Did you know that currency intervention can be one of the factors that causes high volatility in the forex market? So, what is it and how should we respond to it?

Monetary policy could come in many different forms. The main purpose is to control inflation and keep the economy alive at a rate that is neither too low nor too high. Once the central bank imposes a certain monetary policy, all layers of financial institutions will follow the lead.

Interestingly, such conditions can also affect the currency market and forex trading in general. One of the variations of monetary policy that every trader should know is called currency intervention. This is important because having a good understanding of currency intervention will help you analyze the market better and thus, make wiser trading decisions.

Contents

Brief Introduction to Currency Intervention

Currency intervention, also known as foreign exchange intervention or currency manipulation, is a type of monetary policy. It basically occurs when a central bank buys or sells its own currency in the foreign exchange market to other currencies. The idea is that by trading a large sum of its own currency, the central bank can control volatility and influence the exchange rate or the money's value.

Why Do Central Banks Intervene?

There are two push factors that could make central banks intervene in the forex market. Most of the time, it happens because the central bank thinks that there is an urgency in the nation's current condition. This becomes the fuel that makes them feel like they need to set things right by doing currency intervention. Apart from that, external pressure can also affect the central bank's decision to take action in the market.

Generally, central banks have several purposes in mind when doing currency intervention. The first one is to provide liquidity and stabilize fluctuations of the exchange rate. Sometimes, short-term financial events can cause a currency to strongly move in one direction and trigger central banks to intervene.

Secondly, central banks might also intervene to make their currency stays relevant in the market and able to support the country's growth positively. At some points, central banks would notice that their currency is slowly going out of sync with the country's economy. It can either depreciate (decrease in value) or appreciate (increase in value) against its country's favor. For instance, countries that rely heavily on exports may find that their currency's value is too high for other countries to purchase their goods, hence making the country less competitive in the market. As a result, they need to lower the exchange rate to increase exports and support economic growth.

Types of Currency Intervention

There are two methods central banks can use to influence the exchange rate.

Direct Intervention

Direct intervention is the method where central banks buy or sell their national currency. Let's say the central bank is the US Federal Reserve Bank or the Fed, the domestic currency is the US Dollar and the foreign currency is Pounds. If the Fed wants to reduce the value of Dollars, then it should sell the Dollars in exchange for Pounds. This transaction will increase the supply of Dollars in the market, causing the value to depreciate.

On the other hand, if the Fed wants to raise the value of the Dollar, it will have to do the complete opposite of the transaction above, which is to buy the Dollars in exchange for Pounds. The increased demand for Dollars will make its value rise, causing a Dollar appreciation.

It is worth noting that the Fed has a limited power to increase the Dollar's value. In order to buy Dollars to Pounds, the Fed must have enough Pounds available to exchange. Such holding of foreign assets is called foreign exchange reserves. Central banks usually accumulate their foreign exchange reserves over time and hold on to them in case of currency intervention. With that being said, the degree to which the Fed can increase the value of the Dollar in respect to Pounds will depend on the amount of Pounds available in their reserves.

Depending on the monetary base changes, direct intervention can be broadly classified into two types, namely sterilized and non-sterilized interventions.

Sterilized Intervention

While foreign exchange intervention is often seen as necessary at certain times, we can't ignore it will also affect the domestic money supply and economy in general, which is also something that central banks should think about. Apart from maintaining the stability of the exchange rate, central banks should also consider the impact of their intervention on domestic matters like interest rates, GDP growth, unemployment rate, etc. This is why central banks would sometimes choose to use sterilized intervention.

The main purpose of sterilized intervention is basically to make an impact on the exchange rate while simultaneously leave the monetary base unaffected. To sterilize the intervention, central banks should buy/sell a foreign currency with its domestic currency in the forex market while simultaneously sell/buy the equivalent counter transaction in the domestic bond market. So, if the Fed decides to intervene and sells $10 million on the forex market, sterilization means that they will also sell another $10 million of Treasury bonds (T-bonds) on the domestic bond market at the same time.

Non-Sterilized Intervention

On the contrary, non-sterilized intervention affects both the country's monetary base and the exchange rate. The exchange rate may change due to the purchase or sale of the foreign currency or the changes in the bonds with domestic currency. Non-sterilized intervention happens when the central bank makes changes in the monetary base stock, which then could impact interest rates, market expectations, and even exchange rates.

Indirect Intervention

Indirect intervention means that central banks would do certain actions that will influence the exchange rate indirectly. Some of the examples are capital controls (taxing international transactions) and exchange controls (restricting trade in currencies). One of its notable characteristics is that compared to direct intervention in the forex market, this type of intervention takes a bit more time to show its influence on the exchange rate.

Historical Context

Currency intervention actually dates back long before the globalization era. The first currency intervention actually happened in the early 1920s when the Fed decided to intervene in the market by simultaneously purchasing gold and selling US dollars. In the following years, several notable currency interventions occurred, so the policy became more commonly adopted by various central banks.

In some cases, currency intervention is also used as a collective action by several countries. In 2011, another huge currency intervention happened when the US decided to intervene the relative strength of the Japanese yen. This was a part of a joined movement to help Japan, who just suffered a massive earthquake. The US and other G7 countries successfully helped increase the yen value against the US dollar by 5% in a span of only five days.

Final Thoughts: The Implications for Forex Traders

At first glance, currency intervention may look irrelevant to forex traders as it mostly talks about how a central bank could save its economy from crisis and other domestic concerns. As a matter of fact, understanding the concept of currency intervention is highly necessary for any forex trader because it could heavily affect the currency prices and the market dynamics in general.

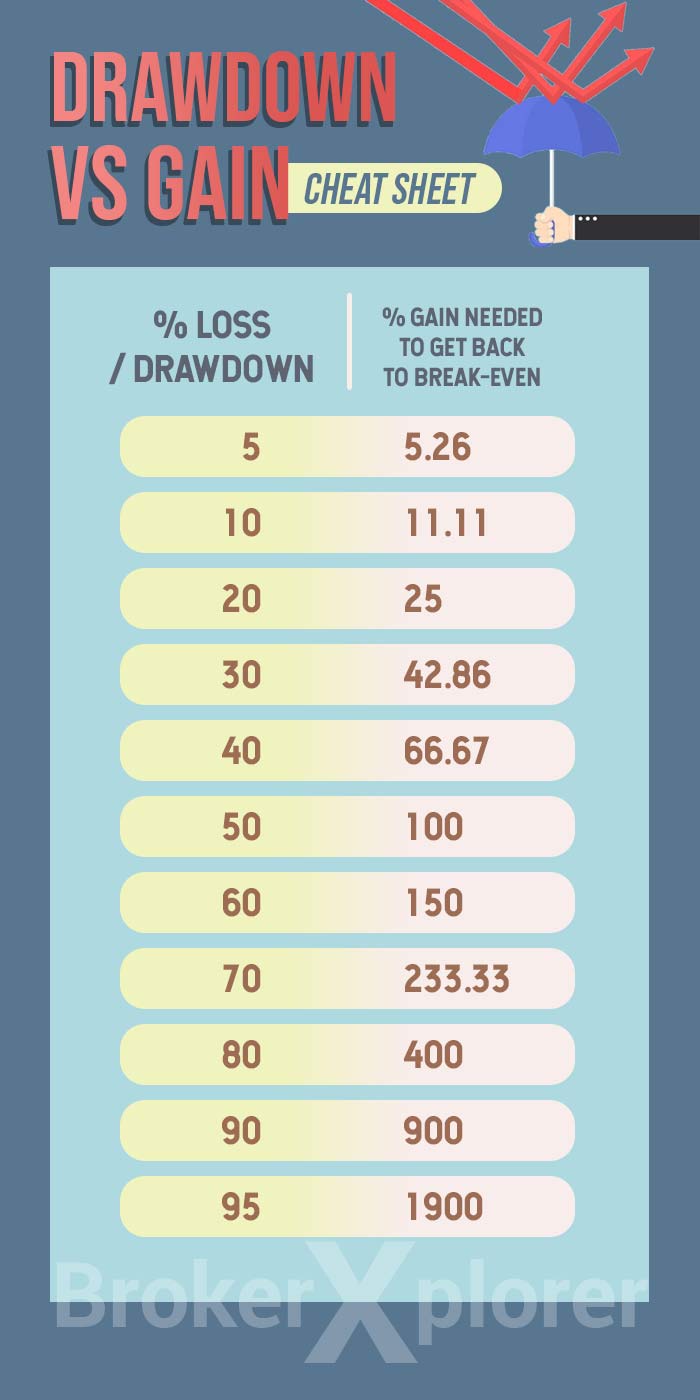

Currency interventions can cause extreme volatility in the forex market. Big movements are usually caused by "big" central banks like the US Federal Reserve, Bank of England, Bank of China, and the European Central Bank. While this can be a huge opportunity to take, it also means that there's a notably high risk involved. This is why it is highly suggested for forex traders to focus on their risk management and be more careful when executing orders during a currency intervention.

Since currency interventions are a big deal in the forex market, it is not advisable to trade against the currents of the intervention. One sell from a notable central bank, for instance, could trigger a series of stop-loss orders of long positions and make a huge turn in the market. If you still insist to trade against the intervention current, then you should place your stop loss somewhere closer to your positions than at normal market conditions. Lastly, it is also important to pay attention to psychological areas since these points are where banks typically enter the market.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance