Price Action strategy is one of the most popular trading methods in the world. These 7 successful traders here have uncovered their secret Price Action strategies and prove its powerful impact.

Without a doubt, Price Action is one of the most effective trading techniques that we can apply to any market conditions. Entry signals and confirmation tools are among the many benefits we can get from the Price Action strategy. For your information, many successful traders rely on Price Action in their trading systems, either for simple technical setups or the main strategy.

Of the many well-known traders who take advantage of the Price Action technique, here are the 7 most prominent who profit consistently with Price Action.

- Gary Wagner: Rely on candlesticks for the best Price Action strategy.

- Nial Fuller: Using candlestick patterns and technical indicators.

- Kim Krompass: Follow the trend and targets a 5-8% profit per month.

- Chris Lori: Focuses on Intraday Trading and uses Price Action purely as technical "assistance".

- Nick Shawn: Applies a screening of Candlestick Patterns on the H4 and Daily time frames.

- Darko Ali: Compiled a new system entitled ACAT (Advanced Candle Action Trading).

- Rayner Teo: Runs a trend-following method and likes to take opportunities in almost all market conditions.

These Price Actions traders have a very interesting way to conduct their trades. What can other traders learn from their trading strategy and methods?

1. Gary Wagner

Gary Wagner started trading in the financial market since the late 1980s. The core of his trading strategy revolves around Candlestick Pattern as a Price Action method. Initially, he did not understand the mechanism of Price Action. But Gary Wagner gradually "fell in love" with Candlesticks and even relied on it to analyze the market sentiment.

Gary Wagner is undoubtedly focused on perfecting his trading techniques with Candlesticks. He admits that using Candlesticks to find out had helped him make a lot of progress and profit consistently. Later, Wagner successfully developed an indicator called the Candlestick Forecaster.

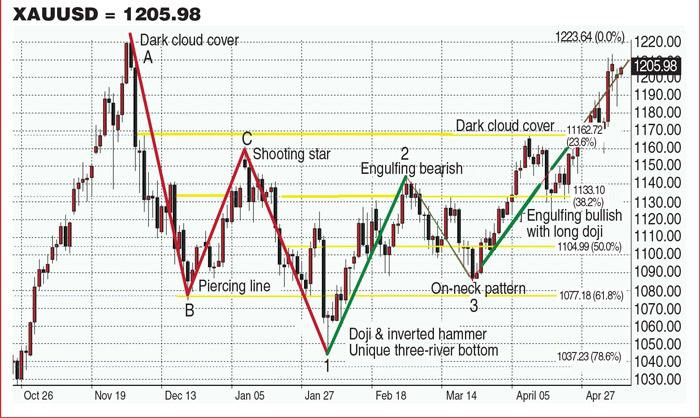

As a whole, Gary Wagner applies analysis with Triple Candlestick Patterns, which are then combined with Elliott Wave and Fibonacci levels as Support Resistance. He still regularly publishes this trading setup in TheGoldForecast[dot]com.

In the end, Gary Wagner emphasizes that chartists and technical traders are obliged to learn the Price Action mechanism. He confirmed that Candlestick is a mathematical expression of the psychology of market sentiment, and specifically called it an 'east indicator'.

He advised beginners to always learn before jumping into the real market.

"Beginner traders tend to be day traders, but that's normal. If you are a beginner trader, don't be lazy to learn to trade, if necessary take any course or education program to get adequate knowledge. If you jump into the real market it's like throwing yourself to a bunch of sharks. Do you know how big players or big boys play? They are very greedy. You need really sophisticated protection. Remember, the market is very fast changing. Your strength and stamina are very important if you want to survive," suggested Gary Wagner.

2. Nial Fuller

Most of the Price Action discussions we found in various articles nowadays could have been inspired by Nial Fuller. Yes, this guy shared a lot of Price Action trading strategies through his website, LearntoTradetheMarketdot com.

From the use of Candlestick Patterns to their combination with technical indicators, Nial clearly describes the application of Price Action analysis for practical trading.

The Price Action trading routine he implements is far from being complicated. Every day, he wakes up early to monitor the market and compile a trading plan, then set his trading positions according to the Price Action setup. Nial will then let his positions run and only monitor the transactions in the afternoon.

The setup he uses is fairly simple; Price Action formation around EMA 8, EMA 21, and Support Resistance. Nial Fuller uses the Daily time frame, but he can also go down to the H4 time frame to look for Price Action signals that are in line with the trend on the Daily chart.

See Also:

3. Kim Krompass

Not every technical traders are aiming for huge profits for each trade. For example, Kim Krompass was able to maximize the Price Action method to reap success with a target profit of only 8-12 pips per trade. Sounds absurd? Such is the strategy that was implemented by the trader who founded PATI (Price Action Trader Institute).

In carrying out her strategy, Kim Krompass uses a time frame of 50 minutes and sets a Risk/Reward Ratio of 1:3. She also tends to follow the trend and targets a 5-8% profit per month.

Most importantly, Kim also applies trading emotion management to know when to stop and not force herself to open positions when the market is extremely unpredictable. She feels like this is especially important for short-term traders because the frequent open positions easily trigger overtrading reactions.

One of her ways to maintain emotions while trading is to keep a balance between trading and her personal life. She always tries to find time to enjoy walking and socializing with her friends despite her busy trading schedule.

4. Chris Lori

Chris Lori is a successful trader as well as a mentor who has been trading since 2001. Similar to Kim Krompass, Chris Lori also uses a short-term approach as his flagship trading strategy. The well-known trader mainly focuses on Intraday Trading and use Price Action purely as technical "assistance". He even admitted that his trading chart was clean of all indicators.

For the day trading strategy, Chris targets a profit of between 10 and 35 pips, with the duration of the trades ranging from 5 minutes to several hours. For some reason, the former professional bobsled driver prefers GBP/JPY over any major pairs.

Even though he mostly applies Intraday Trading, Chris Lori is not necessarily aggressive in setting up his risk management. Instead, he keeps his risk on the conservative side, often at less than half a percent of his target.

According to Chris, this is the recipe for success for most professional traders; they do not pursue high profits to gloat about them in trading forums, but rather focus on maintaining risks. They believed that well-managed accounts last longer and gain consistent profitability in the long run.

5. Nick Shawn

If Chris Lori is a conservative trader, then Nick Shawn is his opposite. This trader openly admits to being aggressive in pursuing profits or determining risk limits. The Price Action technique that he relies on applies a screening of Candlestick Patterns on the H4 and Daily time frames, with a 1:3 Risk/Reward Ratio. He also targets a profit between 100-300 pips per transaction.

In determining his chosen pairs, Nick is not too picky. He can trade on any pairs, even XAU/USD where the risk calculation is slightly different. Even so, he still has his favorite pairs which include EUR/USD, GBP/USD, and JPY pairs.

Interestingly, Nick Shawn admits that he doesn't have a fantastic win rate. In an interview with TradingNut, the divergence analysis user confirms that his win rate is only 50%. His overall account is still profitable because he is disciplined in maintaining the Risk/Reward Ratio.

6. Darko Ali

Not only making Price Action a key factor in his strategy, Darko Ali also compiled a new system entitled ACAT (Advanced Candle Action Trading), which was developed from Candlestick Reversal Patterns and Support Resistance. After testing the system for 2 years, he concluded that the Price Action-based strategy could provide more opportunities than Chart Pattern analysis.

Just like Chris Lori and Kim Krompass, Darko Ali is a short-term trader. He also claims to be a naked trader who takes trading opportunities from price retests after the breakout.

However, the most interesting part of his pro tips is not about the most effective strategy or the likes, but about money management strategy which he considers as the Holy Grail of Trading.

Also, Darko believes that the mindset determines 80% of trading success. It's useless to have a system with a high win rate if the mindset is still profit-driven. That's because trading is a probability; if you can profit, then you can lose. Therefore, the mindset in dealing with losses is a powerful weapon to survive the rigors of the trading world.

7. Rayner Teo

Rayner Teo is the last world-class trader who includes the Price Action strategy in his trading setup. The Singapore-based trader applies Price Action as the confirmation signal before making an entry. Rayner Teo specifically armed himself with the Price Action technique to respond to False Break conditions that might occur around Support Resistance levels.

In general, Rayner Teo runs a trend following method and likes to take opportunities in almost all market conditions, both from trending and sideways conditions. He usually looks for breakout signals and confirms them around the Support Resistance area.

Important Points about Price Actions

1. The longer the market ranges, the harder it takes to break.

When the market ranges, note that the longer the Support and Resistance confine the price movements, the more valid these boundaries will be. From this principle, you can be more confident about making Support Resistance as a reference for opening positions, or setting the Stop Loss and Take Profit targets.

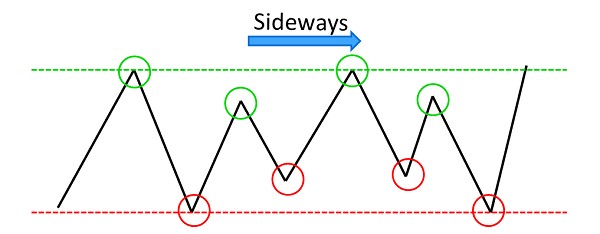

2. Sideways can still be traded if they are accompanied by a clear price range.

In this case, the price oscillates or moves within a fixed range between the Support and Resistance levels. To find out whether sideways conditions are worth trading or not, it can be observed by zooming out or seeing price movements on a higher time frame.

3. Watch for market volatility.

Low market volatility benefits traders because it usually makes the market easier to read. DailyFX research concludes that many traders profit from this condition, especially if low volatility occurs during the day.

This is because the Support and Resistance levels tend to be strong and consistent, thus smoothing the strategy of buying at Support or selling at Resistance, which is commonly called a pullback strategy or "buy low sell high". However, it is important to note that entries in very low volatility conditions should be avoided, for example during year-end holidays.

4. Use stop orders to trade breakouts.

Breakout is when the price breaks a key Support or Resistance. Many traders believe that they can get maximum profit from a strong breakout. If you want to trade on a breakout when the price falls, find the Support and the lowest level (Low) based on the time frame.

If the downtrend is strong, the price will form a new Low and confirm the trend continuation. The most effective entry in this situation is to use a sell stop order or sell below the current market price. The entry (sell) level should be determined below the current Low.

The opposite strategy goes for breakout condition during an Uptrend. You can look for the recently broken Resistance and the highest price in the time frame, then use a buy stop order to trigger an entry above the current price.

5. Know the price momentum.

Higher Lows that point to Resistance shows us a strong signal to sell. In this position, the buying power weakens while the selling power strengthens. When traders think the current price level is too high, they will tend to end the buying trend by executing profit-taking.

Conversely, Lower Highs pointing to Support means a weak signal to sell. This is because the selling power is weakening while buying power is getting stronger. Too much pressure on the bullish side will cause the price to strengthen up. As a result, when it touches the support, the price will increase rapidly.

6. Avoid trading at the exact Support and Resistance levels.

The best position for entry is close to the Support and Resistance levels. If you rely on Support and Resistance in forex, then you can buy when the price closes just above the Support.

Meanwhile, if you want to sell, make sure if the price closes below the Resistance level. Remember, don't put Stop Loss and Take Profit positions too close to your entry. It would be better if you increase the entry distance by placing your Take Profit positions higher.

7. Know the market volatility to set Stop Loss.

While most traders place Stop Loss just below the Support level and above the Resistance level, you should move away from this "zone" a little. You can set Stop Loss based on market price volatility.

In volatile market conditions, you need to set a bigger Stop Loss to avoid the risk of noise or price jumps during high volatility. Conversely, when market conditions are calm and the volatility is low, Stop Loss does not need to be set too far from your entry price.

8. Following the trend can result in bigger profits.

Trend following strategy is generally believed to provide more benefits in the long term if it is balanced with the ability to manage positions and good mental states. If you want to survive in forex trading, following the trend cycle is good, not vice versa.

If the trend is up, you can follow market movements by placing long positions. Conversely, if the trend is down, you can enter short positions. However, it would be best if you also learned how to confirm the continuation of the trend direction.

9. Use the limit orders.

A limit order is a pending order that is set above or below the current market price, depending on the direction you are trading. If you are trading Long (about to open a buy position), then you can open a buy limit order to enter below the current market price. If later the price moves down to the entry level you want, the buy order will be executed.

Conversely, if you are trading short (will open a sell position), then you can open a sell limit order above the current market price. If later the price moves up to the entry level you want, the sell order will be executed. With the help of a limit order, you don't have to look at your computer screen all day long to wait for the perfect price to enter a trade.

10. The best pullback is the first pullback after a breakout.

Many traders wait for a pullback as their entry signal, or when the price moves back in the direction of the trend after experiencing a brief correction. After the market ranges for a while, it is undeniable that the price may break the Support or Resistance. So, the best opportunity to enter in this condition is during the first recovery after the breakout.

11. Market movements cannot always retest at the levels you expect.

Some people expect the price to fall after rising some time, but in the forex market, the prices might continue to rise and eventually form a bullish trend. That's why you need to consider your trading positions carefully.

You need to look for a confirmation signal before making an entry by using other indicators or analysis methods such as Price Action, Price Pattern, etc. Or, you can always use the trading signals recommendations from external sources.

12. False Breaks can be profitable.

Pay attention to the Support and Resistance areas when the price seems to break the levels. If the price returns in the Support Resistance area after trying and failing to break the levels, you can enter by following the False Breakout movement. Price Action.

Time to Act

In conclusion, the 7 top traders above mostly rely on Price Action for short-term trading systems with small targets. Some of them have even built their entire trading system on Price Action methods, either by Candlestick Patterns or the price movement analysis around key levels.

It can be your trading inspiration as successful traders have proved that they can earn regular profits with Price Action. Also, make sure to practice a Price Action strategy in a forex demo account before using it to trade in the live account.

To be successful is not only a matter of utilizing the right strategy but also making sure that your forex broker supports your trading condition. To get the best knowledge on how to recognize the right broker, you can move on to How to Choose the Best Forex Broker.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

2 Comments

Alex

Jan 21 2024

Hey, I'm keen on understanding breakouts better. It mentions that a breakout occurs when the price breaches a significant Support or Resistance level. Traders often aim to capitalize on strong breakouts for maximum profits. If you're looking to trade on a breakout during a price decline, identify the Support and the lowest level (Low) based on the selected time frame.

First things first, what exactly are considered key Support and Resistance levels? The article emphasizes the importance of breakouts, suggesting they're crucial for determining optimal trading times and maximizing profits. Any insights you can share on this?

Herison

Jan 25 2024

regarding key Support and Resistance levels, these are essentially price levels where the market has historically shown a significant response. Support is a level where the price tends to stop falling, while Resistance is a level where it often halts its upward movement. Identifying these key levels is crucial because breakouts from them can signal potential shifts in market direction. For example, see this picture :

The article underscores the importance of breakouts, suggesting they provide valuable cues for knowing when to trade and optimizing profit potential. Breakouts essentially offer insights into potential changes in market dynamics, helping traders make informed decisions for more effective trading strategies. Hope it can help!