Gaining profit is one thing that every traders dreamed of. But as you know that forex is a high-risk trading instrument, you should keep the realistic expectation

Let's face it, how many of us jump headfirst into the Forex market, because of some advertisements saying you can make 100% Forex trading profit only by trading online for several minutes each day? Let me ask again, how many of those people lured by such advertisements got what they expected? According to Bloomberg's insightful article, people were lured by high-leverage (as many as 50:1) Forex trades as it promised a fantastic rate of return.

However, less than a quarter of them got the chance of turning in profits. Most of them quit Forex trading 4 months later. Those high-leveraged trades offer investors with limited capital to multiply their wager. So, if you initially deposited about the US $100, you can open a position that is worth 50 times more (in case of 50:1 leverage). With the above fact said, theoretically, lucky investors may net 100% return, in a relatively short amount of time. If (notice the bold) the exchange rate is moving about 2% in favor of his/her position. But here's the catch...

Forex Market Volatility Can Be Either Your Best Friend Or Worst Nightmare

Are you familiar with fancy price movements on penny stocks? You think you're ready for the worst the market can throw at you. Well, the Forex market eclipses it. The forex market is a pure OTC (over-the-counter) model. What that entails is the fact that most Forex traders are done through decentralized networks. So, there's no single body that strictly regulates and takes responsibility for every single Forex trade.

Simply put, you, as a retail trader will have no idea who is taking the other end of your trading positions. But that's not all. Compared to centralized stock exchanges, the Forex market is better described as an "open shooting gallery with all the security measures mostly stripped off". Essentially, just about anyone, from retail-class to institutional traders may put market orders anonymously, anytime they want. Subsequently, no one can't quite tell who drops the bomb.

a. Here's just how volatile forex market can be

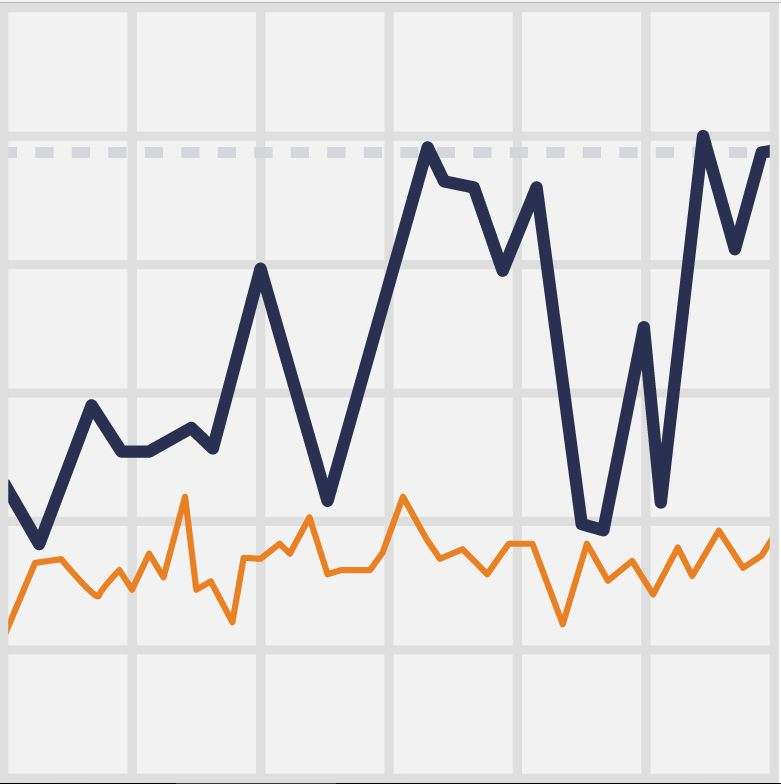

The orange chart represents stock market volatility over time while blue one represents Forex market volatility. If you still can't believe what I said, here's an actual case:

British Pounds fell about 6% against Greenback (USD) on 7th October 2016 during early Asian trading hours. The price snapped back up again in less than an hour. Imagine if you were at that particular moment. A short position could net you about a 300% return in less than an hour. Conversely, you would suffer margin call just as fast if you were on the other end of it (entering long position).

So, what matters the most isn't about how much Forex trading profit you can make over a short period. Because, believe me, you'll suffer some unexpected losing position, and when you lose, that's inevitable. The best thing you can do about it is to make sure your winning positions cover all the losses.

b. How much of forex trading profit should you be aiming for?

Let's check again how 50:1 leveraged position can "potentially" net you 100% Forex trading profit. First, you'll need about a 2% exchange rate movement in favor of your positions. Technically speaking, that's about 200 pips away. Now the proper question is; how hard it is to achieve 200 pips Forex trading profit, you ask? Depending on which Forex pairs you are currently trading, hundreds of pips rate/price movements may range from less than a day to a month.

Get to know Forex market volatility!

According to Forex market volatility, some major pairs takes about a week to accrue 200 pips movement. That list is updated on daily routine, so check it up every time you need to. Secondly, you can only hope that the price movement reaches your 200 pips goal before the price reverse in the opposite direction.

Believe me, it's easier said than done. You can test it yourself on a demo account, risk-free. See it for yourself, just how stupidly hard it is to consistently profit from huge pips movements.

Why You Shouldn't Expect Overly Done Forex Trading Profit

First, you need to know how sensible your Forex trading profit expectancy is. Let me ask this; if institutional traders or hedge fund managers are expected to make way more profits than most retail traders, how much rate of return do they make in each year?

a. Does your forex trading profit expectations make sense?

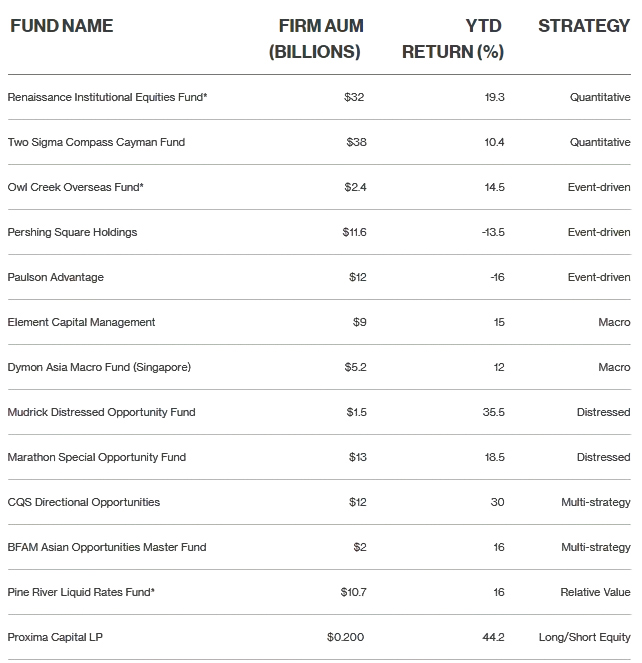

Hedge fund rate of return in 2016.

In 2016, Bloomberg reviewed hedge funds performances by their annual return percentage. As you can see on the list above, the top two hedge funds with the most AUM (asset under management) can only manage a yearly return rate below 20%. Both of those investing giants utilizes a quantitative approach, one of the most advanced methods where pure computerized models judge whether an asset is interesting or not to invest.

Just let that sink in. Even highly advanced hedge funds can only top about double digits rates of return. In a year!

Compare that to some advertisements saying you can make more than 100% return each week as Forex trading profit! Do you think it made sense? Some bloke might argue with it; saying that a 100% return in Forex is possible. Yes, it's possible but at a cost of huge risk. Occasionally, you may gain a 100% return (or even more) if you wager most of your capital to a single position or multiple pyramiding positions.

Next, you'd wait for a certain trade signal to confirm a strong trend formation. When you're convinced that the price is going into a direction you'll bet all the positions into it. But for God's sake, don't rely too much on it. It's a very, very risky proposition to try.

b. Why shouldn't you rely too much on a strong trend hitchhiking?

First; it rarely occurs. Second; you can also end up on the opposite end of it, resulting in massive loss. Especially if you forgot to set Stop Loss. Third; no one can exactly tell how long it will last before it consolidates. Worse yet, it may also reverse sharply in the opposite direction.

This was what a strong trend looked like.

Take a look at some illustration below:

British Pound lost about 9% against US Dollar over 3 months (from early January to early March 2013). Ideally, as a seller, you could take short positions while the downtrend lasted. But here's where Forex reality sets in. Within the next three months, the price swung sharply in unclear directions. It grew harder to tell where the trend was going to head next. Surprisingly enough, GBP/USD made a strong gain that eclipsed the previous decline within the same year.

New trends form and change directions now and then. It may be less stronger than the last or doesn't last as long. In short, if you couldn't adapt to these fluctuations, your initial gains will eventually be chipped out by losses. So, if the probability of making huge Forex trading profit is only a few and far between, and some losses are unavoidable.

Then, How Much Profit An Average Retail Trader Can Achieve?

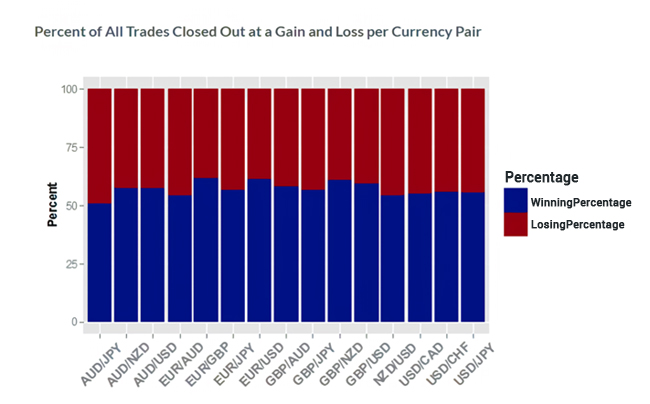

Realistically, a retail trader should learn how to make sure that their gross profit comes up on top against gross loss. In fact, most traders somehow still lost their accounts even though they were right half of the time.

Data source: Derived from data from a major FX broker across 15 most traded currency pairs from 3/1/2014 to 3/31/2015.

That's because human psychology interferes with the ideal trading condition. Naturally, when a beginner sees a profiting position, anxiety sets in, resulting in premature position closing. Conversely, when a position obviously accrues red flashing pips, many neophyte traders hesitated to close it early. They simply hope and wait that the price will bounce into their favor again. In the end, they suffered an even deeper loss.

a. Let the profit run and cut the loss early

If you want to get about just as much return as those top-performing hedge funds you need to revise your trading strategy. Secure your Forex trading profit by learning how to use Take Profit professionally. Also, stop your account from bleeding by learning how to use Stop Loss as well.

b. Discover the power of compound equity growth

Did you know, consistent Forex profit trading can amass to a huge fortune over time! Even though you can only make a 20% rate of return annually, if you can sustain it, it will grow exponentially to many folds of its original base value. Let's say you initially invest about $ 20,000. In five years, if you can manage to make a consistent 20% Forex trading profit, it will tally up to U$ 49,766.

Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it. ~Albert Einstein

Compound annual equity growth = P (1+R) t Where: P = Initial amount of deposit (capital) R = annual Forex trading profit in decimal.

If you got 20% modifier, it should be 20/100 = 0.2 t = number of years

Here's the actual operations:

20,000 (1 + 0.20) powered by 5 = US $ 49,766

How about if you keep it up for another 5 years? 20,000 (1 + 0.20) powered by 10= whooping US $ 123,834 !

The longer you keep it up the more you will accumulate, that's the true power of compound equity growth! The moral of the story is; consistent and sustainable Forex profit trading is the ultimate key to success. Even though it's small at first glance, but it's much, much better than risky one-way-gamble. Now, you get the message. You don't need to rush for a risky 100% return per position. Instead, you should play it calm, controlled, and remember this keyword; gain small but consistent Forex trading profit!

How To Achieve Forex Trading Profit Consistently

Follow these guidelines below to earn Forex trading optimally:

a. Approach the Forex market with correct frameworks

Before setting up any proper trading plan, you should check all the basics: Why do you pick this or that pair? You need to know the reason behind that particular pair you're going to trade. To do so, you need to understand the fundamental and technical reasons why this or that pair is more interesting than others.

At which timeframe do you trade? Lower timeframes (below H4) suit intraday-trading better than higher ones. That's because you can easily spot a temporal trend that is currently forming. Conversely, if you are a swing trader, you can switch to high timeframes to judge and weigh long-term trading strategy. What's your methodology? Each trader may vouch if their trading strategy is true-and-tried.

Don't bother copying other traders' methods if you still can't find consistent ones. Instead, train yourself using the most basic market utility like Moving Average crossovers and Fibonacci retracements until you get the hang of it. This is how Fibonacci retracement works. See how the price bounced from 0.7 Fibonacci points.

b. Develop a proper trading attitude

When you are about to open any position you should check your mental condition: Always be patient, don't rush the market You can't control the market, that's why you shouldn't force your assumption toward Forex market. Instead, work your way around it, only react to the best possible trade signal, and be modest about your capital exposure. Don't let emotion sway your consistent trading method The most important thing is to stay objective.

Don't let fear or over-excitement interferes with your preset entry and exit level. That means, do not change or shift Stop Loss or Take Profit once you set them. Be Realistic with your trading goals If you don't see any reason to set your Take Profit a hundred pips away, then don't... If you don't see the slightest appeal to trade, then don't enter the market altogether. Sometimes, risk aversion is the better option.

c. Pick specific instruments and specialize

The basic premise that one will always be better than others if they specialize only in specific skills or niches also applies to Forex trading. If you don't like specific pairs due to their inherent volatility, then avoid it. On the other hand, if you fancy volatile pairs you may stick your feet to those high-risk, high reward pairs.

d. Manage how much risk you can handle before you even think of potential profits

Forex trading is inherently risky, that's why I'd say this is the most important part. Basically, the rule of thumb is to limit about 2% of capital exposure for each position. However, you can still adjust it to your preset trading setup from a trading journal.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance