Although existing only in a small number of brokers, fixed rate is a useful feature for any trader. Here are the benefits of using fixed rate from brokers.

Before opening a trading position, traders must register in a broker, open a trading account, and deposit some funds. Even though it doesn't necessarily affect the outcome of the trade itself, but the process of deposit and withdrawal should not be underestimated. In fact, it should be one of your top considerations when it comes to choosing a forex broker.

As two of the basic features offered by a broker, deposit and withdrawal can be an early indicator to determine the broker's commitment to supporting their clients. If such a simple matter is already problematic, what about the rest of the features?

Almost all leading forex brokers offer great deposit and withdrawal features. Usually, a good forex broker would offer a wide range of payment methods ranging from the most traditional options such as wire transfers to the more advanced choices like e-payments. Not only that, the process of deposit and withdrawal itself should be straightforward and has no complicated requirements.

To further accomplish a good experience in deposit and withdrawal, some brokers offer a fixed rate feature. How does it make any difference to forex trading?

To answer the question, here is the list of 3 benefits of forex brokers' fixed rate feature:

- Simplifies deposits and withdrawals calculation

- Flexible

- Minimizing the spread risk in transactions

But, is it more profitable? Let's check the answers below.`

The Benefits of Fixed Rates

Fixed rate in forex brokers is one of the additional features that basically refer to the deposit and withdrawal rates set at a certain level. To put it simply, when making deposits and withdrawals, the currency exchange rate will always be the same (fixed). Here are the benefits of fixed rate:

1. Makes It Easier to Calculate Deposits and Withdrawals

Normally, traders must use exchange rates when depositing or withdrawing funds. Most forex brokers would require traders to deposit or withdraw in US Dollars as it is the most stable and standard currency at the moment. Therefore, traders who don't use US Dollars must use the exchange rate and calculate the amount of money needed for the transaction.

As the currency exchange rate itself changes all the time, your deposit amount will not always be the same.

For instance, with AUD/USD exchange rate of 1.36, you would need to spend USDD 136 if you want to deposit AUD100 in your trading account. At other times, the USD may weaken to 1.38. Since you need to deposit another AUD100, then you have no other choice but to deposit USD138. Such condition can be hard for traders because they would have to calculate the exact amount needed before depositing and decide when is the best time to deposit.

However, you won't encounter such a problem if you use the fixed rate. With this feature, the broker will determine the standard rate for deposit and withdrawal. Let's say the standard rate is set at 1.35 USD per AUD1. Then it means that whenever you deposit your money, the exchange rate will always remain the same. If you want to deposit AUD100, then you will need USD135 no matter the actual exchange rate at the time.

The same concept applies to the withdrawal process. If the broker doesn't apply a fixed exchange rate, then the withdrawal amount will fluctuate depending on the current rate. Thus, you would have to calculate the end result from time to time. The profits that you get can't be wholly realized when the exchange rate is not in your favor. On the other hand, a fixed rate would allow you to withdraw funds at the same rate at any time. Your withdrawal amount would no longer be affected by market fluctuation.

2. Offers Flexibility

Just because the rate used by the broker is always the same, doesn't mean it limits your movements and makes forex trading less flexible. Quite the contrary, fixed-rate actually offer more flexibility because you can make deposits and withdrawals at any time without worrying about the changes in currency exchange rates.

Profit and loss are essential to most forex traders. So they are usually very precise when it comes to calculating how much they earn or lose in a trade. This also means paying much attention to the dynamics of the currency exchange rate that they use, whether the currency is strengthening or weakening when they make deposits or withdrawals. Therefore, there's a time barrier that limits their decisions in forex trading.

Imagine your trading account really needs an extra deposit when the currency is weakening drastically at that moment. You might have to postpone it until the currency value goes back up again. The same dilemma occurs when the currency is strengthening, but you need to withdraw your funds. You might end up postponing it too even though you actually need the cash.

Realize it or not, the fluctuations in currency exchange rates greatly affect your forex trading freedom. This usually won't bother many traders because most of them are used to the standard trading system, not the fixed rate. But now that there is an option to use fixed rate in certain brokers, making deposits and withdrawals are even easier than before. You can deposit or withdraw your money at any time with no limitations and concerns.

3. Eliminating the Risk of Transactions Spread

The difference of exchange rates would automatically create a spread. Keep in mind that this is different from the forex trading spread. While the forex trading spread refers to the difference in the bid and ask price, the deposit and withdrawal spread refers to the difference in the deposit and withdrawal rate.

So let's say that the deposit rate in USD/AUD is AUD1.33 and the withdrawal rate is AUD1.38, you will automatically pay for the AUD0.05 difference for every deposit and withdrawal you make, multiplied by the amount of money you use. If your deposit is USD100, then you would have to pay a USD5 spread.

The situation would be different in fixed rate brokers because the deposit and withdrawal rates are always the same, so there's no spread that you need to pay. For example, if the broker determines that the rate is 1.35 AUD per $1, this rate will be used to deposit and withdraw. You won't have to worry about spreads anymore.

Broker With Fixed Rates

Despite its benefits, it is unfortunate that not many brokers offer a fixed rate for their clients. The reason is it might not be as beneficial for brokers because they have to bear a higher risk when the exchange rate is unstable, increasing the broker's chance to go bankrupt from covering traders' losses in exchange rates.

Still, a few brokers have managed to provide fixed rate based on its attractiveness to new clients:

1. InstaForex

InstaForex is well-known for its accommodative trading conditions since its establishment. In fact, it's one of the first brokers offering fixed rate accounts around 3-7 pips, so you don't have to worry about an uncontrollably high spread when the market is extremely volatile during news releases.

2. FBS

FBS started its operation in 2009 and has since added fixed rate feature which starts from 3 pips. Unlike InstaForex that offers fixed spread on two types of accounts, FBS activates this feature only on their micro account.

3. FirewoodFX

FirewoodFX also offers fixed rate features in all accounts, which can be beneficial for news traders because they need to protect their equity when the market is unstable during news releases. The micro and standard account offer a minimum deposit of $10 and a fixed spread that starts from 3 pips and 2 pips respectively.

The Bottom Line

While it seems simple, exchange rates in deposit and withdrawal can make a huge difference in your trading experience. If you're the type of trader that likes to make deposits and withdrawals frequently, you might have to thoroughly think about the best time to do it to get the best rate possible.

But with a fixed rate broker, you won't have such issues anymore because the rate always stays the same both for deposit and withdrawal. You can request a transfer at any time without worrying about the exchange rate and additional costs. However, bear in mind that you might not find this feature in any broker. Only a small number of brokers actually offer fixed rate, so make sure to check it carefully.

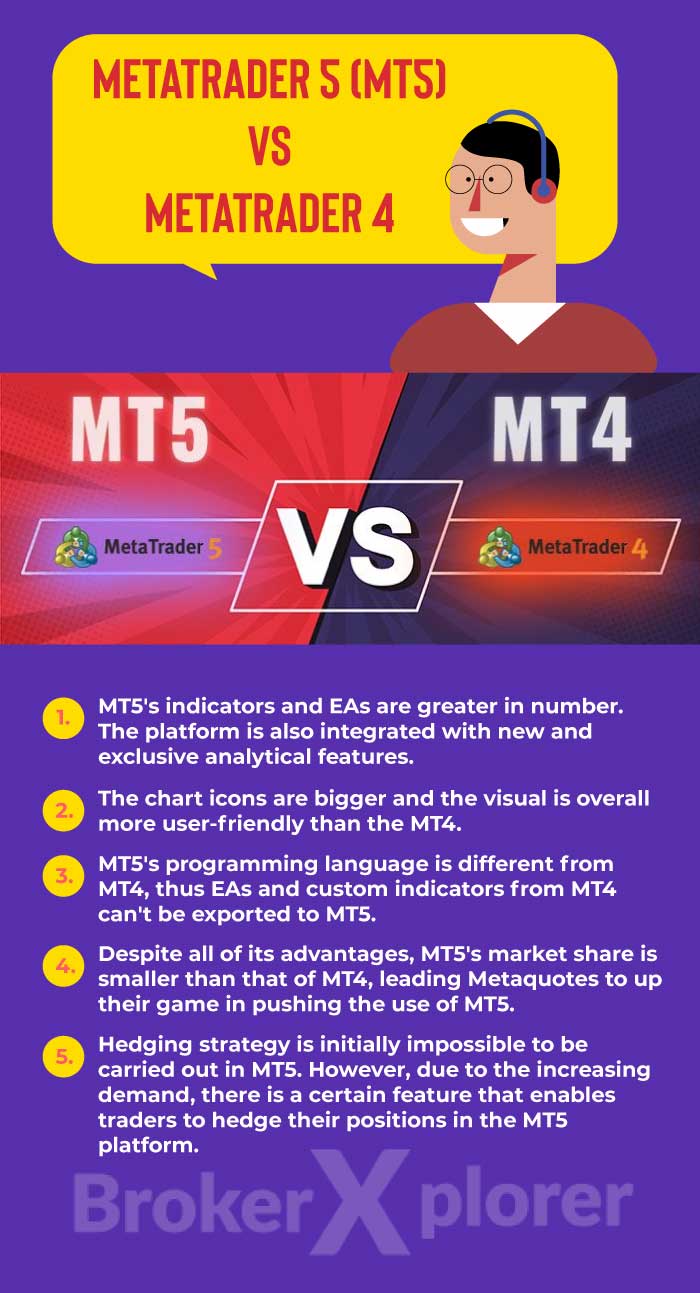

There are two kinds of spread in forex brokers: fixed spreads and floating spreads. So, what's the difference between fixed spreads and floating spreads in forex brokers?

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Anita

Jan 24 2023

Thanks to the author, I really understood why there is variable spread and fixed spread. And based on the above article, the fixed spread is not affected by any market fluctuations, so no matter what, my fixed spread will always be the same, right?

Look, I'm a novice who needs to know my own trading conditions; deposits should be low, and fees should be controlled and one of them is fixed spreads. I mean, is it safe for me to choose fixed spreads instead of variable spreads, right? And what about the trading style that I need to learn with this spread, by the way? I have heard some trading style may be not suit to the type of spread.

Jojo

Jan 24 2023

Dude, I think you should know that spreads and rates are different.

In this article, it is a about fixed rate and not spread.

about your question about the fixed spread is not affected by market fluctuations, it is right, but in some cases it will also be wider.

I think you need to read the article about spreads and remember that rates and spreads are different. Spread is the difference between the bid and ask prices, while the exchange rate is the value of one currency against another.

Nick Saint

Jan 24 2023

I have a question about fixed rate. So, I lived in Indonesia where $1 = Rp 15,600, - If I use fixed rate to deposit, of course I will get lower deposit if fixed rate is $1 = Rp 10,000. So, if i deposit 100$, if i use variable rate i have to deposit 1,560,000 Rp while if i use fixed rate i get 1,000,000 Rp. The difference between a variable rate deposit and a fixed rate deposit is about $50!

This is obviously very help trader to reduce their amount of money to do the trading Forex. But, the question is how about withdraw money? if I use the same example, but "deposit" becomes "withdraw", I will lose about $50, right?

To avoid this, can I change my fixed rate to variable rate?

Edward Alonso

Jan 24 2023

Nick Saint : good question mate, even though the article says something about spreads, I think the spread doesn't affect our withdrawal at all. The spread can be acquired, but not much as the difference between fixed rate and floating rate, I believe.

If you look from a withdrawal perspective, you will find that the fixed rate gives a lower rate than the variable rate. I agree with you, the trader will feel a loss if the floating rate is higher. If you can get $50, why not to use floating rate instead? But for some traders, a fixed rate can be a good choice for those with little money to trade or for traders who no longer want to count. In their mind, if I earn money, I won't think about when to do withdraw because of low floating rate.

And the question that you can change from fixed rate to floating rate? I don't think the broker will allow this because you are actually depositing less than necessary, are you? And the Forex market actually uses floating rates, I think when you deposit with a fixed rate, the brokers will bear the whole rest of the insufficient deposit.

Aaron Calagher

Jan 24 2023

Edward Alonso and Nick Saint : I think you have to try trading with floating rate first. For some traders that trade with floating rate and after that prefer to trade with fixed rate, it is not about difference, loss and profit. A lot of things about exchange rates need to be reviewed, and since Forex is a very risky market, avoid risk-taking is essential.

So, the fixed rate option would be the best choice for beginners and advanced brokers who don't want to add extra risk to their account. Thus, they will no longer think about today's rate or tomorrow's rate. As the article said, flexibility and risk of transaction fees. These two main factors in my opinion are very important, why choose a fixed rate instead of a variable rate. It's like choosing a fixed spread instead of a floating spread.

Remember : all in the forex is about minimalize risk first. Don't be greedy and stay to head cool.