Yesterday, The Fed cuts its stimulus program from 85billion dollar a month into 75billion. As soon as the announcement was made, USD rose in almost all pair, including JPY and AUD, and knocked out Asian currency. Today (20/12), Bank of Japan released its statement for the new stimulus program.

Yesterday, The Fed cuts its stimulus program from 85billion dollar a month into 75billion. As soon as the announcement was made, USD rose in almost all pair, including JPY and AUD, and knocked out Asian currency. Today (20/12), Bank of Japan released its statement for the new stimulus program. Market players immediately anticipate the rise of USD/JPY.

For The Good of The People?

Monetary stimulus refers to central bank's policy to increase the availability of money within the economy. The most controversial way to do it is through reduction of interest rates and Quantitative Easing (QE). If interest rates is being reduced, then corporations could get low-interest loans and common people would prefer to use their money than keeping it in the bank vault. While QE is central banks' contemporary way of buying long-term bonds in order to increase monetary base. The purpose is so that commercial banks will give more loan, rather than burying their money on safe investment like government bonds.

The two are done with the hope that the quantity of money in society grow, and people feel stimulated to do more economic activity. For the real market, the expected effects are a boisterous market, increased production, lessening unemployment, etc. The Fed cut its stimulus (tapering) too, because economic condition was thought of as getting better. Nevertheless, if 'currency' in the forex market could be called as the goods, then we could apply the old law, if there are more goods in the market, then the price will go down.

One thing that we should underline here is, the role of Central Bank is not only safeguarding currency's exchange rate. When the currency's skydiving (as in Indonesian Rupiahs right now), then they will monitor carefully to see if they need to intervene. But as long as the currency's stays in 'safe area', don't ever hope they will do anything.

Now, Bank of Japan

The standard used by BoJ for their stimulus now is a monetary base increase in the annual pace of 60-70trillion yen. It is hoped that this could boosts inflation and resumes Japan recovery. The stimulus is done in the context of Abenomics. If you remember, there is correcting yen's exchange rate' in Abenomics schedule. Therefore, we could conclude that BoJ for the time being won't say anything whether yen weak and weary or jump in to the ravine.

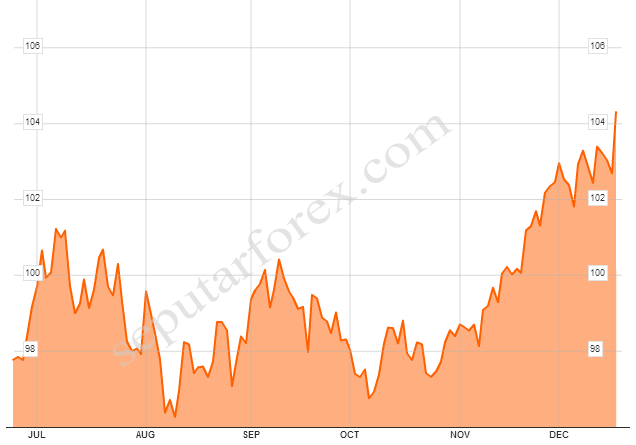

Six-Month Chart of USD/JPY till 20 December 2013

According to Bloomberg, in this year USD have gained 4,3% and Euro rose 8,2%, while the Yen fell 15%. Is Japan satisfied? We don't think so. We could hope for next 15% fall; or, in the other words, USD/JPY rally will possibly go on till the end of the next quarter. With this prediction, will Yen lose its status as safe haven? No, it won't. Japan economy foundation is too strong. Afterall, where else traders would run to in the case of turbulent worldwide economy!?

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance