Understanding how institutional traders move in the market is necessary for retail traders. Mastering order blocks is one of the most reliable solutions to help you with that.

Retail traders often get frustrated when their well-thought strategy doesn't go as planned. There are many reasons why a trade fails, so it doesn't necessarily reflect the trader's lack of skills or knowledge in trading. Sometimes, they can even lose simply because they are stuck in a liquidity hunt. How so?

The truth is that in the vast and busy forex market, institutional traders still have the best advantage over other players. With enough market cap in their possession, they can even somewhat control the market prices for their own gains. So, What can retail traders do?

To improve your trade, you can try using order blocks. It is one of the most reliable solutions for retail traders who wish to reduce the possibility of falling into liquidity hunts and increase the chance of succeeding. Having the ability to locate order blocks and use them in your trading strategy might be a game-changer that you need in your trading journey. Here's everything you need to know about it.

Contents

Understanding Order Blocks in Forex Trading

An order block is a market behavior that refers to an accumulation of orders (when bullish) and distribution of orders (when bearish) from financial institutions and banks. It basically points to an area that indicates where institutional traders would pile up their orders before entering the market. This matters because those entities are practically the main price driver of the market, so it makes sense to understand their plans and use them as one of the bases of your trading decisions. Using a strategy that incorporates the behavior of institutional traders might give you a better chance of winning compared to others.

Unlike retail traders, institutional traders always trade in big numbers. This means that they must plan their actions very carefully. They would spend a lot of money just to analyze the market in order to gain the best trading outcome. Executing such a huge order also means that they must face a unique challenge than regular traders.

Furthermore, remember that for every buy order, there must be an equivalent sell order on the opposite side. Since institutional traders make enormous orders, they might find difficulties when searching for the opposite party that could fulfill their order request. As a result, banks and other institutions usually split up their orders into smaller trades and execute them in several steps.

Let's say, a bank wants to purchase $100 million worth of EUR/USD. However, the market can only provide $20 million due to the liquidity. In the next step, the bank might buy another $50 million and completes the order by buying the remaining $30 million in the third step. This way, they could execute the orders at the price they desire without having to chase the price or disturb the current market condition. The price usually shows a big movement when the full quota of $100 million completes.

Order Blocks Vs Supply and Demand

There are mixed opinions about the correlation between order blocks and supply and demand. Some sources believe that the two concepts are one and the same. More specifically, order blocks are regarded as a type of supply and demand zone that looks like a range. They basically believe that the placement of order blocks creates supply or demand zones from the range consolidation area. However, this isn't technically correct.

Supply and demand usually happen in the commodity market where real physical goods such as corn, wheat, and soybean are being traded on the market. Whenever there's a shortage of supply, the price would rise and whenever there's a rise in demand, the price will fall accordingly. Unfortunately, this is not what happens in the forex market.

See Also:

The price movements in the forex market are mainly to seek liquidity areas that are typically above the previous highs or below the previous lows. With that being said, currency prices are not fully controlled by the supply or demand of the market participants, but they are highly influenced by financial institutions who simply move the price to logical areas so they can place their orders. So, when the price leaves the order block area, it moves not because the demand or supply is currently rising, but it's because the big players take the price to the opposite area of the liquidity pools to allow them accumulating their orders to sell their assets.

The Benefits of Using Order Blocks

As mentioned above, understanding what the institutional traders are doing in the market is necessary for retail traders. In order to do that, you typically would have to go through the Commitment of Traders (CoT) report. This means you'll need to read the report and find parts that are relevant to your trading condition, and then make a connection of how your findings could help your trade. Note that the report won't give you any information on what the institutions are doing intraday, so it's not great for short-term traders.

Order blocks, on the other hand, are able to give you a deeper insight into what the institutions are doing without having to make random guesses because you're practically looking at their digital footprints on the chart. The process is also way faster, so you can save time and make better trading decisions. Last but not least, order blocks can be used in various markets and trading strategies, so it's useful for many types of traders.

How to Identify High Probability Order Blocks

Before learning about how to use order blocks in your trading strategy, it's highly crucial to be able to locate them on the chart. Typically, order blocks are found in higher time frames after a market consolidation because they are formed as a result of the movement of big institutions and banks. This is why order block candles are usually bigger than the consolidation zone.

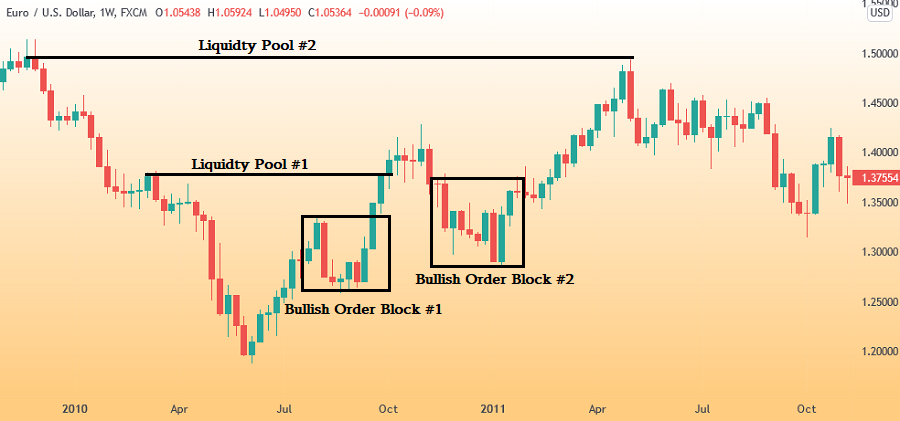

Take a look at the example below.

In a bullish market, you can identify order blocks by looking for a bearish candle on a given time frame before a strong bullish move. Once you're able to spot the order blocks, you can then make a move based on the direction that the price is going.

However, not all order blocks are profitable and have high probabilities. There are certain characteristics that you can observe in order to identify whether an order block is worth using or not.

They Occur in Higher Time Frames

Higher time frames can give you a deeper insight into the quality of the order blocks because they can show you a bigger picture of the price movement. Generally, order blocks form after a strong upward or downward movement. Once the price leaves the order block area with high momentum, the price tends to retrace back into the order block range to pick up market orders. However, this condition shouldn't happen for too long because if it does, then it's just a regular ranging market. There are no exact rules that govern how long the price should move away from the order block before going in the original direction, but using a higher time frame can certainly help you see a bigger picture and make a decision.

The Price Should Move Shortly from the Order Block Area (Relevant to the Time Frame)

If this condition doesn't occur on the chart, then it's more likely that the order block has a low probability and you might want to consider re-evaluating your analysis. So, simply search for a consolidation range where the institutions are either accumulating (bullish order block) or distributing (bearish order block) orders, then observe the price movements that occur after that.

Shouldn't Close Below the Middle Range

Once the price begins retracing towards the order block, draw a rectangle from the high point of the order block to the low and then extend its range to the right side of the chart depending on how long you expect the price to continue being in this range. Make sure that the price doesn't retrace below the middle range of the order block.

Follow the Trend after a Break and Shift in the Market Structure

If there's a shift in the market structure and the trend goes from bullish to bearish, you should change your focus from bullish order blocks to bearish order blocks. Open a short trade and aim for the price target of the liquidity pools that fall below the previous bullish order blocks. The same concept goes the other way around. If the market structure shifts from bearish to bullish, then you should start looking for bullish order blocks and target liquidity pools that rise above the previous bearish order blocks.

From the explanation above, we can conclude that order blocks can be a great addition to your trading strategy, particularly in the forex market. As a retail trader, it's important to understand how the market works and how institutional traders make their moves through order blocks. With a little practice, you'll be able to improve your trade and maximize your gains significantly. Just remember that not all order blocks are considered high probability, so make sure to choose the right one and consider the trading risks.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

14 Comments

Lolla

May 18 2022

How can we identify order blocks in a bearish market?

Divany

May 18 2022

Lolla: Basically, we can use the same concept as to identify the bullish ones, except that it works in the opposite direction.

So, simply look for a consolidation area in a bearish market where the institutions are distributing their orders, then observe the movements that occur after that. Also make sure that the price is making a new low or lower low.

Barton Jr

May 23 2022

Why banks and institutions make order blocks? Why can’t they just buy and sell currencies when they want to?

Divany

May 27 2022

Barton Jr: Institutional traders typically make large orders, which are hard to execute without shifting the price too much and lower their profit. This is why they need to split the order into several smaller chunks called order blocks in order to fill their orders without destroying the market equilibrium.

Michelle Goh

May 24 2022

Can we use order blocks in the crypto market?

Divany

May 27 2022

Michelle Goh: Technically, you can use this strategy in crypto trading too, but instead of banks, you'll need to factor whales into your buying and selling decisions.

Benedict Koerman

May 26 2022

Can you use order blocks for scalping?

Divany

May 30 2022

Benedict Koerman: Yes, you can use it for scalping too. You need to look for a short-term trend first, then identify the order blocks to find trading opportunities. It's best to use this strategy when the market is highly volatile and has a high liquidity.

Derry

May 28 2022

How to choose the right currency pair to trade with order blocks?

Divany

May 29 2022

Derry: Order blocks can be used for practically any currency pair, but it works best on major currency pairs such as EUR/USD, GBP/USD, and USD/JPY because they are used by most banks and institutional traders.

Ahas Iikuyu

Sep 8 2022

Considering the different trading sessions, i.e. NY, and London sessions and important news on financial markets, what time are we most likely to see these order blocks happening?

Amos Kiarie

Sep 14 2022

Can you use order blocks trading synthetic indices?

Jesisca

Jan 22 2024

Hello! I'd like to inquire about the specifics regarding order blocks. According to the article, an order block represents a market behavior characterized by the accumulation of orders during bullish trends and the distribution of orders during bearish trends, primarily by financial institutions and banks. If this interpretation holds true for the concept of an order block, does it imply that trading (buying) is only feasible during bullish periods? I'm a bit unclear about the functionality of an order block and how it can be activated or utilized. I hope to receive clarification on this matter. Additionally, could you provide information on which brokers implement the use of order blocks in their trading systems?

Faisal

Jan 25 2024

Greeting! So, these order blocks are like the play-by-play of big players, banks, and such, stacking up orders when it's all sunshine and rainbows (bullish) and spreading them out when things get gloomy (bearish). Now, about your question on only buying during the good times – not exactly! Order blocks give you a heads up on market vibes, but you can still do your thing, buying or selling, depending on your game plan.

Understanding order blocks and putting them to work involves digging into market dynamics. Activating them? It's all about your strategy and reading the market right. And for brokers rocking the order block vibe, you gotta check with them directly. Each broker has its own set of tools, so pick one that fits your style.

Hope this clears things up! If you're still curious or need more deets, shoot me another question!