USD sank to the lowest level in seven months last Monday amidst global stock market tumble and subsiding expectation on Fed's rate hike. However, it is still important to remember that the currency is also categorized as a safe-haven asset.

USD sank to the lowest level in seven months last Monday (24/8) amidst a global stock market tumble and reduced expectations on Fed's rate hike. The episode following China equities downfall was called Black Monday had put forex and commodity markets into chaos. It all started from Asian stock market in the morning of August 24th, and then continued with oil price slump and US stocks collapse.

US Equities Fall-Off

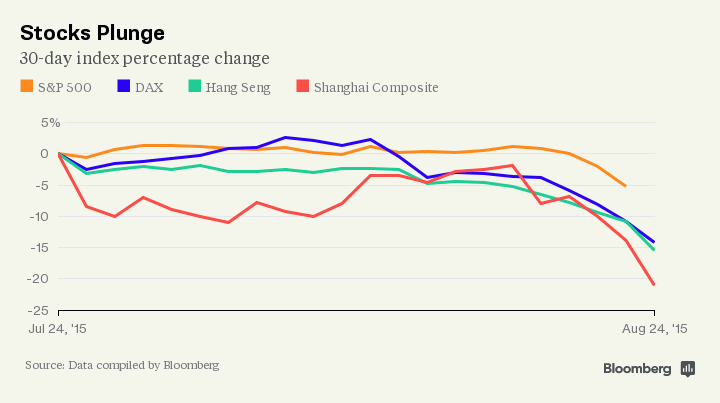

Market panic became headlines after US major indices slumped amid record-high volatility. S&P500 dipped to 3.9%, while NASDAQ came down to 3.8%. Dow Jones was opened with a tumble of 1000 points, and later was closed lower to 588 points; the worst decline since August 2011. However, US stocks fared better than Shanghai Index, which took a decrease to 10%, while Hang Seng and DAX shared similar fates at the same period. Thirty day-record even showed sharper decline.

A chart showing the decline of several world's equities

The aforementioned indices fell down following high market volatility. According to Bloomberg, around 14 billion shares were traded in US stock exchange, which was the highest in four years and was the second highest trade of all time.

Along with the situation, US Dollar slumped to seven-month low against Euro, after market speculated that Fed would not increase rates next September. USD/JPY stepped down to the lowest level since May. FOMC meeting released from the previous week which noted concerns over China economy was the reason why China stocks collapse had a severe impact on the US Market and Greenback this time. Upheaval created from this condition had motivated investors to turn to safe-haven assets like Gold, Japanese Yen, and Swiss Franc.

It's hard to predict when this abnormality will come to an end. However, traders can reveal what factors played behind the market sentiment by considering reasons behind the market panic.

China's Confidence

China stocks crash last Monday was not the first one. The country's equities had been deteriorating since last June and underwent mass suspension on July 8th. Local authority had tried and failed all attempts to prevent further downturn on financial market and growth. Just like a boomerang, every decision made to overcome the problems turned into the reasons behind panick-stricken investors who saw that the government had lost control over the market situation.

Bruce Brittles from Robert W. Baird & Co. stated in Bloomberg that investors in China had no longer trusted its central bank, leads to a difficult situation and making the market unsettled. In the end, it depends on whether China's condition will be weighted by economic slowdown. If it happens then the impact is going to spread over the US.

On the other side, FOMC meeting minutes from July 2015 exclusively noted the members' concern over China's economy condition and the strengthening of USD. Market's response not only highlighted the indication of September's rate hike cancellation, but also regarded it as the official statement from US monetary authority concerning with possible risks of China slowdown's impact to the US. In result, US stocks and Greenback was heavily pushed down when China was unwell.

How Long?

Bloomberg's polls showed market pessimism on Fed's next policy. Survey on August 18th resulted in 48% of professional traders expecting Fed rate on September, but more recent polling published on last Monday indicated declining optimism, by showing only 22% of traders maintaining their views on September's rate hike. In addition, a survey resulting in 73% of traders to expect Fed rate in December also changed to lesser percentage. It recently became 44% of traders who sill held their expectation. This factor contributed to USD tumble, but supported Euro, Yen, and Swiss Franc.

Although investors now is in a restless mode amidst China economy's uncertainty and Fed's rate, it is still important to note that USD is also a safe-haven asset. US will not be the one who suffers the most if China's condition worsen. Commodity market is the one who will take the blow as China is the biggest consumer of several major commodities. Developing countries will be badly affected too as some of them are China's main trading partners. In this perspective, condition can be projected to change when panic subsides.

David Rodriguez of DailyFX mentioned in his note that forex market in the upcoming week will experience the biggest fluctuation since early June, meaning that it can't be taken as a warning of major upheaval. Besides, he considered this as a reminder that a three-day market panic will not lead to a prolonged sell-off. Still, it is important to trade defensively until we can see some significant clues on market normalization.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance