Most traders only focus on the trading strategy compared to money management to gain profit. That's unfortunate and this is why.

Many traders tend to overlook money management. They put more importance on trading strategies that they think have a higher influence on their profitability. It may be right if we're talking about a single trade, but not if we want to profitable in the long term. Consistent result of trading in the long term depends on the implementation of effective money management.

A professional trader and forex mentor Nial Fuller once said that money management is the real "holy grail" in trading. He spoke from his trading experience and his years of forex teaching to his followers.

In some people's minds, money management is like something boring to discuss. It is not interesting and does not have a direct relation to the benefit amount gained in a trading position. Usually, money management is considered as aed matter that can be learned later, when a trader wants to increase his profit or rearrange his portfolio in a trading account.

The above opinion is true if you can gain a consistent profit. Even if your trading result is always positive, it is not a big deal if you do not apply the money management. But, what if your profit is not consistent?

Money management is one of the important factors in forex trading that deal with risk control. Trading is a kind of business and every business comes with a risk. Regardless of our capital, all of us want to limit the risk that might happen. Learning how to control the risk well is a successful key to gain a consistent profit in the long term.

Many beginners fail in their early years due to the lack of money management. Most of them even avoid using money management completely for some obscure reasons. If you feel the same way, it is better to start changing your mindset. Applying money management is crucial whether you like it or not.

A trader who neglects money management will be left clueless should their prediction goes wrong. Just assume that you have an updated trading strategy in trading, so you think you will face the 'perfect' market for your strategy; will you enter the market by bidding all of your capital in your account? Well, this is the perfect time to use money management proportionally and effectively.

Here are some key tips on money management that you can consider using in your trading.

1. Manage Risk Consistently

No risk amount is fixed for every trader. It is different from one trader to another as everyone has different risk tolerance. One thing for sure, use your spare money and avoid trading with your monthly budget. Consider that your capital for forex trading is the money that can be let go, so you will not crumble in a depressive state if you lost big time.

For the bigger picture, a professional trader who has income only from trading (such as stock, exchange, option, etc) will take risk more than 3% from his capital. Many experienced traders recommend the risk amount from 3% to 5%. However, the amount of risk you decide should make you comfortable. If it is smaller than 3%, then so be it.

The amount of the risk is defined by the money value, not the pips. Usually, it is defined in the percentage of the capital or balance in our trading account. Just consider that we are not in the trading position and have the intact balance in our account, we can say that the risk amount is the loss amount in an open trading position.

Unfortunately, setting the risk tolerance inconsistently often happens and it is a prime example of bad money management. Yet, it is normal and natural. After you get sufficient profit continuously, your risk aversion might decrease. You will tend to feel overconfidence.

However, your profit and loss probability will follow the random distribution pattern despite your excellent method and strategy. In other words, there is no standard and logical reason to claim that your profitability is always big, or your loss probability will be smaller. All we can say is there is no defined reason to change your risk tolerance, speaking from a psychological perspective.

We tend to like gambling, and it is difficult to control our euphoria or overconfidence. Even Richard Dennis, a famous trader, experienced a similar thing that almost ended his trading career. Therefore, Richard Dennis suggests that being consistent is important, especially in sizing your risk management and avoiding your trades being taken over by destructive emotions.

How to Do Position Sizing Correctly?

If you want to set your risk management correctly, you may need to convert the amount of risk determined in money value to a lot size (representing the trading volume in the MetaTrader platform).

With the position sizing, the risk amount in money value will be always the same regardless of the stop loss amount in pip. The trading volume can be managed based on the stop loss that fits you. For example, you trade in a Standard Lot in EUR/USD pair, so the value per pip is $10. With a capital of $25,000, the risk amount for one position is set at 4%. The risk value will be:

$25,000 x 4% = $1,000

Let's say your analysis results in a 50-pip stop loss, the trading volume in Standard Lot is:

$1,000 / (50 x $10) = 2 lots

If there are two traders with different capital decide to have the same risk percentage and stop loss, the lot size will surely be different. The trader with bigger capital will have a higher trading volume, although their stop loss amounts (or the risk value in pip) are the same.

2. Withdraw Your Profit Regularly

To keep calm and not to be attempted in changing your risk management, it is better for you to withdraw your profit every month. A professional trader who earns from the market always withdraws a part of his money every month to neutralize his balance in his trading account. He also does not want to take a higher risk when he's in a winning streak.

By maintaining the account balance in a neutral state or an equilibrium point, you do not need to double-up the risk. Equilibrium is a fixed amount and the most convenient point to do a transaction. Stick to the well-tested trading plan, or rearrange your trading plan with the maximum risk that you can afford until a new equilibrium is reached.

3. Avoid Moving the Stop Loss

Moving the stop loss to the same level as the entry-level is acceptable only if you have logical and acceptable reasons. Have you ever experienced the case, when the price move as you predict after the stop loss successfully moved to the breakeven level? If you have experienced it, it means you give less space for the market to move. Usually, it happens due to the fear of loss. Emotional impacts negatively affect trading if they are not handled well. Bad money management might ruin your trading if you let your emotional side takes over the trading.

However, there are certain conditions that allow you to move the stop loss. You can move the stop loss level to the breakeven level if the price movement follows these scenarios:

- The price movement leads to a change in trend direction.

- The price moves closer to key resistance or support levels.

- There is a high-impact release. You are surely unable to anticipate the price movement direction before, during, or just after the news release. Considering the high volatility, it is better for you to move the stop loss to a breakeven level if.

- You have a floating position for a few days, but the market price moves very slowly or even stops moving. In this case, you can consider getting out of the market or move the stop loss level to the breakeven if it is possible.

4. Don't Aim Too High

The risk/reward ratio is the comparison between the targeted stop loss (risk) and the profit (reward). If in the previous discussion we have determined the risk and the lot size, this step is about determining the profit that we want by comparing it to the risk decided before.

Similar to the risk, to decide the profit target, there is no fixed or formal policy we should follow. We just need to be strictly objective and realistic based on the market condition at that time. An experienced trader suggests that the risk/reward ratio is best to set at 1:2. In other words, if the stop loss is 50 pip, the profit is 100 pip at least. Or you can also try the 1:3 ratio or more. The bigger ratio used, the more profit you can get.

A professional trader, Marty Schwarts, advised not to level-up your position size unless you double-up or triple-up your account balance. Many traders make a mistake by increasing the lot size when their balance hasn't increased yet. Sadly, this mistake often leads to a margin call situation.

Therefore, aiming for profit should not be set too high if you are still a beginner. You can try the beginning value at 1:1.5 (or any other ratio bigger than 1:1), then increase the ratio only after your trading balance sees a consistent raise.

If we apply the risk/reward ration consistently, in the long term we will get sufficient return although our entire profit percentage is less than the loss. Let's say, 70% of the total position of a trader experiences loss. Don't just see his bad luck, but consider the ratio between the profit and the loss. Surprisingly, he's got a 15% return from his total trading position. How come? It is because he applies the risk/reward ratio of 1:2 in every position.

The important thing in applying money management is: decide the risk first then set the profit you aim.

See Also:

5. Know the Right Time to Re-arrange Risk/Reward Ratio

Sometimes, the market shows a drastic change in daily fluctuation. Although it rarely happens, we can use that moment to reset the risk/reward ratio as best as possible. The analysis knowledge of the price fluctuation is needed for knowing the right time to gain a lot of profit in trading, especially when the market condition is in trending position.

You can do this suggestion by monitoring the bar formation and the price action on the key level (resistance or support). Here are the further details:

When the Breakout is Strong

When the market reaches final consolidation, normally market consensus to break the price will be realized. If the formation bar is in a convincing breakpoint, the breakout happened will be very strong. You need to pay attention to the false breakout first before deciding to enter a trade in the breakout. The example of a strong breakout is as follows:

The picture above shows the signal of a strong breakout after the price reaches the resistance level. Focus on the candlestick bar formation and their 'tails' before the inside bar, which shows the strong momentum before the prices reach the resistance point. The pin bar formed then experiences the rejection on the key level. It confirms the signal of an upcoming strong uptrend. In this case, the risk/reward ratio can be set higher until the next resistance level.

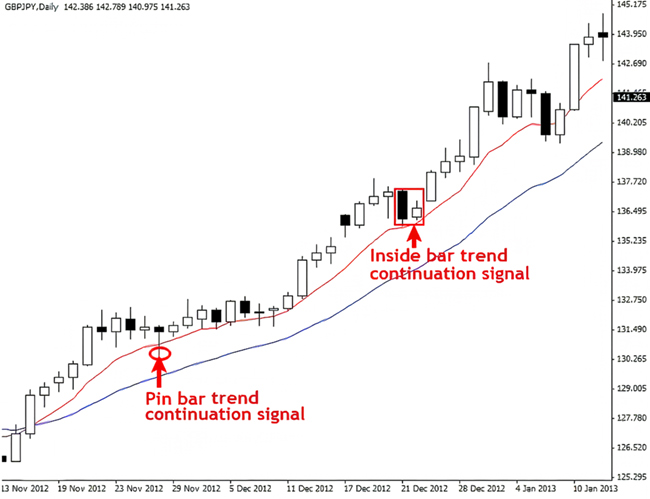

When the Signal Shows Trend Continuation

When the market movement condition is in a trending position, the signals showing trend continuation has very high profitability. For example, the pin bar and the inside bar formed on the moving average line below shows the strong trend continuation. On those levels, the risk/reward ratio can be increased.

When a Price Action Happens Around a Key Level

The setup of price action that happens near a key level, such as support or resistance, will be a valid signal showing that a strong trend will occur. If it happens on the trending market condition, such as the following XAU/USD daily chart, there is a high chance of a trend continuation.

The fakey bar (false bar) on the downtrend moving average is confirmed with rejection at the resistance level and it shows the very strong bearish sentiment after the consolidation. In this case, the risk/reward ratio can be set at the maximum level at the next support level. For maximizing the risk/reward ratio, you need to be patient because the valid signal mostly happens in the daily time frame.

Trading strategy and money management are equally important in the trading plan that must be applied simultaneously. They synergize each other as money management will run better if you master and believe in your strategy. If both of them are applied well, profit will consistently overcome your loss in the long term.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

12 Comments

Nathan

Aug 24 2022

Hey there! Great article btw! I want to ask some questions here. So, what is the suggested profit target for a $100 risk, considering a risk/reward ratio of 1:2, as recommended by experienced traders? How does this ratio translate into pip values, and what considerations should be taken into account when determining the profit target based on the market conditions at the time? Additionally, it would be interesting to know the potential advantages of using a larger risk/reward ratio. Hope there is explanation here, thank you very much!

Brigitta

Aug 24 2022

The article points out that occasionally the market undergoes significant daily fluctuations, albeit infrequently. It suggests that during these moments, there is an opportunity to reset the risk/reward ratio for better trading outcomes. Understanding the price fluctuations and having analysis knowledge becomes crucial, especially when the market is trending. But let's talk about beginner traders—how friendly is this approach for them? Are there any specific tools, indicators, or strategies that can assist beginners in grasping price movements and identifying profitable opportunities during these instances of market volatility? It would be helpful to know if there are any beginner-friendly resources or techniques that can help them navigate and make the most of these drastic market changes. Furthermore, as beginners explore the idea of resetting the risk/reward ratio during such market fluctuations, what are some essential precautions or risk management techniques they should keep in mind to ensure a safe trading experience?

Bruno

May 31 2023

@Brigitta: When it comes to market fluctuations, beginners may find it a bit challenging. But no worries, I've got you covered with some beginner-friendly tips to help you make the most of these wild swings.

First off, it's important to build a solid trading foundation. Start by learning about basic tools like moving averages, trendlines, and support/resistance levels. These can help you understand price movements and spot potential trading opportunities during market volatility.

Demo trading is your best mate! It's like practicing without risking real money. Take advantage of demo accounts to get hands-on experience and test your strategies during these wild market moments.

Don't forget about risk management, cobber! Set stop-loss orders to limit potential losses, and only risk what you can afford to lose. Keep your position sizes small while you're still learning the ropes.

Plenty of beginner-friendly resources are out there. Check out online courses, webinars, and articles to expand your knowledge and techniques. Stay informed about market news and economic events that can trigger volatility.

(hey you can also read more about basic trading plan at here : (Planning Forex Trading: Why You Need Trading Plan And How To Make It )

Jane

Aug 26 2022

When it comes to trading strategies, there seems to be a strong emphasis on risk reduction and implementing key tips on money management. But why is risk reduction such a critical aspect of trading? What is the primary purpose behind these strategies? Are they primarily designed to lower the potential for losses, or do they aim to strike a balance between risk and aiming for higher profits? It would be interesting to understand the rationale behind the focus on risk management in trading strategies and how it serves the overall purpose of making informed and prudent trading decisions. So, could you shed some light on the importance of risk management and the underlying purpose it serves in the world of trading?

Mondy

Jun 10 2023

@Jane: Risk reduction is a critical aspect of trading for a bunch of good reasons. The main purpose behind these strategies is to safeguard your hard-earned money and make smart moves in the market.

You see, trading is all about taking risks, but no one wants to lose everything, right? That's where risk management comes in. By implementing techniques like setting stop-loss orders, diversifying your portfolio, and controlling position sizes, you can minimize potential losses and protect your capital. It's like having an insurance policy for your trades! (read : Managing Risks in Forex Trading)

But wait, there's more! Risk management isn't just about avoiding losses. It's also about finding that sweet spot between risk and reward. You want to strike a balance where you can make profits while keeping the risks in check. So, you gotta analyze those risk-reward ratios, make smart trade-offs, and even use fancy tools like trailing stops or profit targets to secure your gains.

And here's the best part: risk management helps you make rational and informed decisions. It keeps you grounded and stops you from making impulsive moves driven by emotions. With a structured approach, you can stay focused, evaluate the potential risks and rewards of each trade, and make well-thought-out decisions.

Richarlison

Nov 30 2022

Jane

May 18 2023

Hey, have you ever noticed that it can sometimes be a bit tricky to make the risk/reward ratio match up with the support and resistance levels when we're setting our take profit (TP) and stop loss (SL) lines in trading? It's like trying to find the perfect balance between potential profit and those key price levels. I read an article recently that highlighted the benefits of using the risk/reward ratio, and I totally get why it's important. But, I must admit, there are times when it doesn't seem to be the best approach for determining our TP and SL. What do you think? Have you encountered situations where the risk/reward ratio doesn't seem to fit well with setting TP and SL? I'd love to hear your perspective on this

Alejandro

May 24 2023

@Jane: Yeah, I know your feeling. There are definitely situations where the risk/reward ratio may not align perfectly with setting TP and SL levels. It's not always a one-size-fits-all approach, and sometimes you have to be flexible and consider other factors.

For instance, you might come across a strong support or resistance level that's closer to your desired TP level than your ideal risk/reward ratio would suggest. In such cases, you might have to adjust your strategy and take into account the importance of those key price levels. It's all about finding the right balance between potential profit and market dynamics.

Remember, trading is both an art and a science, and it requires adapting to the ever-changing market conditions. While the risk/reward ratio is a useful tool, it's not the sole determinant of setting TP and SL levels. It's essential to consider other factors like trend analysis, candlestick patterns, and overall market sentiment.

As you gain experience and develop your trading style, you'll learn to navigate these situations and make informed decisions that suit your trading strategy. It's all about finding what works best for you and being flexible in your approach. Happy trading!

Alya

Jan 18 2024

Hey there! Just wanted to drop a shout-out for the awesome article – seriously, good stuff! Now, let's get down to the nitty-gritty. I'm keen to understand the ropes of the risk/reward game. So, here's the scenario: with a $100 risk on the line and following the seasoned advice of a 1:2 risk/reward ratio, what's the sweet spot for a suggested profit target? And, could you walk me through the magical translation of this ratio into pip values? Plus, when it comes to setting that profit target, what key market conditions should be front and center in our decision-making process?

Now, on to the intriguing side of things – what's the deal with opting for a larger risk/reward ratio? Are there particular advantages that come with embracing a more generous ratio? Your insights on this would be like gold. Thanks a bunch for shedding some light on these burning questions!

Charlie

Jan 21 2024

When dealing with a $100 risk and aiming for a 1:2 risk/reward ratio, the recommended profit target stands at $200. This straightforward calculation indicates that your potential gain is double your initial risk. It's worth noting that you can reach this $200 target through multiple smaller profit trades instead of achieving it all at once.

Translating this ratio into pip values requires taking into account the specific currency pair's volatility in your trade. For example, if you're working with a pair where one pip equals $1, hitting a $200 profit target might entail aiming for 200 pips. Keep in mind that this achievement can happen gradually over several trades rather than in a single endeavor. For your guidance, read this : Your Guide to Trade with Risk/Reward Ratio

Determining the profit target isn't a one-size-fits-all process; it hinges on various market conditions. Factors like existing volatility, support and resistance levels, and recent price action should factor into your decision-making. Flexibility is paramount, given the ever-shifting nature of markets. So, good luck with your trade!

Andrew G

Apr 25 2024

Hey there! I've got a question to toss out here. So, you know how they talk about this risk/reward ratio stuff? It's basically about comparing how much you're willing to risk (your stop loss) with how much profit you're aiming for.

Now, here's the thing: deciding on your profit target isn't set in stone. There's no strict rulebook for it. It's all about being realistic and objective, taking into account what the market's like at the time. Some experienced traders swear by a 1:2 risk/reward ratio, meaning if your stop loss is, say, 50 pips, your profit target should be at least 100 pips. But hey, you can experiment with ratios like 1:3 or even higher for potentially bigger profits.

Now, here's the question for beginners: What's a suitable pip count for me to aim for?

Romeu

Apr 26 2024

Hey, let me answer your question with simple example. Let's et's say you've been trading for a while now and you've gained some experience. Based my experience of the market and my own risk tolerance, you might decide to adjust your risk/reward ratio accordingly.

For example, if you've found that you're consistently able to identify profitable opportunities with a relatively low risk, you might feel comfortable aiming for a higher risk/reward ratio, such as 1:3. In this scenario, if your stop loss is still set at 50 pips, your profit target would be 150 pips.

On the other hand, if you've had some ups and downs in your trading journey and prefer to err on the side of caution, you might stick with a more conservative ratio like 1:1 or 1:2, even as you gain more experience.

Ultimately, your trading experience will help guide your decision-making process, allowing you to fine-tune your risk/reward ratio to better align with your trading goals and preferences.