Gold futures trading yesterday (1/1) jotted down as the biggest slump in three decades. Bart Melek from TD Securities in Toronto mentioned that The Fed's tapering and equity market's spectacular performance have worked together against gold. Gold's reputation as safe haven continue to decrease along improvements of economic conditions. Even George Soros and John Paulson have sold their golds. What's up with gold?

Gold futures trading yesterday (1/1) jotted down as the biggest slump in three decades. Bart Melek from TD Securities in Toronto mentioned that The Fed's tapering and equity market's spectacular performance have worked together against gold. Gold's reputation as safe haven continue to decrease along improvements of economic conditions. Even George Soros and John Paulson have sold their golds. What's up with gold?

The Difference Between 'Buying Gold' and 'Trading Gold'

In the old days, before human uses paper money, gold is the most important trading tools. It relates to its capability to preserve values and its status as 'the most precious metal'. Instead of corroded and turned into junks, gold's value increases from time to time. As humans advanced, we no longer uses gold in daily transactions due to its impracticality. However, it still has its old status. Nowadays, people still buy and sell gold as investment hedge.

In the era of globalization, buying and selling gold not only could be done physically, but also online. Commoner often thought that buying gold jewelries is also investment. Actually, it isn't. Buying jewelries is a consumption; you could sell them again, but only at a much discounted price. Meanwhile, trading gold means that you buy-and-sell gold in order to take profit from price movements.

Investing in gold could be done in shape of coins and bullion, or in non-physics shape like spot, futures, options, etc. If you want to trade gold physically, then the consequence is that when prices fall like the current trend, you will suffer losses if you are in liquidity trouble and have to sell it right away. On the opposite, if you trade non-physics, then you could do two-way trading like in forex.

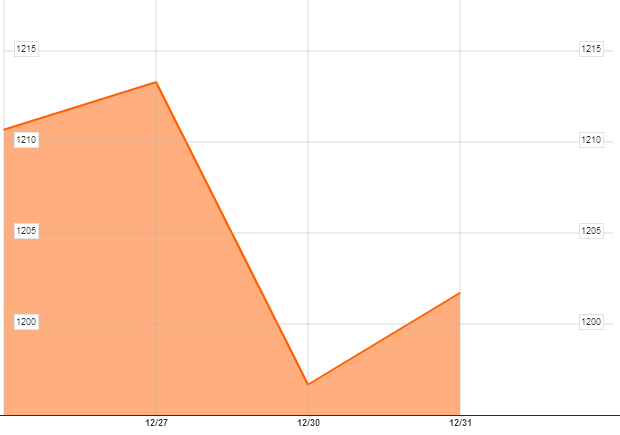

Another difference is about price volatility. Gold price in the market could be very volatile, and experience sharp daily changes. You could see it in XAU/USD Chart during the last week of 2013. On the other hand, physical gold prices is a reflection of gold prices in longer period. In short, not all the ups and downs of XAU/USD will influence physical gold prices. Nevertheless, at a slump like now, the influence is extremely conspicuous.

Chart of XAU/USD in the last week of 2013

Gold is Long Term God

Actually, it is quite difficult to predict the rise and fall of gold values. The factors that influences gold trading continue to change dynamically. Analysts could have said that right now its price decreases do to this and that, but the same may not be said in another time. There are also people who said that the value of gold will rise along economic prosperity. Logically, the more prosperous the people, the higher their budget to buy gold will be. But, if that is so, then does that mean the current decline of gold prices signals lower prosperity!? Of course not.

We have to remember that although gold is still special, nowadays it is just one of several investment option. As an investment, gold has the characteristics of long-term profit. On the other hand, there are various other alternatives in short and long term with relatively higher profit potentials. If, you are in a position of having to choose, which one are you going to take?

Investors tendencies to sell their gold now is exactly because of improved economic prospects. They want to take advantage from the current climate; because the way business cycle works, it will enter downtrend some time after uptrend. If we connect this premise with reports of steady economic recovery in USA and Europe, then it is most likely gold prices will continue to fall in the first half of 2014. Moreover, gold infamously known as having negative correlation with stocks and any other kinds of financial investments. Strengthened stock index in almost all over the world clearly signals gold decline for the time to come.

Gold's revival will come, only if world economic condition once again in turmoil. Even though there are some other factors influencing gold prices, like central banks policies and changes in supply and demand; but the trend seemed to disregard them for now. Investors will go on hunting golds again later when any other financial investment shows extreme risk and high degree of volatility.

In short, we could conclude this discussion in three sentences. If you've already bought physical gold and have enough cash to get by, don't go rushing to sell it; its price will go up again in the fuure. If you are a gold trader, short positions seemed increasingly attractive. If you seek to invest in gold by buying up at the lowest price point, then be patient, it still has far to go.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance