Amid the rise in the index, traders should anticipate the moves that will come ahead of the announcement of important data from the US and Europe.

Yesterday the American indices finally showed some real strength after a couple of weak days. Are they able to continue that move today? We'll try to guess in the analysis. Also today some important data will be published, particularly manufacturing PMI, services PMI, and Markit composite PMI. Firstly in the Eurozone, one hour later in the UK, and in the afternoon finally in the US. So, let's start with the S&P 500:

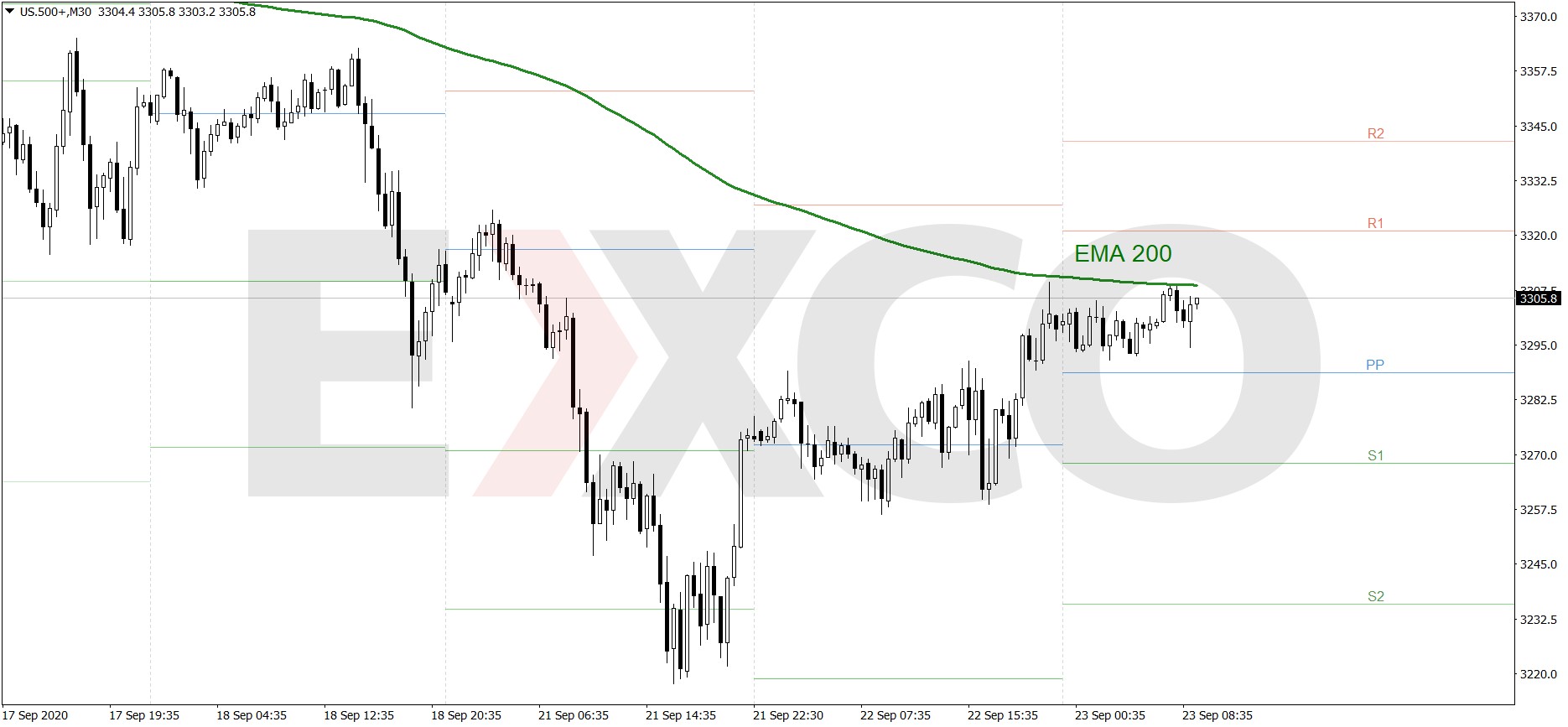

S&P 500

During the strong bullish session yesterday, the S&P 500 was getting close to the EMA 200. This morning the price finally tested it. For now without a success, but it is still close, so the bulls can try one more time pretty soon. If they manage to breach it, the price might even go higher and attack the R1 resistance level. If not, the price could fall to the Pivot Point or even breach it and test the S1 support level.

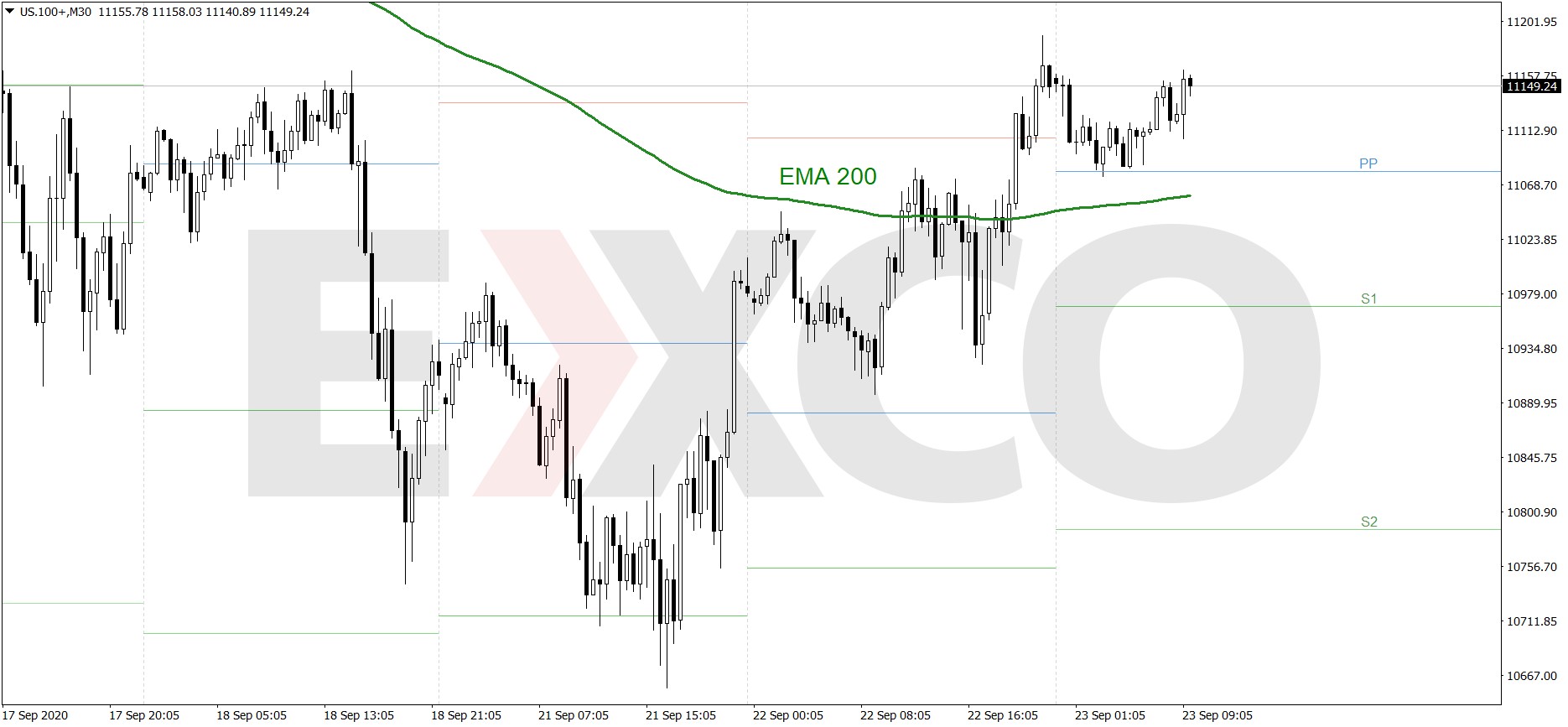

NASDAQ 100

This week, NASDAQ 100 is undeniably the strongest index in the US. Yesterday, it significantly went upwards and beat the EMA 200. During today's Asian trading session, at first, it fell to the Pivot Point, then it bounced and now it is at the same level as at the end of yesterday's session. If the bulls still generate sufficient appetite, the price might even attack 11250 today. However, if not, the price could go down to the Pivot Point once again or even breach it and test the EMA 200.

Dow Jones Industrial Average

The DJIA index looks similar to the S&P 500 this week, but it's a bit weaker. During yesterday's session and last night, it was getting close to the EMA 200 but still hasn't tested it yet. Furthermore, it has to beat the R1 resistance level, which the bulls are trying to do right now. When they do it successfully, the EMA 200 will be extremely close. If the bulls are strong enough to breach it, the price might go even higher, near 27500. However, if they are not, the price could fall to the Pivot Point or even test 27000.

EXCO offers the ability to trade financial markets on leverage through multiply asset trading platforms. Be that pricing, execution, or promotions, they emphasize that what they advertise is what they give to clients, regardless of the size of their investment

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance