Jun 7 2018 05:28

Hi Edison,

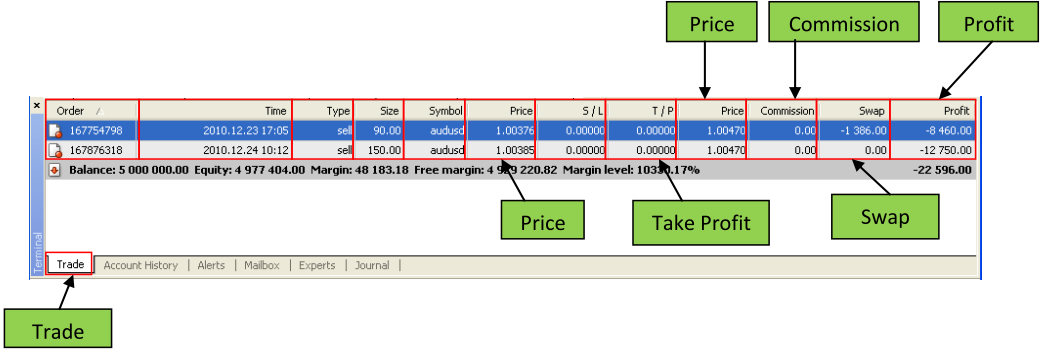

That is the real profit, you can withdraw without any deductions. In Metatrader look at the tab Terminal - Trade, then an example of how it looks:

that is the profit including commission and swap, so there is no further reduction. It's just that if you withdraw via wire transfer (transfer between banks) there will be a transfer fee.

Jun 10 2018 10:16

How to calculate the profit if we win 100 points, trading at 0.01 lot, and leverage 1:1000, so that will be more excited if we know the benefits of our trading. Thanks

Jun 11 2018 12:22

Hi Toby Alfred,

I assume you are trading the currency pair XXX / USD (EUR / USD, GBP / USD, AUD / USD or NZD / USD), which is pip value = USD 0.1. If you profit (win) 100 pips (points), the value of profit in units of money is = USD 0.1 x 100 = USD 10.

How to calculate profit or loss is (profit or loss in pips) x value per pip. For example, you buy EUR/USD at the price of 1.2430 and close at the price of 1.2390, then the loss is (1.2390 - 1.2430) = -0.0040, or in pip units is -40 pips. If you trade 0.1 lot where the value per pip is USD 1, your loss will be = -40 pips x USD 1 = USD 40.

In a standard forex trading account, the size of 1 lot is 100,000 units, which for pairs of XXX / USD 1 pip the value = USD 10, -. For mini accounts you trade 0.1 lot or 10,000 units, which for pairs XXX / USD the value of 1 pip = USD 1, while for micro (cent) accounts you trade with 0.01 lot or 1,000 units and for XXX / USD the value of 1 pip = USD 0.1. The pip value is the profit/loss value per pip that you will get if you trade XXX / USD.

For USD / XXX pairs or cross pairs (XXX / YYY), the calculation of the value per pip is different. To facilitate calculations we use the example of the XXX / USD pair. This knowledge of how to calculate the value per pip should have been taught/taught by your broker before you start the demo because it is the most basic forex trading knowledge. Leverage does not affect the value per pip but affects the minimum margin or guarantee set by your broker. So the amount of leverage has no effect on the amount of profit or loss.

Jun 14 2018 04:23

@Daniel I made 10,000 dollars in profit with 1: 1000 leverage. But when you see the broker only gets 10 $, does that mean the profit is divided by the leverage?

Jun 16 2018 10:28

Hi Jordan Bautista,

Leverage does not affect the profit (or loss) value. Leverage determines the amount of margin. Margin is the amount of money that you have to pledge (deposit) to open a trading position. The amount of margin depends on the contract size and leverage you choose. If you choose 1:100 leverage, your guarantee fund is 1% of the contract value, and for 1: 1000 leverage the guarantee fund is 0.1% of the contract value.

In forex trading, the contract value for 1 lot is USD 100,000. Margin calculation if you trade on the currency pair XXX / USD (EUR / USD, GBP / USD, AUD / USD or NZD / USD) is: Margin = (USD 100,000) x (number of lots or volume) x (percentage of margin) x Current market price For example: you are trading with 1: 1000 leverage, you buy 1 lot EUR / USD at the price of 1.1100, then margin = (USD 100,000) x 1 x 0.1% x 1.1100 = USD 111.00. The funds amounting to USD 111.00 will be held as long as your position is still open (not closed).

Your statement: "I earned 10,000 dollars in profit..."

In this case how many lots are you trading, on what pairs, and how many pips profit? For example, if you trade on a standard account (regular), for 1 lot EUR / USD the value per pip = USD 10. If you trade 1 lot EUR / USD and can make a profit of USD 10,000, then your profit is in pips = (USD 10,000) / (USD 10) = 1000 pips. If you are trading 10 lots, the profit is in pips = (USD 10,000) / (USD 100) = 100 pips (Note: USD 100 is the value per pip for 10 lots EUR / USD).

Jun 20 2018 10:30

@Daniel Robson Wow, your explanation is amazing. Thanks for your effort to make the explanation. I really appreciate that.