Candle breakout strategy is often sought after by beginners as it uses the simplest indicators and approaches. Let's learn how to apply it to your trades.

Regarding trading, traders can use many different strategies to help them make informed decisions about buying and selling assets. One such strategy is the Breakout Candle, which is particularly popular among beginners.

The Breakout Candle strategy is a simple and effective trading strategy that involves identifying support and resistance levels on a chart and looking for a candle that breaks through one of these levels. This can signal a shift in the market's direction and provide a potential trading opportunity.

This article will explore the Breakout Candle strategy in detail, including identifying support and resistance levels, looking for a breakout candle, entering a trade, and managing risk.

What is a Breakout Candle?

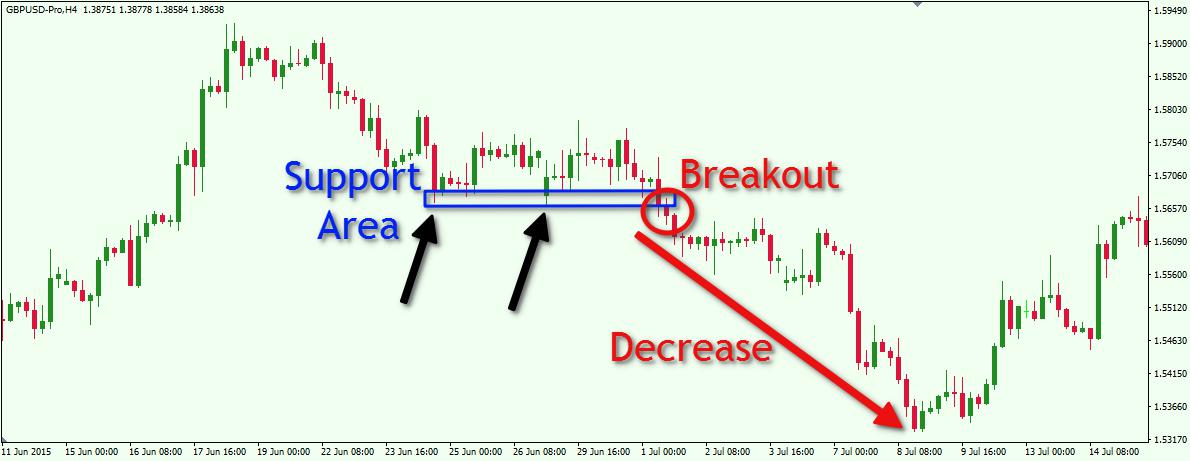

A breakout candle is a candle that breaks through a support or resistance level. It is characterized by a long body and a small or no wick. The longer the body of the candle, the stronger the signal. However, not all breakout candles are genuine signals, and traders should wait for confirmation before entering a trade.

Steps to Trade with Breakout Candle Strategy

The breakout candle strategy is a popular approach traders use to identify potential trend reversals or continuations. The strategy focuses on trading breakouts that occur after consolidation or range-bound trading. Here are the steps to implement the breakout candle strategy:

- Identifying Support and Resistance Levels

The Breakout Candle strategy's first step is identifying the chart's support and resistance levels. Support levels are price levels where buyers are expected to enter the market and prevent prices from falling further. Resistance levels are price levels where sellers are expected to enter the market and prevent prices from rising further. - Looking for a Breakout Candle

Once you have identified the support and resistance levels on the chart, you need to look for a candle that breaks through one of these levels. This can signal a shift in the market's direction and provide a potential trading opportunity. To help confirm the validity of a breakout candle, traders should wait for confirmation. This can come as a candle that closes above or below the support or resistance level. This helps to confirm that the breakout is genuine and not a false signal. - Confirmation

Confirmation can come as a candle that closes above or below the support or resistance level. This helps to confirm that the breakout is genuine and not a false signal. Waiting for confirmation can help to reduce the risk of entering a trade based on a false breakout. - Entering a Trade

Once a trader has identified a genuine breakout signal and received confirmation, they can enter a trade. If the candle breaks through the support level, you can enter a long position; if it breaks through the resistance level, you can enter a short position. - Setting Stop Loss and Take Profit Levels

Setting stop loss and taking profit levels is essential when entering a trade. A stop loss is a predetermined point at which the trader will exit the trade if the price moves against them, while a take profit level is a predetermined point at which the trader will exit the trade if the price moves in their favor. - Risk Management

Managing risk is crucial when using the Breakout Candle strategy. This involves stopping loss and taking profit levels to limit potential losses and protect profits. Traders should also never risk more than they can afford to lose and only trade with money they can afford to lose.

To make it easier to understand the explanation above, please take the following image as an example:

See Also:

Advantages of the Breakout Candle Strategy

The advantages of the Breakout Candle strategy are:

- Easy to Understand

Candlestick charts are easy to read and understand, even for beginners. The breakout strategy based on these charts can be learned quickly and applied easily. - Limited Use of Technical Analysis

Candlestick breakout strategies rely primarily on analyzing patterns, so beginners do not need extensive technical analysis knowledge to use them effectively. - Reduce Risk

By providing straightforward entry and exit signals, a Breakout Candle strategy can help beginners reduce the risk of making trades based on emotions or guesses, which can lead to unnecessary losses. - Develop Discipline

Following a set of rules based on a breakout strategy can help beginners develop discipline and stick to their trading plan, which is essential for long-term success in trading. - Provides a Structured Approach to Trading

Using a Breakout Candle strategy, beginners can develop a structured approach to trading that helps them stay organized, focused, and consistent in their decision-making.

Conclusion

In conclusion, the Breakout Candle strategy is a popular trading strategy among beginners due to its simplicity and effectiveness. It involves identifying support and resistance levels on a chart, looking for a breakout candle that breaks through these levels, and using confirmation to validate the signal.

This strategy can help beginners reduce the risk of making emotional or guess-based trades, develop discipline, and provide a structured approach to trading.

However, it is essential to note that not all breakout candles are genuine signals, and risk management, including stopping loss and taking profit levels, is crucial for long-term success. By understanding candlestick charts, identifying breakout candles, and waiting for confirmation, beginners can use the Breakout Candle strategy as a tool to make informed trading decisions.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance