Before you choose an ideal broker, make sure to check these two factors: the spread that the broker offers and the speed and accuracy of execution.

Finding the right broker is never easy, yet it is a critical step that could determine your trading experience as a whole. Traders must realize that success in their trading depends on their skills and the performance and transparency of the broker that they choose to cooperate with. That is why, as a trader, you must ensure that the broker you pick is suitable and could actually help you reach your goals in trading.

But what makes a good broker "good"?

Indeed, many factors need to be considered before you choose to invest your money in a particular broker. Well, of the many offers and features available, there are two essential factors that we must pay attention to before we start trading with a broker, namely the spread as a trading fee and the accuracy and speed of execution when we open or close a position.

Most traders believe that a low spread is always beneficial because the trading fee must be kept at a minimum to obtain as much profit as possible. But did you realize that even brokers with low spreads and quick execution are still getting negative reviews from their clients?

The fact is, not all brokers are entirely honest with their clients about additional fees that might be charged during the trading process.

However, you must not rely on client reviews only and be so quick to judge a broker. Try to analyze it from a bigger picture and think objectively. In this article, we will talk about finding a genuine broker based on the spread and the speed of execution.

Contents

Beware of the Unpredictable Additional Fees

Before choosing a broker, be sure of their official websites to gather information and learn about their services first. Brokers usually mention all of their services and facilities on their page and show information related to the trading fees and expenses every time a client transmits a request (buy or sell order). Ideally, the broker must act according to these offers.

But in practice, many brokers don't warn clients that they could charge additional fees when the market is extremely volatile. For example, additional fees will be charged when the market experiences a sudden price spike after a high-impact news release.

Many market players would take advantage of this situation and trade at the same time and price level, sometimes with the same aim. This phenomenon could affect the dynamics in the market, especially the buyer and seller's positions. Some parties could take advantage of this and some others could experience huge losses.

As we know, the currency market can quickly change direction in a short period, making it hard to predict sometimes. But by not mentioning this condition in their offering, brokers are technically not transparent to their clients. Keep an eye out for the two conditions under which these additional fees may be imposed:

Slippage

Slippage occurs when there is a gap between the expected price of a trade and the price at which the trade is executed. Most slippage happens during high volatility or when the market is illiquid, where a considerable difference between the amount of trading volume and the price asked by the buyers and sellers exists.

High volatility often happens during breaking economic releases, political events such as elections, and other high-impact news. During this time, many traders are entering the market at the same level, making the price move extremely fast. Pending orders can be executed at the next price level, producing the gap that we call slippage.

Slippage can be positive or negative to your trade depending on the circumstances. When an order is executed, the price can be higher or lower than initially intended. This can be favorable (positive slippage) or harmful (negative slippage) for your trade.

Check out the chart below:

Let's say you want to buy the USD/SGD pair, so you open a trade at 1.3872, close to the previous candlestick. But due to the low liquidity, the next candlestick opens at 1.3893.

This gap is considered to be a negative slippage that you need to face because the price is higher than the number you expected. Just imagine, even a low spread of 0.1 pip by the broker can give you a headache if you encounter this kind of scenario.

Floating Spreads

Before the popular use of fixed spread, the concept of floating spread was already known and widely used by forex brokers. This sort of spread basically uses bid and ask prices closer to market prices. Logically, the bigger the gap, the higher the spread.

The main benefit of using this spread is that under normal market conditions, the spread can be lower than the fixed spread. InstaForex and FBS are some brokers that consistently offer this type of spread.

This idea alone has successfully attracted many traders, especially scalpers and intraday traders. With only trading in a span of one day or less, they could choose to trade at certain times when the spread is lowest.

However, many traders don't realize that floating spreads can also be a disaster for their trade. When the market is exceptionally volatile, the price can move and widens the spread due to the lack of liquidity. Under this condition, a trade would be highly unprofitable and could drain a trader's account deposit little by little.

Sometimes, traders are tempted to open a trade when the trend is going well. But, remember that this could also mean a sharp turn that could lead to a wider gap and a bigger spread.

To avoid the risk of floating spreads, traders should be aware that certain times must be avoided if they do not want to get extreme spread widening. If your broker uses a floating spread, it's best not to trade during high-impact news releases when the market volatility is unpredictable. IC Markets and Exness are some well-known brokers that provide their traders with variable spreads.

How Fast and Accurate Is Your Broker?

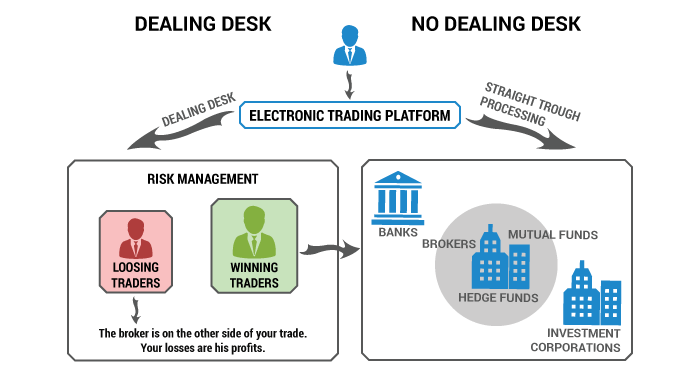

The answer to this question lies in the platform that the broker uses. To pick the right broker, you must figure out if the broker is a dealing desk or a non-dealing desk.

Dealing Desk Brokers

Dealing desk broker or market maker makes money through spreads and providing liquidity to their clients. In other words, this type of broker acts as the principal, so it usually takes the other side of the client's trade by risking its own capital and creating a market for its clients. By creating their own market, these brokers could offer a fast order without a requote.

To put it simply, this sort of broker gets profit by winning the trade over their clients. So if the client makes a profit, the broker will pay from the broker's cash, not purely from the real market. And vice versa, if the client loses, the broker keeps the money.

Let's say you want to place a buy order of EUR/USD for 10,000 units. As the liquidity provider, the broker will search for a matching sell order from other clients in their market.

Usually, dealing desk brokers already have a considerable amount of clients, so the market is quite competitive, and the rates in their market are not far from the interbank rates. If they can't find the matching orders, they will have to take the opposite side of the trade.

It's not exactly misleading to think that using a dealing desk broker might be risky because your loss is basically the broker's advantage, so they might use it against you and make you lose. Sometimes dealing desk brokers would put up many trading terms and conditions as a means to give them an excuse for not fulfilling the obligations promised to the client.

But the fact is, not all dealing desk brokers are problematic. As a trader, before you choose this type of broker, make sure that it is legal and strictly regulated by trusted regulators.

Non-Dealing Desk Brokers

You can tell by the name that non-dealing desk brokers work in contrast to dealing desk brokers. Non-dealing brokers basically act as the liaison that connects the client's requests and the market. It's important to know that the accuracy of non-dealing desk brokers cannot be generalized because each one uses a different set of liquidity providers.

So when you're using this type of broker, you trade straight with the interbank market. In this case, sometimes brokers could ask for some additional charges because they only pass the spread from the market directly to their clients.

Otherwise, they won't make any money at all for their services. This is why in the long run, trading with a non-dealing broker may become more expensive than dealing desk brokers.

To sum up, here is the comparison between dealing desk and no dealing desk brokers:

Conclusion

We can conclude that transparency is one of the most important aspects to consider before choosing a broker, especially when we talk about the possibility of charging an additional fee regarding their spread and execution services.

First, make sure that the spread matches your needs based on your trading goals. Calculate and recalculate the total fee that you must pay to the broker by reading through their facilities and regulations so you can strategically plan your trade better.

Second, check the broker's pricing by comparing the price offered by the broker and the actual price in the market. Every broker has a different risk management strategy, so their approach to market volatility might vary.

Lastly, as a trader, there are many things to think about when choosing a broker. It can be quite an overwhelming task even before you start trading. Nevertheless, keep in mind that trading with zero risks is impossible, but there are ways to avoid the risks, as we already explained in this article.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Larry

Dec 29 2022

Mega

Dec 29 2022

Terry

Dec 29 2022

Penny

Dec 29 2022

Mendy

Dec 29 2022