Scalping is one of the most popular trading methods in forex trading. Read further to learn about the best scalping strategies on the 5-minute chart.

Scalping is one of the most popular trading strategies that have been around for a long time, in which traders basically execute buy and sell orders multiple times a day. Traders who use this strategy are called scalpers, and they can open more than 10 trades in a single day. The goal is to take advantage of small price movements throughout the day. Therefore, scalpers don't look for big profits. Instead, they want to pile up many small win trades to make a generous income.

Since scalpers could open several traders in a very short period of time, it's important to maintain the winning consistency. To get maximum profit, they must enter and exit the trade in a matter of minutes or even seconds. Precise timing and the ability to think quickly are essential in scalping. Today, we're going to present several top scalping strategies that make use of the 5-minute chart.

Contents

Scalping with Bollinger Bands

Bollinger bands is a quite popular trading indicator that's often used in technical trading. The indicator consists of three bands, namely the upper band, middle band, and lower band. These bands move along with the price movement and are used to inform the asset's volatility, whether it's rising or falling. The distance between the three bands is measured by volume. So, the greater the volume, the wider the distance of the bands.

There are several advantages of using Bollinger Bands for scalping. For instance, it works well even in non-trending markets.

Here are the main guidelines for using Bollinger Bands to scalp in a 5-minute chart:

- Once you place the indicator on the chart, you need to find a ranging market, which is usually shown by flat or almost flat Bollinger Bands. In this strategy, you don't need to wait for a huge price swing to open a trade.

- Watch the price movement closely and wait until the price touches the upper band or the lower band. This shows that the price might reverse, giving you a perfect opportunity to enter the trade. During a downtrend, wait until the price touches the lower band and then open a buy position. Conversely, if the market's in an uptrend, wait until the price touches the upper band to open a sell position.

- Place a stop loss 10 pips from the entry price. If it's a buying trade, place the stop loss below the entry price, and if it's a selling trade, place the stop loss above the entry price.

- Close the trade when the price touches the opposite band (the upper band for a buying trade and the lower band for aselling trade). Since you're using a short-term chart, usually it won't take long for the price to reach the exit point. Therefore, make sure you watch the chart closely so you won't miss the signal.

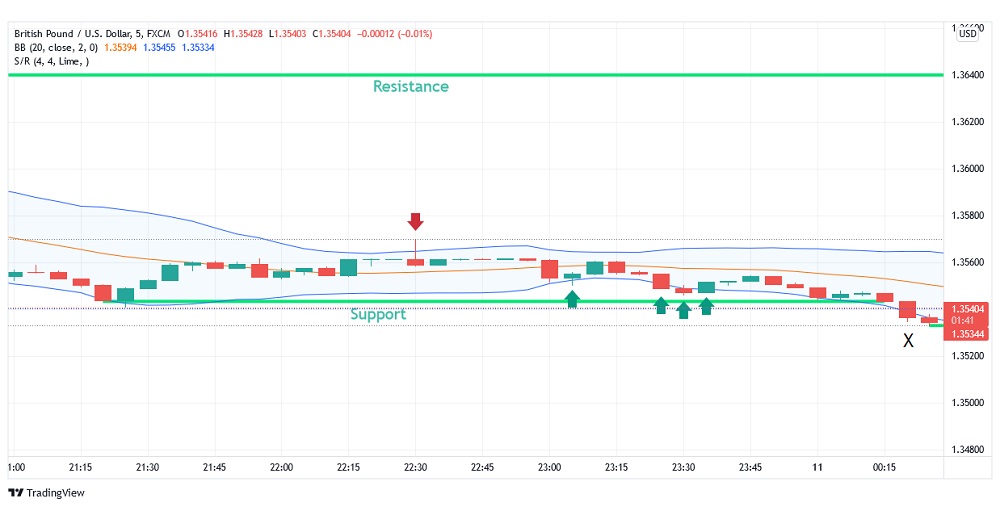

Let's take a look at the chart below.

From the 6 possible entry points, we can see that there are 5 winning trades and 1 losing trade. The losing trade essentially happens because the volatility is increasing (shown by the expanding Bollinger Bands) and the price breaks out below the support level instead of reversing.

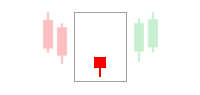

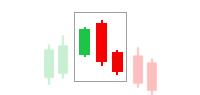

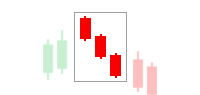

In order to avoid this scenario, it would be helpful if you use other indicators aside from Bollinger Bands, like Moving Average or Stochastic Oscillator. In addition, it's also a great idea to learn about reversal candlestick patterns to confirm the signal. If you spot a reversal pattern, then there's a higher chance that the market will reverse.

The 5-Minute "Momo" Trading Strategy

The next strategy that we're going to talk about is the "momo" or momentum trading strategy. As the name suggests, the strategy helps the trader to find momentum bursts on short-term (5-minute) charts. There are two indicators used in this strategy, namely 20-period Exponential Moving Average (EMA) and Moving Average Convergence Divergence (MACD).

The strategy uses EMA instead of Simple Moving Average (SMA) because EMA puts more weight on recent price movements, which is crucial for fast momentum trades. In short, the EMA indicator is used to identify the trend and the MACD is used to measure the momentum. The combination of the two makes a great strategy for scalping.

The idea of this strategy is to wait and enter the trade only when there's a reversal opportunity that's followed by a momentum big enough to create a large extension burst. In order to exit the trade, traders must close in two separate segments:

- To lock in profits and ensure that the trade is winning.

- To maximize profits with small to no risk because, at this point, the stop loss has been moved to the break-even level.

Buying Rules

- Look for an asset price that starts from below the 20 EMA and ends up going above the 20 EMA line. When that happens, make sure that the MACD indicator is either in the process of going from negative to positive or has moved into the positive area within the last 25 minutes.

- Open a 10-point buy trade above the 20 EMA line.

- For a more aggressive trade, you could place the stop loss in the last swing low. But if you wish for a more conservative trade, place the stop loss around 20 points below EMA.

- Once the price increases a few points (the entry level plus the amount risked), close half of your trading position and move the stop loss of the remaining to the break-even point. You can also adjust the stop loss to the newest 20 EMA value and subtract it by 15 points.

Selling Rules

- Look for an asset price that starts from above the 20 EMA and ends up going below the EMA line. When that happens, make sure that the MACD indicator is either in the process of going from positive to negative or the histogram has not yet formed 5 bars in the negative area.

- Open a 10-point sell trade below the 20 EMA.

- For aggressive traders, simply set the stop loss in the last swing high level. For conservative traders, place the stop loss around 20 points above EMA.

- Once the price drops a few pips (the entry level minus the amount risked), close half of your trading position and move the stop loss to the break-even point. Other than that, you can also move the stop loss to the newest 20 EMA value and then add it by 15 points.

Learning the Risks

Momo trading strategy can be extremely helpful to find momentum-based trading opportunities. However, as with any other strategy, it also has some notable risks and doesn't always work the way we expect it to be. Therefore, we need to assess the possible scenarios that might happen and understand how to manage them in the future.

Such an issue could come up because of the price range. When using the 5-minute Momo strategy, it's important to be aware of a price range that is too narrow or too wide. When the market is quiet, the price typically only fluctuates around the 20 EMA and the MACD histogram moves sideways, so there might be a lot of false signals.

On the other hand, if the strategy is used in a market with a trading range that's too wide, there's a high chance that the stop will be triggered before the target is reached.

See Also:

Summary

From this article, we've learned that there are at least two strategies that you can use to scalp on short-term (5-minutes) charts. Scalping can be a great choice to improve your trade as it can minimize your exposure to losses and help you generate profit even in the flattest markets.

However, if you're looking for a strategy that could give you a million bucks overnight, then this trading method will leave you disappointed. Quite the contrary, scalpers need to be able to accept small gains, control their emotions while trading, and maintain consistency in the following trades.

That being said, if you plan to try these strategies and become a scalper, make sure to weigh the risks and do backtests in a demo account before putting real money into it.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

2 Comments

Ferra

Jan 13 2024

I'm a bit puzzled here. As a novice, I'm inclined towards faster trading and quicker profits. The article suggests that Scalping could be an excellent choice to enhance trading, minimizing exposure to losses and enabling profit even in sluggish markets. However, on the flip side, it outlines the drawbacks of adopting scalping as a strategy. It mentions that scalpers must be comfortable with small gains, manage their emotions during trading, and consistently execute trades.

I'd like to inquire about a few things. First, is it advisable for beginners to venture into scalping? Second, what are the risks associated with scalping? Lastly, regarding emotions, how can one effectively control them while engaged in scalping? Thank you.

Heru

Jan 17 2024

Good Question! As a beginner, the choice to delve into scalping depends on individual preferences, risk tolerance, and the ability to handle the fast-paced nature of this trading strategy. While scalping can offer quick profits and minimize exposure to losses, it also comes with challenges that might be more demanding for those new to trading.

The risks associated with scalping primarily revolve around the need for precision in execution. Since scalpers aim for small gains, transaction costs, and slippage become significant factors that can erode profits. Additionally, the market's volatility during short timeframes may amplify the impact of emotional decision-making.

Controlling emotions in scalping requires discipline and a well-defined trading plan. Beginners should focus on:

Risk Management: Clearly define risk per trade and avoid over-leveraging positions.

Consistency: Develop and adhere to a consistent trading strategy to avoid impulsive decisions.

Practice: Use a demo account to practice scalping strategies before engaging in live trading.

Mindfulness: Stay aware of emotional triggers and implement techniques like deep breathing or taking breaks to maintain composure.

NB: recommended article to read :

Tips for Controlling Trading Psychology by Norman Welz

Forex Scalping Books for Aspiring Traders