Bitcoin Foundation revealed that troubles experienced by two major Bitcoin exchanges are due to denial-of-service attack by an unknown hacker (or hackers). Is this the end for bitcoin?

In late January, two bitcoin exchange operators are arrested in the US over allegations of money laundering. Shortly afterwards, two of the largest bitcoin exchanges, Mt.Gox and Bitstamp, halted bitcoin withdrawal indefinitely. Then yesterday, Bitcoin Foundation, an organization that promotes the use of bitcoin, revealed that troubles experienced by the two exchanges are due to denial-of-service attack by unknown hacker (or hackers). Is this the end for bitcoin?

Questionable Security and Safety

Bitcoin is a cryptocurrency that's been widely talked about. Many people like it as it's value fluctuates according to demands instead governed by certain entity. That was one reason why thousands of online and offline merchants use the currency on transactions. However, it is still embroiled in controversy that makes us question its security and safety.

Last year, FBI closed down Silk Road and confiscated 144,000 btc in relation with drug trade (Silk Road was famous as the e-bay of drugs). Some might think that it ended there. But on January, two bitcoin exchange operator, Robert Faiella of BTCKing and Charlie Shrem of BitInstant, were under arrest in the US. The Authorities alleged the two as knowingly supplied bitcoin for drug trade in Silk Road.

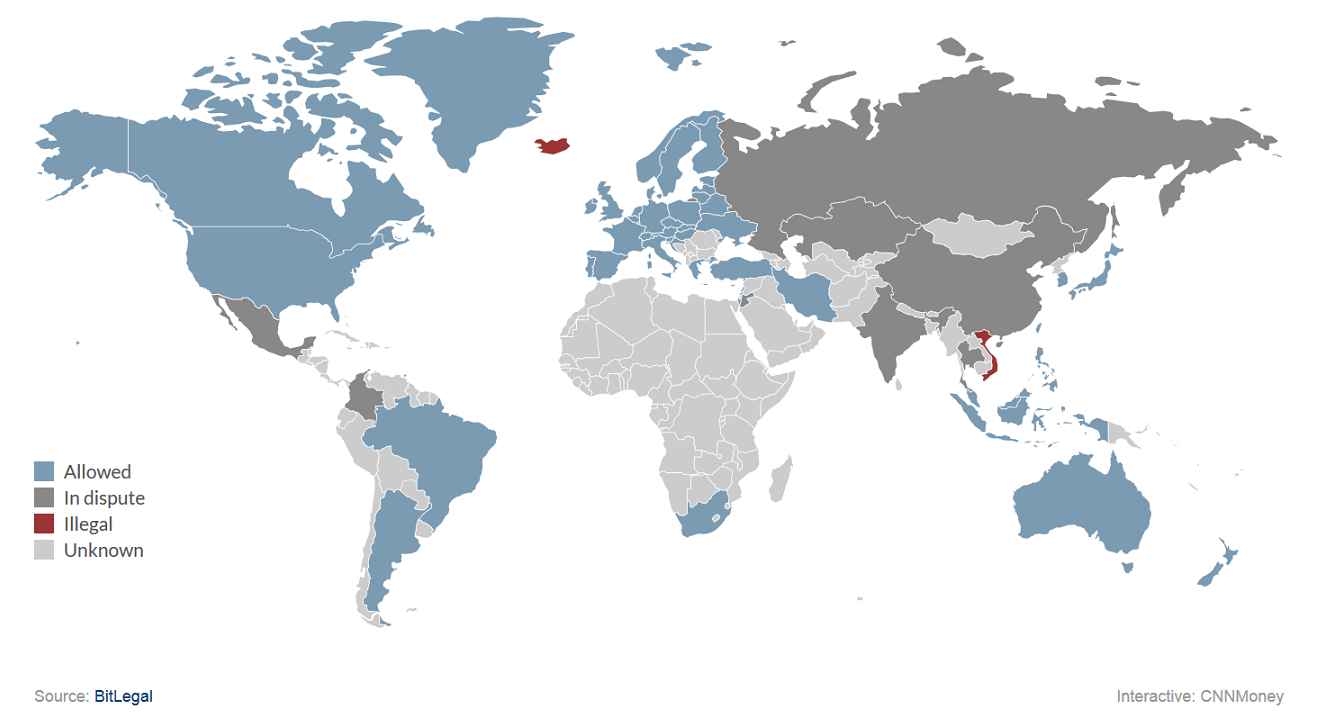

Charlie Shrem was one of Bitcoin Foundation founders. Nevertheless, after his arrest, a member of the organization said that If the allegations are true, it's part of a phase of Bitcoin's life that the project is rapidly leaving behind (and good riddance).. Bitcoin activist wanted to ensure that they don't condone illegal activities. Yet, it doesn't mean that it is legal. Some bitcoin exchanges in the US have been shut down by the authorities, and some others experiences difficulties because of nonexistent regulations. On the other part of the world, China and Russia have been trying to ban and limit the use of bitcoin.

Last Saturday (8/2), biggest bitcoin exchange, Mt. Gox, halted withdrawals on the grounds of bitcoin defects that enabled fraudulent transaction cancellations. Consequently, bitcoin value dropped to lowest level in almost two months. Then on Monday (10/2), Mt. Gox stated that cash withdrawal are all right, but bitcoin withdrawals are not yet possible due to technical glitch. One day later, bitcoin exchange Bitstamp also stopped all bitcoin withdrawals. At the time, the reason was denial-of-service attacks that made them unable to check balances. Bitcoin wallet operator Coinbase too, experience troubles on bitcoin withdrawals.

After Mt.Gox first statement, Gavin Andresen from Bitcoin Foundation said that withdrawal issues in Mt.Gox was not bitcoin fault, Mt.Gox should have been prepared to accomodate bitcoin dynamics. But yesterday, he posted on his update that bitcoin exchanges halted withdrawals temporarily to protect cosumers. It is because there was denial-of-service attacks by unknown person (or persons) on bitcoin's transaction malleability. The attacks did not swipe bitcoin accounts, but succeeded in preventing a number of transactions confirmation.

Regulating Bitcoins

The chains of events enlivened bitcoin news on the net these two weeks. Noenetheless, vast growth of bitcoin users urged governments to start regulating bitcoins and its fellow virtual currencies. Aside of China and Russia, most countries generally stated that it is illegal, but does not explicitly forbid the use of bitcoin on transactions.

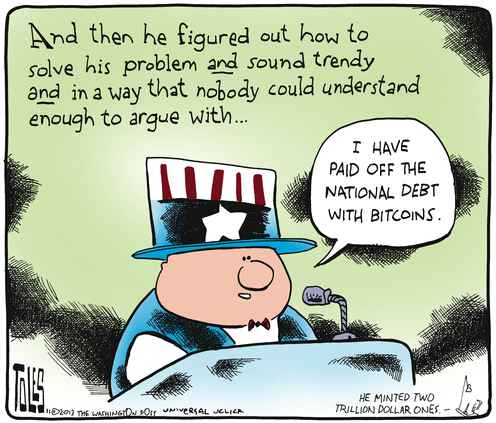

US, on the other hand, seek a different path. Benjamin Lawsky of New York's Department of Financial Services mentioned that they are preparing a set of rules on virtual currencies, and planned a release within the year.

There are two ways to interprets this move. First, Uncle Sam is getting ready to crack down more criminals who use bitcoin. If this is true, then it might mean trouble ahead for bitcoin. Second, US will be actively participating in bitcoin trade. If this is what they want to do, then we could expect more countries to do the same.

Still, no matter what governments do to regulate bitcoin, one thing we are sure about is that it is still experiencing extreme volatility. It may prove to be profitable for early miner and owner, and that's why speculators flock to bitcoin. Seeing US spirit to regulate the cryptocurrency, we are sure that this is not the end of bitcoin. So long as there are many people aspire to use it, bitcoin will go further. Still, as Bank Indonesia said, All risks related to the ownership/use of Bitcoin should be borne by the owner/user...

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance