The US stocks open this week by rising at a slower pace. If the buyers continue to generate support, the prices might reach today's R1.

Friday was a really volatile session. In the end, all three American indices showed mixed sentiment. After the weekend they opened much higher and they have been going up slowly since then. What can they do next? Let's try to answer that question in an analysis. S&P 500 first:

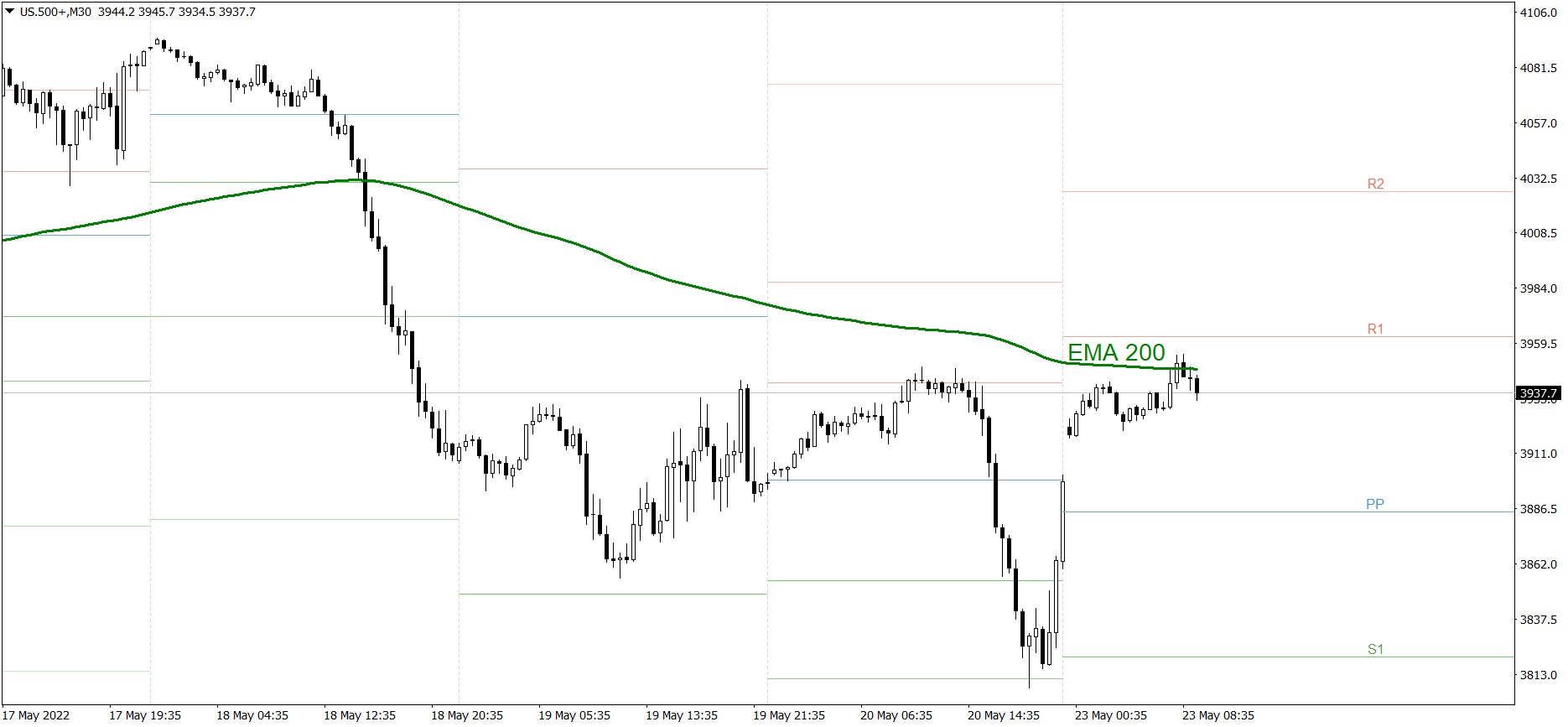

S&P 500

The S&P 500 was really volatile on Friday. First, the price rose to the R1 resistance level. After that, in the afternoon, it dropped heavily and tested the S2 support level. However, the price managed to rise in the evening and finished the last session of the week exactly at the Pivot Point, a little below 3,900. After the weekend it opened 20 pips higher and has been going up slowly since then. If the buyers continue generating firm demand, the price might rise above 3,960 and today's R1. But if the bears counterattack, the price could fall to 3,910.

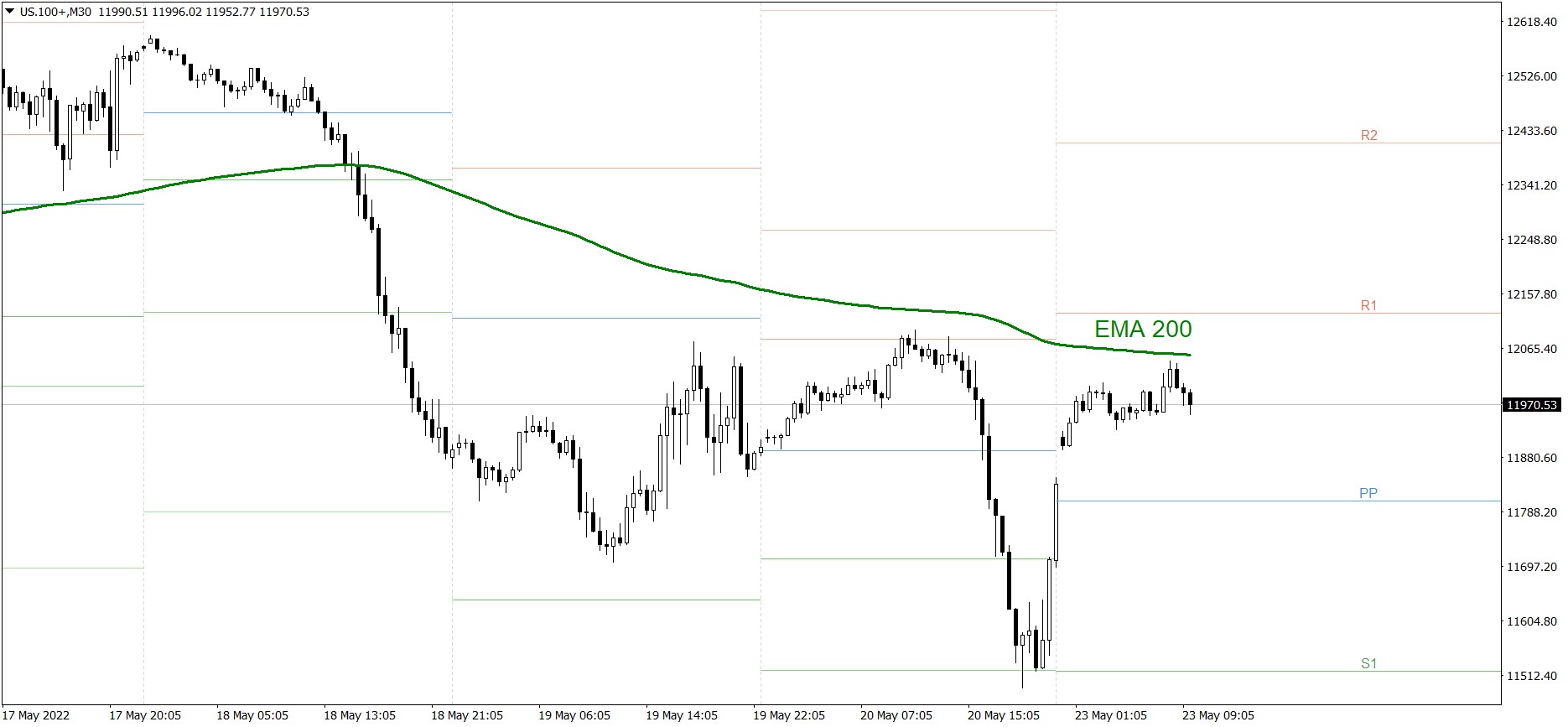

NASDAQ 100

NASDAQ 100 was also really volatile on Friday. First, the price rose to the R1 resistance level. After that, in the afternoon, it dropped heavily and tested the S2 support level. However, the price managed to rise in the evening and finished the last session of the week slightly above 11,830. After the weekend it opened 80 pips higher and has been going up slowly since then. If the buyers continue generating firm demand, the price might rise above 12,100 today and reach today's R1 as well as EMA 200. But if the bears counterattack, the price could fall to 11,800.

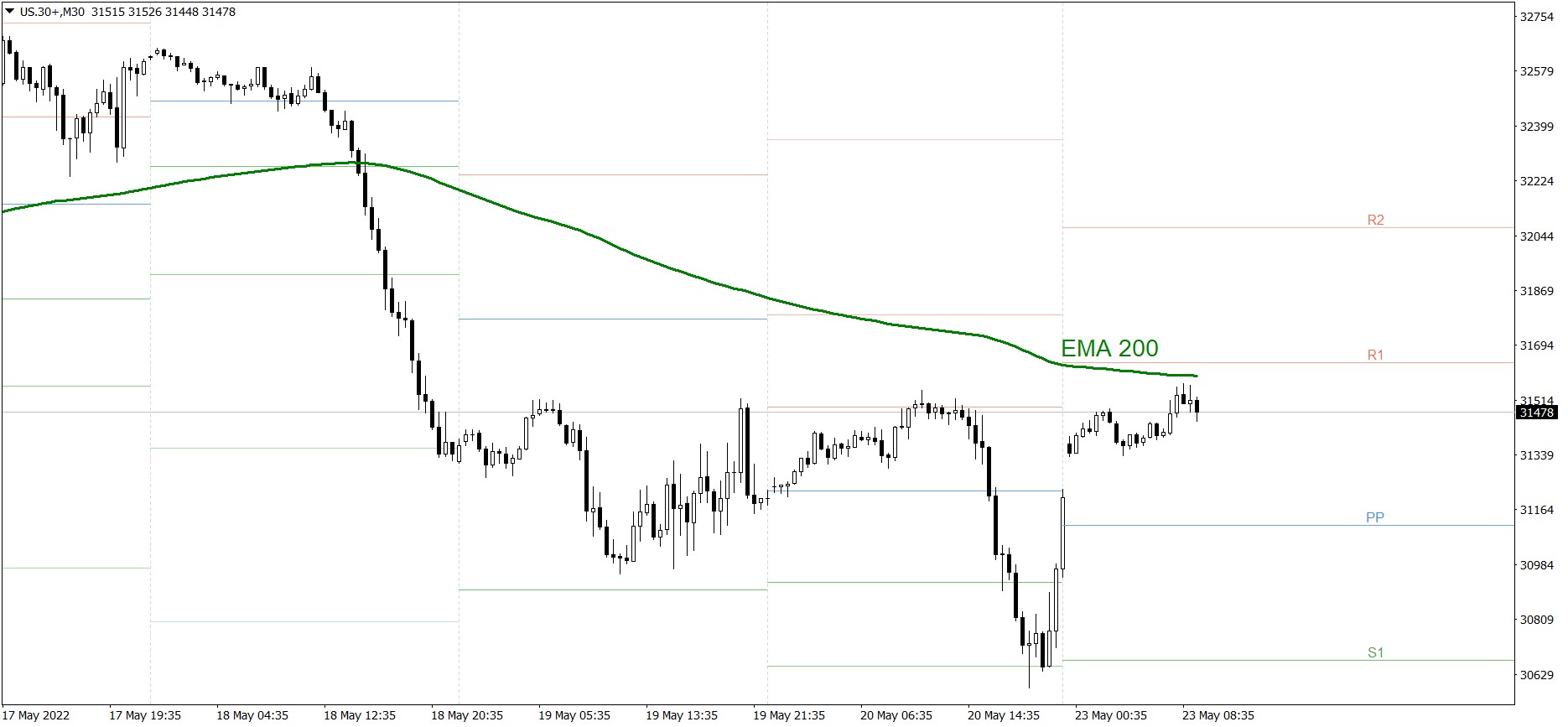

Dow Jones Industrial Average

The DJIA index was really volatile on Friday as well. First, the price rose to the R1 resistance level. After that, in the afternoon, it dropped heavily to the S2 support level. However, the price managed to rise in the evening and finished the last session of the week a little below the Pivot Point, at 31,200. After the weekend it opened 170 pips higher and has been going up slowly since then. If the buyers continue generating firm demand, the price might rise high above today's R1 and reach 31,800. But if the bears counterattack, the price could fall to 31,300.

EXCO offers the ability to trade financial markets on leverage through multiply asset trading platforms. Be that pricing, execution, or promotions, they emphasize that what they advertise is what they give to clients, regardless of the size of their investment.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance