Nov 15 2018 01:07

Hi Ganesh Srivastav,

Yes, have to wait for the next candle. In trading, the term valid does not mean 100% true. To ensure its validity you must confirm with the price action that is formed on the next bar, and also confirmed by at least two technical indicators.

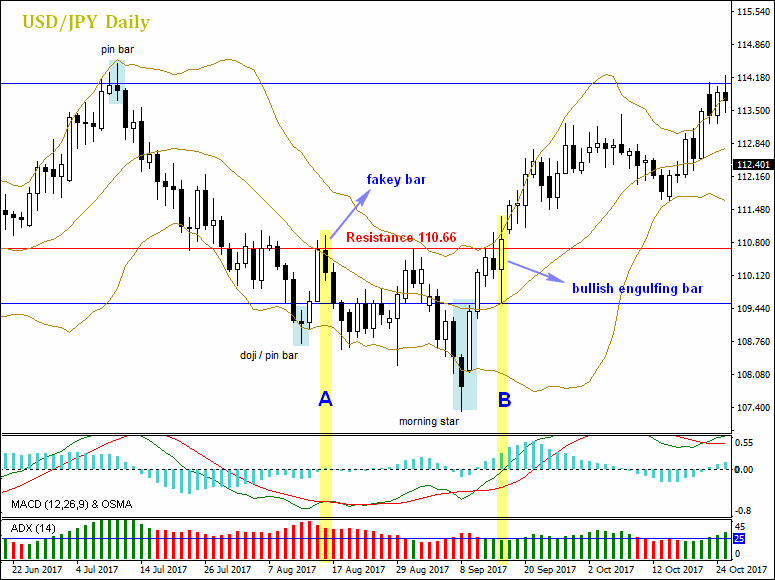

Here's an example on USD/JPY daily:

On A:

The previous candle had broken the strong resistance at 110.66. The candle in A had broken through 110.66 and moved above the middle band curve of the Bollinger Bands indicator, but it was not supported by the MACD and ADX indicators, and finally closed below the middle band and also below the resistance at 110.66, in the form of a bearish bar. The candle is a fakey bar (fake break signal).

On B:

The previous candle had broken the strong resistance at 110.66. The candle at B broke 110.66 and moved on the upper band curve of the Bollinger Bands indicator, and was also supported by the MACD and ADX indicators, and finally closed above the resistance 110.66, forming a bullish engulfing bar. The candle at B is a valid breakout signal.

So price action confirmation and technical indicators in this regard are very important.

Sometimes it closes above R / below S but the next candle closes below R / above S again.

The next candle is called a fakey bar or a false signal that causes a false break.

Nov 16 2018 05:23

Bounces and breakouts sometimes occur alternately at one time. which one is better to wait, sir?

Nov 18 2018 04:24

Hi Joshua Martin,

maybe you mean a candle taking turns to break and bounce a certain level. If this is the case, you have to wait until the candle is finished forming and see the closing price.

For an uptrend: if the closing price is above the level referred to, it means a breakout has occurred, and if the closing price is below the level it means there is a rejection (which means a bounce). Conversely, for downtrend conditions.