According to Warren Buffett, cryptocurrency has no real value and is a bad investment. Should we follow his opinion or is it okay to ignore his remark on this matter?

Cryptocurrency is not a new concept anymore, but still, there are many mixed opinions about it. This year mainly has been an important one for cryptocurrency in general. The price of Bitcoin, the largest crypto at the moment, hit an all-time high of over $63,000 in April and has also made significant steps toward mainstream acceptance like the Paypal adoption and crypto visa transaction. Even though the price has fallen quite significantly in recent months, but it has started to rise again steadily.

See also: Bitcoin Price Today

There are millions of people who are highly interested in cryptocurrency and genuinely believe that it has a bright future in the financial market. Unfortunately, Bitcoin still has some of the biggest high-profile critics, including the famous Warren Buffet.

Warren Buffett is one of the most acclaimed investors and philanthropists of the 20th century. He's often known as the "Oracle of Omaha" and has a personal fortune of $100.4 billion, according to the Bloomberg Billionaire Index. Since his early days, he always has been brilliant at making profitable investments. In 1961, when he was in his early 30s, he was already running seven partnerships. Buffett also manages a company of his own called the Berkshire Hathaway holding company, which has averaged at least a 19% annual growth since 1965.

In recent years, Buffett has been highly vocal about his views on crypto. He consistently maintained his skepticism towards cryptos, even when Bitcoin passed the $1,000 mark in January 2014 and the $50,000 threshold in March 2020. At one point in 2018, he described Bitcoin as "probably rat poison squared", and in 2020, he stated that cryptocurrencies "don't produce anything". Let's take a deeper dive into Buffett's remarks and see if they're true.

From Warren Buffett's Perspective

Over the years, Buffett's skepticism has made people rethink about the idea of investing in cryptocurrency. He has an excellent track record in most of his investments, so obviously, his opinions matter and many people look up to him when making financial decisions. However, when it comes to cryptocurrency, his belief may not be justified. After all, he stated himself in one of the interviews that he doesn't understand cryptos as much as the main portfolio of investments that forms the backbone of Berkshire's entire portfolio.

The portfolio that he uses is relatively conservative and not diversified at all, with over 30% of it being invested in Apple's stock. His strategy is only to invest in a group of giant companies that he understands closely and holds the asset for a long time.

In recent years, Buffett has been criticizing cryptocurrency for not being a durable means of exchange or a store of value. He doesn't support Bitcoin mainly because he considers it an unproductive asset.

Buffett likes companies and assets that generate value in and of themselves. For instance, if you invest in a farm, you will be getting value in what the farm produces every year, even though the stock itself does not gain value. That being said, Buffett is widely known to have a preference for investing in stocks and corporations whose value comes from producing things, such as Coca-Cola and Apple. In fact, most of Berkshire's holdings are productive assets and are the top in their industries, so they can produce monetizable output.

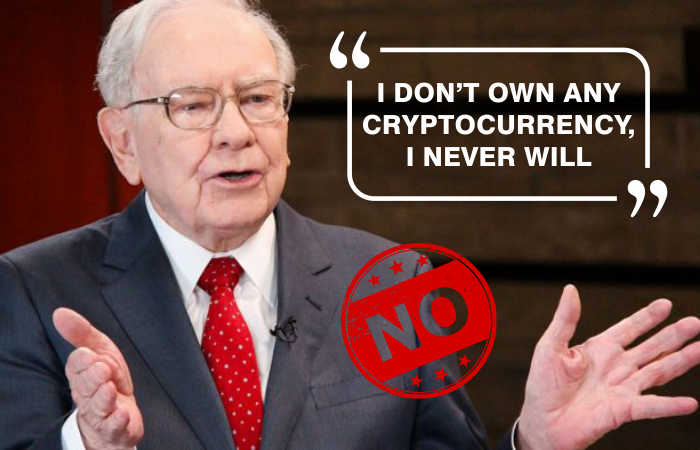

In Berkshire's annual meeting in 2019, Buffett openly compared cryptocurrency tokens to the buttons of his jacket. He stated that he could tear off a button, value it for $1,000 and then attempt to sell it at a higher value, but "the button has one use, and it's a very limited use". He continues to despise Bitcoin and cryptocurrency by saying that, "I don't have any Bitcoin. I don't own any cryptocurrency, I never will," in a CNBC interview in 2020.

See Also:

What Makes His Perception Wrong

If we use Warren Buffett's point of view, then a good and profitable asset must have a production value that can be measured over time. In this case, we won't be able to find such conditions in cryptocurrency, at least at first glance, as it has no client bases to analyze and no cash flows to discount. So it's not surprising that Buffettviews cryptocurrency as unproductive and, thus, has no real value in it.

As Buffett sees it, Bitcoin's value only comes from the hope and optimism that someone else will agree to pay more for it in the future than you're paying today. This is the same reason why he doesn't like gold as well.

Buffett has argued about gold and its lack of output for years, but it's important to note that gold has outperformed Berkshire Hathaway since 2001. For many years, gold has been used to store value and chosen as the safe haven during market turmoils that shocked investors, financial institutions, and even central banks. Despite Buffett's skepticism, the precious metal has more than proved its value as a safe haven asset for many people.

If we relate it to cryptocurrency, many experts believe that Bitcoin can take gold's place as the traditional store of wealth. Both crypto and gold have all the conditions to be a good store of value, which are widely accepted, durable, authentic, portable, fungible, divisible, and rare.

In some ways, Bitcoin is even better than gold. For example, the public ledger where Bitcoin is built upon can offer a strong foundation for authenticity and durability. Other than that, Bitcoin is also easier to divide as it's just purely data in a ledger. It is also much more portable than solid physical gold. In addition, you can hold Bitcoin for as long as you want without fear of debasement or censorship. Many countries, for example, restrict a certain amount of gold that can be carried to and from their area. Bitcoin offers its holders a repository that is free from such government intervention.

Moreover, Bitcoin has been gaining massive acceptance and relevance over time. We can highlight the current event where El Salvador accepted Bitcoin as legal tender. The country's adoption of cryptocurrency led to a 6% jump in its price.

Apart from that, the growth of Decentralized Financing (DeFi) platforms is also proof that cryptocurrency is an effective means of exchange. Defi platforms began on the Ethereum network, which allows users to exchange cryptocurrency for one another and can be used to get traditional banking services such as loans. In practice, they can remove a degree of bias in the financial system, adds global accessibility as well as transparency, and eliminates the need for approval personnel.

As more and more companies continue to accept Bitcoin and make it more mainstream for public use, it has begun gaining usability in our everyday lives. For instance, people can now make purchases in Starbucks or e-commerce stores like Rakuten by using Bitcoin and other cryptocurrencies. This implies that, over time, the problems that Buffett mentions could be reduced or even eliminated.

Conclusion

Apart from Buffett's outstanding track record and experience in financial investments, he might be utterly wrong about cryptocurrency. Perhaps one of the greatest reasons why Buffett has been so skeptical towards cryptocurrency is because he does not fully understand the concept. He likes to stick with his initial investment strategy that he has always used, so he's more likely to refuse the use of crypto.

We can't deny that cryptocurrency and its blockchain technology have brought quite a significant change in the financial industry, so it might not satisfy everyone in the market and be compatible with any strategy. But despite the skepticism from experts like Warren Buffett, the rising value of Bitcoin is proof of people's optimism in cryptocurrency. As more and more businesses start to adopt cryptocurrency, it grows to be more mainstream and accepted in society.

In the end, whether you agree with Buffett's opinions or not comes down to your choice. If you're still unsure, you can do more research to figure out what blockchain can do and how it works. You might be able to get a better insight on how to start or improve your investment.

One thing that we can learn from Buffett is to focus your investment on the long term. That means if you do end up buying Bitcoin, you must do so because you believe that the virtual currency will earn you profit in the long term. Keep in mind that cryptocurrency is just one of the many possible ways to invest your money. Since each asset comes with different degrees of risk, the most important thing to do is to set your own goals and work out what's best for you.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano

1 Comment

Jayden

Nov 1 2022

I think Warren Buffett's point of view is to look for investments that are seen through end products and we can invest in stocks in which companies are included. Cryptocurrencies, on the other hand, do not have a background in which they can produce products and generate profits like companies do and it is just like "exchange" between user and other user that maybe third party doesn't want to accept that exchange.

I support Warren Buffet's view because it is a fact that anyone who owns stock in Coca-Cola or any other company earns a dividend each year, and the value of a good company increases its stock. No problem at all. stock prices go up and some of will sell its to make a profit.

In my view Warren Buffett seems concerned that cryptocurrencies will suddenly run out of users, lost its interest and prices will fall. But for me, maybe 10-, 20-, 30-year crypto will be a good investment in the years to come because large of country began to use as money.