This is the time for restrospection and planning next year trading, plus making new year resolution. To help you, we have prepared two opinion on the topic of 2013 forex market dynamics and what we could hope for in 2014.

A good number of forex broker has entered the end of year vacation since Christmas. It means, this is the time for restrospection and planning next year trading, plus making new year resolution. To help you, we have prepared two opinion on the topic of 2013 forex market dynamics and what we could hope for in 2014.

A Legacy of Stress

European crisis that was started in the end of 2009 hasn't ended yet. The crisis was an accumulation of stress in European economy that has been engulfing the region and made Eurozone countries repeatedly lose their credit ratings. Lowered credit ratings usually won't hurt the Euro, but we must not forget that three causes of the stress (sovereign debt crisis, banking crisis, and slow growth) are some of the most important fundamental factors. European elites inability to reach a certain agreement detains the region's path toward recovery. This situation made many parties expect no more than sluggish growth in Eurozone.

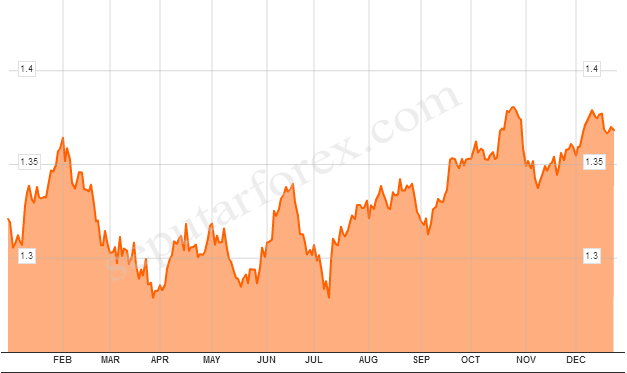

Chart of EUR/USD in 2013

Chart of EUR/USD in 2013

During 2013, EUR/USD shows inconsistent upward movement. This trend could go on well into the next year. On one hand, there doesn't seem to be any red flag both on the real and financial sector. On the other hand, any upward movement will be triggered if ECB launch a certain policy to expedite recovery in the area. There has been many speculation as to what kind of policy it would be, but ECB seems unhurried to give signals (if there is any). Therefore, we could only wait and see.

Years of Tapering

With all the tapering furore during the second half of 2013, it's not surprising that David Rodriguez of DailyFX called it as a 'game changer'. Last week's USD10billion tapering managed to topple most of greenback's counterpart. The release of satisfactory Durable Goods data yesterday intensified speculations about the next tapering.

Tapering is the symbol of how the Fed rules forex market. If tapering will happen again, most likely it will be done in two or three stages in the amount of USD10-20billion. Keep in mind that normally tapering has positive impact on USD. We could say that USD has a big potential in 2014, as long as there is no interference. Its impact on major pairs could differ greatly, depends on the circumstances of respective countries. However, on the whole, the currencies that has the potential to resist are only EUR and GBP.

Samurai Strategy

Apart from tapering, another hot issue in 2013 was the Japanese policy changes under PM Shinzo Abe. The infamous policies successfully bring USD/JPY to its highest level in five year.

Chart of USD/JPY during 2009-2013

Chart of USD/JPY during 2009-2013

In BoJ's December 25 publication, its board of governors agreed that Japan's economy is in the right track. Their most favourite words in the monthly report are 'moderate' and 'moderately'. It means, their approach to end recession is step by step recovery with long-term goal. Keeping in mind the Yen's character which is easily strengthened every time there are better-than-expected data, then it could mean risky trade in 2014. USD/JPY will continue its rally till the first quartal of 2014, but after the period passed, the risks will rise considerably.

To be continued to Forex 2013 Caleidoscope and 2014 Major Pair Outlook (2)

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance