Admiral Markets Card is an excellent solution to make your trading more efficient. How so? Let's find out in this article.

Admiral Markets is a leading forex and CFD broker that has been around since 2001. It operates under the regulation of several top-tier authorities, including ASIC of Australia and FCA of the UK.

To achieve that, Admiral Markets is always looking for ways to improve its services and make them more internationally accessible for traders all around the world. One such innovation is the Admiral Markets Card, which is basically a Visa debit card that's available in both the physical form and virtual form.

The Admiral Markets Card offers the convenience of a one-stop funding source to make various transactions wherever Visa is accepted. It is available for online purchases, over-the-phone transactions, and to withdraw cash from supported ATMs.

In this guide, we'll walk you through everything you need to know about Admiral Markets card.

Introduction to Admiral Markets Card

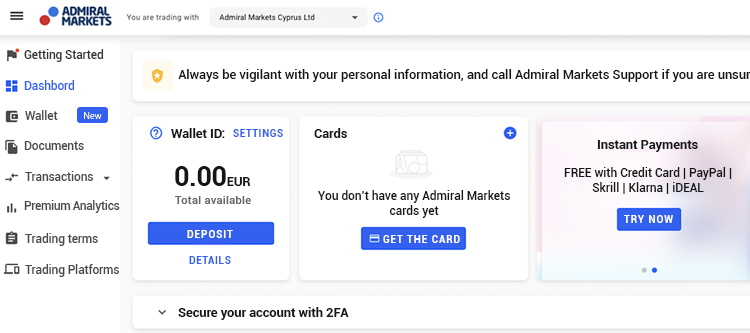

The Admiral Markets Card is an innovative Visa card that you can use to store funds, make and receive payments, and make transfers to other accounts. The card is connected directly to your Admiral Markets account and can be used in both physical and virtual forms. It works alongside the Admiral Markets Wallet which can be accessed from your Traders Room dashboard.

The base currency of the card is Euro with a maximum balance of 12,000 EUR. You can fund your card at any time using any payment method supported by the broker.

Moreover, the Admiral Markets Card can be used in both online and physical stores, anywhere in the world where Visa is accepted. Thus, it's very convenient and accessible for traders worldwide.

The Admiral Markets Card is available to all clients who are at least 18 years old and have an EAA residency. The client must pass the KYC verification to get this additional service. Each eligible client may obtain one physical card and one virtual card, which work in conjunction with each other.

It is worth noting that the card will be valid for three years after the issuance date. After the expiry date, the card can no longer be used.

The Various Uses of Admiral Markets Card

You can use the Admiral Markets Card for many purposes, including:

- SEPA transactions. You can make Euro payments within the SEPA region to any person or business using their IBAN number.

- Invest funds into your trading account. Any transfer you make from the card is instant, so you can easily invest in any available instrument with ease.

- Authorize transactions to any merchant that accepts Visa debit card payments. This includes chip-and-pin payments, magnetic stripe card payments, contactless payments, internet payments, mail payments, e-wallet payments, and telephone payments.

- ATM cash withdrawal. Withdraw cash from any ATM with a Visa logo.

See Also:

How to Get Started with Admiral Markets Card

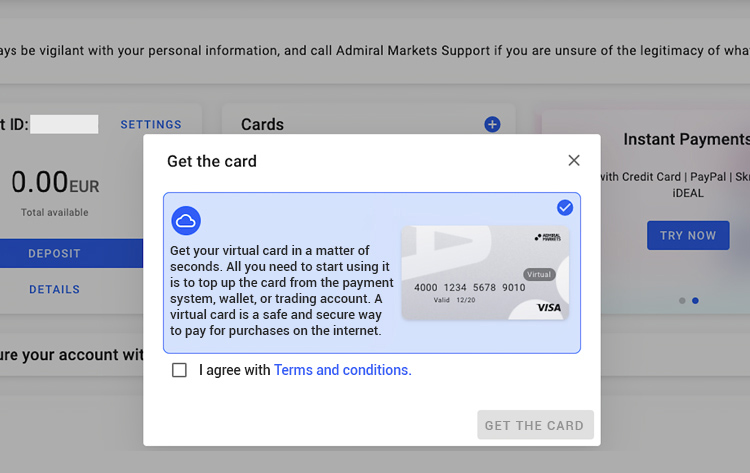

The easiest way to get your hands on the Admiral Markets card is to apply for the virtual card form. Keep in mind that before you apply, you must first have passed the full KYC verification process.

This includes submitting your proof of identity and proof of address. Once you've completed this important step, you can proceed to the steps below:

- Visit the Admiral Markets' website and log in to your Traders Room dashboard.

- Locate the Card module, then click "Get the Card".

- Before you can generate the card, you must first make a deposit using any method available on the platform, such as your existing credit card, bank transfer, Skrill, or the Admiral Markets Wallet.

- You will also need to create a PIN to access your card and make ATM withdrawals.

- Your Admiral Markets virtual card is ready to go! You can use and access it anytime from your dashboard.

While the virtual card is useful enough for making transactions, you may still need to obtain the physical card for more convenience. To get your physical card, you can follow these steps:

- Open your Trader's Room and then select the Card module.

- Make a request for your Admiral Markets physical card.

- Enter your physical address and other details. Make sure to double-check the delivery address to avoid any problems.

- As soon as you receive the physical card, sign the signature strip on the back of the card.

- Then, activate the card by logging in to your account or send an email to the broker's customer service at [email protected]. Note that the card must be activated within three months or it will automatically be cancelled.

Keep in mind that you will be required to pay a card fee of 10 EUR (free for wallet balances of over 5,000 EUR) for the physical card. The issued card will be delivered within 10 business days.

How Admiral Markets Card Can Make Your Trading More Efficient

Admiral Markets card offers a bunch of benefits that can improve your trading efficiency and enhance your user experience in general.

The main benefit is that you can manage all your financial activity within your account with a single card. Since the card is connected to your dashboard and wallet, you can always access your funds to invest in any asset without a hassle.

You can even connect it to e-wallets like Samsung Pay, Google Pay, or Apple Pay to make transactions easier than ever. It works like the usual debit card, so once it's connected to your account, you can seamlessly fund your e-wallet and make online purchases.

Aside from that, the card is also a great solution if you want to avoid costly bank fees. The Admiral Markets Card requires no hidden management fees, so it's very convenient and affordable. The virtual card is completely free of charge, while the physical form only requires a one-time fee of 10 EUR and a 2 EUR monthly management fee.

FAQs on Admiral Markets Card

- Is the Admiral Markets Card safe to use?

Yes, the card is completely safe, but for security purposes, please keep your card information and credentials in a safe place. Never disclose your PIN or security info like password details to anyone. It's highly recommended to check your balance regularly by logging into your account or contacting customer service via email. - Is it possible to change my PIN?

If you forgot your PIN, you can receive a reminder through your online Admiral account. Alternatively, you can change your PIN at any ATM that supports PIN management functionality. - Can I cancel my Admiral Markets card?

Yes, you can cancel your Admiral Markets account and card up to 14 days after the date of registration without any penalty fees. The card issue fee will be refunded as well. After 14 days, you may cancel the card at any time by contacting the customer service. However, the broker will charge a redemption fee of 2 EUR. Once the card is canceled, you should split your card in half through the signature box, magnetic strip, and chip. - What will happen if my card is lost or stolen?

If your physical card is stolen or you suspect that someone else has found out your PIN, password, or account credentials, then you must immediately contact the broker via phone or email. You can also log in to your account and reach customer service. After that, the broker will cancel your card and your account might be blocked to avoid further breaches. - Can I make transactions in any currency?

Technically, yes. However, please keep in mind that the card currency is Euro. So, if you make a transaction in another currency, you may need to pay a conversion fee based on the exchange rate set by Visa on the day of the transaction.

Admiral Markets is a forex and CFD brokerage that has been operating since 2001 to provide smart financial answers for traders around the globe. Their main services revolve around 3 key activities: Learning, Trade, and investing. In doing so, they have many registered subsidiaries, including Admiral Markets UK Ltd, Admiral Markets Pty Ltd (Australia), Admiral Markets AS Jordan Ltd, Admiral Markets Cyprus Ltd, Admirals SA (Pty) Ltd (South Africa), and Aglobe Investments Ltd (Seychelles) for the worldwide market.

Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

25 Comments

Janette Liu

May 29 2023

I must say, I'm pretty impressed with Admiral Markets for offering both AM Wallets and AM Card. Thanks to the visa card, users can now manage all of their financial activities in a single place. For me, the biggest advantage is that I can instantly use my deposited money to do other activities aside from trading and no need to transfer the money to my bank account to withdraw anymore! I can just cash out from the nearest ATM.

However, I'm still unsure about how much you can store in a single card. Is there a minimum/maximum balance limit? And what about spending limits?

Nico

May 30 2023

Well, since it's a debit card, then you can only spend the money you deposited into your account. I don't think there's a spending limit (as long as you have enough balance). I believe the minimum single pay-in wire transfer is 1 euro, while the maximum balance limit is 12000 euro.

If somehow you manage to complete a transaction with insufficient funds, you will need to pay back the short to the broker, unless it is caused by an error by the merchant that authorized your transaction. It's possible that the broker will suspend your account though, at least temporarily, until the negative balance is restored.

Connie

May 30 2023

Hi guys, as a new Admirals user, I'm very pleased to find this article early in my journey. Owning this visa card will definitely help me take care of my funds in a more flexible manner. I'm pretty curious though, why is the card only valid for 3 years and what will happen after that? Also, is there possibility that the card is cancelled before the expiry date?

Nani Kurnia

May 30 2023

I'm not entirely sure why the card is only valid for 3 years, but it's clear that after the expiry date, you won't be able to use the card anymore. I suggest you clear your remaining balance through spending, or transfer them back to your traditional bank account. You can choose any bank to send the money to, but you will need to provide the proof of your ownership of the bank account.

Alternatively, you can request a refund by contacting the customer service. The broker will grant your request unless you request redemption more than one year after the date of termination. As for your second question, the answer is yes, the broker may cancel your card for certain reasons. But don't worry, if this is the case, you will receive a two months' notice before the cancellation date.

Alita

May 31 2023

Yeah, careful with that cause the broker may cancel your card before the expiry date. This can happen if you fail to pay back any negative balance of your card or if the broker suspects fraudulent use of your card or account. They won't cancel your card without a proper notice though, so if your card is somehow canceled, just contact the customer service to find out the reason. If there's nothing you can do about it, you will be given time (3 months) to decide what you're going to do with the remaining funds in your card.

Vance

Jun 8 2023

Admiral Markets is one of the major respected Brokers with strong regulation and good reputation, account opening is easy and digital, Admiral Markets spreads are among the lowest in the industry based on our research, apart from that all trading strategies are available and there is a choice between Mt4 Platform MT5 and excellent education, research, and 24/7 support. Strategies such as auto trading and copy trading are also available on the Admiral market, so beginners are also welcome.

There aren't many negative points for Admiral markets, however, we note that conditions and proposals vary according to the rules of the entity also some deposit methods will incur additional commissions in some jurisdictions, so it's best to verify these conditions accordingly.

Admiral Markets provides fairly good trading conditions, however some of our findings indicate there are emerging issues with the performance of the trades themselves, also some traders notices and execution issues, which are not a constant issue but do occur occasionally. However, the spreads are at a very good level. Based on our experience 0.6 for EURUSD is among the lowest in the industry, so some other brokers may offer higher spreads but better execution.

Jenne

Jun 9 2023

When it comes to trading, the safety of your funds is of utmost importance. With the Admiral Markets card, which comes with a host of benefits designed to enhance your trading efficiency and user experience, it's crucial to understand the measures in place to ensure the security of your trading funds.

The key advantage of the Admiral Markets card is its seamless integration with your trading account. By connecting the card to your dashboard and wallet, you gain easy access to your funds, allowing you to invest in any asset without any hassle. However, with convenience comes the responsibility of safeguarding your financial resources.

So, how does Admiral Markets prioritize the safety of your trading funds? Are there any specific security protocols in place to protect your account from unauthorized access or potential threats?

Johnson

Jun 10 2023

@Jenne: Hey there! Admiral Markets takes the safety of your trading funds seriously and has implemented various security protocols. They understand the importance of keeping your funds secure. One way they do this is by maintaining segregated client accounts, which means your money is kept separate from the company's operational funds. They also comply with regulatory authorities to ensure adherence to industry standards. Admiral Markets uses advanced encryption technology to protect your sensitive information and secure their online platforms. They encourage the use of Two-Factor Authentication (2FA) as an extra layer of security for your account. Regular audits and monitoring systems are in place to detect and address any potential security threats or suspicious activities. Additionally, they may participate in an Investor Compensation Scheme to provide further protection in case of unforeseen circumstances. These measures show that Admiral Markets prioritizes the safety of your funds and the security of your trading account.

Yosselyn

Jun 24 2023

Wait, here the author explains that Admiral is only registered as an Australian broker, are they also registered in Jordan? Will there be any difference compared to one regulated by ASIC? Is it also available for global traders? Please explain, guys

Alleya

Jun 25 2023

Well, considering each jurisdiction has it's own rules and regulations, surely there are some differences between the two. Now, I am not too familiar with it either. But maybe this article about Admiral Market Australia can help.

If you want to check out which Admiral Markets allow global traders, check out this one.

Martha

Jun 26 2023

as long as I use Admirals, I feel Admirals is the right broker for me in trading, even though I am a trader who is not from the jurisdiction of this broker. However, as explained in this article, Admirals is a global broker and has provided the best service and protection for its customers worldwide.

Admiral Markets Pty Ltd is overseen by ASIC Australia (ASFL – 410681) and maintains client funds in segregated trust accounts. Admiral Jordan regulated by the Jordan Securities Commission (JSC), offers the same conditions as they use to provide elsewhere. Environmental regulations, such as a minimum deposit of 25 USD/EUR/JOD, cashback, and Negative Balance Protection Policy of up to USD 50,000, at among other features.

Actually, every regulator in each jurisdiction has their own exchanges that are in accordance with the rules in their country. Both ASIC and JSC also have their own rules.

but one thing for sure you need to know is, When you deposit trading account funds at the admiral market, the funds are kept in separate client accounts in specially segregated banks that are internationally recognized. In addition, the broker adheres to our own strict policies regarding the maintenance and operation of client funds accounts and client funds protection insurance policies.

Jackson

Jun 28 2023

Why is it necessary to split and discard the card after canceling it with Admiral Markets? I noticed that within the first 14 days after registration, the cancellation is penalty-free, and the card issue fee is refunded. However, after this period, there is a redemption fee of 2 EUR for canceling the card. Could you explain the rationale behind splitting the card in half through the signature box, magnetic strip, and chip? What potential risks or concerns does this address? I want to ensure that I handle the cancellation process correctly and understand the importance of properly disposing of the card. Your insights would be greatly appreciated!

Neeson

Jun 29 2023

@Jackson: When canceling a card with Admiral Markets, it is necessary to split and discard the card by cutting it through the signature box, magnetic strip, and chip. This process is implemented for security reasons and to mitigate potential risks and concerns.

The rationale behind splitting the card is to ensure that the card becomes unusable and cannot be misused by anyone else. By cutting through the signature box, magnetic strip, and chip, the card is rendered inoperable, preventing unauthorized individuals from using it for fraudulent purposes.

Properly disposing of the card through splitting it also helps protect your personal and financial information. By destroying the magnetic strip and chip, you eliminate the risk of someone attempting to extract or retrieve any sensitive data from the card.

Furthermore, by discarding the card in this manner, you demonstrate that you have taken appropriate measures to prevent its misuse. This can be important in case of any future disputes or claims related to the canceled card.

It's worth noting that the redemption fee for canceling the card after the initial 14-day penalty-free period is likely imposed to cover administrative and processing costs associated with canceling the card and issuing any refunds or adjustments.

Koth

Jun 30 2023

As an Asian region trader, is it worth considering the Admiral cards offered? While it is technically possible to make transactions in any currency, it's important to note that the card currency is Euro. This means that if you make a transaction in a different currency, there may be a conversion fee based on the exchange rate set by Visa on the day of the transaction. Considering this potential conversion fee, would it still be beneficial for Asian region traders to opt for Admiral cards? Need some insight here! Thank you!

Eddy

Jul 21 2023

Dude, just want to ask some questions here! First of all, based on the article, Admiral Markets, a well-established forex and CFD broker operating under the regulation of top-tier authorities such as ASIC of Australia and FCA of the UK since 2001, has been continuously striving to improve its services and cater to traders globally. As part of its innovative approach, Admiral Markets offers the Admiral Markets Card, a Visa debit card, in both virtual and physical forms. Could you please elaborate on the main differences between using Admiral Markets' virtual card and its physical card? Specifically, how does the virtual card enhance international accessibility for traders, making it more convenient for them to conduct online transactions and payments across borders? In what ways does the virtual card outperform the physical card when it comes to versatility and usage in different countries, considering its digital nature? Additionally, for traders who may prefer a more traditional approach, what benefits does the physical card offer, and how does it complement the virtual card in catering to the diverse needs of traders worldwide?

Kosh

Jul 22 2023

Let me explain to you! The main differences between Admiral Markets' virtual card and its physical card lie in their forms and functionality. The virtual card is a digital version of the Admiral Markets Card, providing traders with a seamless and convenient way to access their trading funds online. It enhances international accessibility by allowing traders to make online transactions and payments across borders without the need for a physical card. This digital nature makes the virtual card more versatile for traders operating in different countries, as it eliminates the constraints of physical boundaries and allows for swift and efficient transactions on a global scale.

On the other hand, the physical card is a tangible option for traders who prefer a traditional approach or may require access to cash through ATMs. It complements the virtual card by providing a physical means of conducting transactions, making it suitable for traders who still value the convenience of physical cards in certain situations.

Eddy

Jul 23 2023

Ah, I see! Thanks for breaking it down for me! The virtual card sounds pretty awesome, huh? Being all digital and stuff, it makes sense that it's super convenient for doing online transactions and payments anywhere in the world. No need to carry around a physical card, that's neat! Plus, it's cool to know that there are no physical boundaries holding it back, making it versatile for traders in different countries. But you know what, sometimes I still like having something tangible, you know, like that good old physical card. It's perfect for those moments when I need cash from an ATM or just want to feel like I have my trading money right in my hand. So, having both options is really cool, Admiral Markets got it going on! Thanks again for explaining all this to me

Veri

Jul 21 2023

Hey, I'm really intrigued by the Admiral Markets Card, it sounds pretty cool! But I'm curious about the balance of 12,000 EUR that's mentioned. Can you shed some light on where this balance comes from? Is it somehow linked to the trading balance, or is there a separate process to fund the card?

Having the convenience of both physical and virtual forms for the card is fantastic, but I'm also curious about how they work together with the Admiral Markets Wallet. Can you tell me more about accessing the Admiral Markets Wallet from the Traders Room dashboard and how it connects with the card?

Thanks a bunch for answering these questions! The Admiral Markets Card seems like a great addition for traders, and I'm really keen to understand how it all comes together!

Ramos

Jul 23 2023

The balance of 12,000 EUR on the Admiral Markets Card is the maximum balance that can be held on the card. It is not directly linked to your trading balance but rather acts as a limit for the funds that can be stored on the card. This means that you can fund the card separately from your trading account, and the maximum amount you can load onto the card is 12,000 EUR.

Regarding the funding process, you have the flexibility to add funds to the card at any time you wish. Admiral Markets supports various payment methods, so you can use the one that suits you best to load funds onto the card. This allows you to manage your card balance according to your trading needs and preferences.

As for the connection between the Admiral Markets Card and the Admiral Markets Wallet, the card is directly linked to your Admiral Markets trading account. The Admiral Markets Wallet, on the other hand, can be accessed from your Traders Room dashboard. The Wallet acts as a central hub where you can manage your funds, including funds in your trading account and funds loaded onto the card. This integration makes it convenient for you to keep track of and manage your finances seamlessly.

Andy Carrol

Nov 20 2023

Hey there! I'm curious about the Admiral Card discussed in this article and how it might influence our trading account balance. Let's dive into the details: Suppose we have a trading account with a balance of $1,200, and then we decide to use the Admiral Card with a value of $100. Now, the big question is: does this transaction have any impact on the balance of our Admiral trading account?

I'm wondering if the Admiral Card operates similarly to other cards provided by banks. Are we looking at a situation where the card is just a convenient tool for depositing funds, without establishing a direct connection to our trading account balance? It would be great to get some guidance on this to understand the dynamics and ensure clarity on how transactions with the Admiral Card influence our overall trading account. Your insights would be much appreciated

Via

Nov 24 2023

Hey let me explain to you! The Admiral Card, as presented in the information in the article, serves as a practical tool offered by Admiral Markets to streamline transactions, akin to a traditional bank card. Its primary purpose is to enhance the ease of depositing and managing funds within the trading account. Importantly, the use of the Admiral Card, with a specified value such as $100, doesn't directly alter the core balance of the trading account. In simple term, the card act as debit card if you deposit some money in your card and it is separate from your trading account.

This card is designed to provide traders with a convenient method for financial transactions, offering efficiency and accessibility in managing their trading capital. It stands as a service from Admiral Markets that aims to simplify the process of depositing funds, ensuring a seamless and user-friendly experience for traders.

Daniel

Mar 19 2024

As someone trading in the Asian region, it's worth taking a closer look at the Admiral cards being offered. While technically, transactions can be carried out in any currency, it's crucial to understand that the card's default currency is Euro. This means that if transactions are conducted in a currency other than Euro, there's a possibility of incurring a conversion fee based on Visa's exchange rate on the day of the transaction. Now, with this potential conversion fee in mind, it begs the question: is it still financially advantageous for traders in the Asian region to opt for Admiral cards? Considering the potential implications and costs involved, I'm seeking some deeper insights into whether these cards are a practical choice for us. Your perspective would be greatly appreciated. Thanks!

Grendy

Mar 23 2024

Hey there! For traders in the Asian region, I think it is better to considering Admiral cards involves weighing the potential benefits against the associated costs. While these cards allow transactions in any currency, it's essential to note that their default currency is Euro. This means that transactions conducted in other currencies may incur conversion fees based on Visa's exchange rates at the time of the transaction. Despite this potential fee, whether Admiral cards are still advantageous depends on various factors, such as the frequency and volume of transactions, as well as the prevailing exchange rate conditions. It's crucial to assess whether the benefits of using Admiral cards, such as convenience and accessibility, outweigh the potential conversion fees for Asian region traders. Seeking further insights and comparing the costs and benefits can help make an informed decision about whether to opt for Admiral cards.

Reka

Mar 24 2024

The Admiral Markets Card is open to all clients aged 18 and above who are residents of the European Economic Area (EEA). To access this service, clients need to pass the KYC verification process. Each eligible client can acquire both a physical and a virtual card, which complement each other.

I'm currently employed in Europe and I'm wondering if I can join Admiral Markets as a trader and obtain the card even though I'm not a resident there.

Yerin

Mar 28 2024

Hello! From what I understand, you're a European-based worker keen on trading with Admiral Markets and getting their card. However, you're unsure if you're eligible because you're not a resident of the European Economic Area (EEA).

No worries! Even if you're not an EEA resident, you can still join Admiral Markets as a trader. Just ensure you're at least 18 years old and successfully complete the KYC verification process. Once that's done, you should be good to go and enjoy their services, including the Admiral Markets Card. So, feel free to dive into trading opportunities with Admiral Markets!