The Euro is seen on a promising path. Therefore, buying momentum when price tests the demand zone is a significant opportunity to watch out for.

Hi fellow traders! EUR/USD is now in a corrective mode from its bullish track. Euro's positive sentiment still feels strong amidst sluggish US Dollar and market optimism about ECB's rate hike. The best trading scenario this time will be looking at the long opportunities in the demand zone.

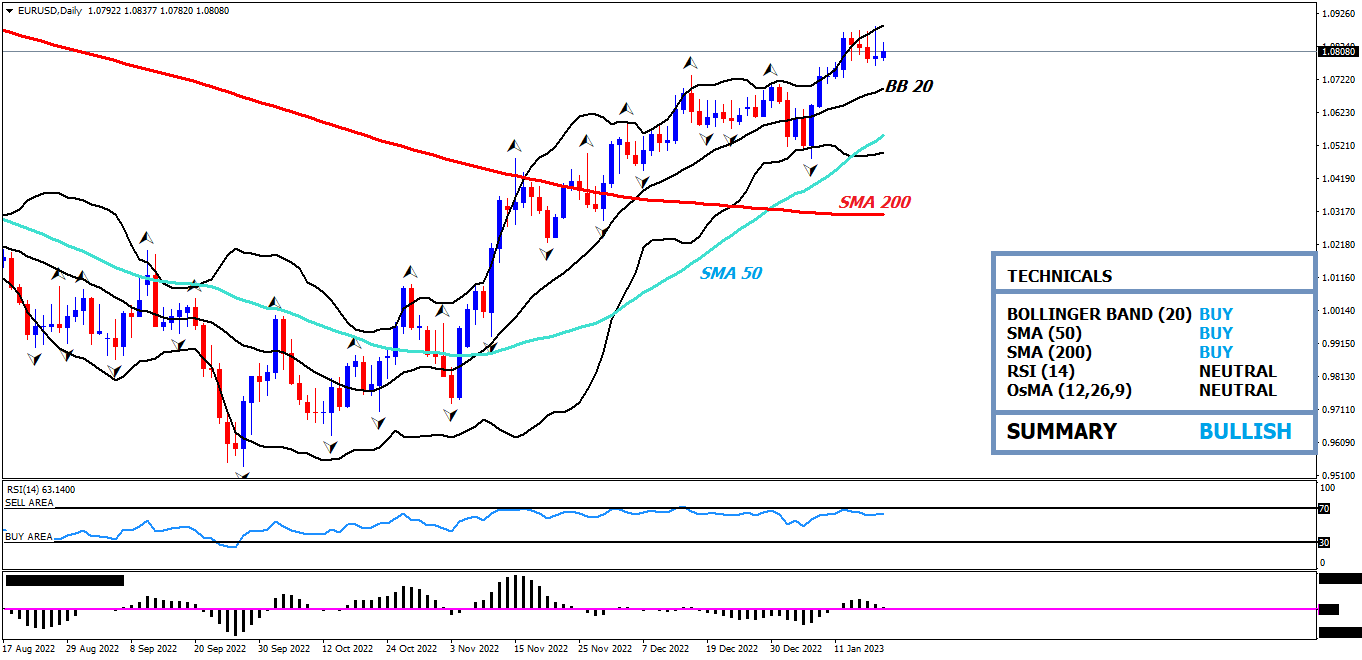

Analysis and Recommendation

Let's take a look at the following EUR/USD H1 chart below:

Based on the H1 chart above, it has been pointed out that EUR/USD is consolidating between the supply zone of 1.0894 – 1.0864 and the demand zone of 1.0795 – 1.0765. When I wrote this analysis, Euro was wearing out to test the demand zone. That way, long opportunities have the potential to appear when there is a bullish signal around the demand zone.

Be aware if it turns out that there is no bullish signal in the demand zone testing since EUR/USD is at risk of further weakness, presuming it breaks the 1.0765 level. Here are two trading scenarios that can be prepared:

- Therefore, set a long position at 1.0795 when the price manages to enter the demand zone and a bullish signal confirms it. Stop loss may be positioned at 1.0765, while the profit target is at 1.0864.

- Alternatively, set a short position at 1.0765 when a significant breakout signal confirms it. Stop loss may be positioned at 1.0795, while the profit target on 1.0724.

Keep in mind to always use risk and money management before trading! In addition, to make use of trailing stops, don't forget to exit the market as soon as you find a reversal signal!

EUR/USD key levels:

- Resistance: 1.0894, 1.0864

- Support: 1.0795, 1.0765, 1.0724, 1.0698

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance