EUR/USD shot to the peak in almost 4 weeks after PMI releases by Markit Economics yesterday. Eurozone PMI was at its highest since June 2011. No less impressive is German PMI, the central player in the region. For several hours, the market forgets tapering which is going to be talked about in next week's FOMC meeting.

EUR/USD shot to the peak in almost 4 weeks after PMI releases by Markit Economics yesterday. Eurozone PMI was at its highest since June 2011. No less impressive is German PMI, the central player in the region. For several hours, the market forgets tapering which is going to be talked about in next week's FOMC meeting. Eurozone Economic Recovery

Eurozone Economic Recovery

EUR/USD's most prominent characteristic is its sensitivity toward economic growth data releases, including GDP, PMI, and Employment. Central bank do have strong impact on the pair, but long term trend is usually built by economic growth prospects. EUR/USD trades can't be distanced from fundamental news. That, and the high frequency of data releases, made news trader love EUR/USD.

After serial sovereign debt crises, Eurozone economy at best could be called precarious. Even more, it was hanging on the precipice of deflation. Thus, the market doubted Eurozone could fully recover from their ordeal this year. However, satisfaction around the recent PMI seemed to revive market confidence toward Euro.

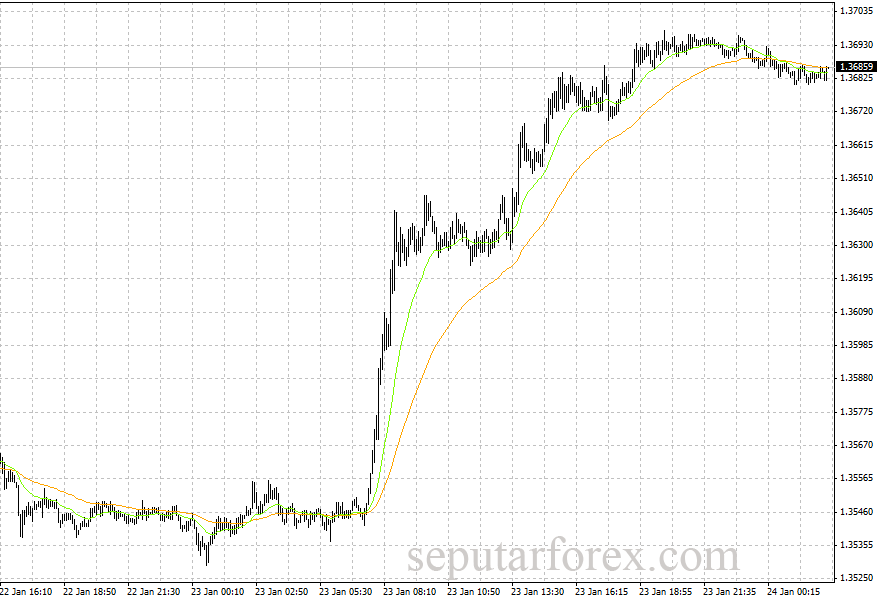

PMI represents economic health from business perspective. It was the result of surveys collected from several companies with high contribution to GDP. Markit Economics PMI Report described significant increases in Eurozone PMI Composite Output, Manufacturing PMI, and Services PMI Activity Index. In separate report, German and France PMI also improved far above analysts estimates. German Manufacturing PMI rose from 54.3 to 56.3, although anaysts estimated only slight increase to 54.6. This is the sharpest business activities improvement in almost three years. France PMI also stepped up from 47.0 in December 2013 into 48.8, its highest in three months. PMI under 50 refers to contracted economy, but such increase mean that progress is underway. Good news like this made forex market reacts almost instantly. EUR/USD shot to more than 100 pip upward.

EUR/USD Chart in M5 at 22-24 January 2014

EUR/USD Chart in M5 at 22-24 January 2014

Fxstreet mentioned that the data diminished speculation on ECB's further monetary easing. Majority of market analysts agree that this signals Euro's tendency to strengthen this year. However, some analysts did say that probably, the market overreacted to the data. We unequivocally agree with their opinion. In short term, we predict EUR/USD will continue to go down nearing market closing this week and will be traded around 1.36389. Plus, there is small chance EUR/USD will pass last night's high price, so long as US data could satisfy the market.

Speculation on Tapering Chapter Two

For the following week, these are the fundamental news you shall observe. On 27 January, there is German Ifo Business Index, and several hours later, US New Home Sales. Ifo Index is estimated to rise slightly from 109.5 to 110.0. On the opposite, US New Home Sales, like any other US datas these days, is predicted to decline from 464,000 to 460,000. It is very probable that there won't be dramatic changes if the news are released in accordance with their estimations (though, you should be extra careful because Europe PMI is not the only misses that analysts made recently). FOMC meeting at 28-29 January will be critical to decide the Fed's movements, especially in relation with the much-speculated tapering. Beside of that, the release of Durable Goods Orders and US Consumer Confidence will enliven the game in the same period.

Nevertheless, the market's focus is still with tapering. Quoted by Bloomberg, Todd Elmer from Citigroup Inc said that there was speculation that the Fed may pull back, but He thought they are going to go on with their very measured tapering. Such moves surely will strengthen the dollar. Some analysts quoted by Reuters voiced the same opinion. Even some Fed's officials have conveyed their optimism that the Fed will persists with their game plan, although recent economic datas are pretty much unsatisfactory.

If you are intending to trade EUR/USD within the next week, stay tune to your news alert, and be really careful on predicting the trend. Make sure that your money management is sufficient to face any possible occurence.

Related Articles:

Currency Pairs Characteristics (1): The Four Major Pairs

Currency Pairs Characteristics (2): CAD, CHF, and NZD

Money Management in Forex Trading

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance