Forex Profit Taking is no science. By that, you can't expect it to work with 100% accuracy all the time. Even so, you'll need these guidelines to wrap your head about how to profit-taking works.

Profit-taking is the core achievement of Forex trading. Simply put, it's like how you maintain the "meat" of your equity. No matter what your trading method, system, or experience is, that one final moment is always true.

Yes, that moment when you ask yourself these questions after closing a position: "Do I make enough profit to keep trading?" "Is it worth it?" "Shall I open other positions?" "Or shall I stop trading?"

Well, I'll be frank, no one can answer those questions better than yourself. But, before you can get your shtick at it, you have to learn some few Profit Taking basics.

See Also:

3 Best Methods To Improve Your Profit Taking

If you haven't figured out how to improve profit-taking yourself, then this is a good start for you:

Secure the Profit with Taking Profit and Stop Loss

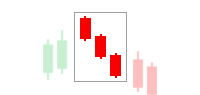

Yes, you can secure your gains with both Take Profit and Stop Loss. Those basic functions can help you to lock profits during volatile market conditions.

Limit and Diversify Your Capital Exposure

Have you heard this proverb; "don't put all your eggs in a basket"? That piece of advice holds some valuable truths, especially in financing. Even though Forex trading promises huge returns (if you win), you should be more careful about your risk for it.

For all that it may offer, you're basically risking your capital whenever you open a trading position. That's why you need to measure how much risk you can take for each position.

To do so, you'll need to learn position sizing. With the help of it, you can set up a trading lot according to your allowance.

Here's the formula: Risked amount (pips range 1 pip worth at 1 volume) = recommended trading lot size.

So, let's say you'd allow about $200 per position on EUR/USD, and you think it's safe to trade within 50 pips away. So it's 200 (50 pips USD 10)= 0.4 lot. With that result, you should open a position with only 0.4 lot and 50 pips Take Profit target.

Second, don't allocate all your trading capital on a single account. You can't ever tell when and how the Forex market will remain profitable.

Consider distributing your money on other productive financial instruments such as; stocks or commodities CFDs (contract for differences).

Know When To Hold 'Em or To Fold 'Em

Entry and exit strategy is never an easy thing to pinpoint. On one occasion, you may make early entry and then exit (close) the position just before it collapses under its own weight.

Therefore, you become the early bird that gets all the juicy worms. While on another, you may end up with late entries, barely turning profits, if any.

But there's a tool to help you ease this profit-taking process by a lot. It's called Fibonacci retracement lines. Here's how it works:

You see, the price retraced on particular Fibonacci turning points, which is at 0.786. What it does mean is, when the price "weakened" to 78.6% of the previous trend, the market slung back up again.

Profit-taking is best as you enter a trade when the price is moving to certain Fibonacci "threshold". Try waiting for the price action to hit either 0.618 or 0.768 Fibonacci points and then close the position once it's spotted near resistance or support limit.

Profit Taking Is Only Half The Part Of This Game

George Soros, the legendary Forex trader, once said, "It's not whether you're right or wrong that's important, but how much money you make when you right and how much you lose when you're wrong".

What he said is true, profit taking is only half the part of the game. Managing the risk of loss is also important. With that in mind, learning Stop Loss is also crucial.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance