Mar 5 2019 11:03

Hi Isaak Leon,

Brokers who provide swap (-) and (+) are applied to floating currency trade positions for more than 1x 24 hours.

Positive and negative interest is determined by the type of your transaction (Buy or Sell) and also the interest rate of the currency of the country concerned, so if there is a change in the interest rate of a country it will also result in this overnight interest change. For this overnight interest calculation, please contact your brokerage company, because each broker has different interest rules.

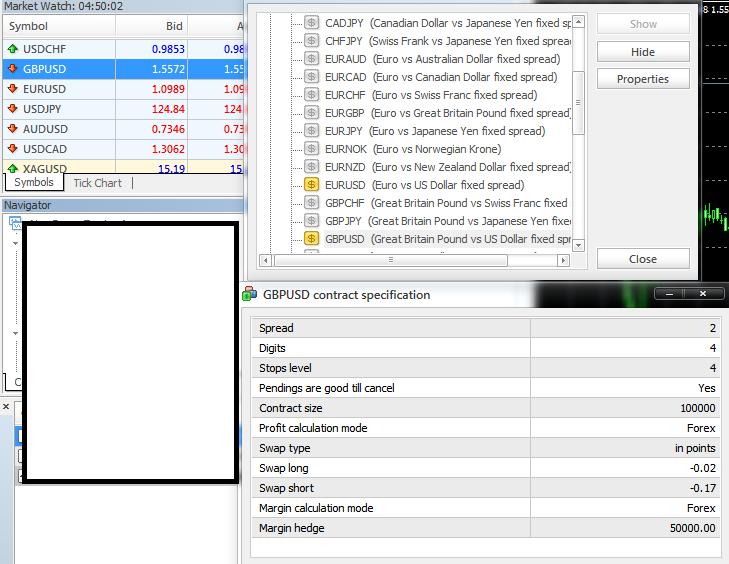

But if you are a user of the MetaTrader software platform, then you can see the interest in the following way:

- Right click on the currency price quote in the left window menu

- Select Symbols

- Select the currency you want to see interest, then click "Properties"

- There you can see the interest value if you open your order position until you stay overnight, which is the interest for the Buy (Long) position and the interest for the Sell (Short) position, and the interest value is in the form of points.

Example:

- Swap Type = in points Swap Long = 0.63 (positive interest for Buy positions in points per day)

- Swap Short = -1.31 (negative interest for Sell positions in points per day)

If you open a Buy position and leave overnight, you will get an extra +0.63 points every day in your cash equity, whereas if you open a Sell position, it will reduce your cash equity by -1.31 points per day. It should be noted that on Saturdays, Sundays, and holidays interest is still calculated, therefore you must pay attention to the calculations. And interest is calculated from the quantity of your contract size and not from your capital. Thanks.

Mar 6 2019 11:06

Are there any specific trading strategies to take advantage of swap interest? do you only need a long term strategy? Thanks

Mar 7 2019 11:31

Of course, there is. The strategy is known as Carry Trade, a carry trader will take advantage of the difference in interest rates between 2 currencies. The carry trade strategy looks easy and profitable.

The way a carry trader works is like this:

A carry trader buys a currency with a higher interest rate, and at the same time sells the currency with the lower interest rate. In order for maximum profit, a carry trader buys the currency with the highest interest rate and sells the currency with the lowest interest rate. And of course, they trade on liquid currency pairs.

Example:

If the current interest rate on Australian Dollars is 3.25% per annum and Japanese Yen 0.1% per annum, then by buying AUD/JPY, a carry trader will benefit from:

- Buy AUD, the trader earns 3.25% interest

- At the same time sell JPY, the trader pays 0.1% interest

Mar 8 2019 03:50

Wow, Your explanation is very detail and easy to catch, thank you very much.