What are the CFD assets that you can trade? As there are many interesting opportunities are presented in the CFD market, here are the 4 types of CFD assets that you can get familiar with.

A contract for differences (CFD) is a financial derivative instrument that can be bought and sold in the financial market. CFDs are called derivatives because they are derived from the underlying instruments. They are like the mirror image of the real assets traded in different financial markets, and there is no delivery of physical goods or securities with CFDs.

CFDs are cash-settled but allowed to use margin trading, so investors need only a small amount of funds to trade CFDs in a bigger volume of transactions. CFDs allow investors to trade short-term available for both Long and Short positions and are especially popular in forex and commodities products.

Experienced traders may trade CFDs as a common thing. They can allocate funds into CFDs by using an advanced trading strategy. CFD traders may bet on the price moving up or downward. Traders who expect an upward movement in price will buy the CFD (Long), while those who see the opposite downward movement will sell the instrument (Short). The net difference between the buying and selling prices is then netted together, representing the gain or loss from the trades.

The main types of CFD assets available for trading are:

- Stocks

- Indices

- Commodities

- Bonds

To better understand the various CFD asset types available for trading, please refer to the following discussion.

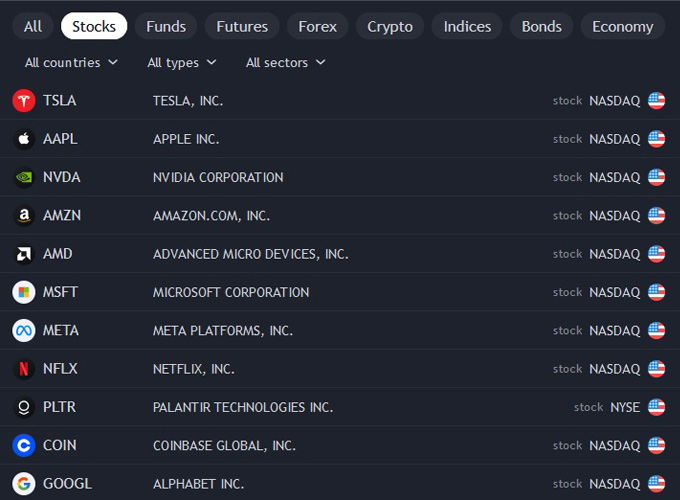

Stocks

A stock (also known as equity) is a security that represents the ownership of a fraction of a corporation. Units of stock are commonly known as "shares". The instrument is usually bought and sold on stock exchanges.

Trading stocks as CFDs are based on the movements of the stock price of underlying shares. It means you don't need to own the underlying shares if you trade stocks as CFDs. For trading stocks as CFDs, you need to open an account with a broker providing stock CFDs as the instrument.

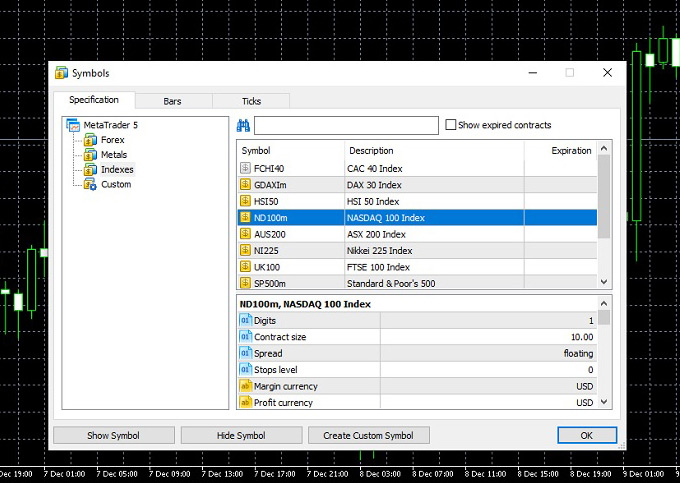

Indices

Indices or stock index typically measures the performance of a basket of securities. It captures the entire market, such as Dow Jones Industrial Average (DJIA), Standard & Poor's 500 (S&P 500), or more specialized markets, such as indexes that track a particular industry or segment.

The risk of trading index CFDs is lower than stock CFDs. It may be related to the pattern of price volatility in both markets. However, index CFDs are leveraged to provide a cheaper option for traders. That is why CFD trading is riskier than trading the underlying asset.

See Also:

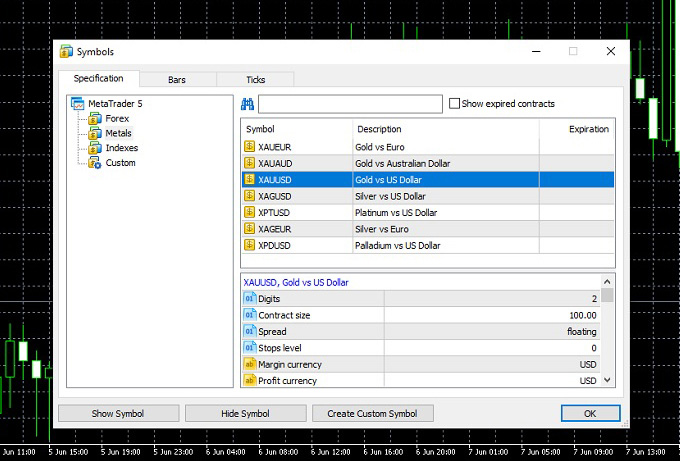

Commodities

A commodity is a basic good used in commerce that is interchangeable with other goods. Many investors diversify their portfolios into commodity markets during periods of stock market volatility. Commodities traded in the financial market are typically divided into four categories: metal, energy, livestock and meat, and agricultural.

The CFD version of commodity trading is based on price changes in the underlying commodity markets. For example, if you trade gold CFD, you track the precious metal's price changes without having the asset.

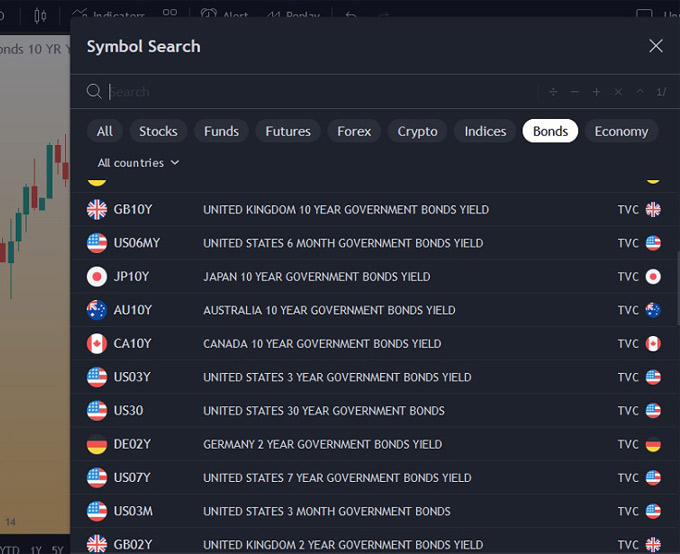

Bonds

A bond is a fixed-income instrument that represents a loan made by an investor to a borrower (typically corporate or government). Bonds are used by companies, states, municipalities, and sovereign governments to finance projects and operations. There are a principal and interest that the borrower must pay to the bondholder.

CFDs can be traded on bonds, in which the aim is to seek benefits from the price changes. Thus, a bond CFD trader does not participate in giving loans to the bondholder, so they will not receive the yield from the bond.

All in all, CFD assets are essential for traders looking for the advantages of simple and short-term trading in markets with complex transactions. By predicting price changes in said markets, CFD traders can profit simply by executing positions in the trading platform.

They need to analyze the price movements, looking for entry and exit positions at the right moment, and they will get profit from the price differences from which they enter and exit the trade. This simplicity has garnered many followers in recent years, so it is no wonder that the number of brokers offering CFD trading keeps increasing.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

2 Comments

Garfield

Apr 19 2024

As a newcomer, I'm still trying to wrap my head around CFDs. From what I gather, they're financial tools bought and sold in markets, deriving their value from underlying assets. Unlike tangible assets, there's no physical exchange involved with CFDs; they simply reflect the performance of real assets in different markets.

But here's the crux: Is it even legal to trade this way? I mean, you're essentially betting on asset values without owning the assets themselves. How does this differ from, say, investing in bonds, which have inherent value? As a beginner, which option is safer and more advisable for me?

Evans

Apr 23 2024

Hello! About The legality of trading CFDs depends on where you're located and the regulations in your area. Generally, they're legal in many countries, but it's crucial to know the specific rules that apply to you and your perspective view about the CFD itself.

Now, comparing CFDs to traditional investments like bonds, it's like weighing risk against safety. CFDs can bring big rewards, but they're also riskier due to leverage. Bonds, on the other hand, are seen as safer bets with steady returns, even if they're not as flashy as CFDs.

For a beginner like yourself, it's smart to start with safer options like bonds. As you learn more about CFDs, you can dip your toes in, but always remember to do your homework and never invest more than you can afford to lose.