Enjoy guaranteed stop loss for free in easyMarkets! This feature allows you to protect your trades even during extreme market conditions.

The forex market can be really volatile at times due to various factors. Such movements can either present opportunities, but they can also cause extreme losses. Without a crystal ball to predict the future, no one is certain about which direction the market will move next. This is why risk management is crucial and it's always a good idea to use handy tools like guaranteed stop loss.

easyMarkets is one of the top brokers that offer guaranteed stop loss. While it serves the same purpose as a regular stop loss, which is to protect your trades by limiting losses, guaranteed stop loss has proven to work better than common stop loss during extremely unfavorable market conditions. The feature guarantees exit at the exact price you want so no risk of execution at unfavorable prices due to market volatility.

Most brokers typically offer this feature as a premium and charge extra fees, but in easyMarkets, guaranteed stop loss is completely free.

A Guide into easyMarkets' Guaranteed Stop Loss

easyMarkets is one of the few brokers that offer guaranteed stop loss, along with many other interesting trading features. Generally speaking, guaranteed stop loss is a type of risk management tool that belongs alongside standard stop loss and trailing stop loss. Stop loss itself is basically a common tool whose purpose is to protect your trades from getting too much loss when the market goes against you.

What makes guaranteed stop loss different is its ability to always execute your closing position at the pre-determined price, regardless of market volatility. Such ability allows guaranteed stop loss to remove any risks of slippage, which is a condition where the trade is executed at a different price. Note that slippage or market gap can happen following major economic events or during the weekends when the prices open at a significantly different level than the previous close.

However, if you use guaranteed stop loss, market gap is no longer a problem because your stop loss order will always be filled at the requested price level. As a result, you can protect your trades and get away from unfavorable markets with the smallest damage possible. This is also why guaranteed stop loss is often said to be insurance against massive losses during volatile times.

To learn more about how guaranteed stop loss works in easyMarkets, you can refer to the video tutorial below:

What Are the Benefits?

Compared to other guaranteed stop loss providers, easyMarkets offers the following benefits that you should consider:

- Completely free of charge. Every stop loss you set is guaranteed to execute the order at the exact price you want with no additional fees.

- Available on the broker's proprietary platforms and apps. Save your time and protect your trades from anywhere.

- There will be no slippage. Guaranteed stop loss can protect you from slippage and market gaps during highly volatile times.

- Perfect for all traders. Any trader can benefit from guaranteed stop loss, especially those using high leverage and those who need extra protection during extreme market conditions.

- Reliable customer support. easyMarkets' customer support team is available 24 hours a day from Monday to Friday. You can reach out via web form, email, and phone.

How to Get Guaranteed Stop Loss from easyMarkets

Free guaranteed stop loss is offered to all easyMarkets clients for free, but keep in mind that it's only available on the broker's proprietary platforms and apps. So, to enjoy this feature, you must trade from the following trading platforms:

- easyMarkets Web Platform

- easyMarkets App

- easyMarkets TradingView Platform

Note that the guaranteed stop loss is not available on MT4 and MT5, despite them being the most well-known platforms in the market and are provided by easyMarkets. Therefore, make sure that you have chosen and installed the appropriate platform before you open a trade in easyMarkets.

Since 2001, easyMarkets have been writing their stories in financial markets. Simple, Honest, and Transparent, become three values that are carried on easyMarkets. The company has tried to make the process of trading as simple as possible.

They rebranded from easy-forex to easyMarkets in 2016. Over the years, easyMarkets expanded their CFD offerings to include global indices, options, metals, forex, commodities, and cryptocurrencies. The company is licensed by CySEC and ASIC.

Another privilege when trading in easyMarkets is its own platform. easyMarkets platform is simple and versatile. Based on reviews from traders, it's friendly to new clients and hosts a lot of features for experienced traders. Clients also receive free guaranteed stop loss, no slippage, fixed spreads, and no funding or withdrawal fees from easyMarkets.

There are three uniques features in the platform. Firstly, dealCancellation gives traders the ability to "undo" their trade. easyMarkets is the only broker that offers a way to close trade before it reaches 60 minutes duration only with a small fee.

Furthermore, traders can enjoy the Inside Viewer. This tool gives traders a deeper understanding of market sentiment by showing them percentage of buying and selling executed in the platform. The third unique feature is Freeze Rate. traders can pause a rate and place their trade at the "frozen" rate using this tool.

easyMarkets also includes financial calendar, market news, trading charts, and trading signals as the platform's perks. They also offer the technology on the mobile interface via iOS and Android devices. Traders can access markets anywhere and at any time.

MetaTrader 4 is also provided by easyMarkets. When using this popular trading platform, traders will get negative balance protection and fixed spreads. Besides that, Vanilla Options is available in this broker.

Because of those innovations, easyMarkets is an award-winning broker, receiving Forex Broker 2019 by The Forex Expo-Dubai, Most Innovative Broker 2018 by World Finance Markets Awards, Best APAC Region Broker 2018 by ADVFN International Financial Awards, Most Transparent Broker 2017 by Forex-Awards, Best Forex Service Provider 2017 by FXWord China, and many more over the years.

Moreover, easyMarkets offers three account types, such as VIP Accounts, Premium Accounts, and Standard Accounts. All of them can be accessed by the Web/App and MT4 platform. easyMarkets provide maximum leverage at 1:200 when using easyMarkets Web/App platform, and maximum leverage of 1:400 when using MT4.

Fixed spreads start from 1.0 pips in forex trading. Traders can become easyMarkets VIP clients with some benefits, such as trading via telephone, access to the tightest fixed spreads, personal analyst, and real-time market updates via SMS.

Traders do not need to pay additional fees whethere it is for commission, account fees, or deposit withdrawal. Account currencies are available in 18 options including EUR, CAD, CZK, JPY, NZD, USD, SGD, and many more. The company offers multiple ways to deposit and withdraw funds, some of them are credit/debit cards, bank transfers, and a ion of eWallets like Neteller, Skrill, and Fasapay.

For any questions or assistance, traders can contact the company directly at one of their local offices or at their headquarters in the Marshall Islands. Besides, traders can chat with their customer service by email, Facebook, WhatsApp, Viber, and Live Chat.

Based on the review above, easyMarkets provides easy-to-use platforms with some unique tools and it can be accessed by traders anytime and anywhere. Besides, traders do not need to pay extra fees for trading commission and deposit/withdrawal fees. Traders who register in easyMarkets can enjoy low spreads in EUR/USD pairs from 0.9 in the MT4 platform.

How to Use Guaranteed Stop Loss

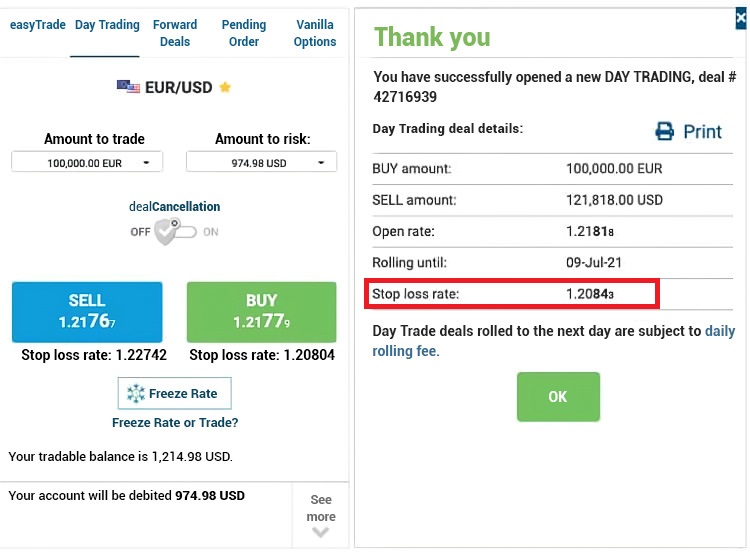

- Open your easyMarkets trading platform and initiate a new trade. The platform will automatically calculate the loss based on your risk tolerance. Keep in mind that the feature is not explicitly mentioned as "guaranteed stop loss", but easyMarkets ensures that the feature is capable of bringing the benefits of a guaranteed stop loss. Click "OK" once you're happy with the settings.

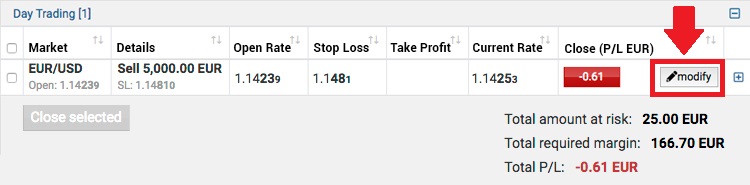

- If you wish to modify the stop loss, simply go to "My Open Trades" and click "Modify".

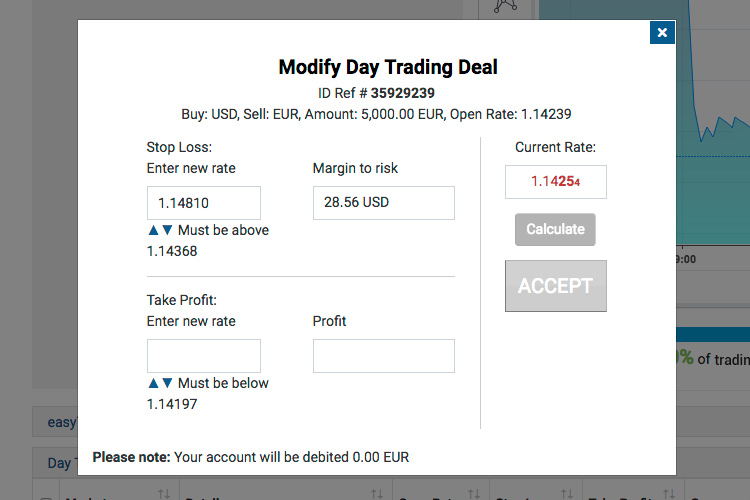

- You'll see a pop-up where you can modify your stop loss and enter a new take profit level.

Final Thoughts

In conclusion, easyMarkets' guaranteed stop loss is a rather useful tool to limit losses if the market goes against your favor. It can help you protect your trades better and effectively limit your losses, especially during extreme market conditions. Remember that even the most liquid markets tend to form a gap during volatile times, so it is highly crucial to use the right tool as your safety net. On top of it all, the feature is completely free for all easyMarkets clients regardless of the account type you use.

easyMarkets was founded back in 2001 when the only way to trade was through a physical trading room. Since then, the broker's purpose was to give market access to anyone that wanted it. They ended up fundamentally changing the online trading industry in several aspects with their "simply honest" basic philosophy and business model.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Dea

Sep 14 2023

Realistically speaking, how secure are guaranteed stop loss exactly? In my case, I have a 9-5 job so I like to open a trade early in the morning and see the results in the evening when I get home. If I put a guaranteed stop loss to my trade, I could expect it to pull my money out immediately when things go wrong, right? I'm guessing that's how it works – it guarantees that my trade would be safe from huge losses even when I'm away.

But what about this. Let's say I put out a trade with a guaranteed stop loss, then a massive economic event happened over the weekend, causing the price to plummet and hit rock bottom at the opening on the Monday morning. Will my position still be covered by the stop loss and pulled out of the market even when it's closed? Or does the market need to be open and operating normally for the stop loss to be triggered? Thanks

Kaila May

Sep 15 2023

A guaranteed stop loss should theoretically pull you out of the market at the selected price level at any time, regardless of what happens in the market. What you described there is called "market gap" and this is a common occurrence in financial markets. If you use the basic, standard stop loss, then such event may affect your trade and leave you with significant loss at the start of the weekend. This is not the case with GSL though. The stop loss will close your position once the price reaches the pre-selected price no matter what. So even if the market went into a major downturn you should still be able to control your loss in accordance to your risk tolerance.

Joko S.

Sep 14 2023

After reading the full explanation about guaranteed stop loss, I can certainly see why it's so popular among traders these days. Even now I'm tempted to try it out myself, even though I never use high leverage to keep the risks at minimum. I'm still curious though, is the tool really that good for everyone or is it suitable only for certain types of traders? What are the downsides to this order type? Also, I want to know where we should put the stop loss. Can we use the same method as basic stop loss? Sorry if I'm asking too much, I hope you guys can help me out here.

Indiraa

Sep 15 2023

Well to start with, guaranteed stop loss in most brokers are not free. Some would charge additional fees upfront, while others only when the stop loss is triggered. This is what makes easyMarkets stands out. It provides GSL completely free of charge for all clients regardless of their account type and spreads.

Secondly, some brokers will require you to place the stop loss at a set percentage away from the current market price. For instance, broker A will require you to place the stop loss at a minimum of 5% of the market. If you're not careful, this can cause you to lose a lot.

As for the placement, I believe it's similar to placing a standard stop loss. In theory, you shouldn't place it too far in case the market goes against you and don't place it too tight as it might get triggered prematurely.

Rizqi

Sep 15 2023

I want to add that there isn't the "right" way to set a stop loss, but there are several factors that you can consider based on what trader type you are. If you're a day trader, you'd want to check the pair's daily price range and set the stop loss outside that range. When the market goes in the losing direction, your trade will be automatically pulled out by the stop loss. Meanwhile, if you're a swing trader, you can place the stop loss much farther from the range but still within your risk tolerance. It is important to know your market before placing a stop loss.