Both Exness and IC Markets provide excellent apps for mobile trading. Let's compare the two to find out which suits you better.

Choosing a reliable trading application is a crucial step for traders. With the advancement of technology today, various features and ease of use of trading in apps are now at traders' disposal. Examples of such applications are those provided by Exness and IC Markets. As large brokers with a lot of clients, they are often compared with each other to determine which is better.

Some of the main considerations that will be key points in the evaluation are the features offered, ease of use, speed and stability of the app, accuracy of data and analysis, and client support. However, the best choice may differ for each person and that's quite normal.

Contents

Exness Mobile App, a Useful Platform for Retail Traders

Exness is a reputable and well-established broker that has been in operation since 2008. The company has its headquarters located in various places such as Cyprus, Seychelles, and the United Kingdom, allowing them to provide their services to clients worldwide. Exness is also regulated by several bodies such as the Capital Markets Authority of Kenya, CySEC, FCA, FSA, FSC, FSCA, and The Financial Commission.

As of December 2019, Exness has served more than 232,000 active traders worldwide, with a monthly trading volume surpassing $1 trillion. They are known for their transparency, regularly publishing their financial reports which are reviewed by Deloitte.

The choice of broker is adjusted to the needs of each trader. If you are a trader who only needs a basic platform and trading features with the best attributes, then Exness can be your best choice.

Exness covers its lack of feature variations with other advantages like low spreads starting from only 0.1 pip. This is very suitable for traders who use scalping strategies (Scalper). Spreads on major pairs in certain account types can also be as low as 0.0 pip, depending on market conditions.

Not only that, but traders can also enjoy other advantages such as automatic fund withdrawals. Exness processes the majority of client withdrawals instantly, without manual checks; however, withdrawals may be subject tos depending on the payment provider or method of choice.

The safety of traders' funds is also guaranteed as Exness is one of the European-based STP/ECN brokers. Exness's ability to become an official partner of the Real Madrid soccer team for 3 years, starting July 2017, also provides evidence that the company has high solidity.

Deposits and withdrawals may be made 24 hours a day, 7 days a week. However, it is important to note that the company shall not be liable fors in processing deposits and withdrawals if suchs are caused by the payment system.

Traders do not need to worry about transaction fees when depositing and withdrawing. Exness doesn't charge any transaction fees to traders even though some charges may be incurred depending on the payment provider of choice. A variety of payment methods are provided for traders, including Wire Transfer, Bank Card, Neteller, Skrill, and many others.

The financial reports and metrics on the Exness website are audited quarterly by Deloitte, one of the four largest public accounting firms globally.

Moreover, Exness is one of the mote transparent brokers in the online trading industry. Traders can find out all information about this company on the website, such as trading volume, number of active clients, client deposits, company funds, and many more.

The platforms provided by Exness vary in MetaTrader 4, MetaTrader 5, Web, and Mobile platforms. This makes it easy for traders when trading on Exness, as they can also access Exness platforms anywhere and anytime.

Over the years, Exness has developed into a broker that attracts traders. Trader's trust is further enhanced by its compliance with financial regulations like the FCA and CySEC.

One measure of client confidence can be put on the trading volume. By December 2018, their clients' monthly trading volume reached USD348.4 billion and active traders around the world surpassed 50,342.

Through the program offered by Exness, traders also have the opportunity to earn extra income by becoming their partners. From the Introducing Broker (IB) program, partners can earn up to 33% spread commission from every new client that registers with them.

Additional income can also be obtained from Exness Partners. Traders can get a spread commission of up to 25% per transaction made by traders who register through an affiliate link.

When trading with Exness, clients can also make use of its free VPS hosting services. A VPS (Virtual Private Server) offers increased reliability and stability for traders as they can maintain their trades and expert advisors without interruption in the event of unexpected technical issues, such as internet or electricity downtime.

From the review above, it can be concluded that Exness is a favorite broker for traders because of low spreads and flexible account types. This condition is very suitable for traders with limited funds but is in need of more opportunities to get maximum profit. This broker is also well known for its maximum support on both new and existing partners.

Exness mobile app offers a wide range of features and tools for traders to access their accounts, manage trades, and track their positions on the go. It provides a low minimum deposit of $1, high leverage of 1:2000, and a competitive cost structure. Additionally, they ensure client funds are safe by providing negative balance protection and segregated accounts that are separate from corporate funds.

Another strength of Exness mobile app is its user-friendly interface, which makes it easy for traders to navigate and find the information they need. The app also offers real-time quotes and charts for a variety of currency pairs, as well as the ability to place stop loss and take profit orders. Another strength of the app is that it is equipped with trading tools such as the economic calendar and real-time news, which help traders stay up-to-date on important economic events.

Exness mobile app also provides a high degree of security to protect traders' accounts and data. The app has a built-in login security feature, and data is transmitted over an SSL-encrypted connection to protect traders' personal information.

One drawback of Exness mobile app is the limited number of instruments that are available for trading. From a wide range of 107 currency pairs supported by the broker, not all the instruments are available on the mobile platform.

Overall, Exness mobile app is a good option for traders who are looking for a user-friendly and feature-rich trading platform that can be accessed on the go. While the app has its limitations, it offers a solid trading experience for traders who want to stay connected to the markets while away from their desktops.

IC Markets Mobile App, a Platform to Access a Variety of Markets

IC Markets, located in Sydney, Australia, is considered a leading provider of forex CFD globally due to its large daily foreign exchange turnover of over $15 billion through more than 500,000 orders executed daily. The company was founded in 2007 and offers trading in a wide range of financial instruments, including currency pairs, commodities, indices, and cryptocurrencies.

They also claim to be an ECN (Electronic Communications Network) broker, which is one of the most popular and transparent trading methods available in today's marketplace.

The broker is regulated by three different governing bodies, such as the Cyprus Securities and Exchange Commission, the Australian Securities and Investments Commission, and the Financial Services Authority (St Vincent & the Grenadines) and it accepts clients from over 140 countries with over 100,000 active clients.

IC Markets is an online forex broker operating under the company of International Capital Markets Pty Ltd. Traders under the Australian jurisdiction are provided with the trading service of IC Markets AU that is headquartered in Australia and licensed by the Australian Securities and Investments Commission (ASIC).

On the other hand, non-Australian traders who open an account in this broker are registered under IC Markets SEY that is based in Seychelles, and regulated under the Seychelles Financial Services Authority (SFSA). The dual operation is a result of the relatively new rules from ASIC that prohibit their regulated broker to offer trading services outside Australia.

Classified as an ECN broker, IC Markets provide clients with MetaTrader 4, MetaTrader 5, cTrader as platform trading options. This broker also follows market trends to include Cryptocurrencies as one of its products, enriching its already wide selection of trading assets that include Currencies, Indices, Metals, Energies, Softs, Stocks, as well as Bonds.

The minimum deposit in IC Markets is in the middle range compared to other ASIC-regulated brokers, as it reaches $200 for every client. Market analysis materials are also prepared regularly for trading insights on IC Markets's official website, proving their competence to serve their traders with important contents created by market experts that work specifically for them.

For payment methods, IC Markets allows funding and withdrawal via wire transfer, credit card, PayPal, Skrill, Neteller, FasaPay, UnionPay, as well as Bitcoin via BitPay. The more interesting aspect from this broker is its multi-base currencies that include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

As the trading technology in IC Markets is highly equipped with co-located servers and extremely low latency (especially on cTrader), the broker is widely known for its capability in hosting traders with the special needs for high-frequency trading as well as scalping.

To sum up, IC Markets is a fitting destination for active traders looking for a well-regulated broker. IC Markets is also flexible in terms of base currency and payment methods, signaling their commitment to welcome traders beyond their home country. As of late 2019, IC Markets provided their website in 18 international languages including English, Korean, Indonesian, French, Spanish, Italian, Malay, German, and Chinese.

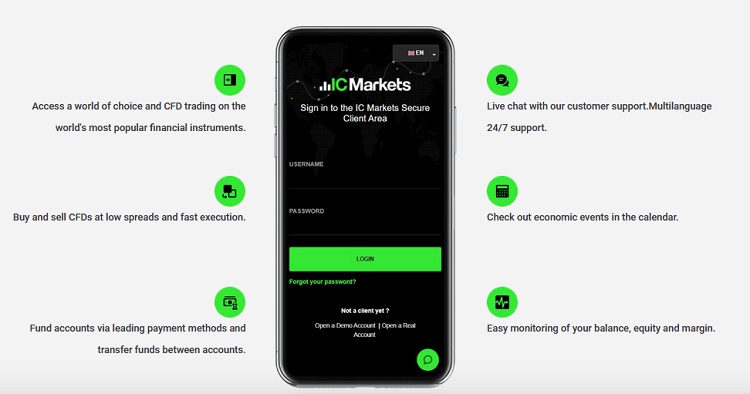

IC Markets mobile app provides traders with access to a variety of markets, including forex, commodities, indices, and cryptocurrencies. The platform offers narrow variable spreads starting from 0.0 pips on main FX pairs and is renowned for its ultra-fast order execution that usually takes under 40 milliseconds, making it a suitable environment for high-frequency trading, algorithmic strategies, and institutional investors. Even though the minimum deposit of $200 may be higher than other retail FX brokers, it is still an affordable amount that welcomes both beginners and professionals.

One of the strengths of IC Markets mobile app is its user-friendly interface, which makes it easy for traders to navigate and find the information they need. The app also offers real-time quotes and charts for a variety of markets and instruments, as well as the ability to place stop loss and take profit orders. The app includes several trading tools such as an economic calendar and live news feeds.

Another strength of the app is that it is fully customized so traders can create and save their watchlists, set alerts and price notifications, and switch between different chart types and indicators.

In addition, IC Markets mobile app supports a high degree of security to protect traders' accounts and data. The app is equipped with two-factor authentication and an SSL-encrypted connection to protect traders' personal information.

One limitation of IC Markets mobile app is that it may lack some of the advanced order types, like OCO orders, which some professional traders might require. Additionally, some traders have reported that the app could have some lags in order executions during high-volatility market hours.

Overall, IC Markets mobile app is a good option for traders who are looking for a well-designed and functional trading platform that can be accessed anytime and anywhere easily. It provides fast and reliable access to the markets and a variety of trading tools that can be helpful for traders to make informed decisions.

Which One Is Better?

Exness and IC Markets are both popular forex and CFD brokers that offer mobile trading apps for their clients. Both apps offer similar features such as real-time quotes, charts, and the ability to place stop loss and take profit orders, along with some trading tools. However, there are some key differences between the two apps that may make one a better option for certain traders.

Exness app has a user-friendly interface and it offers real-time data for a variety of currency pairs. It has also an economic calendar that helps traders to stay up-to-date on important economic events. However, Exness mobile app has a limitation which is the few instruments that are available for trading.

See Also:

Meanwhile, IC Markets app has a customizable interface and offers a wide range of markets and instruments, including forex, commodities, indices, and cryptocurrencies. It also provides traders with fast execution speed and tight spreads which enable them to trade efficiently and effectively.

Additionally, it's equipped with several trading tools such as an economic calendar and live news feeds. However, some traders have reported that the app could have some lags and it may lack in some of the advanced order types.

Conclusion

In conclusion, both Exness and IC Markets apps have their advantages and disadvantages. The choice between the two will depend on your specific trading needs and preferences.

Some traders may prefer the user-friendly interface of the Exness app, while others may prefer the wide range of markets and fast execution of IC Markets app. What's clear is that you may need to lean on Exness' side if your strategy highly depends on fast executions during high volatility. It's important to evaluate the features and functionality of each app and try them out for yourself before deciding which one to use.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

24 Comments

Henderson

Jan 28 2023

What is a negative balance account and what the separate accounts on this article have to say when explaining Exness. Do we really need this account? Sorry if I'm asking about a term and not a broker, as I really don't know a lot of terms involved when trading.

and in terms of execution speed, between Exness and IC Market, which is the fastest? Thanks!

David

Jan 28 2023

A negative balance account means that the broker will prevent your account from going negative. Since the Forex market is very volatile, sometimes the floating loss reaches negative levels and for traders, when they see their balance turn negative, it is obvious that they will close the position to prevent the negative term from continuing. customary. And remember, a negative account means you have a debt with the broker. So to prevent that, a negative balance account will be applied as a margin call and cut.

Whereas a segregated/separated account is for separation of your funds in another bank account that the broker regulator has chosen. Therefore, your funds and the broker's operating funds will not be mixed.

Of course, in terms of fast execution, IC Market because they claim to be an ECN account that I know of, ECN accounts offer very fast execution because they offer more direct trading in the market than other accounts.

Galtier Philips

Jan 28 2023

I am confused about these two brokers. As far as I know, both brokers have very fast execution markets and their mobile apps look very advanced and make it easier for traders to trade and manage their accounts. But on the other hand, Exness provides a simpler and more user-friendly interface on its app as the article wrote, and IC Market offers a wide variety of markets and fast execution. But in my opinion, these two features can be different if the trader wants to trade other than Forex, while for the forex trader those features does not differ at all between these apps.

For these reasons, I decided to look at the broker's regulation. Exness has multiple regulators and only IC Market 3. I mean I really don't care about IC Market because it offers ECN accounts. But is it safe to trade as it has only 3 bodies regulator.

Robert

Jan 28 2023

Galtier Philips: If you're confused, why not try using both apps. The author of the article also says that he plans to try them out to see if they work for you. And as you said about regulations, more or less regulations don't affect their legislation. With many regulations, this means they may be available to some countries, and with less regulation, their activity in some region is limited. So it's not a matter of many regulatory bodies but rather about the area in which they can operate. So try these two apps if you are still confused. If you don't try, you'll never know.

Galtier Philips

Jan 28 2023

Robert:

I am also thinking of using both Exness and IC Market. But I canceled it because I thought it was a waste of time and trying to find the difference. As I said before, I ended up having to compare Exness and IC Market regulations. So first of all I think with more regulations, it's more legal than others.

But after looking at your recommendations and trying to re-read the above article, I can assure you that the only way to find out which trading app is right for me; Exnesss or IC market, I have to try them one by one, and as you said, if I try Exness trading app and IC market, I will know which one works best for me. It all depends on trading experience. Thank you for your comment earlier, it was very helpful.

Sonya

Mar 8 2023

The article mentioned that the IC Markets app offers a customizable interface and a broad ion of markets and instruments, including forex, commodities, indices, and cryptocurrencies. Although the article talks about the customizable interface, I still don't fully understand its capabilities. I noticed that Exness also offers forex, commodities, indices, and cryptocurrencies, but the article did not provide information about the range of markets and instruments available on Exness.

so, i want to ask somebody at here. Can anyone explain to me how the customizable IC Market app Interface is it?? Can it really as main factor of IC Market more advance than Exness??

Russell

Mar 8 2023

Sonya: As a trader with IC Markets, I can share my experience with the customizable interface of their app. It allows us to personalize the platform to our liking, including the layout, color scheme, and other elements that make trading more convenient and easier for us. On the other hand, I can't speak for Exness' app as I haven't used it, but from what I know, IC Markets' customizable interface gives a fresh vibe to my trading experience. For me, it's one of the main factors that make IC Markets more advanced than other brokers. Since I never met brokers have these such stuff.

Thomas

Mar 8 2023

Regarding the segregated accounts in both Exness and IC Markets, I understand that a segregated account separates a trader's funds from the broker's operational fees to prevent brokers from using our money. However, I'm confused about where the funds in the segregated account are kept. Are they kept in a separate bank account created by the broker, or is there another place where a trader's funds can be kept? Additionally, can we guarantee that brokers are unable to steal our funds for their operational fees? Thank you!

Thoriq

Mar 8 2023

Thomas: Segregated accounts are accounts used by brokers to separate their clients' funds from their own operating funds. This helps to ensure that clients' funds are kept safe and are not used for the broker's own expenses. However, it's important to note that segregated accounts are not 100% foolproof and there is still a risk of fraud or misuse of funds although the chance to do that almost impossible.

Regarding where the funds in segregated accounts are kept, they are typically held in separate bank accounts created by the broker. The bank accounts are usually held with reputable banks and are subject to regular audits to ensure that they are being properly managed

Sonya

Mar 8 2023

Thoriq: Wow, I can totally understand why you're excited about IC Markets' customizable trading app! It's always more fun when you can personalize things to your liking, and that's exactly what this app allows you to do. Even if I haven't tried it yet, just the thought of being able to customize your trading experience probably has you itching to give it a shot.

And the best part is that the customization options are not just there for show; they actually make a tangible difference in how enjoyable the app is to use. When you can tailor the app's layout, colors, and functionality to your preferences, it makes everything feel more intuitive and user-friendly. Plus, having a fresh, personalized look to your trading platform can make the experience more enjoyable and less monotonous, which can help keep you engaged and motivated to keep trading. Thank you!!

Sharma Rankten

Apr 12 2023

How does the IC Markets mobile app compare to other mobile trading platforms in terms of user interface, functionality, and overall user experience? Can you provide a detailed review of the app's features, including its charting tools, order management capabilities, and market analysis resources? Additionally, how does the app perform under different market conditions, and what steps has IC Markets taken to optimize the app's performance and reliability?

Jorge

Apr 13 2023

@Sharma Rankten: Hey there! In my opinion, the IC Markets mobile app is really impressive! It's designed with a user-friendly interface that makes trading on the go a breeze. Navigating through the app is intuitive, allowing you to quickly access important features and information. From checking your account details to opening and closing positions, the app provides a seamless experience.

One standout feature of the app is its charting tools. You have access to a wide range of timeframes and can apply multiple indicators and drawing tools to analyze price movements. This allows for comprehensive technical analysis right at your fingertips. The charts are responsive and provide real-time data, giving you the ability to make informed trading decisions on the fly.

Order management capabilities are robust, enabling you to execute various order types such as market orders, limit orders, and stop orders. Setting stop-loss and take-profit levels is easy, allowing for effective risk management.

In terms of market analysis resources, the app offers a variety of features to keep you informed. Real-time news updates, economic calendars, and market analysis articles are available to help you stay on top of the latest market developments.

And also, I think the performance of the IC Markets mobile app is commendable under different market conditions. It is optimized to deliver fast execution and reliable connectivity, ensuring that you can react quickly to market movements. IC Markets prioritizes regular updates and technology enhancements to maintain optimal performance and reliability.

Arshadul Alam

Apr 12 2023

What markets and asset classes can I access through the IC Markets mobile app, and what are the associated fees and trading costs? Can you provide a detailed overview of the different instruments available, including forex, stocks, commodities, and cryptocurrencies? Additionally, how does IC Markets ensure that its pricing and execution are transparent and fair, and what steps has the company taken to prevent issues such as slippage, requotes, and order rejection?

Lidya

Apr 14 2023

@Arshadul Alam: Hey there, let me answer your questions :

It is the best you tried IC Market in demo account to experience the IC Market by yourself!

Larry

May 24 2023

I believe both the Exness App and IC Market App have their own advantages and disadvantages. The article mentions that some traders may prefer the user-friendly interface of the Exness app, while others may lean towards the IC Markets app for its wide range of markets and fast execution. It really depends on your trading needs. In my opinion, if you prefer a simple trading experience without having to learn the app's interface, you can instantly choose the Exness App. However, if you're looking for more diversified assets, the IC Market App would be a better fit. Now, let's put that aside for a moment. I want to ask if there are any potential bugs that could occur in both apps.

Martin

Jun 1 2023

@Larry: Based on my experience, both the Exness App and IC Market App have their own strengths and weaknesses. The article rightly mentions that some traders prefer the user-friendly interface of the Exness app, while others gravitate towards the IC Markets app for its extensive range of markets and fast execution.

In my personal opinion, if you're a beginner or prefer a straightforward trading experience without the need to learn complex app interfaces, the Exness App might be the way to go. It offers a clean and intuitive design that allows you to navigate through the app easily and place trades without any hassle. On the other hand, if you're an experienced trader or interested in trading a diverse range of assets, the IC Market App would be a more suitable choice.

Regarding potential bugs, based on my experience, both apps generally maintain a stable performance. However, as with any technology, occasional bugs or technical issues may arise. In such cases, I recommend reaching out to the customer support of the respective broker. They have dedicated teams to assist users in resolving any technical difficulties they may encounter while using the apps.

Phil Khun

Sep 9 2023

In my experience, the IC Markets mobile app is really a very good trading platform not only for new traders but also for advanced traders. But as you know, the weak point of the mobile trading platform is the chart size. Although you can zoom in and out of the chart, this still has many limitations. If you zoom in, you won't see the time column and if you zoom out the chart will still be small. If you try to rotate the screen and become landscape, the menu will be smaller. I mean for traders with a very relaxed trading style like swing traders, I recommend this mobile app because the design of this IC Market mobile app is very easy to use and user-friendly. In the meantime, if you are a scalper, reconsider using it because, as I said, you will have difficulty determining the chart.

In my opinion, If you compare MT mobile and IC Mobile, yes for me IC Mobile is a bit more similar but if you trade with PC, if there is a broker trading platform, it always loses face to the MetaTrader.

George

Sep 10 2023

The IC Markets mobile app is handy for traders who like to keep tabs on their trades while on the move. It's available for iOS and Android, letting you check real-time quotes, make trades, and manage your account from anywhere. While it might not have all the bells and whistles of the desktop version, it's easy to use, especially for newbies. Just remember, it's best to use it alongside other platforms like MetaTrader, as it might lack some advanced features.

To sign up with IC Markets, you'll need to share some basic info like your name and address, and verify your identity. This usually means sending over a copy of your passport or driver's license, along with a recent utility bill or bank statement. They offer a few different account types, but if you're just starting out, the Standard Account is a good bet. It's got low minimum deposits and gives you access to forex, commodities, and indices.

Overall, IC Markets is a solid broker with tools for traders of all levels. Just make sure you understand the risks before diving in as a newbie!

JK Damian

Sep 13 2023

Hey man, I stumbled upon this article and gave it a read. But you know, I'm still trying to wrap my head around trading stuff, so some of the terms they're throwing around, like "Stop Loss" and "Take Profit," got me scratching my head. What's the deal with these terms in trading? I'm kinda lost here, to be honest.

I also saw something about it in an article about Admiral Markets broker's app. Are these features in trading apps? And how crucial are they for a trader? Can you break it down for me? Sorry if it's a bit of a weird question, but I really need some clarity to wrap my head around trading better.

Xerx Silva

Sep 14 2023

Hey folks!

In trading, there are loads of strategies to make profits, and stop loss and take profit are big ones. Stop loss, or SL, is all about selling a trading instrument like shares or crypto at a set price to limit losses. It's super important 'cause prices tend to drop faster than they rise.

On the flip side, Take Profit lets you close profitable positions at a set level. For instance, if you've got a EUR/USD buy order at 1.1280, set your take profit at 1.3000. If the price hits that mark, your order closes automatically.

When setting up a trading strategy, it's crucial to calculate your risk and reward ratio. First, figure out your stop loss level, then set your take profit according to your planned ratio. For example, if your stop loss is 50 pips, with a 1:2 ratio, your take profit would be 100 pips.

That's the gist of it! Stop loss and take profit are automatic order options to help prevent losses and secure profits. Learning these features is key to managing trading risks effectively.

Axel Gustav

Sep 21 2023

I got my IC Markets account verified, but I'm keen to know what perks come with it.

How does being verified affect my trading? What extra stuff do I get access to?

Any trading rules I should know about?

And any tips to make the most of it while keeping risks low?

I'm wondering about the deal with verifying corporate accounts. What docs and info do they need? And what's the scoop on the benefits and limits of having one?

Basically, any advice for a newbie like me on trading with a verified account on IC Markets?

Manoban

Sep 23 2023

Getting your account verified on IC Markets has some great perks. It boosts security and trust, meets regulatory requirements, and unlocks higher limits, faster transactions, and premium support. Verified traders also get exclusive bonuses. While verified accounts don't usually have trading limits, managing risks is still key. Set realistic targets, use stop-loss orders, and stay updated on market news.

If you're new to trading with a verified account on IC Markets, you can start read this article to gain more knowledge about the trading world! (read: Currency Trading Guide for Complete Beginners)

Victoria

Mar 30 2024

I'm quite intrigued by IC Markets and find it particularly fitting for my needs, especially with its platform offering access to various markets and spreads that can reach as low as 0.0 pips. However, according to the article, a drawback of the IC Markets mobile app is its potential lack of certain advanced order types, such as OCO orders, which could be necessary for some experienced traders.

Could you explain what exactly an OCO order is? I'm still new to all of this, but I understand the importance of learning about the tools and features that professional traders rely on.

Chen

Apr 3 2024

Hey There!

An OCO order, short for "One Cancels the Other," is a type of advanced order used in trading. It allows traders to place two separate orders simultaneously: a buy order and a sell order. The idea behind an OCO order is that if one of the orders gets executed, the other one is automatically canceled.

Let's break it down with an example:

Imagine you're trading the EUR/USD currency pair, which is currently priced at 1.2000. With an OCO order, you could set up two orders:

Now, if the exchange rate moves:

In both scenarios, only one of the orders will be executed, and the other will be canceled. This helps traders manage their risk and potential losses more effectively, especially when they're uncertain about the direction of the market. (for more insight, you can read OCO here : OCO Order Strategy, How Does It Work?)