Nears FOMC meeting next 16-17 September, analysts doubt that Fed will take the moment to start increasing rates. According to several posts earlier this week, market seems to believe that the fisrt rate hike in nine years will be carried out in December, not September.

Nears FOMC meeting next 16-17 September, analysts doubt that Fed will take the moment to start increasing rates. According to several posts earlier this week, market seems to believe that the fisrt rate hike in nine years will be carried out in December, not September.

Nomura: FOMC Won't Raise Rates

Nomura explicitly cited their scepticism towards FOMC to raise rates this week, while at the same time explained the projection for December rate hike. Furthermore, Nomura predicted that in her post-FOMC speech, Fed Chief Janet Yellen will emphasize that FOMC is getting closer to raising rates and that the Committee is still looking forward to cary it out within this year. The projection also noted that Yellen is likely to stress out again the importance of US economy outlook and inflation, as well as notify that the pace of interest rate adjustment (after the first rate) is going to be slow and relies on data.

However, Nomura believed that market still has a lot more to watch. One of them is the newest economy forecast, including the dot plot which records FOMC expectations for short to middle term interest rate. They anticipate for significant decrease in next Thursday's dot plot.

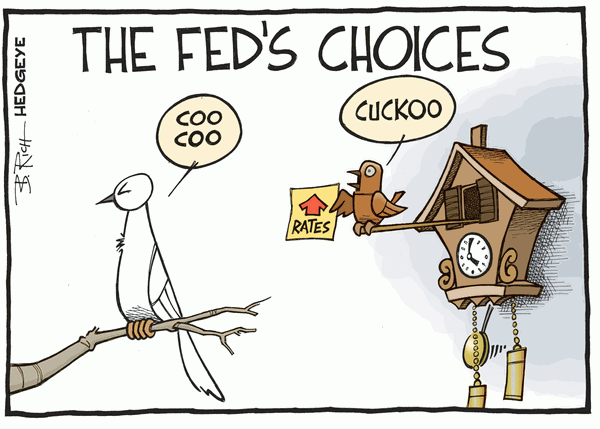

DailyFX: Two Alternatives

On another note, Christopher Vecchio of DailyFX quoted San Francisco Fed President John Williams, who is well known for his centrist and Yellen-like perception. Williams previously commented that Fed is still intending to raise rates this year, and likely to make it happen with one caveat: if market risks ease down. Seeing that market condition has not been able to calm down even after the statement is published, it is very unlikely that there will be improvements in the next days nears FOMC meeting.

In line with the situation above, Vecchio mentioned two possibilities for the next Fed's policy. Firstly, Fed will raise rates but also confirm that there will be no more hike until inflation target is reached. Forex market tends to ignore predictions for future policy, so Fed's indication to apply no more rate hike in the near time will bring down US Dollar. Secondly, the Fed will not raise rate this time, while market has begun to predict December as the most appropriate time for Fed to do it (based on projection from Fed fund futures). Vecchio noted that if the meeting ends with the second option, it will bring back old memories from last March's FOMC when US Dollar was strongly depreciated after Fed cancelled their normalization policy.

Kathy Lien: Reduce Long Dollar Positions

Meanwhile, Kathy Lien from BK Asset Management wrote last week, (if) based on the performance of the U.S. economy alone, Federal Reserve should raise interest rates because the unemployment rate has fallen to a level often associated with full employment. Wages are on the rise, the housing market is steady and manufacturing and service sector activity is expanding. The emergency conditions that warranted the zero interest rate policy is no longer in place and in turn, it is time to raise interest rates.

However, Lien continued that Fed does not operate in an empty space and amid volatility in international stocks, ECB dovishness, and dovish bias from other central banks just to

pull the trigger (to raise rates). Sixty percent of economists in Bloomberg Survey still expect Fed to increase rates next week, but Fed fund futures only counts 30% probability for rate change. It will be a difficult situation for the central bank, and for that reason investors are recommended to reduce their exposure to long dollar positions ahead of rate decision next Thursday. In other words, Dollar should take the fall next week.

In addition, even if Fed hikes (rates), the Greenback's rally will be short and then followed by choppy trading as lower projections are expected to tail behind the tightening policy. One rate hike is all we are looking for from the U.S. central bank this week and they will go out of their way to ensure that the market understands this trajectory, cited Kathy Lien.

Many Focuses To Look Out

Lien also warned that Fed is not the only market driving force for this week. There will be important announcements from two central banks; Swiss National Bank and Bank of Japan. UK will be the highlight too as there is going to be realeases from CPI, Labour, and retail data.

In particular, market will look out for Bank of Japan as the country's top officials have been stating their disappoinment toward recent economy performance for some time. They also expect more monetary stimulus. Credit Agricole, in a post published by eFXnews, conveyed that even if BoJ agrees to expand stimulus, there will be little room for the central bank to launch more policy this week. Hence, Japanese Yen will still be driven out by external factors like sentiment on global risks. They said that if we're assuming Fed to restrain from executing the tightening monetary policy, then we will be looking at a chance for safe-haven demand to fall, which is going to weaken the currency. But, it is also important to note that China uncertainty will still unrest the market.

On the other side, UK data is forecasted to be disappointing. Morgan Stanley stated that they are still bearish towards GBP, and will sell (GBP) against USD and JPY. According to them, UK data has started to weaken so they are still bearish even if Bank of England showed no concern over recent market volatility.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance