Is your broker trading against you? To answer your doubts, here are some crucial signs to find out the truth and what type of broker you should choose.

As a trader, picking an honest broker for trading is crucial. It might be challenging, especially if you're a newbie because there are many unregulated brokers in the market. So, you need to gain as much knowledge as possible about this.

There are various qualities that you would want to find in a broker. Some of the essential things are the safety and reliability of the broker itself. You must know that in forex trading, a broker can choose to trade against their clients.

Most brokers tend to trade by holding the opposite position to their clients. However, the exact mechanism may vary from one broker to another. What matters most is identifying the kind of trade system you will work with before choosing the broker.

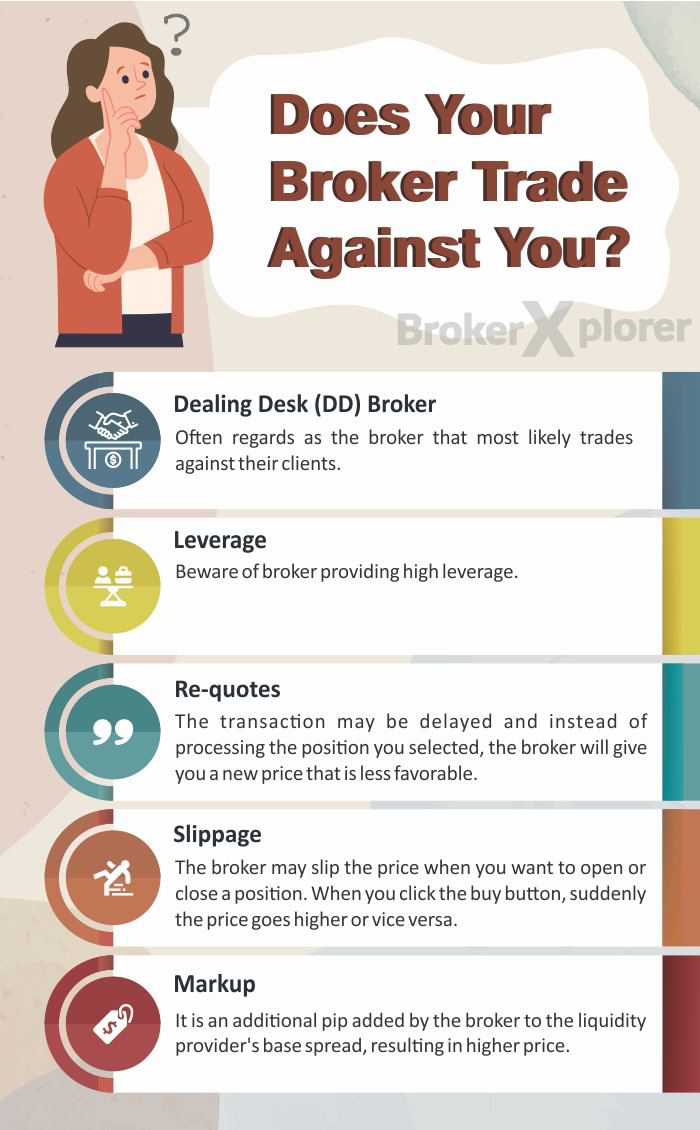

If you are suspicious about your broker, check out these factors:

- The broker's type: If your broker is a Dealing Desk, they tend to trade against you.

- Leverage: Untrusted brokers tend to offer extremely high leverage for new traders.

- Requote: There are too many requotes happening with this broker.

- Slippage: The broker may slip the price when you want to open or close a position.

- Markup: The price offered would be higher than the quoted price.

So, what is the reason? This article would talk about how to find out if your broker is trading against you.

1. Your Broker is a Dealing Desk (DD)

This type of broker is usually regarded as the broker that most likely trades against their clients. A Dealing Desk broker (also known as Market Makers) sets both the bid and asks prices on their systems and makes transactions at these prices with their clients. By doing so, the broker acts as the liquidity provider of the market.

This broker type is also sometimes called a B Book broker. To generate income, Dealing Desk brokers would charge spread to their customers. Spread is the difference between the ask and bid price and is often fixed by the market maker. Usually the spread amount is usually quite reasonable due to tough competition with other market makers.

Moreover, as counterparties to each forex transaction in terms of pricing, Dealing Desks must take the opposite side of the trade. So they must buy from you whenever you sell, and vice versa. In other words, they are trading against you, and your losses are often equal to their profits.

As a result, the market maker model generates a conflict of interest between brokers and their clients. There's a common perception that traders feel unsafe when trading with Dealing Desk brokers because they're concerned that they will be subjected to some tactics that could only profit the broker and make them lose the trade.

The easiest way to figure out a broker that would trade against you is by asking them directly about their dealing system. However, this method is rarely effective because they typically only give a vague answer.

2. Offering Extremely High Leverage

Leverage is a great way to help small traders make big trades, but many forget that leverage is extremely risky. By taking the leverage, they basically open a huge position that would cost them a lot if they lose the trade.

In this case, forex brokers, especially market makers are typically aware that most newbies are inexperienced, and there's a high chance that they're going to misuse the leverage. Thus, they usually offer high leverage to attract new clients.

In other words, many market makers are using high leverage as a part of their marketing offers. They'd invite you to take a lot of risks, knowing that it's not a good move to do especially if you're starting. Generally, NDD brokers connected to liquidity providers cannot offer leverages more than 100:1. Meanwhile, market makers can offer any leverages they want so keep an eye on that.

3. Too Many Requotes

Requoting is another trick that market makers might use to trade against you. Sometimes, when the market is going up strongly and you choose to buy, the transaction may need a few seconds and instead of processing the position you opened, the screen will give you a new price that is less favorable than the price you wanted to enter.

Similarly, when the price is going down significantly, and you chose to go short, it might not let you enter immediately. This is called re-quoting and it's certainly not profitable for traders. Simply put, the broker is not allowing you to go with your ideal position because your loss is their profit.

4. Suspicious Slippage

Another thing to consider when choosing a broker is the possibility of slippage. In this case, the broker may slip the price when you want to open or close a position. The price suddenly increases when you click the buy button, so you enter the trade with a higher price. Getting big slippages is not great because you get smaller profits with winning positions and lose more with losing positions.

In order to avoid this, you can choose a broker based on this feature:

- Check execution speeds

- Test with the demo account

- Choose a well-regulated broker

- Check for upcoming economic events

5. Marking Up the Price

NDD brokers like ECN and STP should directly transfer the orders traders give to the liquidity providers. Similarly, these brokers should also directly pass on the quoted price from liquidity providers to the clients. These brokers can charge a fixed commission for every transaction to generate income. However, some brokers may use a trick to increase their profit by adding markups to the price.

Markup is an additional pip the broker adds to the liquidity provider's base spread. So, the price offered would be higher than the quoted price from the liquidity provider. In this case, it's best to avoid brokers that add markups to their client's transactions. However, since the practice is quite common, brokers with reasonable marked-up prices are still worth considering.

Bottom Line

The type of broker that you pick can significantly impact your trading performance. This article shows that it's quite common for DD brokers to trade against their clients and earn profit from it. There are several methods that they can use that generally favor them and not the clients. If you're new to forex trading, you should be aware of different ways used by brokers to trade against you.

However, it's also worth mentioning that market makers can offer an excellent opportunity with their high leverage and various trading instruments. Trading in such conditions can be profitable if you're an experienced trader with great control over your actions.

That is why trading with a DD broker is not always a bad choice, because it depends on your trading skills, goals, and needs. However, whatever your choice is, seek a genuine broker you can trust to help you achieve your goals.

If you think your broker trades against you, always watch for these four signs:

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

2 Comments

Edmon Nunez

Jul 12 2022

It's a good thing that BROKER XPLORER existed, otherwise most of us new traders would be at a loss. Thanks very much and continue the good work. i highly appreciate the informations you are sharing.

Emmanuel Babayemi

Jul 21 2023

Very Educative Thank you for Explaining in Details