Binance recently launched Binance Liquid Swap to help traders earn passive income and swap tokens easily. What makes it worth the try?

Over the years, many developers have presented a series of developments that aim to improve user experience and minimize the complexity attributed to emerging sectors. One of the most innovative discoveries came in the form of token swaps, intended to reduce the potential cost and the time needed to trade one crypto to another.

Normally, in order to exchange crypto coins, one would have to convert the crypto asset to fiat and then use the earned fiat to buy another crypto. This process can be cost-inefficient and time-consuming at times, considering that the process takes some rather complex steps to complete, not to mention the high probability of not getting the desired price due to volatility.

To resolve such issues, token swap services offer a solution to exchange a crypto asset for another directly. Simply enter the desired trading pair and the amount that you wish to exchange and the token swap service would immediately convert the coins for you. By using this method, you only need to pay transaction fees once.

Contents

Binance Liquid Swap

Recently, the widely known crypto exchange Binance released a DeFi-like product called Binance Liquid Swap feature for its users. Binance claimed that the service has gained massive support lately and even reached the highest number of active users among DeFi (decentralized finance) platforms for the first time ever.

Binance Liquid Swap was released with the aim of providing a token-swap service that allows users to trade tokens directly from pools and earn rewards. While it is supposed to be a DeFi product, the service actually runs on top of the Binance infrastructure. Therefore, Binance Liquid Swap gives users access to the DeFi sector, while simultaneously providing the convenience, reliability, and high security of a top centralized exchange.

So far, Binance is able to offer 97 liquidity pools where users could trade their cryptos. The exchange also promises that there are many more projects and pools coming in the future.

The wide option of liquidity pools is a part of the reason why the service easily became so popular among many crypto traders in the world. According to debank.com, Binance Liquid Swap is recognized as the leading liquidity pool platform in terms of 24-hour active users with over 171,000 active users as of July 2021.

How Does Binance Liquid Swap Work?

First of all, Binance Liquid Swap is a DEX (Decentralized Exchange) and yield farming application built on the Binance CEX (Centralized Exchange). The platform uses an AMM (Automatic Market Maker) model to facilitate token swapping.

It essentially hosts a number of liquidity pools where traders can swap one crypto for another with a much smaller fee than what they would have if they use a regular centralized exchange. Each liquidity pool is funded by Binance users who have agreed to stake their tokens in return for crypto rewards.

Binance users could participate in Binance Liquid Swap as a liquidity provider. To become a liquidity provider, one must simply stake some crypto in a staking pool. Liquidity providers will earn crypto rewards depending on which tokens they choose to stake and the current market situation.

The Benefits You Can Get

On its official website, Binance pointed out that they mainly focus on four things when building their services: convenience, variety, unique features, and earnings. By combining those key values together, they are able to create a world-leading exchange that is reliable and supported by many people worldwide. The following are some of the advantages you can get from Binance Liquid Swap:

1. User-friendly Interface

The main benefit of using Binance Liquid Swap is the easy-to-use interface. From the Binance homepage, you can easily navigate the service and view all of the available options that you can choose. All actions, including the process of transferring funds to your account, managing your earnings, and withdrawing your funds can be done with a few simple clicks. There is no complicated procedure or requirements that you need to fulfill to participate in the service.

From the user's perspective, this is incredibly helpful because it saves time and makes the whole process more convenient. Many other platforms require switching between several sites and wallets to access their services, which certainly makes users easily confused and anxious about their safety. Luckily, this won't be an issue for Binance users.

2. Wide Choices of Liquidity Pools

We've mentioned before that Binance currently offers 97 liquidity pools to choose from. Apart from the quantity, Binance also offers a wide diversity of choices, including big crypto pools like BTC and BNB, as well as pools for stablecoins and altcoins. Each pool has at least $1 million liquidity and the largest one contains more than $300 million assets. On top of that, Binance constantly adds more options to the list to satisfy users' demands.

3. A Chance to Generate Money

Another advantage is that you could earn income simply by participating in Binance Liquid Swap. As a liquidity provider, you could get a high APY (Annual Percentage Yields) from the tokens you choose to stake. Certain tokens can even give you the potential of double-digit APYs. However, note that the number of yields is subject to everyday market movements, so the number might change from time to time.

If you want a less-risky investment, you could stake in stablecoins. Stable pools offer a fixed value of an investment with added APYs of as much as 4.88% (as of August 2021) from the fees you earned as a liquidity provider.

4. BNB Farming Opportunity

Still related to the previous benefit, you could get rewards and bonuses by being a liquidity provider, but more specifically, you could get rewards in the form of BNB tokens. Since BNB is Binance's native token, Binance is the only exchange that offers BNB rewards.

To put into perspective, BNB is now one of the most popular cryptocurrencies in the world and at the time of writing, each BNB is equal to $373.15. Aside from that, the token has various functionalities that can be used in many Binance services, such as Binance Chain, Binance Smart Chain, and Binance Academy.

How to Claim Rewards in Liquid Swap

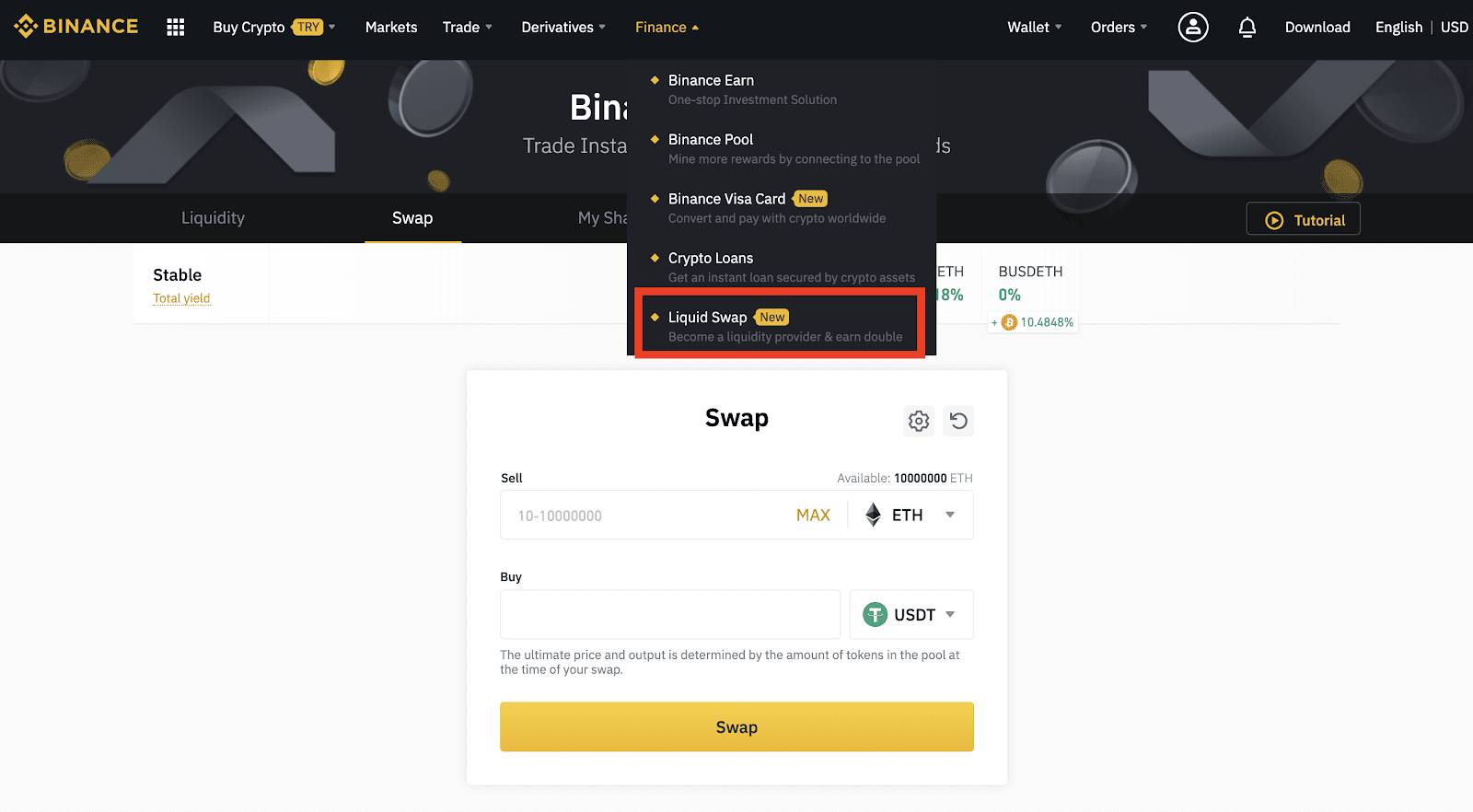

1. Head over to Binance.com, click "Finance" and "Liquid Swap"

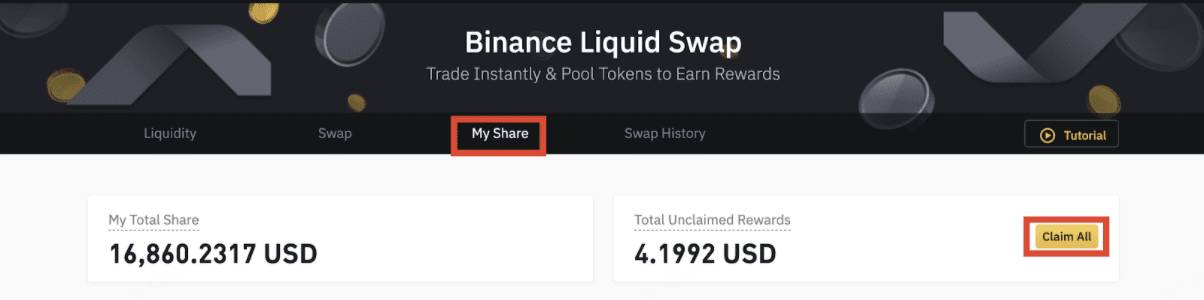

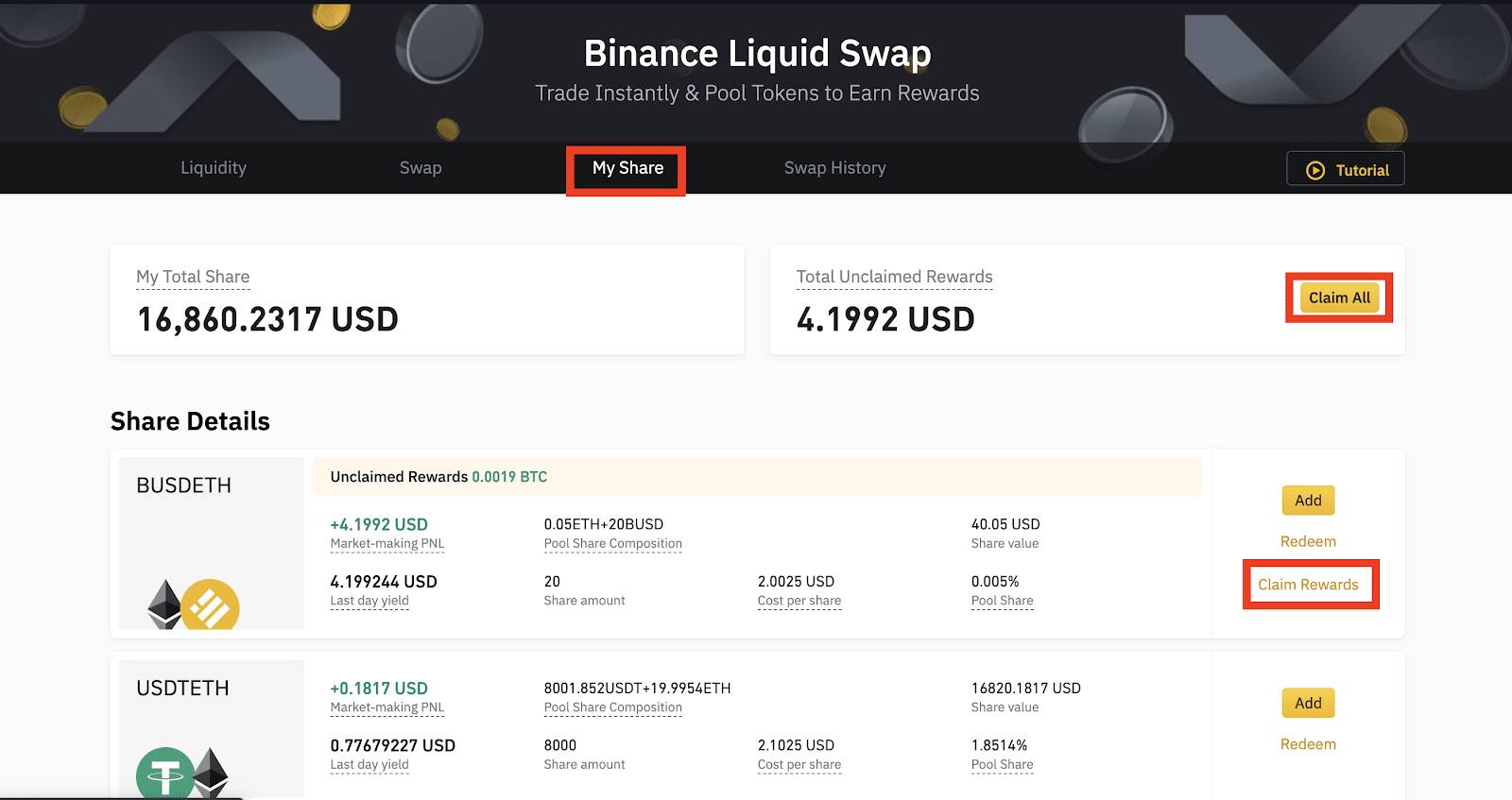

2. Click "My Share" to see your progress or ongoing projects.

3. Click "Claim" to claim your rewards.

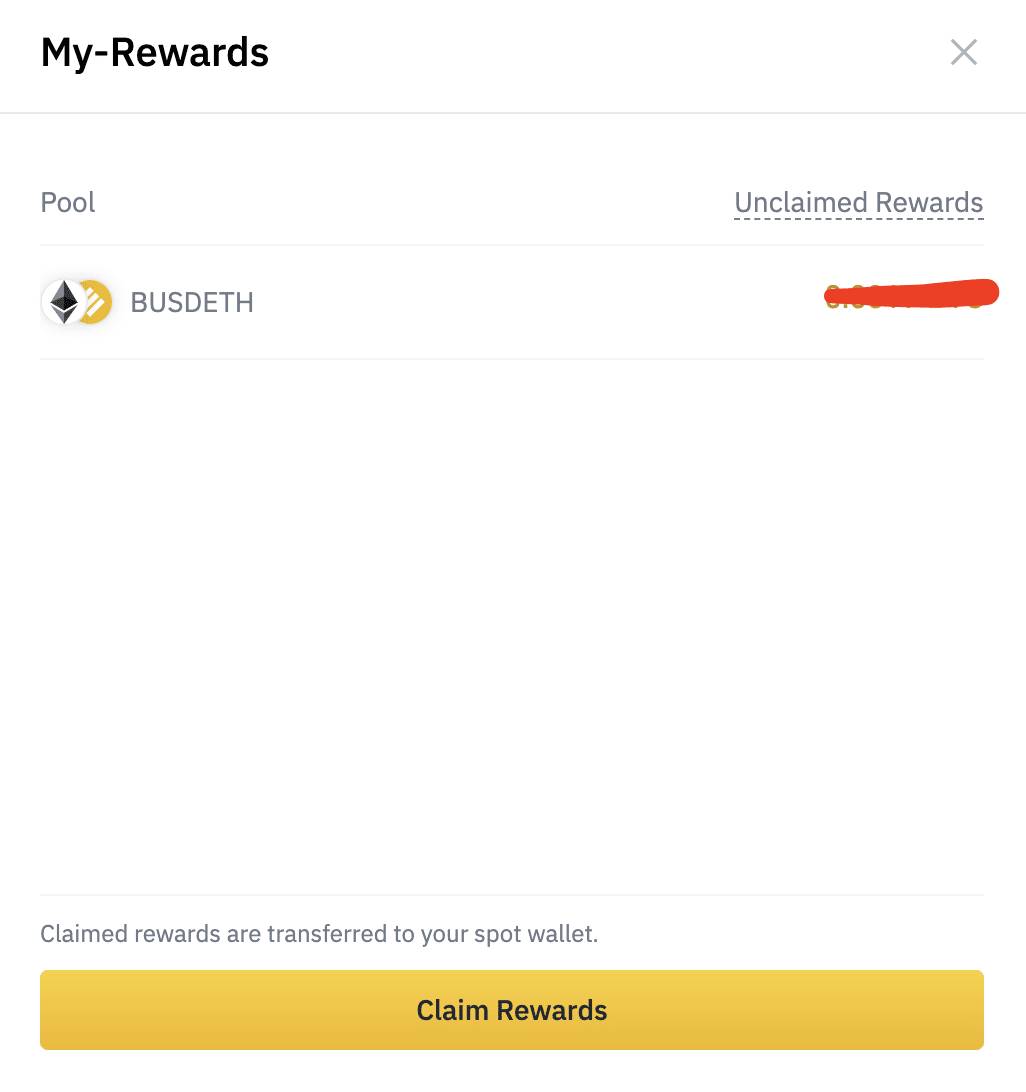

4. Confirm your request by clicking the "Claim Reward" button.

Binance Swap Farming

Apart from being a liquidity provider, you could also use the liquidity pools provided by the exchange to swap tokens. Binance offers a way for users to swap and trade their coins while enjoying the best rates on the market. Binance Swap Farming uses an AMM (Automated Market Maker) to help traders easily and securely swap their crypto coins within a liquidity pool.

How Does Binance Swap Farming Work?

Binance Swap Farming allows traders to swap their coins directly from a liquidity pool without having to deal with another party. Basically, how it works is that the liquidity pools collect a bunch of tokens from liquidity providers and traders can then use these tokens to swap for a fee. For instance, in a BNB-BUSD pool, a user would provide an equal amount of BNB and BUSD. These tokens can then be used by other traders who wish to swap BNB to BUSD or BUSD to BNB.

Is There Any Risk?

Binance claims that there is no risk of loss involved when using Binance Swap Farming. There's also no need to access external decentralized applications to swap your tokens.

However, it is worth noting that there is a risk of getting slippage. Slippage happens when you get a different execution price or exchange rate than the price that you initially expected, so you might not always get the price that you wanted. But even so, slippage can happen practically anywhere in almost all liquidity pools. Thus, the issue is not peculiar to Binance.

How to Swap Tokens in Binance

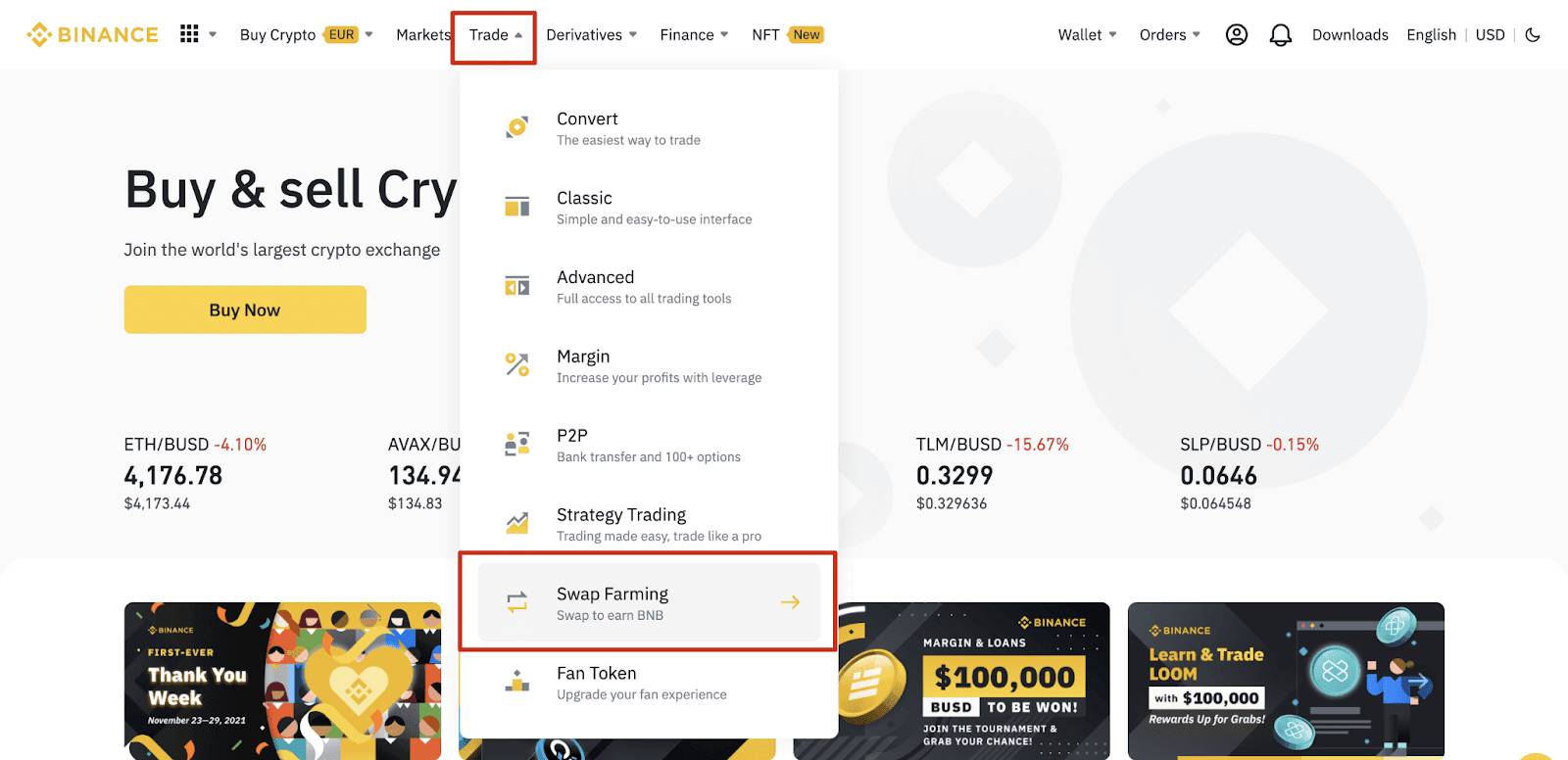

1. Head over to Binance.com and hover to "Trade" at the top part of the navigation bar. Click "Swap Farming" to enter the Swap Farming service menu.

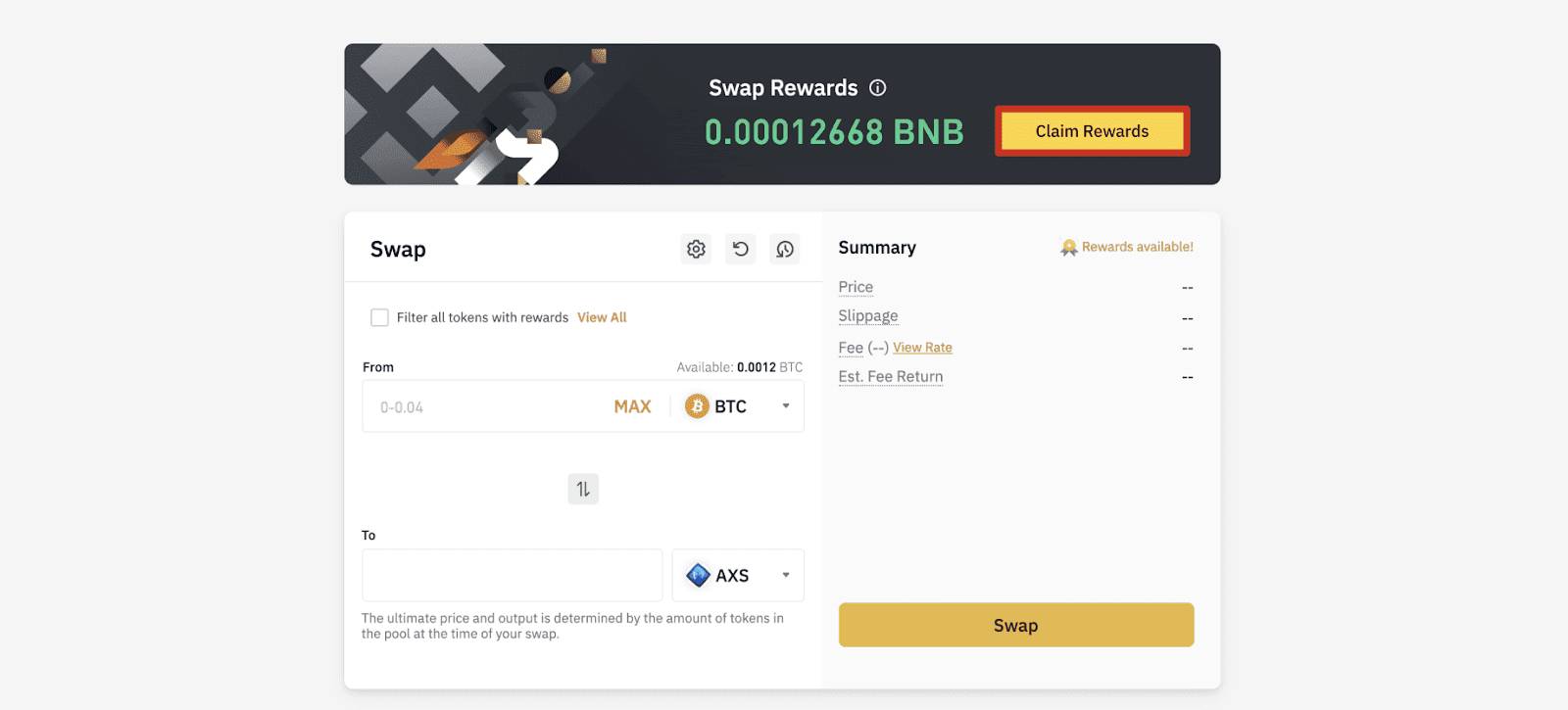

2. Select the token pair that you wish to swap. You can choose from multiple crypto assets by filling the "From" and "To" fields. Enter the amount that you'd like to swap and confirm the details. Slippage and the fees will be calculated automatically.

3. Confirm your request by clicking the "Swap" button.

Conclusion

Token-swapping is a brilliant innovation for many crypto traders as it offers a solution to swap one asset to another in a very cost and time-effective way.

In Binance, you can participate in the token-swapping process either by being a liquidity provider or a token-swapper. As a liquidity provider, you simply need to stake some coins into the liquidity pools and earn passive income from the transaction fees. Binance offers pretty high APYs compared to other exchanges, so it's certainly profitable and worth trying if you have some spare coins in your balance.

On the other hand, you could also use the Binance Swap Farming service and easily swap your tokens to another one directly from a liquidity pool. There's no need to worry about complex procedures and paying several different fees. All in all, Binance offers a rather convenient, yet secure way to access the DeFi sector without the hassles of DeFi itself.

If you are interested in more fun reward-based tokens, Binance also offers a Fan Tokens feature.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano