Knowing how bank trading strategy works is not enough if you want to really try it out. This article reveals an example of the strategy's implementation and extra tips on how to successfully trade like bank traders.

In the previous article, we've discussed the importance of learning bank trading strategy and the basics of its 3 key steps. Now, let's see the implementation of this strategy in the real market.

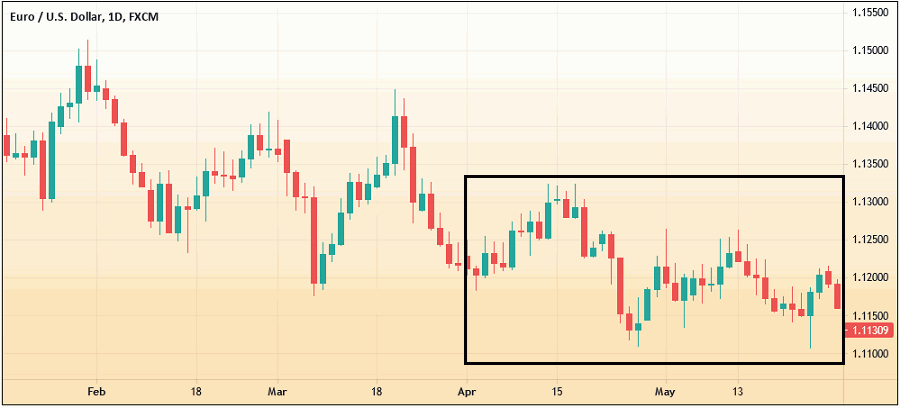

We will use the EUR/USD pair below as an example.

The chart above is the EUR/USD in April and May 2019. In this period, the banks were accumulating a position. Notice how the price moved in range. This is because the banks entered the market over time to avoid spiking the market. By doing so, the banks managed to maintain a relatively stable price action.

The manipulation phase occurred in late May until June 2019. In the chart below, we see a false push at the end of the manipulation phase. But the reality is, there was no economic news that supported the price to keep climbing up. Needless to say, an understanding of fundamental analysis is very important in this strategy.

In this phase, the banks manipulated the market by creating buying pressure as they were accumulating a short position. Although the price was rising, it was only momentary as the banks were planning to push a downtrend.

After the manipulation stage came to an end, the banks started to drive the market downward. This should be where retail traders like us can profit. We can enter a short position immediately after the short-term uptrend ends.

How to Trade Like Banks

For retail traders, this strategy may be quite hard to grasp. Most strategies out there are reactive, meaning that the strategies react to the price movements and produce either buy or sell signals accordingly.

The banks understand this situation all too well. As market makers, they exploit our dependency on reactive strategies. So when the market pressures retail traders into buying or selling, it is actually the banks that direct them to do so.

Retail traders who don't have this knowledge are always at risk of being trapped by the banks. That's why it is very important for you to be aware of different types of strategies. For example, the bank trading strategy is predictive in nature. Instead of reacting to the price action, this strategy's main premise is to predict the upcoming market trend.

It goes without saying that you will need time to master this strategy. If you are new to this, you can follow these approaches to increase your probability of success.

Trade on Higher Time Frames

The banks don't trade in the short term. They do not trade on minute charts. As mentioned before, they accumulate a position for hours or even days. Needless to say, the bank trading strategy is not designed for day traders. If you are one, you will need to transform yourself into a position trader who holds a position for weeks or months.

See Also:

Apply Fundamental Analysis

This approach involves analyzing macroeconomic data, news reports, and sociopolitical factors that may affect currency prices. This is a recipe for headaches especially if your specialty lies in technical analysis. Understanding the fundamentals will enable you to find the areas of supply and demand, where you can identify which direction the currency price is heading.

In other words, bank trading strategy won't concern you with sophisticated technical indicators that sometimes can be confusing too. The only technical tool you need is the chart that shows the price levels. However, you can also use simple technical tools to help you identify a false breakout. After all, no traders want to be manipulated by banks.

Monitor the Price in the Distribution Step

If you have successfully tracked the banks' accumulation and manipulation phases and arrived at the distribution phase, you may now start collecting profit. Let's say the market is in an uptrend, so you follow the trend by buying. This is obviously the right thing to do, but you should be aware of this one important takeaway: the banks are experts in contrarian trading.

They will be selling when retail traders are buying, and buying when retail traders are selling. What they do here is accumulating a position that will eventually start a trend in the opposite direction. So you have to carefully monitor the price in the distribution step, because this may be the phase where the bank starts accumulating again.

Final Words

Understanding how the banks trade forex is a great foundation to set up a trading strategy. The banks most likely win trades thanks to their financial power to control the market. The bank trading strategy is designed for retail traders to track the banks' trading activity, so we can ride the trend they create.

We can identify where the banks accumulate a position, how they manipulate the market, and what market trend they try to push. It may sound easy on paper, but you will need time to master this strategy and produce consistent profits. Don't forget to try the strategy in a demo account before using it in a real account with real money.

Bank trading strategy is built to help retail traders enter the market in the right position, where they can avoid being trapped by banks' accumulation and manipulation phases. To improve this strategy, you can also monitor banks' trading positions with the help of a certain trading tool. How so? Read further in The Premium Tool to Get the Major Banks FX Positions.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance