bankruptcy of one of the largest crypto exchanges, FTX. Is it time to invest yet? If you feel confident, analyze crypto, and decide it's time to start investing in crypto, you can do it...but it's not the right time for me yet. But once again, the crypto will rise for sure. This is not the first time crypto has crashed, so after the global state becomes more stable, crypto will rise again.

Coutinho

Jan 5 2023

How about trading cryptocurrencies instead of investing? Just like forex trading, you can always make a profit. And crypto market volatility is high these days. So many traders can take advantage of this opportunity to make a lot of profit, but there is also a higher level of risk. You can trade at many forex brokers or crypto exchanges or any broker that has crypto trading. Be sure to get a regulated broker, you can find them on this website too. About crypto will rise or not? for me, I hope Crypto will rise again in 2023

Al Nasser

Jan 5 2023

Katya Hernandova

Jan 6 2023

Muller

Jan 5 2023