Trading journal software is an easier method to organize your trading plan and evaluate yourself. Which software has the best features?

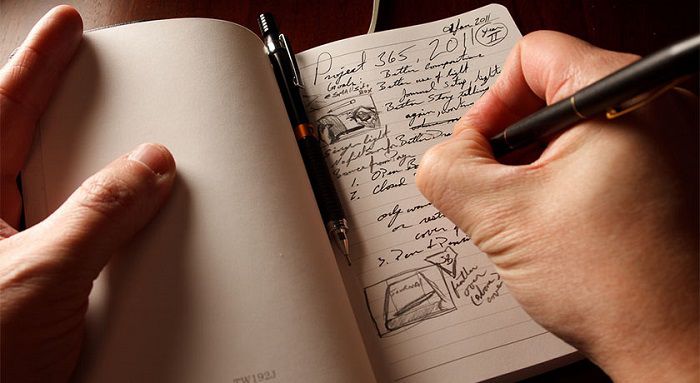

Trading is a complicated process. There are a lot of things to do such as arranging strategies or calculating your risk to reward ratio. Because of that, you are often left with scrambled pieces and memories from your last traders. This can affect your trading journey and your learning experience. That is why most traders keep a trading journal to write down what they're doing during their trades.

A trading journal is a diary of some sort, of which the main idea is to document all the steps you take when you open a position and how that trade goes. Although it can be written manually, you can also take advantage of trading journal software for more advanced note-taking.

Contents

What You Want in A Trading Journal Software

There is a lot of trading journal software out there, each offers different features. This can give you a hard time choosing. To help your ion process, you can start with these things below:

Instruments

There are a lot of trading instruments in the financial market such as stocks, futures, forex, and many more. Unfortunately, it is very rare to find a good trading journal software that offers all instruments. The first thing you should consider when looking for the best trading journal software is to make sure that it supports the instruments you trade with.

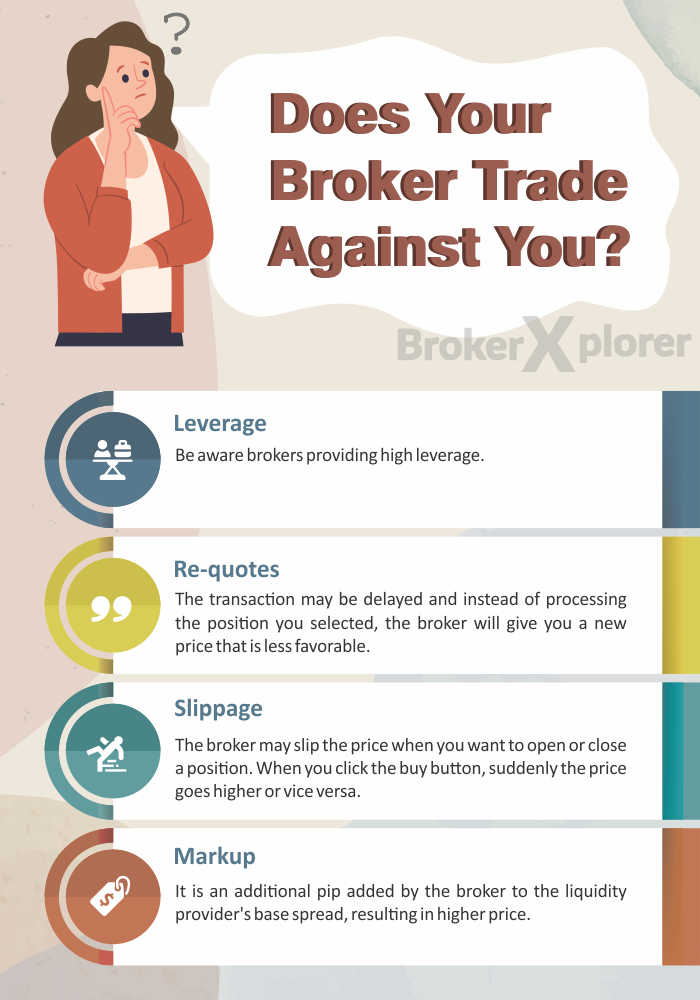

Brokerages

A lot of trading journal software is connected to some brokers. This feature is great to help you get every detail of your trades a little better. If this is a good feature for you, it's best if you take some time to find trading journal software that is compatible with your broker.

Trading Style

Make sure that your trading journal software works great for how you trade. There are several things you can consider for this such as frequencies, objectives, and many more. This will make it easier for you to take notes of your trading plan.

Based on the parameters above, here is a list of recommended trading journal software you can use as a guide:

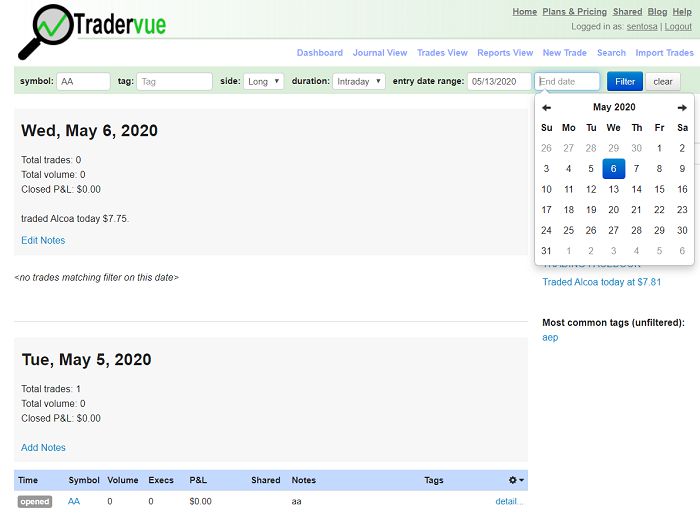

TraderVue

TraderVue is one of the best trading journal software you can consider. It is a well-established software that offers the best solutions for your trading system. This software comes with built-in journalling features and comprehensive reporting. In addition, there are several other useful features such as filtering and tagging of trades, multi-currency options, access sharing with your trading coach for easier feedback, and risk analysis based on R multiples. Unfortunately, the free tier of TraderVue is very limited. You can try on their free trial to evaluate their platform before signing up for the full package.

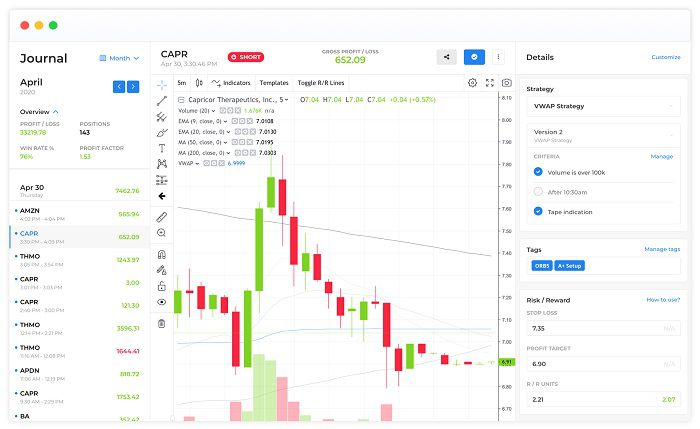

Trademetria

This trading journal software is a great choice with a free tier that might work for not-so-active traders. It also comes with a set of useful features such as import functions for over 140 brokers, over 30 reported trading metrics, a full WYSIWYG editor, automatic chart displays for your entries and exits, and advanced intraday performance. On top of that, it also allows you to run simulations using your past trades. For a better experience, you might want to subscribe to their recurring monthly fees.

Trading Journal Spreadsheet

It is an intuitive and powerful trading journal software you can get your hands on. One of the best advantages of the Trading Journal Spreadsheet is that you can get a copy on your computer and you can run it as long as you have excel. On top of that, it has great features such as what-if analysis, expectancy graph, position sizing tools, MAE/MFE analysis, Multi-broker tracker, and many more. You can get Trading Journal Spreadsheet with a one-time payment.

TraderSync

If you are looking for trading journal software with a variety of markets including stocks, options, and futures, TraderSync is your answer. It has a wonderful user interface with built-in recommendations on how to trade better. This software supports over 100 brokers, so there is a good chance that your broker might be one of them. Furthermore, it has a supporting app for mobile trading that works on both Android and IOS. It has a free trial option that you can try before deciding whether you want to subscribe to their paid service or not.

Chartlog

Chartlog is a highly customizable and intuitive dashboard with great features that allows you to filter your trades according to your needs. There are also nifty features for analyzing the most profitable weekday or time of the day. It's a great feature especially if you are an intraday trader. Furthermore, it comes with real-time and historical data for over 16 US exchanges. Aside from that, Chartlog offers automatic import for a few brokers. Try on the 7-day free trial where you can get the full experience of this software before committing to the whole thing.

Bottom Line

Sometimes, you won't realize that you have been developing a bad habit of trading. A trading journal is a great way for you to find out about this and improve yourself to be a better trader. Trading journal software offers plenty of useful features for you to get just what you need in tracking your performance. That being said, most trading softwares are not free and their prices vary according to which tier you choose. Each tier might offer you different features and advantages. If you are afraid to commit fully, try on their free trial options to find out if the software works for you.

Remember that creating a trading plan is not only about making a list of what you want to do, it's even more important to stick to the plan.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance