The three indexes are stuck at a low level, even breaking the Support level 3. Will the price strengthen?

The American indices started the week with shockingly big drops. The S&P 500 reached the S4 support level and the other two tested the S3. However, all three of them started going up in the evening and continued that move during the Asian trading session.

Right now they are close to today’s Pivot Points. What can they do next? Let’s try to answer that question in an analysis. S&P 500 first:

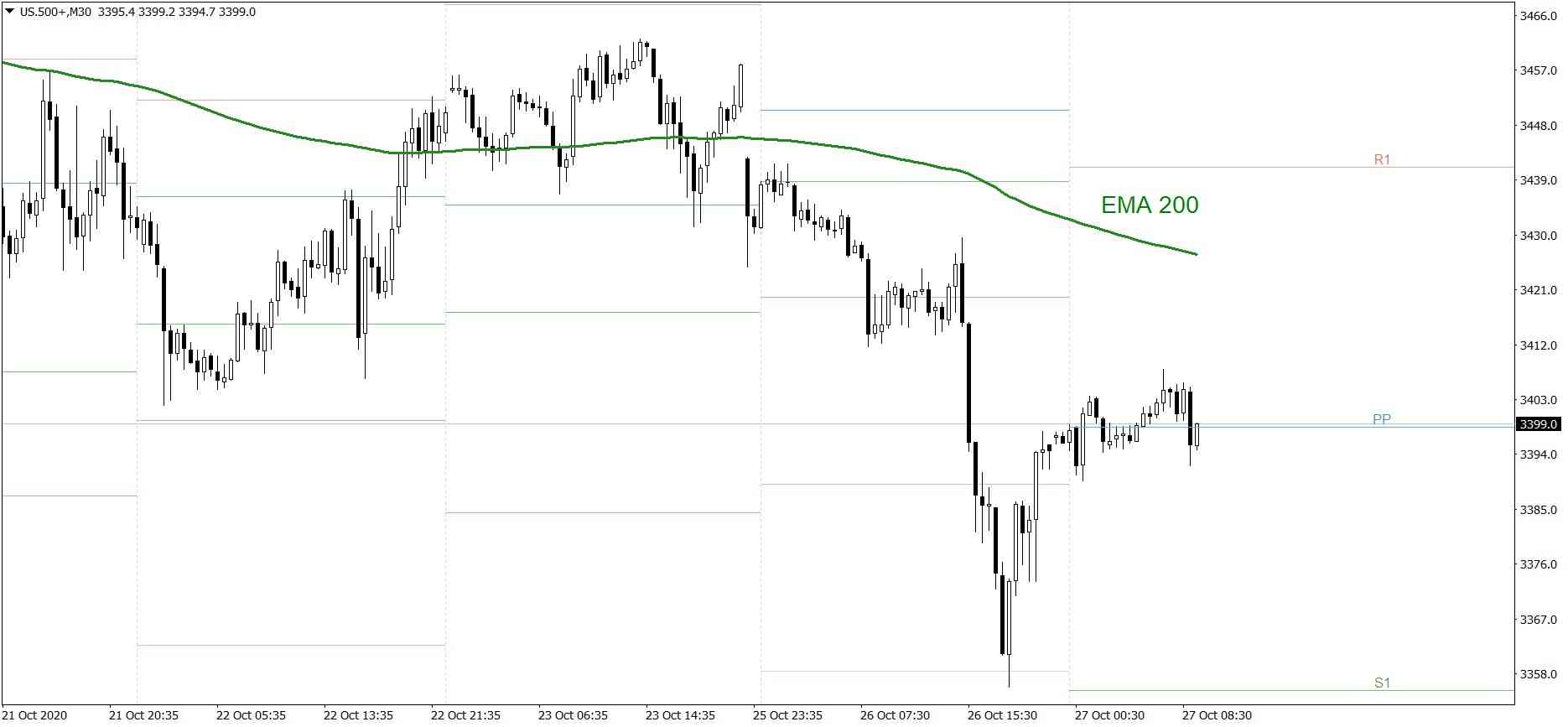

S&P 500

The S&P 500 was really shocking yesterday. The price fell really deeply, it even tested the S4 support level. However, the bulls counterattacked in the evening, and right now the price is really close to the Pivot Point and 3,400.

If they are strong enough to hold above those levels, the price might even test the EMA 200 in the next hours. But if they fail, the price might drop to the S1 support level.

NASDAQ 100

Unlike the S&P 500, NASDAQ 100 went up above the Pivot Point and EMA 200 right before the big drops yesterday. Maybe that’s why it only tested the S3 support level and finished the day on the S2.

The buyers also bounced in the evening and continued going up during the Asian trading session, right now the price is slightly above the Pivot Point. If they are able to still generate firm demand, the price might test the EMA 200. But if they are not, the price could fall to the S1.

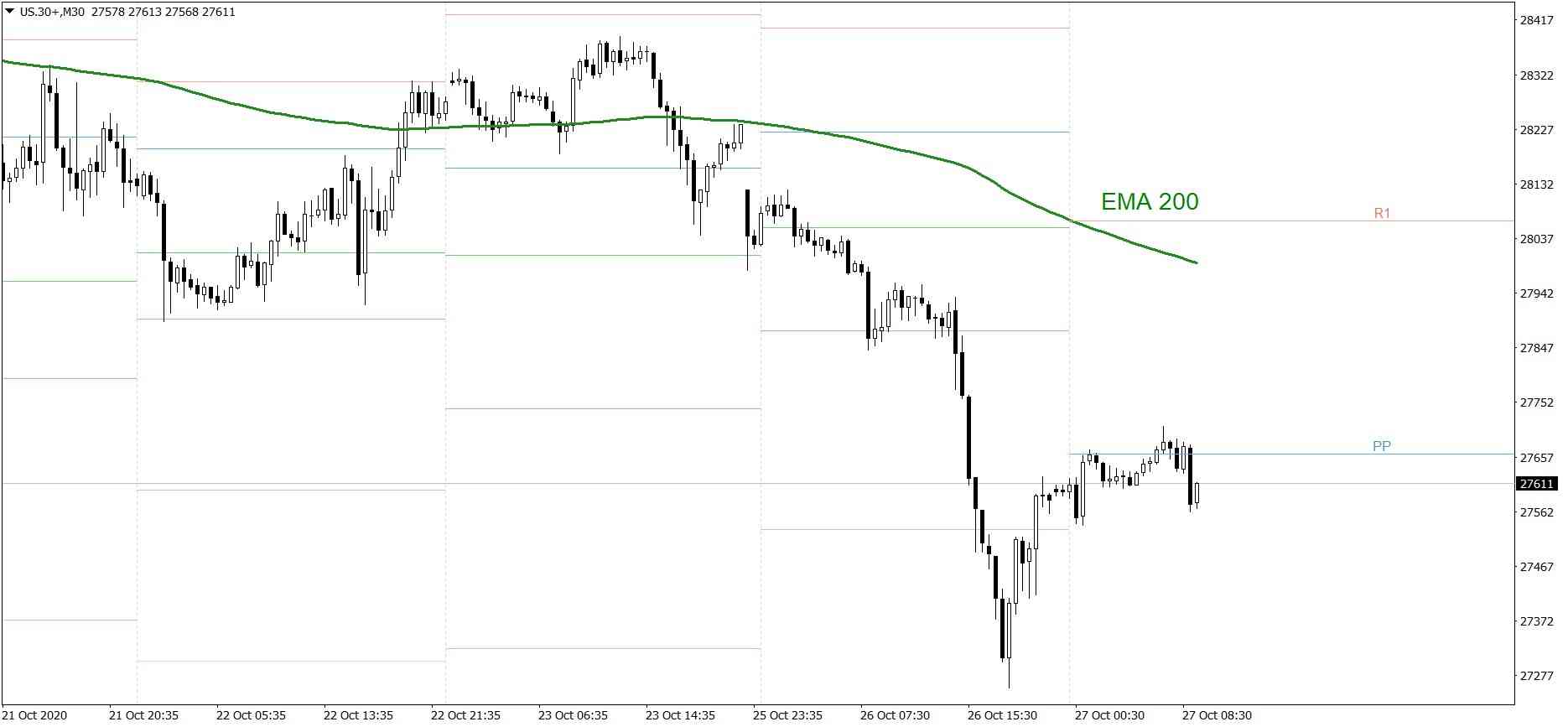

Dow Jones Industrial Average

The DJIA index wasn’t as weak as the S&P 500 yesterday, but it is without a doubt the weakest today. It finished yesterday’s session slightly above the S3 support level and the price is slightly moving up since last evening, but it is still below the Pivot Point.

If the bulls attack it successfully, the price might test the EMA 200 as well. But if they fail, the price could drop below 27,000.

EXCO offers the ability to trade financial markets on leverage through multiply asset trading platforms. Be that pricing, execution, or promotions, they emphasize that what they advertise is what they give to clients, regardless of the size of their investment.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance