To be a successful day trader with MACD is actually quite simple. You don't need any advanced parameters as the best MACD setting for day trading.

Forex trading is a billion-dollar industry filled with strategies and tactics to make profits. One of the most popular tools to make it possible is the MACD. If you're a day trader, you might want to consider using the best MACD setting for your strategy.

What is Day Trading

Day traders are investors that initiate new positions and liquidate all of their existing ones within the same trading day. Instead of carrying over deals from one day to the next, they consistently begin the following day with a clean slate. Therefore, it is necessary for them to have a rapid reaction time when conducting market analysis.

They are frequently observed engaging in a large number of positions of relatively little transaction size with the expectation of achieving a profit of a few pips from each of them, which, when added together, results in a respectable sum.

What is MACD

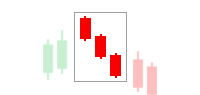

The Moving Average Convergence Divergence (MACD) indicator is a momentum indicator that follows trends and displays the connection between two Moving Averages of the price of an asset. It is a tool that traders use to determine when bullish or bearish momentum is high. This helps them choose when to enter and exit deals.

Gerald Appel introduced the concept of Moving Average Convergence Divergence (MACD) back in 1979, and it has since become one of the most widely used technical indicators in trading.

The theory behind the MACD is not too complicated to understand. Essentially, it determines the value of the difference between an instrument's Exponential Moving Averages over the last 12 and 26 days. The 12-day Exponential Moving Everage (EMA) is the quicker of the two Moving Averages that make up the MACD. The 26-day EMA is the slower one.

Best MACD for Day Trading

According to the findings of our investigation using the M30 minute chart, the default values for the MACD parameters of EMA 12, EMA 26, and EMA 9 constitute the best MACD settings for day trading. The MACD signal line crossing indicates that the acceleration is currently moving in a different direction. When the average velocity of the MACD line passes through zero, this represents a change in the direction that the line is moving in.

The MACD charts demonstrate the usage of three distinct numbers for the configuration parameters. The first number is for the periods, and it is utilized in the calculation of the average for things that move more quickly. When calculating the slower-moving average, the second number of periods is utilized. The third value, which represents the total number of bars, is used to distinguish between the slower and faster moving averages.

Final Verdict

There is no doubt that the forex market is filled with several strategies that work for several people. MACD is definitely a popular trading strategy, especially for day traders. So long as you follow the parameters properly, you should do just fine. Aside from that, you might want to try combining MACD with other indicators to get better confirmation signals. One notable example of this method is the MACD and Moving Average combo strategy.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance