A broker's withdrawal is one of the most important factors to determine its reliability. How about IC Markets withdrawal?

Among many other Australian brokers, IC Markets is probably one of the most renowned. A team of professionals in the financial service industry created this broker. There are many things that traders can enjoy in IC Markets.

One of the most popular is their raw spread offers. In addition to providing 0.0 pips spread for MT4 and MT5, IC Markets hosts the same raw spread for the cTrader trading platform. IC Markets also provides free VPS for certain requirements.

However, having low spreads and sophisticated tools won't cut it if a broker can't guarantee a reliable withdrawal process. One of the most important factors in determining whether a broker is trusted is how they handle the withdrawal process.

Here is a glimpse of IC Markets' withdrawal details:

- Payment options: IC Markets allows withdrawal from International Bank Wires, Visa or MasterCard, and other secure credit and debit cards.

- Time spent: Common withdrawals in IC Markets normally take 1 to 2 business days.

- Withdrawal fees: Most IC Markets withdrawal methods don't charge any fees.

- Minimum withdrawal: IC Markets has no minimum withdrawal.

To get more insight into each IC Markets withdrawal aspect, let's get to the next part.

1. Payment Options

Why are withdrawal options so important? There are many reasons for this, but one of the most obvious ones is ensuring that the methods are available in the country where the traders live. The most popular withdrawal method is probably through bank transfers.

But, some traders might prefer something simpler such as PayPal or any other third-party options. The most important thing is ensuring the broker provides various options.

For IC Markets withdrawal, there are plenty of choices to choose from. IC Markets allows withdrawal from International Bank Wires, Visa or MasterCard, as well as other secure credit and debit cards. For traders who are looking for easier withdrawal, the best options are PayPal, Neteller, UnionPay, Bpay, FasaPay, POLI, Rapidpay, Klarna, Qiwi, and Skrill.

Most importantly, the withdrawal must be made from the same account the traders use as a deposit method. Also, traders' countries may affect the payment options.

See Also:

2. Time Spent for IC Markets Withdrawal

Unlike deposits, broker withdrawals are rarely instant. That being said, it is understandable that traders want to find a broker with the shortest withdrawal time.

For IC Markets, common withdrawals normally take 1 to 2 business days, while credit/debit card withdrawals took around 3-5 business days. Unfortunately, international bank wire transfers might take up to 14 days and might cost traders additional intermediary and beneficiary fees.

It's understandable if traders prefer to use e-wallets as a withdrawal option. For the most part, this method is probably the fastest way to withdraw. However, there might be times when the withdrawal process takes a lot longer than usual even with this payment option. In that case, traders are welcome to contact the customer support service.

3. IC Markets Minimum Withdrawal

Usually, brokers would establish a minimum withdrawal amount for their traders. But that is not the case with IC Markets' withdrawal. No minimum withdrawal amount gives traders more flexibility when withdrawing their profits.

That being said, IC Markets remind traders to be mindful when making withdrawals. The banking fees might be higher than the traders expected, depending on the withdrawal amount.

4. IC Markets Withdrawal Fees

Another thing to consider when withdrawing money from brokers is the fees. It is not uncommon for a broker to charge a few amount of money from a withdrawal. The amount can be varied according to what methods the traders use. Luckily, most IC Markets withdrawal methods don't charge any fees for traders.

This includes domestic bank withdrawals, credit and debit cards, and other electronic wallets (PayPal, Neteller, Skrill). That being said, not all IC Markets withdrawals are free of charge. The international bank withdrawal will charge AUD20 or equivalent per withdrawal. As for additional charges from the third party, IC Markets is not responsible for covering them.

How to Withdraw From IC Markets

Although the process is very simple, new traders might have trouble doing it. For recurring clients, there's no harm in learning the tutorial every now and then. To withdraw from IC Markets, traders need to:

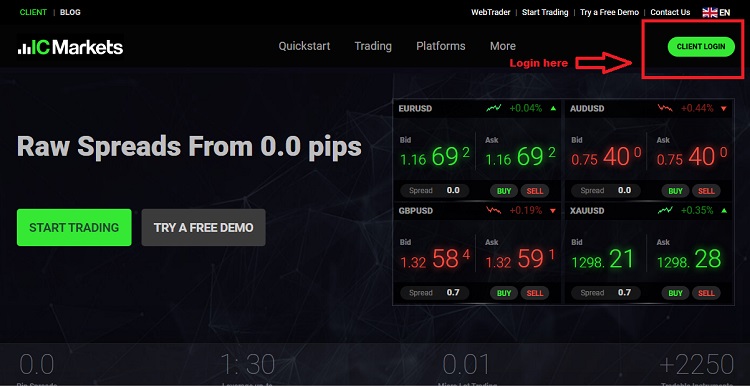

1. Log in to Personal Account.

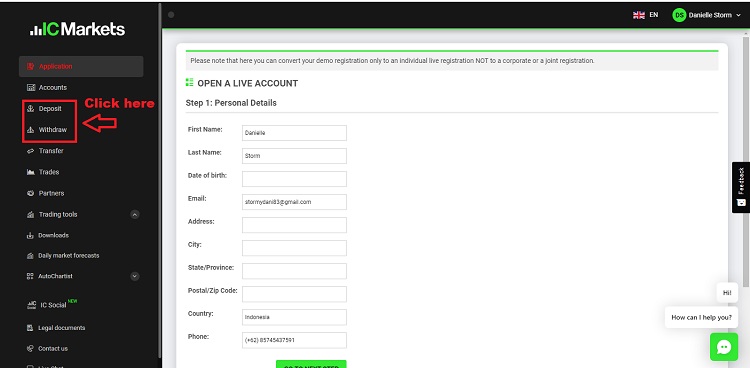

2. Choose to withdraw or withdraw funds from the menu.

3. Go to the desired withdrawal method.

4. Enter the amount to withdraw. Sometimes, traders must write down their withdrawal reason here, so write it down accordingly.

5. Submit the request and then wait until the money arrives.

As a side note, the IC Markets withdrawal request cut-off time is 12:00 AEST/AEDT. Therefore, if traders submit a withdrawal request before the time, it will be processed on the same day as the receipts. However, if the withdrawal request was submitted after it, the withdrawal will be processed on the following business day.

Is IC Market Reliable?

There are many reasons to determine whether a broker is reliable or not. One of the most obvious ones is through their regulations. Considering IC Markets is incorporated in Australia, they are regulated by the Australian Securities and Investments Commission (ASIC), one of the most reputable authorities when it comes to forex and CFD brokerages.

In addition to that, IC Markets is a member of the Financial Ombudsman Service (FOS). This approved Australian external dispute resolution scheme independently resolves conflicts between consumers and financial providers.

This broker applies client money segregation and insurance coverage as extra protection to ensure the trader's funds are well protected. The insurance will cover up to US$1,000,000 per trader. It's available for all IC Markets raw traders and will be triggered only in the unlikely event of insolvency.

IC Markets is an online forex broker operating under the company of International Capital Markets Pty Ltd. Traders under the Australian jurisdiction are provided with the trading service of IC Markets AU that is headquartered in Australia and licensed by the Australian Securities and Investments Commission (ASIC).

On the other hand, non-Australian traders who open an account in this broker are registered under IC Markets SEY that is based in Seychelles, and regulated under the Seychelles Financial Services Authority (SFSA). The dual operation is a result of the relatively new rules from ASIC that prohibit their regulated broker to offer trading services outside Australia.

Classified as an ECN broker, IC Markets provide clients with MetaTrader 4, MetaTrader 5, cTrader as platform trading options. This broker also follows market trends to include Cryptocurrencies as one of its products, enriching its already wide selection of trading assets that include Currencies, Indices, Metals, Energies, Softs, Stocks, as well as Bonds.

The minimum deposit in IC Markets is in the middle range compared to other ASIC-regulated brokers, as it reaches $200 for every client. Market analysis materials are also prepared regularly for trading insights on IC Markets's official website, proving their competence to serve their traders with important contents created by market experts that work specifically for them.

For payment methods, IC Markets allows funding and withdrawal via wire transfer, credit card, PayPal, Skrill, Neteller, FasaPay, UnionPay, as well as Bitcoin via BitPay. The more interesting aspect from this broker is its multi-base currencies that include USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD.

As the trading technology in IC Markets is highly equipped with co-located servers and extremely low latency (especially on cTrader), the broker is widely known for its capability in hosting traders with the special needs for high-frequency trading as well as scalping.

To sum up, IC Markets is a fitting destination for active traders looking for a well-regulated broker. IC Markets is also flexible in terms of base currency and payment methods, signaling their commitment to welcome traders beyond their home country. As of late 2019, IC Markets provided their website in 18 international languages including English, Korean, Indonesian, French, Spanish, Italian, Malay, German, and Chinese.

For the longest time, a lot of traders feel unsafe when withdrawing their accounts due to fear of being scammed. Still, withdrawing errors are more common than most people thought.

Free FOREX Virtual Private Server

Free FOREX Virtual Private Server Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

28 Comments

Fred

Jan 29 2023

"the withdrawal has to be made from the same account that the traders use as a deposit method"

This means that when I open an account and make a deposit, I have to reconsider which payment option I should use, right? thanks author before warning me before opening an account at IC Market.

Of all the payment options available, I only have a bank deposit, a debit/credit card and an e-wallet. Out of these three payment methods, excluding bank transfers, which one suits me best? And about the bank transfer, why does the process take so long? And the deposit and withdrawal time is the same, about 14 days, right?

Allen

Jan 29 2023

In my opinion, it is better to use an e-wallet as it is free of charges and other fees, whereas if you use a credit card, you will be charged. In my experience, using an e-wallet is the best option as it can deposit and withdraw money faster but with minimal fees. The fee is usually an e-wallet management fee when you send and receive from the bank. And it's normal anyway.

Meanwhile, why does a bank deposit take so long? As the article said, because international transfers need multiple checks.

Example: Your local bank has sent the money to the broker's bank, which is an international transfer. So, your local bank should first contact the clearinghouse for verification, then the funds will be sent to the clearinghouse and the clearing house will transfer the funds via central bank as well as with the front desk. It takes a lot of fees and money as well as verification.

But if by coincidence IC Market has your local bank account, you can deposit and withdraw using your local bank account without much verification as the transfer is the same as a regular transfer.

Thomas Mings

Jan 29 2023

Dude maybe I am off topic. I am a newbie looking for forex education on this site. First, I plan to not open a forex account until I am ready. But after reading this article, I got interested in IC market because it has so many payment options that luckily, I have all of them. But for some reason, I think I am not ready yet to open forex account.

The question is what is the best account I can open with IC Market? And another question is what are the requirements to open an account on IC market? And is it possible to learn Forex without opening an account with a broker? Thanks!

Jammie

Jan 29 2023

Thomas Mings: Why should you have doubts about opening an account on IC Market? Yes, you need to learn about Forex theory before you start Live Forex Trading, but that doesn't mean you can only learn with theory. Theory and practice can be the best teachers to learn Forex effectively.

So, I suggest you to quickly open a demo account for free and without any terms. I mean it's almost impossible to learn Forex without an open account because after all, Forex is not a theory. What is the best account you can open at IC Market? If you are a beginner, open a demo account first. Then you can decide to open a real account and I recommend a standard account.

To open account here is guide for you :

Leon Tan

Jan 29 2023

Thomas Mings: Man, I agree with the above comment. you have to learn Forex through a demo account. And I am really shocked that you want to learn Forex without practice, I mean there are many factors that require practice in Forex to know what is the best trading strategy for you.

And what might surprise you is that one trader's trading strategy will be different from another's. So, you can't just rely on theory because Forex is dynamic and hard to learn, even though you learn by doing. But I strongly recommend that you define money management and risk management as your trading rules first. You can read the definition of money management and risk management here:

Dale Farmer

Jan 30 2023

Leon Tan: That is true. I also trained myself in the Demo Account like a Jedi until I was absolutely sure I was ready for the real one. But this is not the only way you can use a demo account. Sometimes I still use a demo account to try out a new strategy. It is the best way to backtest your new strategy, I swear. Unfortunately, IC Market limit how many demo account you can use, which is a shame.

Chryssta

Feb 12 2023

I was looking for a broker that provides transaction facilities using cryptocurrency, and found this article about IC Markets. It has been explained above that withdrawals can be made via bitcoin Wallet, ok, cool...

But apart from bitcoin, is it possible or not? Because I HODL a lot in dime coins, not Bitcoin. If so, please advise how to deposit. Thank You.

Mark

Mar 21 2023

I have a big question about withdrawing funds using credit cards on IC Markets. I understand that when we deposit using credit cards, it's like paying for a purchase and the bill will be charged to us next month, including any fees. However, I'm not sure how withdrawing using credit cards works. Will the money be transferred directly to our credit card limit or to our bank account? And if it's the latter, what's the difference between using credit cards and bank transfer? I'm also curious why credit card withdrawals can be faster than bank transfers. Thank you!

Josh

Mar 21 2023

Dude, when it comes to withdrawing using a credit card, the money will go back to your credit card limit instead of being transferred directly to your bank account. That's why it's different from a bank transfer, but it can actually be faster.

In my experience, credit card withdrawals can be pretty convenient because the money goes back to your credit card and you can use it right away for other purchases. Plus, it's usually processed pretty quickly, so you don't have to wait too long to get your funds. But it's important to keep in mind that some credit card issuers may charge cash advance fees for credit card withdrawals, so you'll want to check with your card issuer first to see what fees may apply.

Hitsuma Kaoki

Mar 21 2023

So, in IC Markets, you can choose from different payment options. But I heard that International Bank Wire Transfer is the safest one. However, I don't understand why it takes so long, like 14 days, to receive the money. I mean, we're living in the digital era, right? Can't you just transfer money online like we do with mobile banking? It's just a click away, so why does it take so long for International Bank Wire Transfer to process? What's the deal with that? Need an explanation here, thank you!

Allexis

Mar 21 2023

Hey there! IC Markets offers a bunch of payment options, but international bank wire transfer is probably the safest way to go. As for why it takes so long, it's because international transfers involve a lot of different banks and financial institutions, each with their own processing times and fees. It's not as simple as sending a quick mobile payment between friends, unfortunately. Plus, there are often regulatory requirements and compliance checks that need to be done, which can add even more time to the process. But hey, at least you can rest easy knowing your money is secure!

Hitsumi Kaoki

Mar 21 2023

So, it's pretty clear that using international bank wire transfer is one of the safest ways to transfer money compared to other payment options. And what's interesting is that I just found out that our money needs to go through a verification process with the bank, and the bank of the receiver needs to verify our identity to check if we're not some kind of criminal, right? It's like a KYC process that we have to go through when opening a bank account. But based on your explanation, it seems like KYC in the bank is even more useful when it comes to performing international bank transfer, right? Thanks for breaking it down for me!

Ariful Islam

Mar 23 2023

What are the different withdrawal methods available for IC Markets customers, and how do these compare in terms of processing times, fees, and convenience? Additionally, what are the requirements and restrictions for each method, such as minimum withdrawal amounts and currency conversion fees, and how can traders optimize their withdrawal strategy to minimize costs and maximize efficiency?

Labib Hossain

Mar 23 2023

How does IC Markets ensure the security and reliability of its withdrawal process, and what measures does the broker have in place to prevent fraudulent activity, such as identity theft or unauthorized access to trading accounts? Furthermore, how does IC Markets handle customer disputes or issues related to withdrawals, such ass or errors in processing, and what recourse do traders have if they encounter such problems?

Harvey

Oct 30 2023

@Labib Hossain: As I know, IC Markets, like many reputable brokers, implements several measures to ensure the security and reliability of its withdrawal process and to prevent fraudulent activities:

In the event of disputes or issues related to withdrawals, IC Markets typically has a customer support team to assist traders. Traders can contact the support team to resolve withdrawal-related problems, such as errors in processing.

Sandy

May 3 2023

This article provides a detailed explanation of the IC Market Withdrawal process, including the available payment options, processing times, and associated fees. It also explains how to initiate a withdrawal in a simple manner. However, you have a question regarding the payment options available for withdrawal. Some brokers only allow withdrawals through the payment method used for the deposit. For example, if you deposit funds via bank transfer, you can only withdraw via bank transfer. Do the same rules apply to IC Market withdrawals?

George

May 3 2023

The good news here, to answer your question about IC Markets withdrawal options - they offer a variety of payment methods for you to choose from. You can withdraw your funds using credit/debit cards, bank transfers, and e-wallets like PayPal and Skrill. The best part is that IC Markets doesn't limit you to the payment method you used for depositing. So if you deposited with a credit card, but want to withdraw with PayPal, you're good to go. They also offer fast processing times for withdrawals and have detailed information on their website to guide you through the entire process. Overall, IC Markets is pretty flexible when it comes to their withdrawal options, which is a big plus.

Sally

May 3 2023

Security is a big concern when it comes to depositing funds with a broker, and I'm curious about the security measures in place for IC Markets. With the KYC process, our personal identity is exposed, so it's crucial for brokers to have strong security measures in place to prevent any leaks. Additionally, we also need to feel secure during the withdrawal process. Can you tell me about the security measures that IC Markets has in place for both deposits and withdrawals?

Roger

May 4 2023

IC Markets is known for its high level of security when it comes to the safety of its clients' funds. The broker uses advanced encryption technologies to protect client information and has implemented strict security protocols to ensure that all transactions are secure. Additionally, IC Markets is regulated by multiple reputable regulatory bodies, including ASIC in Australia and CySEC in Europe, which require the broker to adhere to strict rules and regulations related to client fund safety and security.

As for the withdrawal process, IC Markets also has measures in place to ensure the security of client funds. For example, the broker requires that all withdrawals are processed to the same payment method used to deposit funds, which helps to prevent fraudulent activity. But in the IC Markets, they may request additional verification documents from clients to ensure the security of their accounts and funds because you can do the withdraw with other payment option

Overall, IC Markets takes security very seriously and has implemented various measures to protect its clients' funds and personal information.

Boris

May 5 2023

AS you know, CySEC (Cyprus Securities and Exchange Commission) is a reputable regulatory body in the financial industry. They are responsible for overseeing the financial activities of companies operating in Cyprus and ensuring that they comply with the relevant laws and regulations. While there is no perfect regulatory body, CySEC is generally regarded as one of the more reliable and trustworthy regulators in the industry. Their regulations aim to protect investors and maintain the integrity of the financial markets. And also same as ASIC. And overall, brokers that regulate from there is can be considered safe either in their activities and in their security as well!

JK Bowling

Jul 14 2023

Is anyone having a problem with me? I am interested in becoming a client of IC Market. For several months, I have been trading in a demo account to prepare for real trading. Now, I feel ready to open a real account and sign up with them. However, during the KYC process, I was not verified because I am from the US. The broker rejected me as their client. I would like to know if anyone has experienced the same problem and how to avoid it, so I can become verified and start real trading at IC Market. I hope someone can provide an answer. Thank you very much!

Boguslav

Jul 15 2023

In simple terms, brokers like IC Market have to follow rules and regulations set by different countries to ensure fair and safe trading. In the United States, there are organizations like the SEC and CFTC that make sure brokers play by the rules and protect investors.

Now, when it comes to international brokers like IC Market, it can get tricky for them to meet all the requirements set by US authorities. They would need to register with the SEC, become part of organizations like FINRA, and meet specific financial obligations. This can be a lot of work and may not fit with how international brokers typically operate.

Because of these complications, some brokers decide it's better to not accept clients from the US. It helps them avoid legal and regulatory problems and focus on serving clients from other countries where the rules are more in line with their way of doing things.

Jane

Jul 16 2023

That's right, not many brokers accept US traders. According to the articles I read, it is known that getting a US license is very difficult because the requirements are quite strict. One of the main reasons why forex brokers do not accept US clients is because of the strict regulations imposed by the US government. The US government has implemented a number of regulations regarding forex brokers, including the Dodd-Frank Act which was introduced in 2010. This law requires forex brokers to register with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) which can be a lengthy and expensive process.

In addition, forex brokers are also required to meet a number of other requirements, including maintaining minimum capital requirements and submitting periodic financial reports to the authorities. These regulations can be difficult for forex brokers to comply with, which is why many prefer not to accept US clients.

Well despite the many rules in the US, it is important to remember that these regulations are designed to protect traders and ensure that the forex market operates fairly and transparently. As a result, it is important to choose a regulated and trustworthy forex broker, even if they do not accept US clients. Yeah, even though IC Markets Broker can't penetrate the US market, it can't be denied that it is a good broker. IC Markets is a highly regulated Broker with a good reputation. The company is recognized globally and offers good trading conditions for professional or regular traders. IC Markets has one of the best and most good study and research materials for trading EAs.

However, you still need an account that has US regulations, you have to read this (Forex Brokers Offering Us Clients)

Sky Miroslav

Jul 17 2023

Actually, here I just want to add the reason why forex brokers don't accept US clients is because of the higher costs associated with doing business in the US. The US is known to have a higher cost of living and wages than many other countries, meaning forex brokers have to pay their employees more, resulting in higher operating costs.

In addition, forex brokers also have to pay higher taxes and fees to operate in the US, which can be a significant burden for smaller companies. As a result, many forex brokers choose to focus on other markets where the costs of doing business are lower.

Apart from these reasons, In the US, forex brokers are only allowed to offer a maximum leverage of 50:1 on major currency pairs and 20:1 on minor currency pairs. This is much lower than the leverage that is offered by brokers in other countries, such as Australia and Europe, where leverage of up to 500:1 is available. The restrictions on leverage in the US can make it difficult for traders to make a profit, as they are not able to take advantage of the same level of leverage that is available in other countries. As a result, many traders choose to use offshore forex brokers that offer higher leverage, which is why many US forex brokers do not accept US clients.

This is all done to protect traders from fraud and cybercrime.

Cabello

Aug 30 2023

I've successfully verified my account on IC Markets, but I'm interested in learning more about the benefits of having a verified account. How does having a verified account impact my trading experience, and what additional features or privileges do I have access to? Are there any trading restrictions or limitations that I should be aware of as a verified account holder? Additionally, what are some tips or strategies you would recommend to verified account holders to help them maximize their profits and minimize their risks? Finally, I'm curious about the verification process for corporate accounts. What documents and information are required, and what are the benefits and limitations of having a verified corporate account? Overall, what advice do you have for someone who is new to trading with a verified account on IC Markets?

Ling

Nov 17 2023

Hey, just want to double-check the safety vibes with IC Market. After going through the article, it looks like their withdrawal policy is right up my alley. Firstly, the speed of withdrawals with IC Market is impressive, and they offer a bunch of options for it. Plus, the fact that they're regulated by ASIC, the Australian watchdog, is reassuring. The article highlights ASIC as a robust regulator, so no worries there.

What adds an extra layer of security for me is knowing IC Market is a member of the Financial Ombudsman Service, an approved external dispute resolution scheme in Australia. It's like an independent referee for conflicts between consumers and financial providers. Now, my question: what kind of situations might spark conflicts between customers and brokers? Curious to know the ins and outs of that. Cheers!

Charlie

Feb 25 2024

Roger

Feb 27 2024