Jan 22 2020 11:24

@Zendaya, as far as I know, scalping is a term for people who trade using short term strategy, usually, they called as Scalper. They are the type of trader who is never holding his position for too long. Usually, nothing is more than 1 day. Even in 1 day, you can open a position several times, because each position is already profitable, it is usually closed immediately without considering the maximum profit potential.

In general, scalping does not require a large trading size, so the profit collected is not too much. It could be a lot if more and more trading positions are opened. Hence this is also risky. But if done with risk management, it might reduce the potential losses.

Jan 23 2020 06:20

What pairs are most suitable for scalping? and what time is the safest trading time?

Jan 24 2020 01:56

@Martin Alarcón, All pairs are suitable for scalping. But be careful, if you are a newbie don't enter into pairs with high volatility, especially GBP/USD and GBP/JPY.

Trading hours suitable for scalping is usually in the Asian session and before and after the New York market closes. During these hours market volatility is relatively low. Avoid the time that high impact fundamental data will be released, a central bank press conference, central bank official speeches, or other high impact events.

Jan 25 2020 10:33

@Anya Watson, I have tried scalping strategy as you suggested, but how come I waited for a long time for a buy/sell signal. I traded as your suggestion time, it is on the Asian market. My question is, is there something wrong with the indicator or anything else? Thank you

Jan 26 2020 11:41

@Martin Alarcón, this is one of my strategy when I do scalping.

If the currency pair you choose is slow, look at other currency pairs including the cross currency pair (not the one versus the USD). Among the many currency pairs, there are certain movements that are quite volatile. You can also create a template with indicators, then attach it to each pair that you observe, choose which pair has fair volatility, and can be traded.

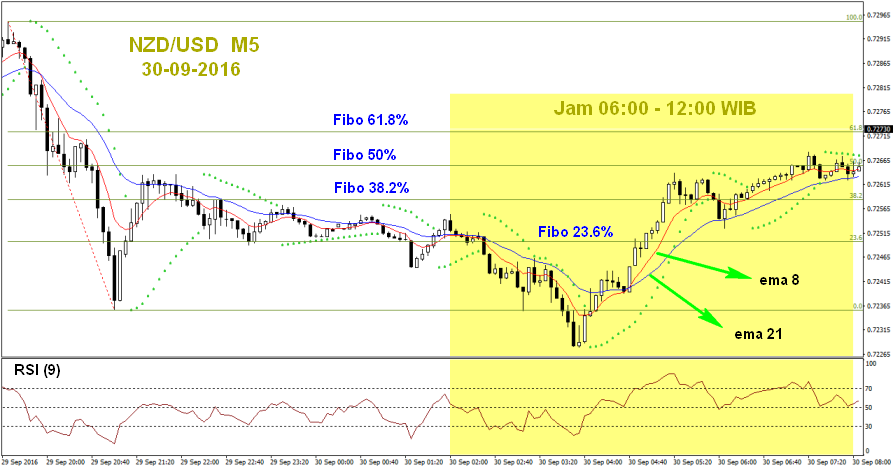

The indicators used are mainly the exponential moving average (ema). You can try using ema 8 and ema 21, parabolic SAR (default setting), and RSI with period 9. For more detail, you can take a look below:

The priority for making decisions is on the ema 8 (red) and 21 (blue) curves. If the ema 8 curve is above ema 21 then open buy and if ema 8 is below ema 21 open sell. Parabolic SAR and RSI indicators for confirmators. RSI above 50.0 level: buy, below 50.0: sell. Determination of resistance and support levels can use Fibonacci retracements from the nearest high and low levels.